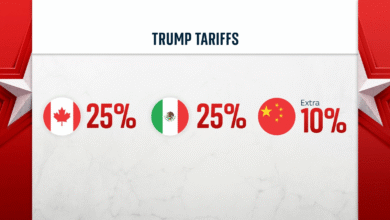

Summer Recession: How Tariffs Impact the US Economy

As the summer season approaches, the looming threat of a summer recession is becoming an undeniable reality for the US economy. The repercussions of ongoing tariffs, particularly from the recent trade war with China, have set the stage for potential shortages and empty shelves in American stores. According to Apollo Global Management’s chief economist, Torsten Slok, the impact of these tariffs will soon ripple through supply chains, leading to noticeable effects on consumers by mid-year. With trucking layoffs increasing and companies witnessing diminished sales due to trade barriers, many fear that the economic downturn may be inevitable. This precarious situation underscores the interconnectedness of global trade and the significant consequences tariffs can have on everyday life for Americans.

The seasonal economic decline often referred to as a summer recession highlights the vulnerability of consumer markets to external pressures like tariffs and trade disputes. As businesses grapple with disruptions in supply chains, including the halting of containerships and a sharp reduction in trucking demand, the implications for local availability of goods become increasingly concerning. Economists point to the cascading effects that these fiscal strategies have on inventory levels in retail settings, drawing parallels between current shortages and those experienced during the height of the pandemic. Crucially, this downturn is reflected not only in consumer goods but also in broader business outlooks, indicating a potential tightening of the U.S. economy as we move deeper into the summer months.

The Looming Summer Recession: Understanding its Causes

The prospect of a summer recession is increasingly discussed among economists, particularly in light of the trade wars initiated during the Trump administration. Apollo Global Management’s predictions indicate that the economic repercussions of the tariffs will manifest soon, leading to visible shortages in U.S. stores. As the U.S. economy grapples with inflationary pressures and declining consumer confidence, the situation is exacerbated by the ongoing trade tensions with China. Elevated tariffs have not only raised costs for American businesses but also diminished their ability to maintain adequate inventory levels, which can ultimately result in empty shelves across the nation.

Moreover, the timeline presented by economist Torsten Slok outlines a direct correlation between the tariffs imposed and the expected economic downturn. As containerships to U.S. ports dwindle and trucking demand stagnates, retailers will be forced to confront the stark reality of diminished supply. This potential for a summer recession raises questions about the sustainability of current economic policies and the long-term effects of the trade war. Without a robust strategy to mitigate these impacts, the U.S. economy may face significant turmoil ahead.

Impact of Tariffs on Supply Chains

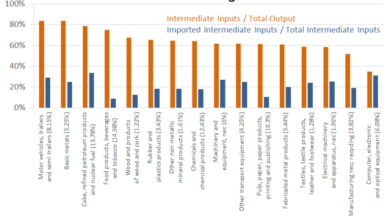

The tariffs imposed on goods coming from China have far-reaching implications for U.S. supply chains. These levies, which have escalated to rates as high as 145%, are not merely cost adjustments; they disrupt the entire flow of trade. As companies grapple with increased expenses, many are beginning to severely limit orders of Chinese products, further compounding the issue of empty shelves that consumers may soon face. These unexpected shortages can lead to a decrease in consumer spending, as the availability of desired products determine purchasing behavior.

Furthermore, trade dependency on China raises alarm regarding the U.S. economy’s resilience. The decline in new orders, coupled with falling earnings outlooks, showcases a weakened economic landscape. As businesses anticipate ongoing tariff impacts, they may choose to cut back on capital expenditures and staffing — a trend already observed in the trucking sector. As noted by analysts, if this situation persists, the anticipated summer recession may become an alarming reality for many Americans.

The Role of the Trucking Industry

The trucking industry plays a pivotal role in the U.S. economy, serving as a vital link between manufacturers and consumers. The anticipated layoffs within this sector due to revenue drop-offs signal a significant turn for the worse in the current economic climate. When trucking demand plummets, it not only results in job losses but also delays the movement of goods across the nation. This scenario can cause cascading effects throughout various industries, further exacerbating supply shortages and leading to empty shelves that consumers will soon find unavoidable.

In addition, the trucking industry’s struggles are mirrored in the retail landscape, where sales are predicted to decrease as goods become scarcer. The correlation between trucking layoffs and retail performance underscores a delicate balance; as logistics become strained, consumers are likely to feel the pinch. The longer these operational disruptions persist, the more formidable the onset of recession becomes, characterized by stagnant economic activity and decreasing consumer trust.

Consumer Behavior Amidst Economic Uncertainty

Consumer behavior is significantly influenced by economic conditions, particularly during times of uncertainty such as impending recessions. As news of potential empty shelves spreads, shoppers may panic, leading to stockpiling and altered purchasing habits. This behavior creates a feedback loop; as consumers rush to purchase what’s available, it depletes stock even faster, potentially accelerating the timeline for shortages. Economic analysts predict that this reaction could exacerbate the challenges faced by retailers already struggling under the weight of new tariffs.

Additionally, with the cost of goods increasing due to elevated tariffs, budget-conscious consumers might change their purchasing decisions, opting for lower-cost alternatives or delaying non-essential purchases altogether. This shift in consumer behavior not only affects retailers’ sales figures but also has broader implications for the economy as a whole. An environment of cautious spending can hinder recovery efforts and potentially prolong a recession, creating challenges for policymakers as they strive to stabilize the U.S. economy.

The Future of the U.S. Economy: Predictions and Concerns

Looking ahead, the U.S. economy faces a precarious situation, with many experts advocating for careful monitoring of the ongoing trade tensions with China. With perceptions of economic stability at risk due to tariffs and subsequent layoffs, predictions for a recession in the summer become pressing. While some analysts express cautious optimism about a brief ‘detox period’ for the economy, the overarching concern remains focused on the long-term impact of such economic disruptions, particularly as sectors become increasingly interdependent.

Moreover, while some industry watchers remain hopeful for an economic turnaround, the timeline laid out by Apollo’s chief economist suggests a more pronounced downturn. If conditions lead to widespread consumer frustration over shortages and elevated prices, public sentiment could shift further against the current administration’s economic strategies. In navigating these turbulent waters, both businesses and consumers must adapt to the evolving landscape, reconciling the dual pressures of inflation and trade challenges as they embrace the possibility of difficult economic times ahead.

Global Trade Relations and Economic Interdependencies

The intricate web of global trade relations highlights the interdependencies between the U.S. and its major trading partners. China, serving as a primary source for consumer goods, plays a crucial role in the supply chain dynamics that affect the U.S. economy. As tariffs disrupt established trade norms, even minor fluctuations can lead to significant disruptions in inventory management and cost structures for American retailers. Understanding this complexity is essential as economic stakeholders evaluate the potential fallout from a summer recession and its implications on global markets.

In the wake of these trade tensions, both governmental and business leaders must consider the long-term consequences of their decisions. The heavy reliance on imports from China indicates a fragile trade relationship, and increased tariffs may compel companies to seek alternative suppliers. However, this transition may not happen overnight, underscoring the need for strategic planning to mitigate the adverse effects. As trade relations continue to evolve, how these interdependencies are managed will be crucial in determining the resilience of the U.S. economy amid looming recession fears.

The Effects of Economic Policy on Retailers

Economic policy has far-reaching effects on retailers, where fluctuating tariffs and economic forecasts directly influence pricing strategies and inventory decisions. As businesses adapt to a landscape marked by rising costs associated with trade wars, the strategy of passing these costs onto consumers may not always be feasible. Retailers face the challenge of maintaining market share while managing consumer perceptions regarding price changes, particularly in light of impending shortages and ongoing economic signals pointing towards potential recession.

As demand wanes for certain products and consumers become increasingly price-sensitive, retailers may also seek innovative ways to retain customer loyalty. Potential solutions could include promotional sales, re-evaluating their supply chains, or even pivoting towards locally sourced products to mitigate the tariff impacts. However, these adaptations require time and resources, adding additional strain to retailers already grappling with the prospect of empty shelves and a summer recession affecting the broader economy.

From Past to Present: Learning from Economic Downturns

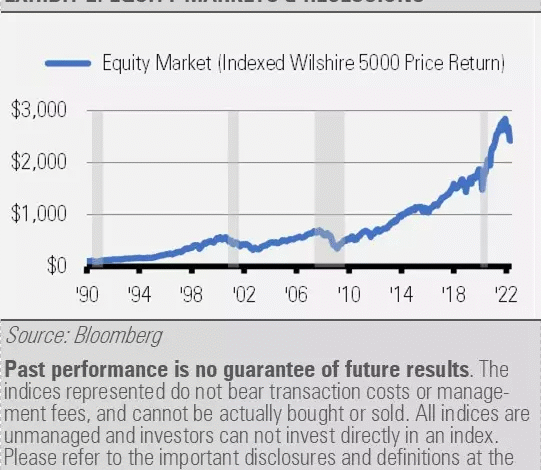

Historical data on economic downturns reveals patterns that can guide contemporary economic policy and business strategies. Reviewing past recessions showcases a recurring theme where external pressures, such as trade disputes and tariff wars, contribute substantially to economic slowdowns. In light of this understanding, analysts argue for the necessity of proactive measures to avoid the pitfalls seen in previous downturns. Observing the nuanced effects of tariffs on supply chains and consumer behavior may aid policymakers in crafting more effective responses.

Additionally, learning from past experiences can provide insight into consumer resilience and adaptability during economic strain. Investors and businesses need to remain vigilant in understanding market shifts and consumer sentiment, as these factors can aid in navigating challenging times. Analyzing the economic responses during previous recessions can reveal best practices that not only inform current strategies but also prepare individuals and organizations for whatever challenges lie ahead as the U.S. approaches a potential summer recession.

Apollo’s Insights on Emerging Economic Trends

Apollo Global Management’s analysis brings to light critical insights regarding emerging economic trends influenced by tariff impacts and shaky trade negotiations. Their forecast underscores the urgency of addressing these issues as the timeline for adverse effects becomes increasingly pronounced. With the imminent threat of a summer recession, Apollo’s data serves as a sobering reminder of how quickly economic conditions can change and the pervasive nature of tariffs on the overall U.S. economy.

Moreover, the insights offered by Apollo’s economists highlight the importance of strategic awareness for investors and businesses navigating these tumultuous waters. Staying ahead of economic trends and understanding the broader implications of trade policies will be crucial in formulating both short- and long-term plans. As we move towards an uncertain economic future, those who embrace adaptability and resilience are more likely to thrive despite the challenges posed by tariffs and the potential for empty shelves.

Frequently Asked Questions

What is the expected impact of the summer recession on the US economy?

The summer recession is anticipated to have a significant impact on the US economy, as indicated by the predictions from Apollo Global Management. Factors such as increased tariffs and empty shelves due to supply chain disruptions are likely to lead consumers to experience shortages in local stores, effectively dampening economic activity.

How do tariffs impact the likelihood of a summer recession?

Tariffs imposed by the Trump administration have disrupted trade flows, and their impact is expected to contribute to a summer recession. As outlined by Apollo’s chief economist, these tariffs have slowed containership arrivals and caused trucking demand to drop, leading to empty shelves and ultimately affecting retail sales.

What evidence supports the claim of empty shelves during the summer recession?

According to research by Apollo Global Management, data reveals that trucking demand may halt, resulting in empty shelves across the US. This is supported by declining orders for goods and a slowdown in consumer spending, which could signify the onset of a recession this summer.

What role does Apollo Global Management play in predicting the summer recession?

Apollo Global Management, through its chief economist Torsten Slok, has provided a detailed timeline showing the anticipated effects of tariffs on the US economy. Their analysis suggests that supply chain disruptions and economic indicators are leading toward a potential summer recession.

Can the empty shelves in stores affect the overall US economy during a summer recession?

Yes, the empty shelves are a strong indicator of broader economic issues stemming from the summer recession. As shortages persist, consumer confidence may wane, leading to decreased spending and further economic slowdown.

How does the trade war factor into the summer recession scenario?

The ongoing trade war between the US and China exacerbates the situation by increasing tariffs on imported goods, which affects supply chains. Apollo’s analysis suggests that these interruptions will contribute significantly to the anticipated summer recession.

What should consumers expect regarding product availability amidst a summer recession?

Consumers are likely to notice shortages and empty shelves caused by the ongoing trade tensions and tariffs. This situation could mirror the product scarcity experienced during the COVID-19 pandemic, making it crucial for individuals to prepare for potential difficulties in obtaining necessary goods.

Could a summer recession lead to long-term economic changes in the US?

A summer recession could trigger long-term changes in the US economy, particularly by altering consumer behavior and supply chain management strategies. Increased reliance on domestic production may arise to mitigate the impact of tariffs and empty shelves.

| Timeline Phase | Key Events |

|---|---|

| April 2 | Tariffs announced; containership departures from China to U.S. slow. |

| Early-to-mid May | Containerships to U.S. ports come to a stop. |

| Mid-to-late May | Trucking demand halts, leading to empty shelves and lower sales for companies. |

| Late May to early June | Layoffs in trucking and retail industries begin. |

| Summer 2025 | Expected recession due to ongoing tariff impacts and economic slowdown. |

Summary

The summer recession is looming as economic indicators reflect the impact of increased tariffs under the Trump administration. According to Apollo Global Management’s analysis, consumer shortages and empty shelves in stores are expected to begin soon due to supply chain disruptions. The timeline detailed how quickly these issues will escalate, leading to significant layoffs and a predicted recession by summer 2025. Despite some optimistic indications from analysts, the overall sentiment remains cautious, suggesting that the repercussions of trade pressures are becoming ever more pronounced.