U.S. Economic Downturn Predictions: Polymarket Insights

Recent U.S. economic downturn predictions have sparked intense debate among analysts and investors alike as speculators on Polymarket wager heavily on the future likelihood of a recession by 2025. Following the announcement of President Trump’s new tariff policies, market sentiment has shifted, with the probability of an economic slide now nearly reaching 50%. This alarming expectation has prompted discussions on the potential impacts of Trump tariffs, especially concerning trade dynamics with countries like China and the EU. As the financial landscape reacts negatively to these developments, many are closely monitoring the Dow Jones drop, a significant indicator of market health. The stakes are high, as predictions of a downturn can dramatically alter investment strategies and consumer behavior across the country.

In light of the shifting economic climate, experts are increasingly focused on the prospects of a financial slow-down in the United States, often referred to as recession likelihood for 2025. The recent implementation of significant tariff measures has stirred unease among investors, resulting in a sharp financial market reaction that has left many questioning the sustainability of economic growth. Analysts are delving into the implications of rising tariffs and their potential to disrupt trade relations worldwide. As discussions unfold, the effects on the Dow Jones and overall market indices play a crucial role in forecasting the economic trajectory. The situation remains fluid, with financial experts keenly observing changes that could herald a turbulent economic future.

Understanding the Impact of Tariffs on the Economy

The introduction of the “Liberation Day” tariffs by President Trump has left many economists grappling for answers on the broader implications for the U.S. economy. These tariffs, which impose a hefty 10% duty on all imports, are designed to address trade imbalances and counter unfair practices from nations such as China and the EU. However, this aggressive move could lead to increased costs for consumers and businesses alike. When companies face higher raw material costs due to tariffs, they often pass those costs to consumers, sparking inflationary pressures that can stifle economic growth. Furthermore, retaliatory tariffs from affected countries could exacerbate trade tensions, causing further instability in the financial markets.

As a result, speculations arise regarding the likelihood of a recession. The Polymarket prediction market reflects this unease, indicating that nearly 50% of participants believe a recession is on the horizon. With businesses hesitant to invest and consumers pulling back on spending due to anticipated price hikes, the economy may face a dual threat of declining demand and increased costs, creating a feedback loop that could drive the U.S. economy towards a downturn.

Moreover, the volatility stirred by the recent tariffs is evident in the financial markets’ reaction, particularly in the Dow Jones Industrial Average, which experienced its worst single-day drop in years. This significant decline signals investor fears about the economy’s health, prompting many to withdraw or rethink their investment strategies. With about $1.1 million wagered on the likelihood of a recession by 2025, Polymarket’s numbers affirm a growing concern that financial market stability could be jeopardized by these tariffs. If the predicted downturn materializes, sectors most reliant on imports could face severe challenges, potentially leading to job losses and an overall economic contraction.

Financial Market Reaction and Predictions

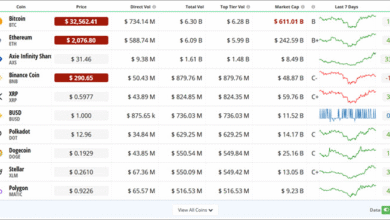

The immediate financial market reaction to President Trump’s tariff announcement was nothing short of catastrophic. Following the declaration, the Dow Jones plummeted by 1,630 points, marking a stark reminder of how quickly investor sentiment can sour based on policy announcements. This unprecedented drop impacted not only stocks but also resonated throughout the cryptocurrency market, which saw a significant slump. Such volatility often breeds uncertainty, which can deter investment and lead to slower economic growth, further raising the specter of recession as predicted by Polymarket’s betting pool.

As experts analyze the situation, they are closely watching the predicted recession likelihood for 2025, which has seemingly climbed in response to the latest tariffs. The market’s response is a reflection of investor anxiety over the implications of prolonged trade disputes and the instability of policies that can alter economic dynamics overnight. Investors are keen to decipher what this means for sectors such as technology, manufacturing, and services—industries that stand to be heavily impacted by increased costs and potential retaliation from trading partners.

Furthermore, the fluctuations in the S&P 500 serve as a barometer for market confidence, showcasing the direct impact that nonsensical policies can produce. The aftermath of Trump’s tariff announcement evidences that even a single decision can demolish years of market gains, showing how critical investor faith is to economic growth. The market’s tumultuous behavior following these tariff announcements raises important questions about the future of U.S. financial stability. If the recession does hit as the Polymarket predictions suggest, it could lead to a significant re-evaluation of investment strategies across portfolios.

The Role of Speculation in Economic Predictions

Speculation plays a crucial role in economic forecasting, and platforms like Polymarket offer insights into investor sentiment regarding the U.S. economic outlook. With massive amounts wagered on the probability of a recession by 2025, these predictions reflect a growing apprehension among market participants. Speculators, who often operate ahead of trends, provide a unique perspective on market conditions that traditional economic indicators may not always capture. This new form of trading not only bets on future events but also informs the broader market about ongoing sentiments regarding policies like Trump’s tariffs.

As such, speculation feeds into financial market reactions, influencing how different asset classes are perceived. Rising odds of a recession can prompt investors to pivot their strategies towards more stable investments or hedge against downturns, which can in turn affect market liquidity and volatility. For instance, the immediate aftermath of the tariff implementation saw a rush to safe havens, indicating that traders are increasingly apprehensive about the possible repercussions of such aggressive trade policies.

In light of Polymarket’s predicted likelihood of a recession, the markets have been responding to these speculative bets with increased volatility. Understanding this interplay is crucial, as speculators can often act as early indicators of larger trends in the economy. As they place bets on conditions such as the likelihood of market downturns, they create ripple effects that affect trader confidence and decision-making. The dynamics of financial predictions demonstrate how speculation can sometimes lead to a self-fulfilling prophecy, especially in cases where traders react to perceived risks and uncertainties surrounding fiscal policy changes.

Assessing the Broader Economic Implications of Tariffs

The implementation of the ‘Liberation Day’ tariffs raises concerns beyond immediate market reactions. The economic implications can be far-reaching, influencing everything from trade balances to job creation rates. Economists warn that rising tariffs might lead to a deterioration in relationships with key trading partners, resulting in retaliatory measures that could further constrict trade. This tightening of international economic relations might not only affect U.S. exports but could also lead to increased consumer prices domestically, thereby jeopardizing the economic recovery many had anticipated in the post-pandemic landscape.

Moreover, the likelihood of a downturn highlighted in Polymarket predictions points towards an awareness of these complex dynamics among participants. The economic model assumes that as tariffs escalate, businesses will cut back on production and hiring, fearing a decrease in consumer demand due to higher prices. Ultimately, this could manifest in a slowdown that exacerbates the potential for recession in the coming years, a grim outlook echoed by the sharp declines witnessed in the Dow Jones and other indices.

In navigating the turbulent waters of economic policy and market reactions, businesses must remain vigilant. The fluctuations and rising speculations regarding a recession by 2025 have broader ramifications for strategic planning and investment decisions. Companies need to reassess their dependence on imported goods and consider diversifying supply chains to mitigate tariff impacts. The uncertainty introduced by President Trump’s trade policies could compel firms to innovatively adapt their business models, avoiding single points of failure that could arise from punitive tariffs. As the situation develops, both businesses and consumers alike will be affected by the shifting economic landscape.

Investor Sentiment and Market Volatility

Investor sentiment is a powerful force that drives market dynamics, especially during periods of economic uncertainty. Following the announcement of the new tariffs, market volatility surged as traders reacted to the implications for future business costs and consumer pricing. The stark increase in the probability of a U.S. recession—approaching 50% on Polymarket—reflects a deteriorating outlook that has influenced trading behavior. Investors tend to gravitate towards more defensive positions when uncertainty looms, which can exacerbate market dips as demand for riskier assets diminishes.

These fluctuations not only impact stock investors but also resonate across other financial markets, affecting commodities, currencies, and cryptocurrencies as well. A sudden downturn in the equity markets, exemplified by the Dow’s significant drop, illustrates how rapidly sentiment can shift in response to geopolitical events such as tariff announcements. The interconnectivity of markets means that a shake in one sector can lead to ripples across others, heightening the sense of urgency around financial maneuvers.

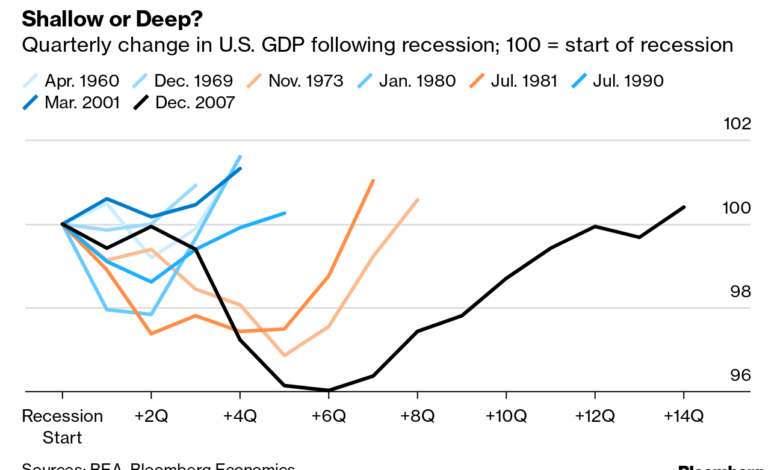

Moreover, the relationship between investor sentiment and market reactions also touches upon historical precedents where sharp market movements have led to broader economic consequences. The bearish sentiment post-Tariff announcement poses questions as to how long these effects may linger and whether it reinforces a cycle of skepticism among investors. Following dramatic drops, history has shown that recovery times can vary greatly; thus, understanding sentiment becomes imperative in forecasting when markets may stabilize again. In light of potential recession probabilities, investors are likely to remain cautious, continually eyeing potential indicators that might suggest an economic rebound or further decline.

Political Commentary and Economic Stakes

Political commentary increasingly intertwines with economic analysis in times of crisis, and the discourse surrounding Trump’s tariffs has proven to be no exception. The polarized views expressed on platforms like Polymarket demonstrate how emotional investment in political outcomes can overshadow economic considerations. As participants place bets on recession likelihood, they not only express skepticism about fiscal policies but also engage in a broader narrative about economic governance. This commentary reflects how deeply intertwined political ideologies are with perceptions of economic stability, especially during tumultuous periods like this.

One notable facet of this economic conversation is the way political allegiances can cloud judgment about market dynamics. Critics have already emerged, intertwining political rhetoric with predictions of economic doom, as Seen in responses that mock rival political factions related to expected market outcomes. Such exchanges can lead to an echo chamber, where diverging viewpoints about policy effectiveness can shape investor sentiment and market reactions significantly, potentially complicating discussions about the realities of recession risks.

Furthermore, the stakes surrounding these discussions extend beyond mere speculation; they influence real economic conditions that affect everyday Americans. Tariffs designed to protect domestic industries may, paradoxically, lead to job losses in sectors reliant on international supply chains. The political implications of these economic realities can create a cycle that nurtures further division among constituents as they grapple with the tangible impacts of policy decisions. Given the complexities of global trade, it becomes increasingly vital for stakeholders in both political and economic spheres to approach discussions surrounding tariffs and their consequences with data-driven perspectives rather than solely ideological battles.

Future Market Trends Amid Tariff Uncertainty

As the dust settles on President Trump’s recent tariff announcements, analysts are already speculating on future market trends in light of this uncertainty. A significant volume of trading on Polymarket highlighting recession likelihood reflects an urgent need for investors to reassess their portfolios. The risks posed by swift tariff implementations can lead to market corrections, suggesting that over the medium term, volatility might become the norm as traders continue to react to rapid changes in economic policy. Market analysts predict that sectors heavily dependent on international trade will face continued pressure, which could prompt a shift in the types of investments that are being pursued during this uncertain climate.

Moving forward, investors are likely to consider less exposure to industries vulnerable to tariff impacts as they evaluate their long-term strategies. Historically, periods of high volatility have encouraged diversification and innovation, prompting businesses to explore new markets or adopt technologies that streamline their operations against fluctuating costs. The present climate may serve as a catalyst for companies to embrace agility and adaptability in their strategies, proactively exploring operational efficiencies, or engaging in mergers and acquisitions to bolster market positioning during turbulent times.

Moreover, as the political landscape evolves, emerging trends may shape how companies respond to tariff risks. Transactions and business decisions could increasingly prioritize local supply chains, reducing dependency on potentially problematic imports. This shift not only mitigates risks associated with trade policies but also taps into growing consumer trends favoring locally-sourced products. Therefore, while current sentiment is charged with anxiety over a potential economic downturn, it may also inspire long-term strategic shifts in the business world that embrace resilience within a frame of responsible policymaking that balances economic growth and fiscal protection.

Frequently Asked Questions

What are the Polymarket predictions regarding a U.S. economic downturn by 2025?

Polymarket predictions indicate a growing sentiment towards an economic downturn in the U.S. by 2025, with current market activity suggesting the likelihood has reached almost 50%. This surge in predictions coincides with significant economic events, including the recent introduction of tariffs.

How do Trump tariffs impact the likelihood of a recession in the U.S. economy?

Trump tariffs, particularly the announced ‘Liberation Day’ tariffs, have raised concerns about potential economic fallout. Economists warn that these tariffs may contribute to a recession, evidenced by Polymarket predictions that indicate a heightened probability of nearing 50% for a downturn due to increased costs and trade tensions.

What is the recession likelihood for the U.S. in 2025 based on current trends?

The recession likelihood for the U.S. by 2025 is currently estimated at approximately 49%, according to Polymarket’s latest predictions. This number reflects a significant increase tied to financial market reactions and recent tariff announcements.

What was the financial market reaction following the tariff announcements?

In response to the tariff announcements, the financial markets experienced a steep decline, with the Dow Jones dropping an unprecedented 1,630 points. This marked one of the worst single-day performances, signaling concerns about the potential economic downturn and its effects on investor confidence.

How has the Dow Jones been affected by predictions of a U.S. economic downturn?

The Dow Jones Industrial Average faced a dramatic drop of 1,630 points following the announcement of tariffs, highlighting the market’s negative reaction to increased predictions of a U.S. economic downturn. Such fluctuations underscore the volatility linked to economic uncertainty.

| Key Point | Details |

|---|---|

| Market Speculation | Speculators on Polymarket are betting on the likelihood of a U.S. economic downturn by 2025. |

| Tariff Announcement | President Trump announced a 10% tariff on imported goods effective April 5, 2025. |

| Initial Market Response | On April 3, 2025, the Dow Jones dropped by 1,630 points, reflecting market turmoil. |

| Increased Recession Probability | Wagering on the probability of a recession rose to $1.1 million, increasing from 39% to 49% after the announcement. |

| Political Climate | The contract comments show a divide in political opinion, with users criticizing each other about Trump’s impact on the economy. |

| Overall Market Loss | The equity market suffered a loss of $2.85 trillion, indicating a significant financial crisis. |

Summary

U.S. economic downturn predictions have intensified following President Trump’s announcement of substantial tariffs, which have led to increased market speculation and fears of recession. With the probability of an economic downturn hovering around 49% as a result of these tariffs, investors are closely monitoring developments in both the financial market and broader economic indicators. The responses from across the trading floor underscore rising concerns over potential repercussions, marking an uncertain future.