Bitcoin Future Predictions: Experts Forecast $10 Million Value

Bitcoin future predictions are at the forefront of conversations among experts and enthusiasts alike, sparking debates about the cryptocurrency’s potential trajectory. Notable figures such as Cathie Wood and Michael Saylor assert that Bitcoin could soar to unimaginable heights, with estimates reaching up to one billion US dollars per coin. This bold vision for Bitcoin echoes sentiments first expressed by Hal Finney, a pivotal figure in Bitcoin’s inception, who suggested that if Bitcoin achieves global currency status, each coin could be worth ten million dollars. The foundation of these predictions lies in various market analyses and the evolving landscape of cryptocurrencies, which are gaining traction worldwide. As discussions around the identity of Satoshi Nakamoto and the historical context of Bitcoin’s development unfold, the community eagerly anticipates the future of Bitcoin and its capacity to redefine monetary systems globally.

The future of Bitcoin has become a hot topic in financial circles, with various projections emerging from both enthusiasts and crypto experts. Many predict that this digital asset could revolutionize the financial landscape, potentially even positioning itself as a universal currency. Spearheading these discussions are influential figures who have closely followed the history of Bitcoin, such as Hal Finney, whose early insights laid the groundwork for current Bitcoin price forecasts. The ongoing debate around the true identity of Satoshi Nakamoto also adds to the intrigue, as many believe that understanding this enigma could shed light on Bitcoin’s future. As these conversations evolve, the push for Bitcoin as a mainstream financial tool continues to gain momentum, drawing attention from investors and policymakers alike.

The Rising Predictions for Bitcoin’s Future

Leading figures in the crypto world, such as Cathie Wood and Michael Saylor, have made astonishing predictions for Bitcoin’s future, forecasting a price that could soar to one billion dollars. This optimistic view, while debated, is not unfounded; it echoes earlier forecasts by Hal Finney, one of Bitcoin’s earliest adopters and contributors. In January 2009, Finney hinted at Bitcoin’s massive potential growth, claiming that a single Bitcoin could one day be valued at ten million dollars if it were to replace traditional currency. Such statements continue to fuel discussions among crypto enthusiasts and investors, sparking interest in the feasibility of Bitcoin becoming a global currency.

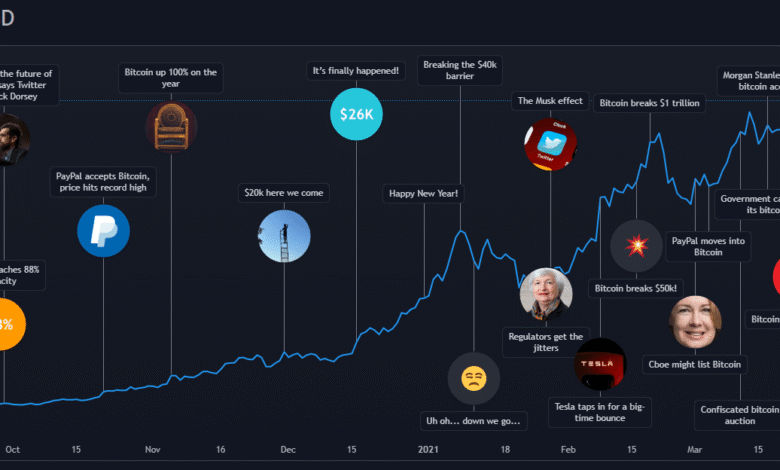

The volatility of Bitcoin’s price is part of what makes it a subject of both excitement and caution. Crypto expert predictions have varied widely, with some analysts suggesting that external factors—like regulatory changes, global economic stability, and technological advancements in blockchain—could greatly influence Bitcoin’s trajectory. As Bitcoin garners more institutional investment and public interest, its potential to reach drastic price points, as previously speculated, becomes a captivating yet uncertain endeavor.

One fundamental aspect underpinning these predictions is the concept of Bitcoin as a global currency. Investors and theorists alike grapple with the idea that if Bitcoin were to achieve widespread adoption as a means of exchange, its market value could correspond directly with the total wealth across the globe. Current estimates of global household wealth range from $100 to $300 trillion; dividing that by 20 million Bitcoins leads to staggering price estimates. This framework not only highlights the aspirational values set forth by early believers like Finney but also emphasizes the speculative nature of crypto investments, which hinge on numerous variables at play.

Understanding Hal Finney’s Legacy in Bitcoin History

Hal Finney is often recognized as a pivotal figure in Bitcoin’s creation and early development. He was among the first individuals to interact with Bitcoin’s code, famously running it shortly after Satoshi Nakamoto introduced it to the world. Finney’s contributions didn’t stop with mere participation; he engaged actively with Nakamoto, reporting bugs and helping refine the software in its infancy. His foresight and technical aptitude allowed him to envision Bitcoin’s potential long before it gained mainstream attention. This involvement has cemented his status as one of the leading candidates for being Satoshi Nakamoto, adding layers of intrigue to the already mysterious identity of Bitcoin’s creator.

Beyond his technical contributions, Finney’s perspective on cryptocurrencies stood out due to his fascination with their inherent paradoxes and enigmas. He was not only a miner but also a thinker who participated in discussions about privacy solutions and alternative currencies well before Bitcoin arrived on the scene. The legacy of Hal Finney is not exclusively tied to his connection with Bitcoin but extends to the broader philosophical underpinnings of cryptocurrency, making him a crucial historical figure that continues to influence discussions about digital currencies today.

In 2014, Finney passed away due to amyotrophic lateral sclerosis (ALS), but his insights and early visions for Bitcoin have left a lasting imprint in the crypto community. As the search for the true identity of Satoshi Nakamoto continues to perplex enthusiasts, Finney’s narrative becomes entwined in the larger story of Bitcoin’s evolution—marking him as a symbol of both ambition and innovation within the cryptographic landscape. His work remains a beacon of what can come from pioneering efforts in technology, reminding us of the ongoing battle to unravel not only Bitcoin’s potential but also the mystery of its inception.

The Status of Bitcoin as a Legal Currency

The legal status of Bitcoin continues to dominate discourse surrounding its adoption as a form of global currency. Various countries have struggled with integrating Bitcoin into their economies, with some exploring its potential as official tender while others exercise caution. For example, El Salvador made headlines as the first country to adopt Bitcoin as legal currency, but this bold move came with significant risks and challenges. Following pressure from the International Monetary Fund (IMF), the nation had to reassess its approach, highlighting the complex interplay of regulatory frameworks, economic stability, and public perception regarding cryptocurrencies.

This tug-of-war over Bitcoin’s legitimacy raises pertinent questions about the future of digital currencies. As nations navigate their sovereignty against the backdrop of blockchain technology, the experiences of countries like El Salvador serve as critical case studies for others considering similar paths. The broader implications of Bitcoin’s acceptance as a global currency could reshape financial legislation worldwide, pushing governments to either embrace or restrict its use, leading to diverse and sometimes conflicting regulatory environments.

In countries where Bitcoin has not found official recognition, the landscape often includes various barriers that stifle its growth and acceptance. Nations impose regulations driven by concerns over market volatility, tax evasion, and potential illegal activities, which compels the crypto community to advocate for clearer, more accommodating laws. This ongoing debate underscores the critical balance between innovation in the financial sector and necessary regulatory oversight. How Bitcoin adapts to these conditions could be crucial for its long-term viability and acceptance as a trustworthy alternative to traditional currencies, harking back to implications set forth by visionaries like Hal Finney.

Crypto Expert Predictions for the Future of Bitcoin

The crypto community thrives on the insights of experts who speculate about the future of Bitcoin and its potential to redefine global finance. Experts’ opinions vary, with many confidently endorsing the prospect of a Bitcoin surge fueled by factors such as increased adoption, greater mainstream acceptance, and heightened institutional investment. As Bitcoin continues to break boundaries, these predictions garner attention from both seasoned investors and newcomers, establishing a narrative that excites and intrigues.

Predictions suggest that Bitcoin could carve its niche as a digital gold, an asset that holds value amid economic uncertainty. This speculative outlook aligns with earlier forecasts made by pioneers like Hal Finney, whose assertion that Bitcoin could someday achieve staggering valuations largely resonates with today’s crypto analysts. Experts also contend that the journey toward this future will not be linear; rather, it will be a volatile ride marked by dramatic price fluctuations, technological breakthroughs, and evolving regulations.

As the cryptocurrency landscape evolves, predicting Bitcoin’s price trajectory involves analyzing greater macroeconomic trends and technological advancements. Factors such as inflation, currency devaluation, and shifts in consumer behavior contribute to the volatile nature of Bitcoin’s market. Moreover, the increasing diversification of the crypto market, with the rise of alternative cryptocurrencies and blockchain innovations, affects Bitcoin’s standing as a dominant player. Crypto experts underscore the importance of adaptive strategies for investors who aim to ride the waves of this dynamic landscape.

The Mystery Surrounding the Identity of Satoshi Nakamoto

The enigmatic figure of Satoshi Nakamoto remains one of the most compelling stories in cryptocurrency history. The identity of Bitcoin’s creator has been a subject of speculation and intrigue for over a decade, fueling numerous theories and claims. Many believe that Nakamoto is either a pseudonym for an individual or a group of developers, and this uncertainty has only heightened the mystery surrounding Bitcoin’s inception. As individuals like Hal Finney have been closely associated with the early interactions of Bitcoin, discussions often revolve around whether he could be Nakamoto himself, given his centrality in Bitcoin’s initial development.

While various individuals have been suggested as potential candidates for the title of Satoshi, none have proved conclusively to be the elusive creator. The ongoing quest to unveil Nakamoto’s identity adds layers of complexity to how Bitcoin is perceived—from its historical roots to its future trajectory in the global economy. This puzzle captivates crypto enthusiasts and drives speculation, heightening the allure of Bitcoin itself as a groundbreaking innovation.

Uncovering Satoshi Nakamoto’s true identity could hold significant implications, not only for Bitcoin’s narrative but also for regulatory and legal frameworks surrounding cryptocurrencies. Should Nakamoto be revealed, questions surrounding authority, ownership, and control over Bitcoin would come into play, influencing both investor sentiment and governmental action. For now, the mystery remains intact, serving as a reminder of the decentralized ethos that has come to define Bitcoin and its future.

Bitcoin’s Evolution: From Inception to Potential Mainstream Adoption

Since its inception in 2009, Bitcoin has undergone a transformative journey from a niche digital currency to a recognized financial asset, sparking debates about its place in the global economy. Early advocates like Hal Finney envisioned Bitcoin’s potential as a revolutionary payment system, emphasizing its privacy features and decentralized nature. As cryptocurrencies gained traction, Finney’s thoughts on the inevitability of Bitcoin’s success now reflect the growing optimism surrounding its role as a transparent and secure method of value exchange.

As Bitcoin continues to evolve, its future seems intertwined with broader economic trends and technological advancements within the blockchain ecosystem. The surge in interest from institutions and retail investors alike has shifted Bitcoin from a revolutionary idea to a viable investment product. Strikingly, the narratives surrounding Bitcoin’s rise often echo those of traditional financial mechanisms, stimulating the conversation about whether it can stand alongside fiat currencies as a mainstream alternative.

Despite facing regulatory hurdles, Bitcoin’s resilience in the face of market fluctuations showcases its potential for longevity. With increasing recognition and acceptance around the globe, the journey to mainstream adoption appears more attainable. This evolution requires continued advocacy from experts and pioneers who champion Bitcoin’s capabilities, including visionaries like Finney who laid the groundwork for future discussions about its practical applications. Whether Bitcoin becomes a global currency or not remains a central question in discussions about its future.

The Impact of Early Bitcoin Mining on Future Price Predictions

The early days of Bitcoin mining played a crucial role in shaping both the currency’s capabilities and its perceived value over time. Initial miners, including Hal Finney, had the advantage of relatively uncomplicated mining processes, allowing them to accumulate large amounts of Bitcoin with minimal equipment. As prices began to soar, the value of these early investments grew immeasurably. This unique position of early adopters has led to discussions about how their influence on Bitcoin’s supply could impact future price predictions, including Finney’s audacious claim of $10 million per coin if Bitcoin ascends to global currency status.

The significant profits made by early miners create a dichotomy in Bitcoin’s market that both excites and poses concerns for present-day investors. Critics argue that the wealth concentration among early Bitcoin adopters creates barriers for new entrants, which may discourage equitable participation in the Bitcoin economy. The leveraging of these early gains against future predictions is a crucial aspect of understanding Bitcoin’s price dynamics, highlighting the intricate relationship between mining activity and market valuation.

Moreover, as the network effects of Bitcoin grow, the behaviors of early miners can have lasting implications for future price stability and growth. Current mining protocols are increasingly complex and energy-intensive, diverging from the simplicity of early mining for a more competitive environment. Observing how early miner actions impact price momentum, including the speculative price targets set by enthusiasts and experts, becomes a focal point for understanding the long-term potential of Bitcoin. These trends not only highlight the influence of historical mining practices but also underscore the ongoing challenge of maintaining Bitcoin’s accessibility to a broader audience.

Hal Finney’s Influence on Cryptographic Innovations

Hal Finney was not merely a participant in Bitcoin’s creation but also a visionary who contributed significantly to the broader field of cryptographic innovations. Before his involvement with Bitcoin, Finney had been actively engaged in discussions surrounding cryptocurrencies and privacy solutions, developing ideas like RPOW (Reusable Proof of Work) that laid the foundation for future mechanisms within the blockchain space. His foresight and commitment to privacy in digital interactions showcased the potential for cryptocurrencies to provide secure alternatives for financial transactions.

Finney’s engagement with cryptography links closely to the fundamental principles that underpin many cryptocurrencies today. His advocacy for privacy technologies, such as ZK-proofs, resonates with contemporary discussions about anonymity and security in transactions, reflecting ongoing concerns within the crypto community today. By examining Finney’s influence, we can appreciate how the evolution of Bitcoin is intertwined with broader cryptographic advancements that shape the functionality of digital currencies.

As the landscape of digital currencies expands, the innovative spirit embodied by figures like Hal Finney encourages ongoing exploration within the cryptographic realm. The advancements in privacy, security, and decentralization fostered by early contributors continue to inform the strategies adopted by modern crypto projects. Recognizing Finney’s legacy serves not only as a tribute to his contributions but also as a reminder of the challenges and opportunities that lie ahead as the crypto landscape evolves, making it critical for advocates and developers to remain vigilant in their approach to innovation.

Frequently Asked Questions

What are the most popular Bitcoin future predictions from crypto experts?

Several crypto experts, including Cathie Wood and Michael Saylor, have made bold predictions regarding Bitcoin’s future price. Some forecasts suggest that Bitcoin could reach values as high as one billion US dollars as it moves toward becoming a global currency. These predictions heavily rely on the potential for Bitcoin to dominate the payment landscape worldwide.

Who is Hal Finney and what were his Bitcoin price forecasts?

Hal Finney, one of the earliest contributors to Bitcoin, is credited with making one of the first Bitcoin price forecasts, predicting it could reach 10 million US dollars per coin if it became the dominant global currency. Finney’s involvement in Bitcoin’s early development and his historical significance add credibility to his predictions.

What role does Bitcoin play as a potential global currency?

Bitcoin is increasingly seen as a potential global currency, with various supporters positing that if it achieves widespread adoption, its value could escalate to as much as 10 million US dollars per coin. The premise of these Bitcoin future predictions hinges on its acceptance as a primary payment system worldwide.

What is the significance of the identity of Satoshi Nakamoto in Bitcoin’s future predictions?

The mystery surrounding Satoshi Nakamoto’s identity plays a crucial role in Bitcoin’s narrative. Some believe that understanding who Satoshi is could provide insights into Bitcoin’s future trajectory and its price potential. This enigma fuels speculation and contributes to various Bitcoin future predictions.

Will Bitcoin ever reach Hal Finney’s predicted price of $10 million?

Hal Finney’s prediction that Bitcoin could reach up to 10 million US dollars per coin is contingent on its acceptance as a global currency, which remains an open question in the crypto community. While many forecasts are optimistic, factors such as regulatory challenges and market adoption will influence whether this prediction materializes.

What historical context supports Bitcoin’s future predictions?

Understanding the historical context of Bitcoin, such as Hal Finney’s early involvement and the initial transactions with Satoshi Nakamoto, provides a foundation for Bitcoin future predictions. These events highlight the evolution of Bitcoin and its potential impact on the global financial system.

How do current global economic trends influence Bitcoin future predictions?

Current global economic trends, such as increasing interest in cryptocurrencies and a shift towards digital currencies, impact Bitcoin future predictions. Economic instability in various regions could further push Bitcoin as a safe haven asset, reinforcing forecasts for its price increase.

| Key Point | Details |

|---|---|

| Predictions of Bitcoin value | Crypto experts including Cathie Wood, Michael Saylor, and the Dogecoin founder predict Bitcoin could rise to values as high as $1 billion. |

| Hal Finney’s forecast | Finney predicted Bitcoin could reach $10 million if it becomes the global currency, based on total world wealth. |

| Hal Finney’s background | Finney was a pioneering cryptographer, a potential Bitcoin inventor, and the first recipient of a Bitcoin transaction. |

| The mystery of Satoshi Nakamoto | Satoshi Nakamoto’s true identity remains unknown, having disappeared in 2010. |

| Global currency potential | Finney suggested Bitcoin could theoretically become the dominant global payment system, aligning its value with total global household wealth. |

| Bitcoin’s volatility | While many speculate about Bitcoin’s future, its actual path to becoming a global currency is uncertain and subject to market dynamics. |

Summary

Bitcoin future predictions suggest an optimistic yet uncertain trajectory for the cryptocurrency, with notable figures estimating its value could soar to unprecedented heights. The perspectives shared by industry pioneers like Hal Finney illustrate the potential of Bitcoin, particularly if it becomes the preferred global currency. Despite the ambiguity surrounding its adoption and the enigmatic identity of Satoshi Nakamoto, the cryptocurrency landscape remains vibrant and captivating, breeding hope among investors and enthusiasts alike.