HBAR Technical Analysis: Insights into Price Movements

In the realm of cryptocurrency trading, **HBAR technical analysis** is becoming increasingly important for traders seeking to optimize their investment strategies. Recent movements in HBAR’s price have highlighted critical support and resistance levels, which form the bedrock of effective trading strategies. With the HBAR price prediction showing potential upward trends, understanding these dynamics through technical indicators is essential for success. As participants monitor crypto market trends, the interplay between HBAR support resistance levels will play a crucial role in future price movements. Armed with this analysis, traders can better navigate the fluctuating waters of HBAR crypto trading, positioning themselves for profitable outcomes.

Exploring the nuances of **HBAR price movements** requires a refined understanding of market mechanics and charting tools. Analyzing Heodyan network tokens calls for keen attention to support and resistance dynamics, which provide valuable insights into trader sentiment and potential price reversals. As digital asset enthusiasts dive into the craft of **crypto trading**, they will find that technical indicators for HBAR are vital for constructing sound trading strategies. By keeping an eye on liquidations and momentum shifts in the ecosystem, traders can gain a competitive edge in the volatility of HBAR and its market implications. Ultimately, leveraging these analytical techniques equips traders to decipher the complex tapestry of crypto market fluctuations.

Understanding HBAR Price Predictions

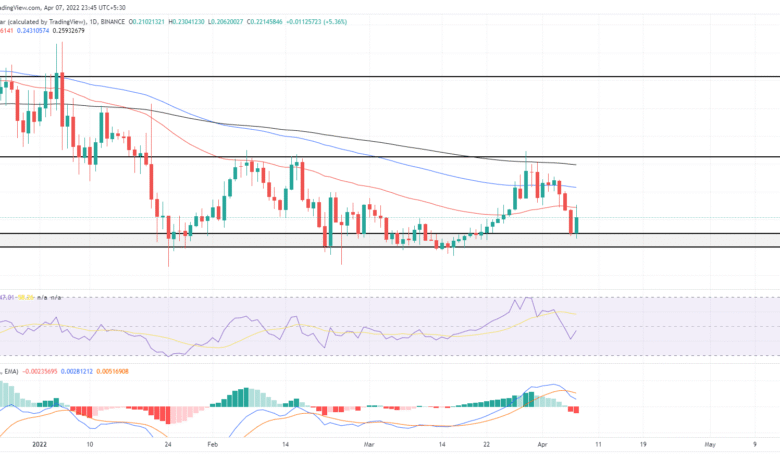

As a burgeoning cryptocurrency, HBAR has navigated volatile market conditions, making accurate price predictions crucial for investors. Analysts utilize various strategies and technical indicators to forecast future movements, with focus areas including support and resistance levels. Currently, the price of HBAR is showing potential recovery after finding support at the 800 EMA, indicating that a bullish trend may be on the horizon if the price maintains above significant structural zones. Investors should analyze the historical behavior of HBAR along with market trends to identify patterns, which can be essential for making informed predictions.

Furthermore, keeping an eye on related metrics like HBAR price predictions becomes increasingly vital as the crypto market fluctuates. The interaction between HBAR and broader market movements, especially from Bitcoin, significantly impacts price dynamics. Hence, the vital resistance levels established by the 50 EMA and the 200 EMA should not be overlooked; successful breaches or rejections of these zones will likely dictate HBAR’s short-term performance and market sentiment.

Analyzing HBAR Support and Resistance Levels

In the ever-changing landscape of cryptocurrency trading, understanding HBAR’s support and resistance is essential. Currently, HBAR has found a robust support level at the 800 EMA, which signifies strong buyer interest in this price range. If HBAR can decisively break above the remaining double resistance created by the 50 EMA and 200 EMA, it may open the door for an upward trend, signaling a shift in market sentiment. This analysis is key for traders looking to establish positions based on potential price action.

The interplay between HBAR’s support and resistance levels can also be used to gauge market trends. For instance, if HBAR garners enough momentum to confirm these EMA levels as new support, it could signal a lasting uptrend. Conversely, failure to hold the support may lead to increased bearish sentiment. By monitoring these critical technical indicators, traders can better time their entries and exits within the highly speculative crypto market.

HBAR Technical Analysis: Key Indicators to Watch

Performing a technical analysis on HBAR is vital for understanding its price movement potential. Currently, several indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), are crucial for assessing HBAR’s market conditions. The RSI is nearing oversold territory, suggesting potential upward momentum if it rebounds, while the MACD indicates ongoing negative momentum, hinting at a waiting phase before any possible reversal. For traders, these indicators should be closely monitored to predict short-term activity.

Moreover, the presence of a potential W-pattern forming on the daily chart aligns with upcoming market movements—assuming conditions in the broader crypto market stabilize. A confirmed break above the double resistance area could be interpreted as a bullish signal, despite mixed signals from technical indicators at present. Being abreast of such technical analysis can enhance traders’ strategic planning in HBAR crypto trading.

Evaluating HBAR in Current Crypto Market Trends

The cryptocurrency market is fiercely competitive, with trends shifting rapidly. For HBAR investors, evaluating the current market landscape is essential when making trading decisions. As HBAR has established itself within a unique technical framework, analysts must consider external influences, particularly from Bitcoin. The correlation of HBAR’s price movement with Bitcoin trends underscores the importance of comprehensive market trend analysis.

Observing the prevailing market conditions, it becomes evident that HBAR stands at a technical juncture, with price action bounded by significant support and resistance levels. Therefore, whether the market is bullish or bearish could dramatically influence HBAR’s trajectory. Understanding these market trends will allow investors to navigate potential volatility and adapt their strategies accordingly.

The Role of Indicators in HBAR Trading

Indicators play a pivotal role in HBAR crypto trading, providing insights into market conditions and potential price movements. Traders often use a combination of technical tools, such as the RSI, MACD, and EMA lines, to craft informed trading strategies. As HBAR approaches critical resistance zones represented by the 50 EMA and 200 EMA, these indicators serve to either reinforce bullish momentum or signal caution if bearish patterns emerge.

By leveraging these technical indicators, traders can cultivate a nuanced understanding of market sentiment and timing. For instance, a sudden spike in selling volume accompanied by a bearish MACD cross could foreshadow a trend reversal, prompting traders to reassess their long positions. As the landscape in crypto trading is ever-evolving, remaining adaptable and informed about these indicators can prove invaluable for trading HBAR successfully.

The Importance of Liquidity Zones in HBAR Trading

Liquidity zones represent critical levels in HBAR trading, where an influx of buy or sell orders can significantly influence price dynamics. Currently, a well-defined liquidity zone exists above HBAR’s present price, indicating that the likelihood of a price increase exists if the resistance levels are overcome. Such zones can provide traders with strategic entry points, particularly if supported by strong volume.

Recognition of these liquidity zones not only aids in devising entry and exit strategies but also offers insights into potential price reversals. The market’s overall liquidity can dictate how effectively HBAR can navigate resistance levels. As traders keenly observe the interaction of price with these zones, the implications for potential short squeezes and liquidation events become evident, emphasizing the need for diligence in trading strategies.

Bitcoin’s Influence on HBAR Price Action

Bitcoin, being the foremost cryptocurrency, often sets the tone for other altcoins, including HBAR. As Bitcoin fluctuates, its influence on HBAR cannot be overstated; thus, any analysis must consider Bitcoin’s market behavior. Fluctuations in Bitcoin’s price can often lead to synchronized movements in HBAR’s price, creating opportunities for traders to capitalize on inter-market strategies.

Currently, HBAR’s potential upward movement hinges on Bitcoin maintaining stability. If Bitcoin faces resistance or experiences bearish trends, that may impede HBAR’s progress toward establishing new support levels. Traders must, therefore, keep a vigilant eye on Bitcoin’s price action as they navigate HBAR trading, ensuring that their strategies remain aligned with market dynamics.

Developing Strategies for HBAR Trading

Developing effective trading strategies for HBAR involves a blend of technical analysis and market sentiment assessment. Understanding key indicators, support and resistance levels, and potential liquidity zones can help traders identify opportunities. An effective strategy could involve setting target prices near identified support levels while simultaneously accounting for resistance zones to manage risk.

Moreover, utilizing tools such as stop-loss orders can be vital in protecting against unexpected volatility. As HBAR’s market develops, strategies may need continual refinement. The combination of strong technical indicators and adaptive planning will be essential for navigating HBAR trading successfully in the competitive crypto landscape.

Learning Resources for HBAR and Crypto Trading

Education is an essential component for successful trading in HBAR and the broader cryptocurrency market. From resources that delve into technical analysis to trading courses that focus on practical strategies, investors can enhance their understanding significantly. Platforms like BTC-ECHO Academy offer in-depth insights into crypto trading, helping traders of all levels refine their skills and strategies.

Such resources can provide a solid foundation for new traders looking to understand HBAR crypto trading intricacies. Learning about market trends, price indicators, and trading strategies equips traders to navigate the complexities of the crypto market more effectively. Ultimately, ongoing education and adaptation to market changes can pave the way for success in trading HBAR.

Frequently Asked Questions

What are the key technical indicators for HBAR technical analysis?

When conducting HBAR technical analysis, key indicators to consider include the 800 EMA, 50 EMA, and 200 EMA. These moving averages help identify support and resistance levels. The RSI (Relative Strength Index) can also signal potential price reversals when it approaches oversold zones, while the MACD indicates market momentum.

How does HBAR price prediction relate to crypto market trends?

HBAR price predictions are influenced by broader crypto market trends. For instance, if Bitcoin shows stability or an upward movement, it can positively impact HBAR’s price trend. Analysts often look at correlation with Bitcoin to gauge potential price movements in HBAR.

What does HBAR support resistance tell us about potential price movements?

In HBAR’s chart analysis, the support and resistance levels, such as the recent support at the 800 EMA and resistance near the 50 and 200 EMA, reveal areas where price may reverse or consolidate. A breakthrough of these resistance levels could signal a continuation of an upward trend.

How can crypto trading strategies incorporate technical indicators for HBAR?

Successful HBAR crypto trading strategies should incorporate technical indicators like EMAs, RSI, and MACD. For example, traders may look for buying opportunities when HBAR approaches support levels with oversold RSI readings, or they might seek to sell or short when price encounters resistance.

What is the significance of the W-pattern in HBAR technical analysis?

A W-pattern emerging on the HBAR chart suggests a bullish reversal, signaling the potential for a new upward trend. For this pattern to materialize confidently, it must be supported by broader market conditions, especially movements in Bitcoin.

What role does the heatmap play in HBAR crypto trading?

The heatmap in HBAR technical analysis provides insight into liquidity zones, indicating areas with a higher likelihood of price action. Identifying these zones can help traders make informed decisions about entry and exit points in crypto trading.

How do pullbacks affect HBAR’s trading strategy?

Pullbacks to significant support areas in HBAR, such as the green support line in the 4-hour chart, present opportunities for traders. These pullbacks, especially when accompanied by low RSI readings, may lead to profitable counter-movements.

What challenges does HBAR face in achieving a sustainable trend change?

A sustainable trend change for HBAR requires breaking through key resistance levels, particularly the 200 EMA, and confirming these as new support. Additionally, without backing from Bitcoin and overall market stability, HBAR may struggle to initiate an upward trend.

| Time Frame | Key Observations | Indicators | Potential Outcomes |

|---|---|---|---|

| Daily Chart | Price found support at 800 EMA, moving above structural zone, near major resistance from 50 EMA and 200 EMA. | Positive if breakthrough occurs, possible W-pattern emerging pending Bitcoin stability. | Breakout above resistance could initiate upward trend, confirmation needed for sustainable support. |

| 4-Hour Chart | Potential test of green support line, RSI nearing oversold territory. | MACD indicating strong negative momentum, no immediate trend reversal in sight. | High short delta suggests a sudden price increase might cause a short squeeze, but above 200 EMA required for durable trend change. |

Summary

HBAR technical analysis reveals a market poised between significant support and resistance levels. With the current price finding support at the 800 EMA in the daily chart, a potential upward trend could initiate if HBAR breaks and confirms levels above the 50 EMA and the 200 EMA as new support. However, the mixed signals from the 4-hour chart, particularly the negative momentum indicated by the MACD and the potential test of the support line, suggest caution. A market impulse, especially from Bitcoin, could provide HBAR with the necessary momentum to move past these resistances.