Coinbase Staking Services Reactivated in South Carolina

Coinbase staking services have recently resumed in South Carolina after the state successfully resolved a legal blockade against the popular cryptocurrency exchange. This pivotal moment signals a shift towards more favorable cryptocurrency regulations, providing users with renewed access to staking rewards that enhance their digital asset portfolios. Following the cessation of legal action against Coinbase, which had initially threatened to inhibit its operations, stakeholders can now breathe easier about the prospects of crypto investments in the state. Coinbase news reveals that this resolution not only helps the platform recover lost staking opportunities but also encourages other regions to reconsider their stance on this emerging financial practice. As more states recognize the benefits of staking, consumers are likely to see a burgeoning ecosystem enriched by clearer guidelines and fewer restrictions on cryptocurrency.

The revival of Coinbase’s staking operations marks a significant development in how cryptocurrency platforms can interact with state regulations and offer their services to consumers. With the legal barriers lifted, users can now maximize their potential earnings through staking activities, a process that has become increasingly favored in the digital currency landscape. This reopening also highlights a broader trend where regulatory bodies are beginning to adapt to the complexities of blockchain technology and its applications, potentially leading to a more supportive environment for future crypto innovations. As discussions around cryptocurrency regulations evolve, states may find new ways to foster growth without compromising consumer protection. The recent developments in South Carolina set an encouraging precedent for other jurisdictions contemplating similar crypto policies.

The Return of Coinbase Staking Services in South Carolina

After a period of uncertainty, Coinbase has successfully reinstated its staking services in South Carolina following the withdrawal of a legal blockade by state regulators. This event signifies a positive shift in the legal landscape for cryptocurrency exchanges, illustrating a reduction in regulatory hurdles. The agreement not only clears the path for Coinbase to operate freely within the state but also brings hope for other jurisdictions grappling with complex staking regulations. As more states become receptive to cryptocurrency, stakeholders can look forward to a more expansive environment for digital asset activities.

This revival is particularly crucial for many South Carolinians who had been affected by the preceding legal actions that halted their staking activities. Coinbase’s Chief Legal Officer, Paul Grewal, revealed that South Carolina residents lost around $2 million in staking rewards during the dispute, highlighting the tangible impact of regulatory decisions on consumers. As Coinbase restarts its staking services, it provides an opportunity for South Carolina citizens to reclaim those potential earnings while simultaneously strengthening the state’s position as a progressive player in the crypto ecosystem.

Implications of Cryptocurrency Regulations on Staking Rewards

The scrapping of the legal blockade has raised discussions about the overall implications of cryptocurrency regulations on staking rewards, particularly in states where such regulations have been tightened. Staking offers a unique opportunity for cryptocurrency holders to earn passive income, yet it is essential that users are aware of the regulatory landscape in their respective states to maximize potential gains. Clear and consistent regulations could enhance user confidence, encouraging greater participation in staking activities, thus benefiting not only individuals but also the broader cryptocurrency market.

Moreover, the debate over cryptocurrency regulations is crucial in determining the viability of staking as a mainstream investment strategy. With stakeholders like Coinbase advocating for clarity on legal frameworks, the goal is to create a conducive environment where potential rewards from staking can be fully realized without the fear of abrupt legal interruptions. As other states observe South Carolina’s recent decisions, the hope is that similar changes will emerge nationwide, ultimately leading to a more defined and supportive regulatory structure.

Coinbase’s ongoing efforts and recent victories indicate an evolving landscape in which the legal armament against crypto activities is lessening. As such, the potential for staking to grow as an attractive financial strategy hinges on the continuous push for reasonable regulations that protect consumers while allowing innovation in the cryptocurrency space.

Coinbase News: A Shift in Legal Landscape for Crypto Exchanges

The latest news surrounding Coinbase highlights a significant turning point for cryptocurrency exchanges operating in the United States. The recent resolution to dismiss legal actions against Coinbase is not just a win for the exchange but also signals a broader acceptance of cryptocurrency operations by regulatory bodies. As the environment softens, Coinbase and other exchanges may find themselves in a position to expand their services, after years of facing stringent scrutiny and legal challenges.

This shift towards a more favorable legal landscape could lead to increased interest from investors and consumers who were previously hesitant due to fear of regulatory repercussions. As these entities regain confidence in staking opportunities and cryptocurrency investments, the potential for economic growth in states like South Carolina becomes apparent. This momentum underscores the importance for other states to reconsider their stance on cryptocurrency regulations, necessitating a more progressive approach that aligns with technological advancements and innovation.

The Future of Staking Amidst Legal Challenges

As Coinbase’s staking services return to South Carolina, it raises questions about the future of staking amidst ongoing legal challenges affecting the entire cryptocurrency industry. The agreement reached by Coinbase and South Carolina ministers a blueprint for reopening channels for staking operations, suggesting that more states could be encouraged to follow suit. However, it also serves as a reminder that the need for a delicate balance between innovation and regulatory oversight is crucial for facilitating stakeholder engagement in digital assets.

Looking forward, the precedent set by the resolution should inspire a push for uniform regulations across the United States, reducing discrepancies between states. If other states observe the positive ramifications of Coinbase’s reinstated operation, there is a chance for a collective re-evaluation of staking bans. Such movements could increase accessibility to staking services, allowing users to benefit from staking rewards without the cloud of legal intimidation. With consumer advocacy groups promoting clearer guidelines, the future indeed looks promising for stakers across the nation.

Consumer Protection in the Cryptocurrency Space

As Coinbase resumes its staking services, a fundamental theme emerges: the urgent need for enhanced consumer protections within the cryptocurrency space. Many users risk potential losses without clear regulatory frameworks, as evidenced by the recent $2 million loss experienced by South Carolinians due to litigation. Advocates like Paul Grewal have called for sensible regulations that protect the interests of the 52 million Americans who actively participate in cryptocurrencies, reflecting a growing recognition of the need to safeguard consumers.

Consumer protection is essential not only for maintaining user trust but also for fostering an environment where cryptocurrency innovation can thrive. A clearly defined regulatory landscape allows users to engage confidently in staking and other crypto activities, knowing that their investments are protected against unwarranted legal challenges. As Coinbase’s recent victory sets a precedent, it is hoped that a wave of reform will emerge, emphasizing consumer rights and paving the way for a more secure future for cryptocurrency stakeholders.

Legal Action Against Coinbase: Lessons Learned

The legal action against Coinbase serves as a pivotal case study for the cryptocurrency industry, teaching valuable lessons about the importance of adaptability and resilience. The scrutiny that Coinbase faced underscores the ongoing challenges in navigating the complex regulatory landscape. By successfully defending against the claims in South Carolina, Coinbase has illustrated how timely cooperation and dialogue with regulators can yield positive outcomes, mitigating risks associated with legal disputes.

These developments signal a broader trend within the crypto community, emphasizing the need for exchanges to actively engage with regulators. As regulations continue to evolve, learning from past encounters with legal actions will empower crypto companies to better advocate for themselves and their users. Moving forward, both industry players and regulators can benefit from collaborative approaches that prioritize clarity and fairness in enforcement strategies, leaving behind the contentious battles that have historically characterized bitcoin law.

Understanding Staking: What It Means for Investors

Understanding the nuances of staking is essential for investors looking to take advantage of the benefits it offers. Simply put, staking allows cryptocurrency holders to earn passive income by locking up their assets to support blockchain operations. However, as highlighted by recent legal battles, potential investors must be wary of the regulations governing staking in their respective states. Prior to investing, individuals should thoroughly research local laws and consult with financial advisors to ensure compliance and maximize their staking rewards.

Moreover, engaging in staking comes with its own set of risks. Investors should be informed about potential market volatility and changes in regulatory conditions that could impact their investments. By keeping abreast of news, such as legal actions against platforms like Coinbase and subsequent resolutions, investors can make more informed decisions. Understanding these key factors will ultimately empower users to reap the benefits of staking while mitigating risks associated with this innovative investment strategy.

The Role of State Regulations in Shaping Cryptocurrency Markets

State regulations play a significant role in shaping cryptocurrency markets by either promoting or stifling innovation. The recent decision to dismiss legal actions against Coinbase in South Carolina is a testament to how shifting regulatory environments can lead to rejuvenated market activities within localities. More states adopting similar approaches can result in a national landscape where cryptocurrency thrives, spurring economic growth, and technological progress.

As jurisdictions observe the outcomes of Coinbase’s reactivated staking services, they may find inspiration to revise their own laws regarding cryptocurrency. Regulation that aligns with the forward momentum of crypto technology not only protects consumers but also attracts businesses to establish their operations in a particular state. By fostering sustainable relationships between regulatory bodies and cryptocurrency platforms, states can cultivate a thriving ecosystem that embraces innovation while ensuring consumer rights are upheld.

Coinbase’s Impact on the Future of Cryptocurrency Ecosystems

Coinbase’s recent actions and legal victories have positioned it as a significant player in shaping the future of cryptocurrency ecosystems across the United States. By reactivating staking services in South Carolina, Coinbase is demonstrating the viability of crypto platforms that prioritize compliance and adaptability in a changing regulatory landscape. This approach not only strengthens Coinbase’s market presence but also sets an example for other exchanges to follow, advocating for responsible governance in the crypto space.

Furthermore, as Coinbase continues to engage with regulators and support reasonable consumer protections, the potential for a harmonized approach to cryptocurrency regulation emerges. Other exchanges and stakeholders can look to Coinbase as a model of how to navigate legal complexities while fostering an innovative environment. The outcome of these efforts will likely reshape investor confidence and facilitate a progressive shift towards embracing cryptocurrency as a standard investment avenue.

Frequently Asked Questions

What does Coinbase staking in South Carolina mean for local users?

Coinbase staking in South Carolina allows local crypto users to earn staking rewards by participating in the network of supported cryptocurrencies. After the resolution of legal action, South Carolinians can now access these services, which enable them to earn yields on their crypto holdings.

How does the recent legal action against Coinbase affect staking services in South Carolina?

The recent legal action against Coinbase was resolved when South Carolina dropped its enforcement action, allowing the crypto exchange to reactivate its staking services. This legal decision signifies a more favorable regulatory environment for staking in the state.

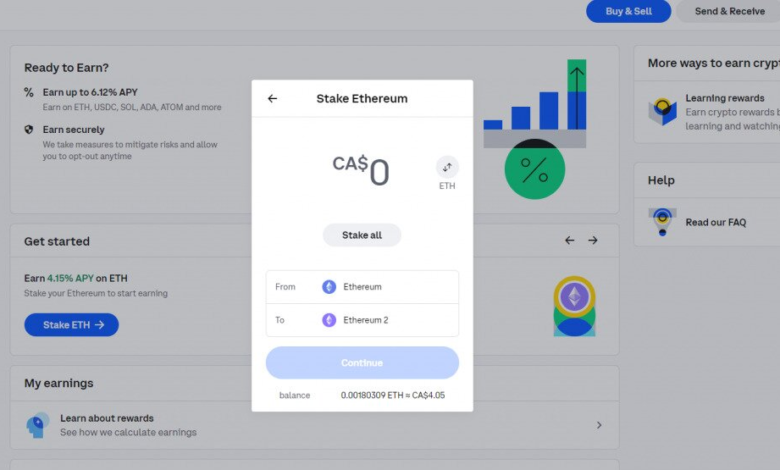

What are staking rewards and how do they work on Coinbase?

Staking rewards on Coinbase are payouts given to users who participate in the staking process of certain cryptocurrencies. By holding and staking their assets, users can earn rewards over time based on the network’s performance, thereby generating passive income.

Is Coinbase staking impacted by cryptocurrency regulations in other states?

Yes, Coinbase staking may be influenced by cryptocurrency regulations in other states. As seen with South Carolina, changes in state regulations can either restrict or permit staking services, impacting how platforms like Coinbase operate in those jurisdictions.

What recent news has there been regarding Coinbase staking services?

Recent news indicates that Coinbase has successfully resumed its staking services in South Carolina after the state lifted its legal blockade. This development highlights a positive shift in the regulatory landscape for cryptocurrency staking.

Can South Carolinians now earn staking rewards on Coinbase?

Yes, South Carolinians can now earn staking rewards on Coinbase following the resolution of legal issues. This allows residents to participate in the staking ecosystem and benefit from potential earnings on their crypto investments.

What actions did Coinbase take regarding legal disputes over staking services?

Coinbase engaged with the South Carolina Attorney General’s Office and reached an agreement to dismiss the cease and desist order that previously hindered its staking services. This proactive approach helped restore access to staking rewards for users in the state.

What are the implications of the legal resolution for Coinbase staking services in South Carolina?

The legal resolution enables Coinbase to resume staking operations in South Carolina without penalties, which can lead to increased participation in staking among users and potentially impact the overall crypto economy positively.

| Key Points | Details |

|---|---|

| Reactivation of Staking | Coinbase has resumed its staking services in South Carolina. |

| Legal Action Dismissed | The South Carolina Attorney General’s office reached an agreement to drop the enforcement action against Coinbase. |

| No Legal Penalties Imposed | The resolution has no penalties or legal fees for Coinbase. |

| Impact on Consumers | Around $2 million in staking rewards were lost by South Carolinians due to the prior legal action. |

| Call for Regulation Clarity | Coinbase’s Legal Officer urged for clearer regulations for crypto staking to protect consumers. |

Summary

Coinbase staking services have successfully returned to South Carolina, following the resolution of legal issues that previously barred its operation. This development not only underscores the growing acceptance of cryptocurrency services but also highlights the need for transparent regulatory frameworks to protect consumers. As Coinbase resumes staking in the state, it paves the way for more states to reconsider restrictions, benefiting the millions of Americans involved in cryptocurrency investments.