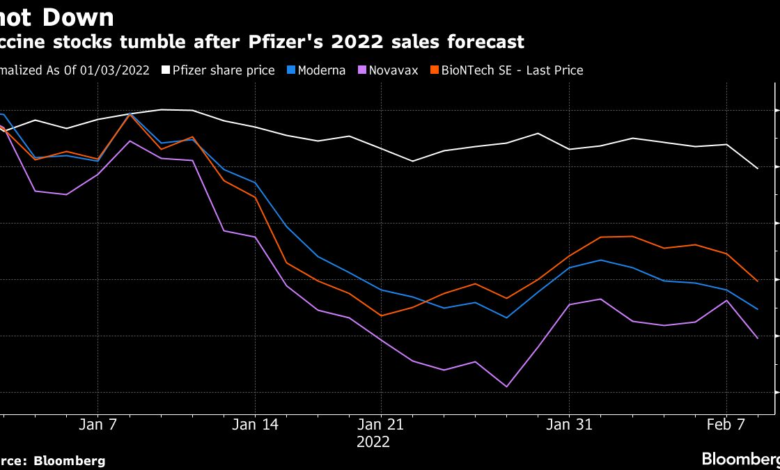

Vaccine Stocks Decline Following Peter Marks’ Resignation

Vaccine stocks decline sharply as the market reacts to the resignation of Peter Marks, a prominent FDA official, who left in protest of Health and Human Services Secretary Robert F. Kennedy Jr.’s controversial anti-vaccine rhetoric. This unexpected shift sent shockwaves through the biotech sector, with shares of key companies like Moderna and Novavax witnessing significant drops of over 11% and 6%, respectively. The SPDR S&P Biotech ETF also fell nearly 5%, reflecting widespread investor concern about the implications of Marks’ exit on regulatory oversight. Analysts warn that his departure could undermine the FDA’s ability to ensure the safety and efficacy of essential vaccines and treatments. As the situation unfolds, the influence of Marks’ resignation on vaccine stocks remains a crucial focus for investors and health experts alike.

The recent downturn in the shares of vaccine manufacturers signals a troubling moment for the biotech sector, sparked by the departure of a key regulatory figure, Peter Marks. As the FDA grapples with the political implications of Kennedy’s anti-vaccine stance, the fallout has raised questions about the stability of vaccine development and approval processes. The turbulent atmosphere has not only affected Moderna and Novavax, but has also made investors wary about the overall landscape of pharmaceutical stocks as they anticipate responses from the incoming leadership at the FDA. In light of these events, monitoring the biotech sector updates will be essential for understanding the long-term effects on public health initiatives and the market’s recovery.

Impact of FDA Leadership Changes on Vaccine Stocks

The recent resignation of FDA official Peter Marks has sent ripples through the vaccine investment sector, prompting discussions on how leadership changes affect vaccine stocks. Marks, a key figure overseeing the approval of critical vaccines, stepped down in reaction to the anti-vaccine rhetoric promoted by Health and Human Services Secretary Robert F. Kennedy Jr. His departure raises concerns not only about the current stability of vaccine stocks but also about the long-term health of the healthcare regulatory environment. The fallout from his exit is seen in the sharp declines of shares in major companies like Moderna and Novavax, emphasizing how critical regulatory figures influence market sentiment.

Analysts caution that as vaccine stocks decline, investors should take a closer look at the evolving landscape of the biotech sector. Marks’ leadership provided a certain level of trust and predictability that has now been disrupted. The subsequent drops—Moderna seeing an 11% fall and Novavax dropping over 6%—reflect broader apprehensions about the FDA’s ability to carry out its mission effectively during this transitional phase. In the biotech sector, such uncertainties often lead to volatility; thus, the implications of Marks’ resignation could resonate for months to come as the industry adapts to potential regulatory changes.

Understanding the Broader Biotech Sector Following Recent Events

In the wake of Peter Marks’ resignation, the outlook for the biotech sector appears increasingly complicated. Regulatory bodies such as the FDA are vital for ensuring that emerging treatments, particularly vaccines, are both safe and efficacious. With Marks’ departure, market observers are left wondering how this void might affect timely approval processes for essential therapies, which in turn can impact overall investor confidence in biotech stocks. The recent drops in Moderna and Novavax share price are symptomatic of these broader concerns, creating a sense of urgency for a new regulatory strategy that reassures investors.

Furthermore, the market’s reaction also highlights the interconnectedness of pharmaceutical companies and regulatory environments. Pfizer, while more diversified and experiencing only a slight dip, still reflects the cautious atmosphere prevailing in the sector. As the SPDR S&P Biotech ETF also fell by 5%, it indicates a collective anxiety among investors. It’s likely that as the industry awaits clearer direction from incoming FDA leadership, market volatility will persist, and careful monitoring of biotech sector updates will be essential for informed investment decisions.

Future Implications for Vaccine Approvals and the FDA

The future trajectory of vaccine approvals will largely depend on the strategic direction adopted by the new FDA Commissioner, Marty Makary. The urgent need for stable leadership is underscored by Marks’ stark criticism of Robert F. Kennedy Jr.’s anti-vaccine stance, which has the potential to undermine public trust in vaccination efforts. This scenario poses a risk not only to the routine vaccination programs in the U.S. but could also have international repercussions, as confidence in American biomedical leadership is intertwined with global vaccine distribution and acceptance.

Additionally, analysts are pondering the long-term consequences of potential delays in vaccine authorizations due to oversight changes at the FDA. The ongoing concerns surrounding vaccine misinformation and the suspension of established vaccination protocols could lead to public health challenges. As the CDC tackles the complex narratives associated with vaccines—such as the debunked theory linking vaccines to autism—the agency must maintain transparency to curb fears. The potential decline of vaccine stocks amid this political turmoil emphasizes the essential need for clarity in regulatory processes for safeguarding public health.

Market Reactions to Vaccine Stock Declines

The immediate market reaction to vaccine stocks following Peter Marks’ resignation was swift and significant. Investors watched closely as shares of both Moderna and Novavax plummeted, reflecting a broader apprehension about the stability of vaccine approvals. The dramatic decline, categorized by an 11% decrease for Moderna and a 6% drop for Novavax, indicates that market participants are highly sensitive to regulatory news and the perceived safety of future vaccines. The fluctuation in stock prices signals how deeply intertwined investor confidence is with the actions of FDA officials.

Market analysts suggest that such declines are also indicative of a more profound concern about the biotech sector’s health. The potential for these stocks to rebound hinges on the FDA’s next steps and the clarity provided by its new leadership. As the FDA navigates this newly unstable landscape, investors will be closely examining any updates that might reassure them of continued regulatory support for vaccines and related products. The ongoing dialogue within the industry regarding regulatory guidelines will be crucial for restoring confidence among investors in the biotech sector.

FDA Accountability and Public Trust

Public trust in vaccine safety and efficacy is paramount, especially in the context of regulatory accountability. Peter Marks’ outspoken stance against the anti-vaccine ideology portrayed by Robert F. Kennedy Jr. highlights the significant role FDA officials play in promoting science-backed messaging. The resignation of such a pivotal figure can negatively affect public perceptions of the FDA’s commitment to transparency and safety, raising doubts about the agency’s capability to guard against misinformation.

Moving forward, it is critical for the FDA to reinforce its dedication to grounded scientific practices while also ensuring clear communication to the public. The scrutiny surrounding Marks’ resignation may lead to demands for a more transparent FDA process, one that also fosters public dialogue about vaccination. As the conversation surrounding vaccines continues, the role of the FDA in navigating these discussions remains vital to maintaining public health confidence and the efficacy of future vaccination campaigns.

Political Ramifications of Vaccine Leadership Changes

The political implications following Peter Marks’ resignation cannot be understated as health officials navigate a contentious landscape influenced by anti-vaccine sentiments. Robert F. Kennedy Jr.’s rhetoric represents a growing faction within politics that threatens long-standing public health initiatives. As the relationship between vaccine manufacturers and regulatory bodies becomes channeled through political discourse, the urgency to stabilize this tension increases to safeguard vaccine implementation and public health safety.

Health experts are now tasked with counteracting the pitfalls posed by misinformation while lobbying for support for ongoing vaccination initiatives. The stakes are high; if vaccine stocks continue to decline amidst political turbulence, there could be a chilling effect on future investments in public health. Accordingly, understanding the dialogue between the political landscape and vaccine approval processes will be crucial as the next steps unfold in both the public and private sectors.

Long-Term Outlook for Vaccine Investments

As investors consider the long-term implications of vaccine stocks, the interplay between leadership at the FDA and the overall health of the biotech market will become increasingly salient. The recent fluctuations observed in major companies’ share prices, such as Moderna and Novavax, compel investors to think critically about their financial strategies. While some analysts view Marks’ resignation as a short-term setback, others warn that a lack of strong leadership could create persistent instability in the biotech sector.

Investors will need to pay close attention to how the FDA adapts its practices in light of the current controversies. As the agency seeks to restore faith in its regulatory processes, there may be opportunities for savvy investors who can weather initial volatility. The ongoing narrative surrounding vaccine safety, regulatory transparency, and public health will shape investment strategies as the biotech sector navigates these turbulent waters.

Navigating Future Challenges in Vaccine Development

Looking ahead, the future of vaccine development will likely be marked by challenges that must be addressed to ensure the continued progress and acceptance of vaccines. The resignation of Peter Marks highlights not only a leadership vacuum but also the potentially disruptive impact of political rhetoric on public health initiatives. Health authorities face the challenge of combatting misinformation while simultaneously promoting facts that affirm the need for vaccination, which is essential for public health.

From a development standpoint, ensuring robust data and effective communication strategies will be vital to counteracting any adverse effects stemming from politically charged narratives. Future vaccine negotiations and approvals will require deft handling by regulatory bodies to reassure both the market and the public. By prioritizing evidence-based practices, health agencies can work to build stronger foundations for vaccine acceptance and innovation in the sector.

The Role of Analysts in Vaccine Stock Predictions

In this evolving landscape, analysts possess significant power in shaping perceptions of vaccine stocks and the biotech market at large. Their insights into the ramifications of regulatory changes, such as Marks’ resignation, are crucial for guiding investor sentiment. With the biotech sector’s inherent volatility, analysts are tasked with discerning short-term fluctuations from potential long-term trends, a complex challenge in an environment influenced by political agendas and public opinion.

Moreover, analysts play a pivotal role in formulating expectations around future vaccine approvals and its implications for market stability. As they assess the potential impacts of changes in FDA leadership and political discourse, their forecasts serve as blueprints for investor strategy. By focusing on robust data, trends, and market dynamics, analysts can help navigate the uncertain waters ahead in the biotechnology space.

Frequently Asked Questions

What caused the recent decline in vaccine stocks?

The recent decline in vaccine stocks, particularly those of companies like Moderna and Novavax, can be attributed to the resignation of FDA official Peter Marks. His departure was a protest against Health and Human Services Secretary Robert F. Kennedy Jr.’s anti-vaccine stance, raising concerns about the future regulatory environment for vaccine approvals.

How did Peter Marks’ resignation affect Moderna and Novavax stock prices?

Following Peter Marks’ resignation, Moderna and Novavax witnessed significant declines in their stock prices, with Moderna dropping over 11% and Novavax falling by more than 6%. This reaction indicates investor apprehension regarding the FDA’s capability to ensure the safety and effectiveness of vaccines amidst political controversies.

What implications does Peter Marks’ exit have for the biotech sector?

Peter Marks’ resignation may have serious implications for the biotech sector as it raises concerns about the future regulatory framework within the FDA. Analysts fear that his absence could hinder the approval process for vaccines and treatments, potentially impacting stocks of companies in the sector, including those focused on COVID-19 vaccines.

Is there a long-term impact of the FDA’s internal changes on vaccine stocks?

While the immediate impact on vaccine stocks is evident, such as the drops in Moderna and Novavax, analysts perceive it may be too soon to determine the long-term effects of Peter Marks’ resignation. The future direction of vaccine stocks will depend largely on the strategies and actions of his successor and the FDA’s continued commitment to vaccine safety.

How is the current vaccine sentiment affecting the stock market?

Current vaccine sentiment, particularly influenced by FDA developments and anti-vaccine rhetoric from political figures like Robert F. Kennedy Jr., is affecting the stock market. Following Marks’ resignation, vaccine stocks saw a notable decline, while the biotech sector indices also reacted negatively, signaling investor anxiety over regulatory stability.

What are the analyst expectations regarding the FDA’s future following Peter Marks’ resignation?

Analysts are cautious yet hopeful regarding the FDA’s future following Peter Marks’ resignation. While there are concerns about the FDA’s ability to maintain effective and safe vaccine approvals amid political pressures, the appointment of a new FDA Commissioner could define the trajectory for vaccine stocks and biotech companies moving forward.

What are the broader effects of the decline in vaccine stocks on public health initiatives?

The decline in vaccine stocks could have broader implications for public health initiatives, especially if regulatory concerns diminish confidence in vaccine development and approval processes. As financial backing for vaccine research could be affected, it may impact the availability of vaccines essential for public health.

What steps is the CDC taking in response to vaccine-related controversies?

In light of vaccine-related controversies and public skepticism fueled by figures like Robert F. Kennedy Jr., the CDC is conducting a study to revisit discredited claims linking vaccines to conditions such as autism. This underscores the agency’s commitment to ensuring that accurate and factual information is communicated to the public.

| Key Point | Details |

|---|---|

| Resignation of FDA Official Peter Marks | Peter Marks resigned due to Health Secretary Robert F. Kennedy Jr.’s anti-vaccine stance, raising concerns about the FDA’s future vaccine approval processes. |

| Impact on Vaccine Stocks | Shares of Moderna and Novavax fell over 11% and 6%, while Pfizer experienced a smaller decline of about 2%. |

| Broader Market Impact | The SPDR S&P Biotech ETF dropped nearly 5% following the resignation. |

| Concerns from Analysts | Wall Street analysts worried that Marks’ departure might hinder the FDA’s ability to oversee effective vaccine and treatment approval processes. |

| Kennedy’s Anti-Vaccine Measures | Kennedy’s views threaten routine vaccinations in the U.S., prompting concern from health experts. |

| CDC Investigations | The CDC is conducting a study on unfounded vaccine-autism connections, emphasizing the need for clear communication. |

| Future Outlook | The future of the biotech sector now hinges on the appointment of Marks’ successor and the new FDA’s strategies. |

Summary

Vaccine stocks decline significantly in response to the resignation of Peter Marks, a top FDA official, which raises alarms about the FDA’s regulatory capabilities. This unexpected exit has sent ripples through the stock market, particularly impacting leading vaccine manufacturers such as Moderna and Novavax. Moreover, the ongoing controversy surrounding the new Health Secretary Robert F. Kennedy Jr.’s anti-vaccine rhetoric adds further uncertainty to the market. Analysts stress that the FDA’s mission to ensure safe and effective treatments may be at risk, casting doubt on the future approval processes for crucial vaccines. Clarity and transparency surrounding vaccine communications must be prioritized as the situation unfolds.