Bitcoin Fair Launch: The Gold Standard in Crypto History

Bitcoin Fair Launch has become a pivotal moment in the history of cryptocurrencies, marking the beginning of a decentralized currency movement that emphasized equality and transparency. Unlike many projects that have engaged in pre-mines or conducted initial coin offerings (ICOs), Bitcoin was introduced by Satoshi Nakamoto without any preferential treatment to any group of investors. This fair crypto launch not only laid the foundation for Bitcoin’s immense popularity but also set the benchmark for what a legitimate launch should entail in the crypto realm. The Bitcoin launch history is characterized by its open-source nature, enabling anyone to participate from day one, ensuring a level playing field for all aspiring miners. This approach has established Bitcoin as the gold standard for crypto fair play, inspiring subsequent projects to adopt similar fair launch strategies.

The introduction of Bitcoin represents a watershed moment in the financial world, showcasing an equitable approach to digital currency launch. This method, often referred to as a fair crypto initiation, differs significantly from traditional fundraising techniques commonly used by other cryptocurrencies. By avoiding early private sales and ensuring that every individual had access to mining opportunities from the outset, Bitcoin’s inception is celebrated for its integrity and transparency. Satoshi Nakamoto’s model not only revolutionized how cryptocurrencies are perceived but has also influenced countless other decentralized projects striving for a similar ethos in their launch strategies. As the crypto landscape continues to evolve, understanding the principles behind Bitcoin’s fair launch remains essential for recognizing the true value of decentralized currency.

Understanding Bitcoin’s Fair Launch

At the heart of Bitcoin’s design is the principle of fairness, which was crystallized during its inception by Satoshi Nakamoto. Unlike many cryptocurrencies that emerged later, Bitcoin did not undergo a pre-mine or initial coin offering (ICO), eliminating any unfair advantage from the outset. This unique approach ensured that all participants had the same chance to earn Bitcoin from its genesis block, fostering a sense of community and trust. With Satoshi’s open-source ethos, the protocols for mining and maintaining the network were made accessible to everyone, allowing for an inclusive environment where developers and enthusiasts could contribute to the project right from the start.

The gradual adoption of Bitcoin highlights its fair launch history. As it slowly gained traction, it attracted a diverse group of miners and users who were invested in the asset for its potential, rather than for speculative gain. This organic growth led to a robust and decentralized network, setting a precedent for future cryptocurrencies. As more users began to participate in Bitcoin’s ecosystem, the community established a culture of fairness that many other projects have aimed to replicate, often falling short when compared to Bitcoin’s foundational principles.

The Role of Satoshi Nakamoto in Bitcoin’s Success

Satoshi Nakamoto’s anonymity provides a compelling angle in discussing Bitcoin’s fair launch. By distancing themselves from traditional notions of leadership and control, Satoshi prevented any scenario of founder worship that might have skewed the community’s perception of Bitcoin. This absence of a charismatic leader enabled true decentralization, effectively eliminating the risk of centralized power that could manipulate the market for personal gain. In contrast, many other cryptocurrency projects often rely heavily on their founders for legitimacy and credibility, which can create distrust among users.

Moreover, Satoshi’s departure from the project catalyzed a culture of decentralized governance within the Bitcoin community. It allowed miners, developers, and users to come together to make collective decisions based on consensus, further reinforcing the fairness of Bitcoin’s launch. Without the influence of venture capital or institutional backing, Bitcoin set a compelling example of how a decentralized currency could operate freely without the typical constraints of financial institutions, paving the way for future innovations in blockchain technology.

Comparing Bitcoin to Other Crypto Launches

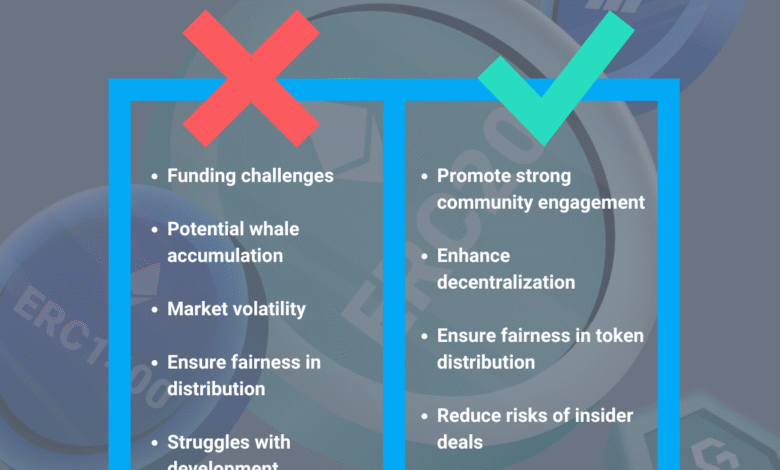

When we analyze other notable cryptocurrency launches, the stark contrast to Bitcoin’s fair play becomes evident. Numerous projects began with substantial venture capital funding or pre-sales, where early investors were granted significant portions of coins at lower prices. This often created an uneven playing field where the initial backers had an inherent advantage over average investors. For instance, many altcoins conduct ICOs that promise immense returns, but they often come with risks of manipulation and pump-and-dump schemes, undermining the fair and equal opportunity ethos that Bitcoin established at its launch.

Furthermore, the phenomenon of “fair crypto launches” has led to various experimental funding mechanisms and community-driven initiatives aimed at achieving a fair distribution of tokens. Yet, none have managed to replicate the integrity and success of Bitcoin. While they attempt to level the playing field for participants, many still grapple with issues such as liquidity constraints and centralization of power among their founding teams. Bitcoin remains the gold standard in this domain, attracting scrutiny and admiration from both enthusiasts and skeptics alike.

Decentralized Currency: The Vision of Bitcoin

Bitcoin represents the quintessential vision behind decentralized currency—an asset governed by the principles of transparency, accessibility, and community engagement. With a capped supply of 21 million coins, Bitcoin’s design reflects a commitment to monetary policy that is tamper-proof and well-defined. This predictability, established at the outset, has nurtured a sense of trust among users, ensuring that no single entity can issue more coins or change the rules of the game unilaterally. This stands in sharp contrast to fiat currencies that can be subject to inflation due to arbitrary governmental policies.

Moreover, Bitcoin’s decentralized nature empowers individuals, challenging the traditional banking systems that often exclude segments of the population. As a decentralized currency, Bitcoin permits anyone with internet access to participate in its financial ecosystem without prior approvals or documentation—essentially democratizing finance. This empowerment has led to the invention of remittance solutions, microtransactions, and various other applications, all built upon Bitcoin’s pioneering framework. The concept of fair launch resonates strongly here, as it sets the foundation for broader discussions about the future of currency, control, and equality in a rapidly evolving digital landscape.

Lessons for Future Cryptocurrencies

As the cryptocurrency market evolves, the lessons from Bitcoin’s fair launch can guide future projects toward a more equitable foundation. New cryptocurrencies should take note of the significant community trust and engagement that stems from transparent launches devoid of pre-mines or insider advantages. A focus on organic growth and allowing for open-source contributions can also help cultivate a loyal user base. By prioritizing fairness and decentralization, new projects can seek to avoid the pitfalls that have plagued many in the crypto space and focus instead on providing real value to their participants.

Additionally, the necessity of clear, immutable rules from inception cannot be overstated. Bitcoin’s monetary policy and issuance schedule have been central to its stability and attractiveness as a digital asset. For newcomers in the crypto space, establishing transparent governance models that discourage manipulation and foster community consensus can create a more resilient and trustworthy ecosystem. By adhering to these principles, future cryptocurrencies can uphold the spirit of fair crypto launch while contributing to a more trustworthy and equitable market.

The Community Aspect of Bitcoin’s Launch

One of the most significant aspects of Bitcoin’s fair launch is its intrinsic commitment to community building. Early adopters and miners collaborated on forums, sharing insights, experiences, and strategies. This culture of openness and information exchange fostered a more inclusive environment where newcomers felt welcome, despite being complete novices in the realm of cryptocurrency. The collaborative atmosphere enabled individuals from diverse backgrounds to understand and participate in Bitcoin, helping educate many about the potential of decentralized currencies and paving the way for widespread acceptance and understanding.

Moreover, this bolstered sense of community also extends to the present day, as Bitcoin enthusiasts and developers continue to engage through various platforms and events. The community regularly meets to discuss improvements, propose upgrades, and build on the foundational principles established by Satoshi Nakamoto. By maintaining an open dialogue and collaborative spirit, the Bitcoin community has been able to stay adaptive and resilient in the face of evolving market challenges, reinforcing the decentralized ethos that began at its launch.

Bitcoin as a Template for Fair Crypto Play

In a world inundated with initial coin offerings and cryptocurrency projects aiming to disrupt the status quo, Bitcoin stands out as a benchmark for fair practices. It serves as a template for what a fair crypto play looks like, demonstrating that it is possible to create a successful and decentralized currency without the need for backdoor deals or shady fundraising tactics. The simplicity and clarity of Bitcoin’s launch processes provide critical insights for new projects; they can avoid the traps that lead to distrust and volatility by following principles of transparency, inclusivity, and responsibility in their operations.

Future cryptocurrency ventures can borrow from Bitcoin’s lessons by implementing fair distribution strategies that prioritize equal opportunities across their user base. This not only enhances the credibility of a project but also cultivates long-term loyalty among its users. The remarkable resilience and brand identity of Bitcoin serve as a powerful reminder that ethical considerations in a project’s launch translate into significant competitive advantages within the broader digital economy.

Investigating Satoshi’s Legacy and Fair Launch Concept

Satoshi Nakamoto’s legacy is intricately tied to the concept of a fair launch, pushing forward an ideology of trustless and decentralized systems. By elucidating principles that champion the collective interest over individual gain, Satoshi’s vision set the stage for examining ethical frameworks in cryptocurrency launches. It suggests that future innovations in the space must carefully consider their approach to distribution and community engagement in order to build an ecosystem that is both profitable and equitable for all participants.

Moreover, having a creator who remains anonymous challenges traditional models of leadership in blockchain projects. This has sparked debate about how the cryptocurrency space should navigate authority and governance. Without a central figure to hold accountable, the community essentially becomes its own caretaker, driving home responsibility and self-governance, principles that foster fairness and trust. Emulating Satoshi’s model may not only pay homage to the original vision but also provide a roadmap for emerging projects seeking legitimacy in a crowded market.

Frequently Asked Questions

What makes Bitcoin’s fair launch the gold standard in the crypto world?

Bitcoin’s fair launch is often considered the gold standard due to its lack of pre-mining or initial coin offerings (ICOs) which allowed for equal opportunity among all participants. Satoshi Nakamoto made the code open-source from the start, enabling anyone to contribute or mine Bitcoin from the very first block without any insider advantages. This organic growth, coupled with the absence of venture capital support, created a truly decentralized currency and a genuine fair crypto launch.

How does Bitcoin’s launch history demonstrate fairness in cryptocurrency?

Bitcoin’s launch history showcases fairness through its principle of inclusivity. Unlike many cryptocurrencies that had pre-sales or were pre-mined by developers, Bitcoin was launched without any favoring of insiders. Satoshi Nakamoto’s commitment to a transparent and open-source model ensured that every miner had a level playing field, allowing for a fair distribution of the currency right from its inception.

Why is Bitcoin considered a fair crypto play in the context of other cryptocurrencies?

Bitcoin is regarded as a fair crypto play due to its decentralized nature and the absence of privileged access during its launch. Unlike many contemporary projects that benefit from large investors or marketing campaigns, Bitcoin’s simple and clear rules, such as the fixed supply of 21 million coins and predictable block rewards, fostered an equitable environment for all early adopters.

What role did Satoshi Nakamoto play in Bitcoin’s fair launch?

Satoshi Nakamoto was crucial to Bitcoin’s fair launch by devising a system that eliminated the need for pre-mining or initial fundraising events. By keeping the code open-source and ensuring that everyone had the same opportunity to mine from the start, Satoshi promoted a decentralized currency ethos that remains central to Bitcoin’s identity today. Their anonymity also helped in avoiding centralized control and the pitfalls associated with founder-led projects.

How does Bitcoin’s decentralized currency model benefit from its fair launch?

Bitcoin’s decentralized currency model benefits significantly from its fair launch as it minimizes central authority and potential exploitation. The absence of venture capital influence and the equitable access to mining created a system where power remains distributed among users rather than concentrated in the hands of a few. This foundational fairness has encouraged trust and adoption over the years, solidifying Bitcoin’s role as a leading cryptocurrency.

| Aspect | Details |

|---|---|

| No premine or pre-sale | Satoshi Nakamoto did not pre-mine coins or hold an ICO, allowing everyone an equal opportunity to participate in mining. |

| Open source from day one | The Bitcoin code was available publicly from the beginning, enabling participation, audits, and contributions from the community. |

| Gradual adoption | Bitcoin gained popularity naturally over time, without hype-driven marketing or insider benefits. |

| Anonymous creator | Satoshi’s identity remains unknown, avoiding centralized control and founder worship, enhancing decentralization. |

| Simple, clear rules | Bitcoin’s monetary policy is transparent with a capped supply of 21 million coins and a predictable issuance schedule. |

| Level playing field | Early miners could use regular CPUs, eliminating barriers that come with specialized mining equipment. |

| No venture capital or institutional backing | Bitcoin’s launch was free from the conflicts of interest that often affect modern cryptocurrency initiatives. |

Summary

Bitcoin Fair Launch is regarded as the most equitable launch in the history of cryptocurrency. With no premine or pre-sale, open-source code, and a commitment to decentralization, Bitcoin’s introduction has set a gold standard for other cryptocurrencies. Its gradual adoption and transparent rules allowed for a level playing field, making it accessible to anyone interested in participating. This fair launch not only avoids many pitfalls associated with newer cryptocurrencies but also establishes a foundational ethos for the entire crypto landscape.