10% Tariffs: Trump Official Confirms Long-Term Impact

In the evolving landscape of global trade, the recent implementation of 10% tariffs has sparked a flurry of debate and discussion among economists and consumers alike. As officials like Commerce Secretary Howard Lutnick echo President Trump’s assertions from earlier this month, the long-term presence of these tariffs raises questions about their impact on consumer purchasing power. Lutnick maintains that businesses, not consumers, will absorb the costs; however, recent data tells a different story, with consumer confidence already wavering. The ramifications of the 10% tariffs could ripple through various sectors, affecting everything from household goods to essential imports. As trade agreements progress into 2025, it remains crucial to monitor how these tariffs will shape the economic climate and affect trade relationships moving forward, especially as concerns grow regarding the impact of tariffs on consumers.

In the current trade environment, the establishment of a 10% levy on imported goods marks a significant shift in America’s economic policy. Termed as the baseline tariff, this rate is expected to influence future trade negotiations and consumer behavior significantly. The ongoing discourse around these tariffs emphasizes the broader implications for market stability and consumer trust. With administration officials reiterating that the burden will fall primarily on businesses rather than shoppers, many are left questioning the actual effects on personal finances. As we delve deeper into the implications of these trade policies, it’s essential to consider how they align with upcoming trade agreements and the overall sentiment among consumers.

Understanding the Implications of 10% Tariffs

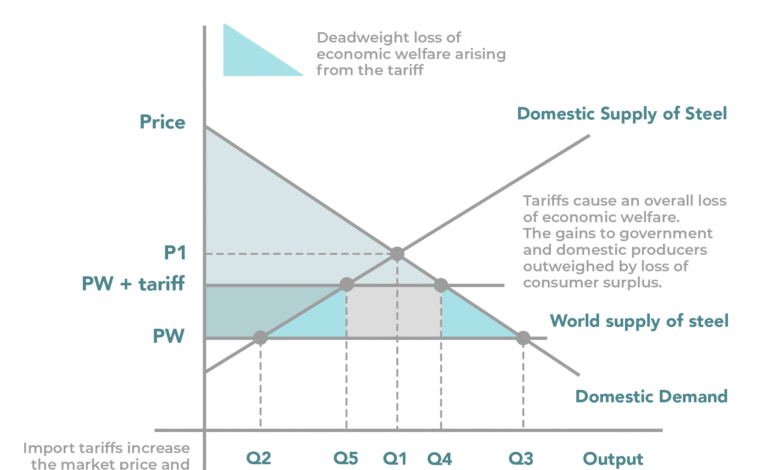

The recent announcement from U.S. Commerce Secretary Howard Lutnick regarding the continued enforcement of 10% tariffs presents significant implications for American businesses and consumers alike. Tariffs, particularly such a baseline rate, can dramatically impact the cost structure of imported goods. While Secretary Lutnick suggests that the burden of these tariffs will not fall on American consumers, the reality could tell a different story as businesses may choose to pass these increased costs onto their customers amid a competitive market landscape.

Moreover, with consumer confidence declining significantly since President Trump’s April 2 proclamation regarding tariffs, it becomes paramount to analyze their broader economic impact. As businesses reassess their pricing strategies in light of the tariffs, consumers may experience increased prices on everyday essentials, prompting concern over the overall cost of living. If the 10% tariffs become a long-term feature in the trade environment, the collective behavior of consumers in response to price changes could further influence economic recovery and spending patterns, adding a layer of complexity to the evolving narrative surrounding tariffs.

Consumer Confidence and the Impact of Tariffs

The repeated statements from Commerce Secretary Howard Lutnick claiming that consumers will not feel the direct impact of the 10% tariffs are met with skepticism from market analysts and experts alike. Recent trends indicate that as businesses face heightened costs associated with importing goods subject to United States tariffs, they may have no alternative but to increase consumer prices. This upsurge in prices can erode consumer confidence, which is critical for economic stability and growth.

Historically, a drop in consumer confidence often correlates with a decrease in spending, which could stagnate economic recovery. For instance, with the backdrop of decreasing consumer confidence after the tariff announcement, many worry that essential goods and services could become less affordable, spurring further economic challenges. It highlights a misalignment between governmental assurances and actual market behaviors; businesses may struggle to absorb the costs associated with tariffs, and thus, the burden may ultimately fall on the very consumers Secretary Lutnick believes will remain unaffected.

The Dynamics of Trade Agreements in 2025

As the landscape of international trade continues to evolve, the U.S.’s recent trade agreements, particularly with the United Kingdom, introduce fresh complexities into the realm of tariffs. President Trump’s reaffirmation of a 10% tariff rate for many imported goods, even amid new trade deals, raises questions about the strategic advantages of these arrangements for American consumers and industries. While tariffs may serve to protect domestic production, they also create tension in pricing and availability of foreign goods.

Furthermore, analysts are watching closely how these tariffs may affect future trade agreements beyond 2025, noting that the fluctuating tariff levels could challenge negotiations with other countries. As companies in the U.S. weigh the implications of these tariffs, the potential for companies to shift their sourcing strategies follows. Understanding how tariffs influence trade relations will be crucial for shaping effective trade policy moving forward.

Howard Lutnick’s Take on Tariffs: Who Really Pays?

Commerce Secretary Howard Lutnick asserts that businesses and foreign countries will bear the financial brunt of the 10% tariffs, while consumers will be insulated. Nevertheless, this perspective has raised eyebrows among both critics and supporters of the current tariff regime. Historical data suggests that when tariffs are levied, it’s often consumers who ultimately feel the impact of increased prices as businesses pass along costs in various forms—be it through raised prices for goods or diminished service offerings.

This leads to an essential debate about the true nature of tariff economics. For example, while Lutnick maintains that domestically produced products would not incur such costs, the reality is multifaceted. Suppliers may feel pressured to increase prices to maintain margins, and foreign manufacturers could potentially reconsider their pricing strategies, leading to unpredictable shifts in competitive dynamics. Looking at various consumer products, it becomes clear that the claims made by Lutnick may not encapsulate the intricate realities of market responses.

Analyzing the Long-term Effects of Trump’s Tariffs

The long-term consequences of the Trump administration’s tariffs, particularly with the reliance on a 10% baseline rate, remain a prominent topic of discussion among economists and policymakers. As the imprint of these tariffs becomes embedded in supply chains, industries may face persistent uncertainties about pricing, product supply, and consumer behavior. The current dynamics suggest that businesses will continue to examine how these tariffs influence their operational costs, which could lead to shifts in sourcing and manufacturing practices over time.

Additionally, ongoing adjustments to consumer prices may lead to behavioral changes among buyers, who might seek alternatives or postpone purchases as they navigate the evolving pricing landscape. If tariffs remain a fixture in U.S. trade policy, the complexities of the market landscape will continue to expand, possibly stalling economic growth and consumer spending efforts. The administration’s focus on tariffs as a tool for trade negotiation must factor in these long-term ramifications on both business strategy and consumer choices.

Tariffs and the Future of American Businesses

As American businesses grapple with the implications of the 10% tariffs, a sense of caution has permeated many sectors. Such policy measures can lead companies to reevaluate their cost structures and profit margins, particularly those heavily reliant on foreign imports. Lutnick’s assurances that the tariffs will not affect consumers must be scrutinized by businesses, as they balance maintaining competitiveness with responding to increased costs. Strategic adjustments may become necessary to mitigate impacts, such as sourcing domestically or altering pricing structures.

Moreover, companies might find themselves caught in the crossfire of international trade disputes, where tariffs can impact their viability and growth. In an era where global supply chains are crucial, the introduction of a consistent 10% tariff creates unexpected hurdles, possibly prompting businesses to reengineer their approaches to trade and procurement. The focus will be not only on sustaining current operations but also finding ways to thrive amidst evolving trade landscapes—where tariffs play a pivotal role.

Economic Recovery Amidst Tariffs

The intersection of economic recovery and tariffs presents an intriguing landscape for analysts and policymakers alike. With a keen focus on consumer behavior post-April 2, the significant correlation between decreased consumer confidence and tariff enforcement becomes evident. An economy on the path to recovery must examine how these tariffs could affect consumer spending, as continued uncertainty surrounding costs might lead to an inclination towards savings rather than expenditures.

Beyond short-term disruptions, the potential for long-term economic ramifications looms. If the current sentiments prevail, the connection between tariffs and consumer hesitance could shape broader market dynamics, complicating recovery efforts. Ultimately, navigating this interplay will be crucial for ensuring sustained economic health as businesses, consumers, and policymakers adjust to the realities of a tariff-laden environment.

Reactions to Lutnick’s Tariff Policies

Howard Lutnick’s steadfast stance on tariffs has attracted a wide range of reactions, making the discourse surrounding U.S. trade policy all the more vibrant. Critics argue that his refusal to acknowledge the impact of tariffs on consumers suggests a disconnect from reality, hinting at an insensitivity to everyday financial burdens faced by households. As consumers begin to see price increases in key goods, many wonder how these policies align with broader economic initiatives aimed at supporting American families.

Conversely, proponents of the tariff regime emphasize the notion of protecting the American manufacturing sector from foreign competition. They argue that by insuring a steady 10% base tariff, more jobs will remain within the U.S., benefiting domestic labor in the long run. The tension between these two perspectives highlights how Lutnick’s comments resonate differently across economic classes, leading to a complex debate about the balance of domestic protectionism against consumer freedoms.

Future Trade Agreements and Tariff Expectations

As discussions around new trade agreements intensify, the role of tariffs—specifically the sustaining of a 10% rate—could be pivotal. The ongoing negotiations underscore a delicate balancing act between securing favorable terms for U.S. businesses while ensuring that consumer interests are not sidelined. The recent trade agreement with the United Kingdom exemplifies this complexity, showcasing a scenario where tariff rates could sway future negotiations and economic relationships.

Looking ahead to trade agreements in 2025, stakeholders must carefully consider how tariffs influence the overall trade ecosystem. Anticipating that countries will require actionable strategies to manage tariff implications, the U.S. must cultivate a collaborative approach to trade that not only emphasizes tariff enforcement but also fosters economic partnership and mutual growth. The intersection of tariffs and trade diplomacy will be a defining aspect of America’s economic landscape in the years to come.

Frequently Asked Questions

What are the implications of the 10% tariffs discussed in Howard Lutnick’s comments?

Howard Lutnick reinforced the notion that the 10% tariffs imposed will remain for the foreseeable future, affecting trade agreements and economic strategies. Although he claims consumers won’t bear the cost, data suggests that businesses might pass on these expenses to consumers, potentially increasing prices and affecting consumer confidence.

How might the Trump tariffs of 2025 affect consumer confidence?

The Trump tariffs of 2025, particularly the 10% tariffs, have already begun to impact consumer confidence negatively. After the announcement in April, many consumers reported feeling uncertain about price stability, with some household item prices rising, signaling a potential burden on buyers despite official claims to the contrary.

What are the potential effects of the 10% tariffs on imported goods in the U.S.?

The implementation of 10% tariffs on imports is likely to affect the pricing of goods significantly. While officials like Howard Lutnick assert that foreign businesses will absorb these costs, the reality indicates that U.S. consumers may see increased prices as companies adjust to maintain margins.

Will the 10% tariffs influence trade agreements in 2025?

Yes, the 10% tariffs are pivotal in shaping trade agreements in 2025, as they establish a baseline rate. Commerce Secretary Howard Lutnick indicated that this rate could be adjusted higher for countries with substantial trade surpluses, impacting negotiations and strategies moving forward.

What strategies might businesses adopt in response to the 10% tariffs?

In reaction to the 10% tariffs, businesses are likely to implement strategies focused on price adjustments. As stated by Howard Lutnick, businesses may attempt to pass on these tariff costs to consumers. They may also seek to promote domestically produced goods that are exempt from these tariffs to maintain sales and customer loyalty.

How do the Trump tariffs relate to overall economic stability?

The ongoing 10% tariffs may disrupt overall economic stability by affecting consumer prices and confidence. As businesses adjust to these tariffs, the fear of inflation and uncertainty around pricing might lead to decreased consumer spending, influencing broader economic growth.

What might be the long-term effects of the 10% tariffs on U.S. consumers?

Long-term effects of the 10% tariffs could manifest as sustained higher prices for imported goods, impacting purchasing power for U.S. consumers. This scenario could lead to ongoing decreases in consumer confidence, which may slow economic growth and adjust consumer behavior significantly.

What were Trump’s remarks regarding the 10% tariffs and their future?

President Trump indicated that the 10% tariff would likely set a baseline for future trade agreements, suggesting that rates could be higher for specific countries with significant trade surpluses. His statements highlight a strategic approach to international trade that could reshape economic relations.

Are there any consumer goods that are exempt from the 10% tariffs?

While the 10% tariffs apply broadly to imported goods, domestically produced products remain exempt. Businesses may promote these domestic products to mitigate the impact of tariffs and respond to changing consumer preferences amid economic uncertainties.

What is Howard Lutnick’s stance on the costs related to 10% tariffs?

Howard Lutnick insists that the costs from the 10% tariffs will be shouldered by businesses and foreign countries rather than consumers. However, the reality may show a different outcome, with evidence suggesting that consumers could ultimately feel the financial strain.

| Key Point | Details |

|---|---|

| 10% Tariffs Duration | Commerce Secretary Howard Lutnick confirmed that the 10% tariffs are expected to remain for the foreseeable future. |

| Consumer Impact | Lutnick claimed that consumers would not directly bear the costs, but evidence suggests businesses are passing costs onto consumers with rising prices. |

| Trade Agreements | Despite the recent trade agreement with the UK, the 10% tariff applies to most U.S. imports. |

| Consumer Confidence | Consumer confidence has decreased since the tariff announcement, coinciding with rising prices for household items. |

| Tariff on Domestic Products | Lutnick stated that domestically produced products would not incur tariffs, suggesting a competitive advantage over imported goods. |

Summary

10% tariffs are set to remain a crucial component of U.S. trade policy, as Commerce Secretary Howard Lutnick has confirmed that they will likely persist for the foreseeable future. The Trump administration has made it clear that these tariffs, initially introduced to protect American businesses, may inadvertently lead to increased prices for consumers as businesses attempt to transfer costs. Despite assurances that consumers would not be directly impacted, evidence points towards rising prices for household goods and plummeting consumer confidence following tariff announcements. As the U.S. navigates through trade agreements with countries such as the United Kingdom, the baseline of 10% tariffs underscores the ongoing complexities of international trade and its implications for everyday Americans.