Tokenized Treasury Funds: Blackrock’s BUIDL Achieves Milestone

Tokenized Treasury funds are revolutionizing the landscape of institutional investments by merging traditional finance with innovative blockchain technology. Recently, Securitize, the firm behind Blackrock’s BUIDL fund, announced an impressive $4.17 million in dividend payouts for March, standing out as the highest monthly figure among tokenized Treasury offerings. This remarkable achievement brings the total dividends distributed to $25.4 million since the fund’s inception, showcasing the growing appeal of digital liquidity in the financial sector. With its operations spanning multiple blockchain networks, BUIDL represents a new era where traditional Treasury instruments are accessible through tokenization. As demand for blockchain investments surges, tokenized Treasury funds are poised to provide efficient and transparent financial solutions for institutional investors.

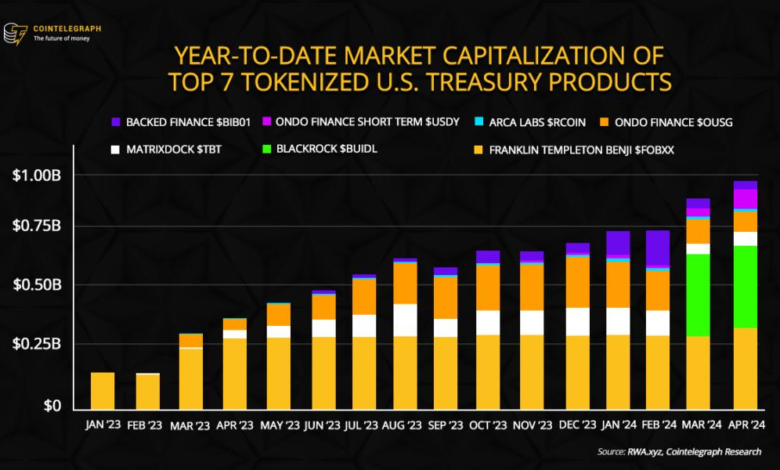

Tokenized government securities are becoming pivotal in reshaping investment opportunities, particularly among institutional entities. Securitize, which facilitates Blackrock’s innovative BUIDL fund, recently reported record dividend payouts, highlighting the fund’s competitive edge in the evolving market of digital assets. This indicates a shift towards acknowledging the significant benefits of integrating blockchain technology into conventional financial frameworks. As these digital securities gain traction, investors increasingly recognize the potential for regular dividend distributions and enhanced liquidity. The rise in popularity of these tokenized assets reflects a broader trend towards modernization in investment strategies.

The Importance of Tokenized Treasury Funds in Modern Finance

Tokenized Treasury funds are revolutionizing the financial landscape, offering institutional investors a new avenue to manage liquidity and generate returns. The introduction of products like Blackrock’s BUIDL demonstrates how tokenization is making traditional investment vehicles more accessible and efficient. By leveraging blockchain technology, these funds provide enhanced transparency and streamlined processes, which are crucial for modern investors seeking to navigate the complexities of digital finance.

This evolution reflects a broader trend where institutional players are increasingly venturing into blockchain investments. Tokenized Treasury funds not only unlock new opportunities but also create a more liquid market environment. With services like Securitize facilitating the issuance and management of such funds, the finance industry is poised to experience substantial shifts, ensuring that traditional investment frameworks adapt to the digital age.

Blackrock’s BUIDL: Record Dividend Payouts and Impact on Investors

In March, Blackrock’s BUIDL tokenized U.S. Treasury fund achieved a remarkable milestone by distributing $4.17 million in dividends, making it a standout player in the tokenized Treasury market. This is particularly significant as it indicates not just the operational success of the fund, but also the burgeoning interest in institutional digital liquidity. As more investors realize the potential of tokenized assets, platforms like BUIDL may redefine how dividends are perceived and distributed.

The impressive cumulative distribution of $25.4 million since launch emphasizes the growing acceptance of blockchain investments among institutional investors. Daily dividend payouts, available from Monday to Friday, represent a shift from traditional payout schedules, allowing investors to enjoy near real-time access to their earnings. This innovative approach not only enhances investor satisfaction but also showcases the disruptive nature of tokenized funds in enhancing liquidity while remaining compliant with financial regulations.

Exploring Blockchain Investments: The Future of Institutional Finance

Blockchain investments are becoming increasingly vital in the new era of finance. They offer not only unprecedented opportunities for yield generation but also a mechanism for achieving greater security and efficiency in transactions. Funds like Blackrock’s BUIDL are leading the charge by integrating these advantages into their financial products, effectively merging traditional finance with the cutting-edge capabilities of blockchain technology.

As institutional investors gain confidence in blockchain infrastructures, we can expect to see a rise in the creation of tokenized assets across various sectors. Organizations are recognizing the benefits of utilizing established blockchain networks, which allow for faster settlements and lower costs. This shift signifies a deepening partnership between finance and technology, paving the way for a future where blockchain and digital liquidity become the norm in the investment landscape.

The Role of Securitize in Tokenization and Asset Management

Securitize plays a pivotal role in the realm of tokenized assets, acting as a bridge between traditional securities and the innovative world of blockchain. By managing the issuance and lifecycle of tokenized assets like Blackrock’s BUIDL fund, Securitize supports compliance with regulatory standards while optimizing asset management. This is crucial as institutional investors look for assurance in the legitimacy and security of their blockchain investments.

Moreover, Securitize’s platform significantly enhances the efficiency of dividend payouts and investor communications. With its technology, investors can experience streamlined processes and timely updates regarding their investments. The firm’s commitment to transparency and adherence to compliance ensures that as the market for tokenized Treasury products expands, it does so on a solid framework that promotes trust and confidence among stakeholders.

Dividend Payouts: A New Era for Institutional Investments

The trend of daily dividend payouts, as exemplified by Blackrock’s BUIDL, marks a new era for institutional investments. This model not only provides faster returns but also meets the evolving expectations of investors who crave more immediate engagement with their assets. The tokenization of Treasury funds, particularly through platforms like BUIDL, allows institutional players to align their financial strategies with modern liquidity demands.

Furthermore, this shift enhances the overall appeal of blockchain investments, providing a competitive edge over traditional investment vehicles. The flexibility of earning daily dividends can incentivize more investors to consider tokenized products, driving greater liquidity in the market. As institutions adapt to these new frameworks, the landscape of finance is set to be transformed by innovative payout structures and enhanced investor experiences.

Institutional Digital Liquidity: Navigating the New Frontier

Institutional digital liquidity represents a significant turning point in how large investors manage and deploy their assets. The advent of tokenized funds such as Blackrock’s BUIDL highlights the increasing prevalence of digital liquidity solutions that enable faster transactions and improved cash flow management. As institutions embrace blockchain technology, they gain access to more dynamic methods of liquidity that can adjust to their needs in real-time.

Digital liquidity allows institutions to capitalize on opportunities in ways that were previously unattainable. For instance, tokenized Treasury funds offer immediate access to liquidity while maintaining the stability of traditional assets. This synergy positions digital liquidity as a transformative factor in the financial markets, encouraging more institutions to adopt blockchain strategies and further integrate these technologies into their operational frameworks.

The Rise of Institutional Tokenization: Implications for Investors

The rise of tokenization is reshaping the investment landscape, particularly for institutional investors who are traditionally more conservative in their asset allocation strategies. As seen with Blackrock’s BUIDL, the ability to tokenize Treasury funds not only enhances efficiency but also opens up new avenues for investment diversification. This trend suggests a paradigm shift where institutions may broaden their portfolios to include a mix of digital and traditional assets.

Investors are beginning to recognize the advantages of tokenized investments, including enhanced liquidity and peer-to-peer capabilities that traditional financial instruments often lack. The implications of this shift are profound, as institutions that adopt tokenization stand to benefit from increased operational efficiencies, better returns, and a stronger alignment with the demands of today’s market participants.

Revolutionizing Financial Instruments with Blockchain Technology

Blockchain technology is at the forefront of revolutionizing financial instruments, making traditional processes more reliable and efficient. The tokenization of assets like U.S. Treasury funds through Blackrock’s BUIDL exemplifies how blockchain can eliminate inefficiencies inherent in traditional financial systems. By providing a transparent, secure, and instantaneous method of transaction, blockchain opens up new horizons for both issuers and investors.

As more financial products adopt blockchain features, we can expect to see significant shifts in investor behavior and expectations. The capacity to offer real-time transaction capabilities, coupled with seamless dividend payouts and overall improved liquidity, will attract a new wave of investors looking for modern solutions to their financial needs. The continuous evolution of these technologies will ultimately dictate how financial instruments are structured and operated in the future.

Investing in the Future: The Role of Tokenized Funds

Investing in tokenized funds like Blackrock’s BUIDL signifies a forward-thinking approach to asset management. These products not only cater to the needs of today’s investors but also position them advantageously for future market dynamics. By incorporating features like daily dividends and enhanced liquidity, tokenized funds are designed to align with the fast-paced nature of modern finance.

As interest in tokenization grows among institutional investors, asset managers must adapt their strategies to include these modern financial products. The evolution of investment paradigms will hinge on the continued acceptance of tokenized solutions that offer scalability, compliance, and superior performance. Ultimately, the integration of tokenized funds into investment portfolios can yield substantial benefits, paving the way for a more inclusive financial landscape.

Frequently Asked Questions

What are tokenized Treasury funds and how do they relate to blockchain investments?

Tokenized Treasury funds represent traditional treasury securities that have been digitized through blockchain technology. These funds, like Blackrock’s BUIDL, leverage blockchain investments to enhance liquidity and streamline automated dividend payouts, enabling investors to access government bonds in a more efficient and transparent manner.

How does Blackrock’s BUIDL fund distribute dividend payouts?

Blackrock’s BUIDL tokenized fund distributes dividends daily, from Monday to Friday. This structure allows investors to benefit from near real-time yield generation, making it appealing for those seeking consistent income from their blockchain investments.

What milestone did Securitize recently achieve with Blackrock’s BUIDL fund?

Securitize recently announced a record-breaking $4.17 million in dividends for March, marking it as the highest monthly payout among tokenized Treasury products. Since its inception, the BUIDL fund has distributed a total of $25.4 million in dividends, highlighting growing institutional interest in tokenized Treasury funds.

Why are tokenized Treasury funds like BUIDL gaining popularity?

Tokenized Treasury funds are gaining popularity due to their ability to bridge traditional finance and blockchain technology. BUIDL’s structure offers increased institutional digital liquidity, more efficient transaction processes, and consistent dividend payouts, attracting both institutional and retail investors interested in blockchain investments.

Which blockchain networks does Blackrock’s BUIDL fund operate on?

Blackrock’s BUIDL tokenized fund operates across seven major blockchain networks: Solana, Ethereum, Aptos, Arbitrum, Avalanche, Optimism, and Polygon. This wide operational range enhances its accessibility and institutional appeal in the realm of digital asset investment.

How do tokenized Treasury funds improve liquidity in the financial markets?

Tokenized Treasury funds, such as BUIDL, enhance liquidity by utilizing blockchain technology to facilitate faster transactions and easier access to investment opportunities. This transformation allows for more efficient trading and improved market dynamics, making it easier for investors to liquidate their holdings when necessary.

What is the significance of the $4.17 million dividend payout by Blackrock’s BUIDL fund?

The $4.17 million dividend payout by Blackrock’s BUIDL fund is significant as it represents the highest single-month distribution among tokenized Treasury products. This record highlights the appealing nature of tokenized investments and the growing demand for alternative ways to generate income through blockchain-based financial instruments.

How does tokenization transform traditional financial instruments like U.S. Treasuries?

Tokenization transforms traditional financial instruments by digitizing them and utilizing blockchain for transactions. This process increases accessibility, efficiency, and transparency, enabling innovative investment strategies and daily dividend payouts, as seen with Blackrock’s BUIDL tokenized U.S. Treasury fund.

| Key Point | Details |

|---|---|

| Record Dividends | BUIDL reported $4.17 million in dividends for March, the highest among tokenized Treasury products. |

| Total Distributions | Since its launch, BUIDL has distributed $25.4 million. |

| Operational Networks | The fund operates on seven major blockchain networks including Solana and Ethereum. |

| Investment Appeal | Tokenized Treasury funds like BUIDL enhance access and liquidity in traditional financial markets. |

Summary

Tokenized Treasury funds like BUIDL are demonstrating their growing significance in the financial landscape. Securitize’s BUIDL fund has achieved remarkable success, not only by securing record monthly payouts but also by establishing a strong track record of dividends. As institutional interest in blockchain-based investments continues to climb, tokenized Treasury funds are poised to redefine investment strategies, providing investors with enhanced liquidity and efficiency in managing their assets.