March Retail Sales Surge 1.4% Exceeding Expectations

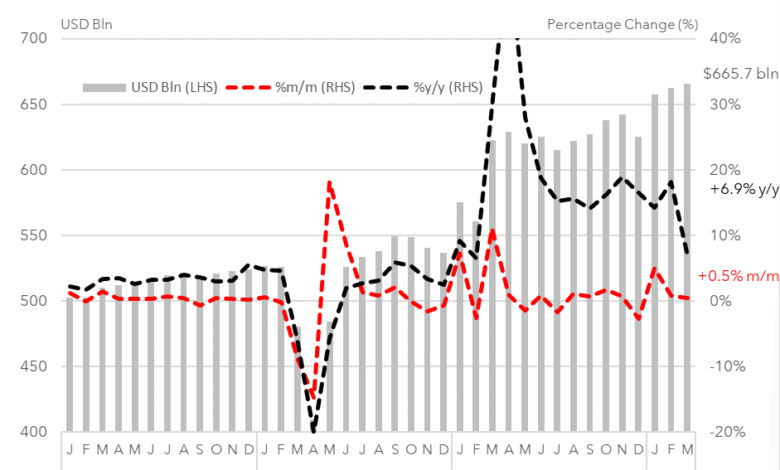

March retail sales surged by 1.4%, exceeding expectations and marking a remarkable turnaround from previous months. This impressive growth not only highlights a year-over-year retail increase of 4.6%, but it also points to a resilient consumer spending March that puzzled many economists. With shoppers eager to take advantage of sales before anticipated price hikes due to tariffs, the strong performance in retail underscores the potential impact of tariffs on sales dynamics. Notably, the 1.4% uptick surpassed the Dow Jones estimate of 1.2%, revealing the strength of the current economic outlook for 2025. As businesses adapt to evolving consumer behaviors, the trends in retail sales growth seem promising, suggesting that the retail sector may continue to thrive amidst challenges.

In the month of March, consumer purchases experienced a significant uptick, illustrating a dynamic shift in spending patterns. This month’s retail performance showcased a notable bounce back, defying earlier predictions and pushing retailers to reassess market strategies. As Americans continued to shop despite a backdrop of rising tariffs and economic uncertainties, the retail sector benefitted from increased spending levels that were reflected in the robust statistics. Various sectors, including automotive and home improvement stores, witnessed substantial gains, contributing positively to the retail landscape. Such resilience in consumer behavior offers a hopeful glimpse into the trajectory of economic health going forward.

Analysis of March Retail Sales Performance

The retail sales report for March revealed a compelling growth trajectory, with a remarkable 1.4% increase, surpassing the Dow Jones estimate of 1.2%. This uptrend demonstrates a robust consumer spending landscape despite challenges posed by economic uncertainties. The monthly gain reflects a significant rebound from the 0.2% increase observed in February, indicating that consumers are actively engaging with the retail market. The data suggests that consumers are not only spending but doing so with confidence, marking an optimistic shift in their purchasing behaviors.

Excluding automobile sales, the retail growth narrative remains equally strong, with a 0.5% increase that outperformed expectations. This broader indicator of retail sales growth showcases how diverse sectors are thriving despite potential headwinds, such as economic tariffs and a fluctuating economic outlook for 2025. The resilience observed in March indicates a prioritization of essentials and discretionary spending, reflecting evolving consumer confidence in navigating economic pressures.

The Impact of Tariffs on Consumer Spending in March

March’s retail sales data provides intriguing insights into how tariffs are shaping consumer spending patterns. According to analysts, aggressive tariffs initiated by the Trump administration have prompted consumers to make decisive purchasing decisions ahead of potential price increases. The significant 5.3% hike in motor vehicle and parts sales underscores this behavior, as buyers rush to acquire vehicles before tariffs potentially inflate costs.

This strategic consumer action indicates a broader trend where individuals are reacting to economic forecasts and concerns. Retailers may find that such proactive purchases could lead to short-term spikes in certain sectors, but they also raise questions about long-term sustainability of consumer spending amid potential economic slowdowns. Analysts will continue to assess how tariffs and related factors influence year-over-year retail increases as we move further into 2025.

Year-Over-Year Retail Growth Insights

The year-over-year retail sales increase of 4.6% in March marks a noteworthy achievement and signals a promising economic outlook. This 4.6% growth, based on seasonally adjusted figures, reflects resilience in consumer demand and an ability to absorb rising prices amid shifting economic conditions. Such a strong increase year-over-year could point to a stabilization in consumer spending patterns, indicating that households are returning to a sense of normalcy post-pandemic.

Retailers specializing in sporting goods, hobbies, and even food services have benefited from this surge, showcasing diverse consumer interests. The robust performance across various segments not only highlights a recovery trajectory but also suggests that consumers remain inclined to invest in experiences and activities despite economic uncertainties. As forecasts evolve for the rest of 2025, continued observation of this growth will be essential for understanding the dynamics of consumer behavior.

Forecasting Economic Outlook for 2025

Looking ahead, the economic outlook for 2025 remains a focal point for economists, especially as current retail sales trends suggest varying consumer sentiment. With retail sales having risen 1.4% in March, analysts are examining how these numbers will evolve in response to national and global economic factors, including inflation rates and possible recession fears. Such factors will undoubtedly influence consumer behavior and spending priorities.

Forecast adjustments will be crucial as retailers and economists navigate potential impacts of tariffs and policy shifts. While the March retail sales figure offers a snapshot of present consumer confidence, it raises questions on how sustainable this growth will be amidst longer-term economic variables. Retailers will need strategic foresight to adapt to the changing landscape as we progress toward the latter half of 2025.

Consumer Sentiment Amid Economic Challenges

March’s retail sales report illustrates an interesting paradox: while consumer spending has increased, sentiment remains cautious due to anticipated economic challenges. Despite the impressive numbers, survey data reflect concerns around tariffs and their implications on purchasing power, suggesting that while consumers are currently spending, their confidence may be vulnerable to changes in the economic landscape. This dynamic adds complexity to the narrative of retail sales growth.

Moreover, consumer behavior is often influenced by external economic signals. If people continue to feel hesitant about the future, this could lead to shifts in spending habits, thereby affecting retail sales metrics in subsequent months. Retailers must therefore remain agile and responsive to shifts in consumer sentiment while positioning their inventory and marketing strategies to capitalize on ongoing consumer demand.

Sector-Specific Trends in March Retail Sales

The latest retail sales data points to diverse trends across various sectors, with notable increases in specific categories. Automotive sales, which experienced a sharp 5.3% rise, are indicative of consumer readiness to make significant purchases despite the backdrop of potential tariffs. This surge in car sales serves not only as a key driver of retail growth but also reveals underlying consumer sentiments about future pricing.

Additionally, areas such as sporting goods and gardening equipment have also seen promising increases with 2.4% and 3.3% jumps, respectively. These figures suggest a robust engagement in leisure and home improvement activities, indicating that consumers continue to invest in both recreation and personal projects. As retailers adapt to these nuanced demands, understanding sector-specific trends will be essential for maximizing sales opportunities.

Implications of Falling Gas Prices on Retail Sales

Interestingly, March’s retail sales report highlights a decline in gasoline station sales by 2.5%, attributed to falling fuel prices during the month. While this decrease might appear alarming at first glance, it offers a contextual understanding of consumer spending patterns. Lower gas prices can translate to increased disposable income for consumers, potentially stimulating spending in other retail categories.

As consumers spend less at the pump, they may be more inclined to allocate additional funds toward discretionary purchases, enhancing overall retail sales figures. This correlation suggests that while certain segments may face downturns, the broader retail environment could benefit if consumers redirect their savings towards shopping, particularly in non-essential sectors. Monitoring these shifts presents an opportunity for retailers to capture the changing landscape.

Strategies for Retailers to Adapt to Market Trends

As March retail sales exhibit strong performance, it becomes imperative for businesses to capitalize on current market trends. Retailers should prioritize inventory management and stay aware of price-sensitive consumers, particularly in sectors experiencing spikes due to tariffs and economic forecasts for 2025. Effective strategies could involve promotions or product bundling to attract cautious consumers who remain wary of future spending.

In addition, leveraging data accrued from consumer buying patterns can help retailers anticipate shifts in demand. Understanding which product categories are thriving, such as sporting goods or home improvement items, allows retailers to allocate resources efficiently and drive sales. Adapting to market trends will not only enhance customer satisfaction but also solidify retailers’ positions in an increasingly competitive marketplace.

Preparing for Future Economic Fluctuations

Retailers must strategize for potential economic fluctuations as we progress through 2025. The current economic climate, influenced by retail sales dynamics and external factors like tariffs, calls for agility in planning and execution. Businesses are advised to build resilient supply chains and expand digital sales channels, fostering both online engagement and physical store traffic to buffer against market volatility.

Furthermore, monitoring consumer sentiment and economic indicators is crucial for making informed business decisions. Proactive adaptations in response to these insights might empower retailers to maintain competitive advantage while mitigating risks associated with unforeseen economic downturns. Thus, fostering a culture of innovation and responsiveness will be key as firms navigate the complexities of the retail environment.

Frequently Asked Questions

What were the key highlights of March retail sales 2025?

March retail sales reported a robust increase of 1.4%, exceeding the Dow Jones estimation of 1.2%. This rise marks the highest monthly gain since January 2023, demonstrating strong consumer spending against a backdrop of economic uncertainty.

How did consumer spending in March affect retail sales growth?

Consumer spending in March was exceptional, contributing to a year-over-year retail sales increase of 4.6%. This growth occurred despite concerns over tariffs and potential economic slowdown, indicating resilience in consumer behavior.

What impact did tariffs have on March retail sales?

The anticipation of President Trump’s tariffs spurred a notable 5.3% increase in auto sales, as consumers sought to buy vehicles before potential price hikes. This demonstrates how external economic factors can influence retail sales dynamics.

How did the economic outlook for 2025 influence March retail sales?

Despite a challenging economic outlook for 2025, March retail sales showed significant resilience with a 1.4% increase, highlighting that consumers are still willing to spend even amidst uncertainty and inflation concerns.

What categories saw the highest growth in March retail sales?

In March, retail categories like motor vehicles increased by 5.3%, followed by building material and garden stores at 3.3%. Other sectors also performed well, indicating broad consumer engagement across various retail markets.

What were the expectations for consumer spending in March 2025?

Expectations for consumer spending in March 2025 were exceeded, as robust demand and strategic purchases ahead of anticipated price increases led to a significant retail sales growth, affirming consumer confidence.

How did March 2025 retail sales compare year-over-year?

Retail sales in March 2025 saw a 4.6% increase year-over-year, showcasing strong consumer engagement despite economic challenges, indicating a positive trend in retail performance.

What factors contributed to the strong retail sales in March 2025?

The strong retail sales in March 2025 were driven by solid consumer spending, significant growth in auto sales due to tariff anticipation, and increased sales in categories such as sporting goods, contributing to overall retail sales growth.

What does the March retail sales report signify for the future?

The March retail sales report suggests a persistent stability in consumer spending habits, which may bode well for economic growth and retail trends as we move further into 2025 despite anticipated economic challenges.

| Key Points | |

|---|---|

| Retail Sales Increase | 1.4% increase in March, exceeding Dow Jones estimate of 1.2% and surpassing February’s 0.2% rise. |

| Excluding Automobiles Growth | Sales rose by 0.5% compared to a forecast of 0.3%. |

| Year-over-Year Growth | 4.6% increase, highest monthly gain since January 2023. |

| Auto Sales Surge | 5.3% increase as consumers anticipate aggressive tariffs. |

| Consumer Spending Trends | Strong despite concerns over tariffs and potential economic slowdown. |

| Market Reaction | Muted; stock futures down, Treasury yields rising. |

| Sales Increases by Sector | Sporting goods (2.4%), Building materials (3.3%), Food service (1.8%); Gas stations down 2.5%. |

Summary

March retail sales showed a remarkable increase of 1.4%, exceeding expectations and indicating a resilient consumer market despite economic uncertainties. This significant uptick reflects not only the momentary demand surge for various goods, particularly in the automobile sector, but also suggests proactive consumer behavior in anticipation of future price hikes. As businesses navigate potential challenges ahead, March retail sales stand as a bright indicator of consumer confidence and spending patterns.