U.S. Job Growth Surprises with 177,000 New Positions in April

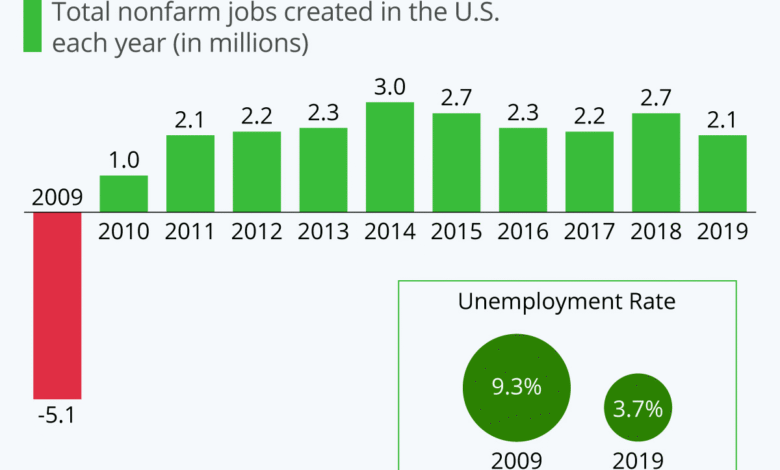

U.S. job growth demonstrated resilience in April, with nonfarm payrolls rising by 177,000—a figure that defied expectations amidst ongoing economic uncertainties. Despite a slight dip from March’s revised total of 185,000, this increase was notably higher than the Dow Jones estimate of 133,000, signaling positive momentum in the labor market. The unemployment rate remained steady at 4.2%, indicating stability within the workforce, while average hourly earnings rose modestly by 0.2% for the month. This steady pace of job creation reflects the labor market’s ability to withstand external pressures and highlights the continued demand for workers across various sectors. As we delve deeper into the implications of the April job report, it becomes clear that the interplay of nonfarm payrolls, unemployment rates, and wage growth paints a comprehensive picture of U.S. job growth dynamics.

The recent employment landscape in the United States presents a compelling story of resilience and adaptation within the hiring sector. As businesses navigate through challenges posed by tariffs and other external pressures, the labor market continues to display signs of stability. Job creation has remained solid, contributing to a stable unemployment situation that reflects broader economic trends. Additionally, fluctuations in average earnings signal evolving labor conditions that are worth noting. A closer examination of these employment trends reveals an intricate balance between growth and economic factors influencing the workforce.

April Job Report Highlights U.S. Payroll Growth

In the April job report, U.S. nonfarm payrolls showed a robust increase of 177,000 jobs, surpassing the Dow Jones estimate of 133,000. This growth, although slightly down from the 185,000 recorded in March, is a crucial indicator of labor market stability in the face of economic uncertainties such as tariff impacts. Despite predictions of potential turmoil due to recent trade policies, the resilience exhibited by the labor market suggests that the economy continues to forge ahead successfully.

The stability of the labor market is further highlighted by the unemployment rate holding steady at 4.2%. The report indicated not just payroll growth but also an impressive gain in household employment, revealing an additional 436,000 people reporting job gains in April. Such figures point to a dynamic and recovering economy that appears unperturbed by tariff-related fears. As U.S. job growth remains solid, analysts express optimism about the underlying health of the economy.

Understanding Nonfarm Payrolls and Their Impact

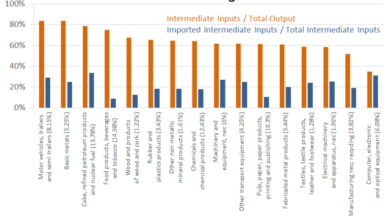

Nonfarm payrolls serve as a critical economic indicator, reflecting the number of jobs generated in various sectors across the economy, excluding farming, government, and a few other job categories. In April, the reported addition of 177,000 jobs covered notable job creation in the healthcare and transportation sectors, demonstrating the ongoing demand for labor. Understanding these dynamics helps investors and policymakers gauge where job growth is occurring, allowing for more informed decisions regarding monetary policy and economic forecasts.

Moreover, the aforementioned payroll growth indicates that the U.S. economy is managing to grow despite a landscape of uncertainty stemming from international trade relations. This nuanced context behind nonfarm payroll data can significantly guide businesses in workforce planning and government in labor policy formulation. Continued monitoring of these trends is essential as they provide vital insights into economic health and labor market conditions.

The Unemployment Rate’s Role in Labor Market Stability

The unemployment rate is another essential element of labor market analysis, reflecting the percentage of the labor force that is jobless and actively seeking employment. In April, the unemployment rate remained at 4.2%, aligning with economist expectations and indicating relative job market stability. A stable unemployment rate often supports consumer confidence, which is crucial for bolstering economic activity, particularly in sectors significantly influenced by spending.

A consistently low unemployment rate signals not just job availability but also a tight labor market, where hiring can become increasingly competitive among employers. This situation often contributes to wage growth as businesses attempt to attract and retain talent. Thus, monitoring the unemployment rate alongside payroll growth allows for a more comprehensive picture of economic resilience and labor market dynamics.

Wage Growth Trends: Average Hourly Earnings Analysis

The average hourly earnings marked a modest increase of just 0.2% in April, which was below the anticipated 0.3% forecast. This subdued wage growth indicates that while jobs are being created, pay raises may not be keeping pace, raising concerns about consumer spending power. The annual rate of 3.8% growth in average hourly earnings illustrates a slight deceleration, prompting discussions among economists regarding its implications on inflation and living standards.

Despite the challenges in wage growth, segments of the labor market, such as healthcare, continue to demonstrate strength, contributing to overall job satisfaction and stability. Effective policies and strategies to encourage higher wage growth can play a pivotal role in enhancing labor market conditions and contributing positively to economic expansion.

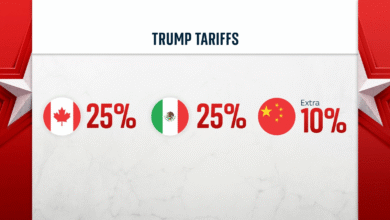

Labor Market Insights: The Impact of Economic Policies

Current economic policies, particularly under the pressure of tariffs and international trade negotiations, offer crucial insights into labor market behavior. As highlighted by the consistent job growth despite uncertainties among trading partners, the U.S. labor market appears resilient. Experts point out that continued positive job numbers reflect the ability of sectors like health care and transportation to navigate challenges effectively.

Looking ahead, the clarity on economic policies will play a pivotal role in shaping labor market trends. Investors and stakeholders must closely watch the interplay between government decisions and payroll figures as these will provide hints on possible future market reactions. The adaptability of the labor force in response to changes in policy will undoubtedly impact overall economic growth.

Sector-Specific Job Gains in the Health Care and Transportation Industries

Health care emerged as a strong driver of job creation in April, adding 51,000 new jobs to the economy. The growth in this sector reflects ongoing demand for health services, particularly as the population ages and healthcare needs expand. Job gains in health care not only support the economy but also highlight areas where additional educational and training investments may be beneficial to meet workforce requirements.

Similarly, the transportation and warehousing sector added 29,000 jobs, reflecting the significant role of logistics and supply chain management in the modern economy. As consumer behavior evolves with the growth of e-commerce, these sectors are becoming increasingly vital in creating employment opportunities. Understanding these sectoral shifts can guide policymakers in establishing targeted economic strategies and workforce development initiatives.

Forecasting U.S. Job Growth Amid Global Economic Shifts

As we analyze the implications of the latest payroll report, forecasts for U.S. job growth will increasingly depend on external global economic factors such as trade disputes and tariffs. While strong job numbers signal a resilient economy, uncertainties surrounding international negotiations could pose risks to future growth patterns. Economists suggest that the U.S. must implement sound policies to safeguard against potential downturns that might emerge from these global pressures.

Furthermore, job growth forecasts will also hinge on domestic policy shifts at the Federal Reserve, especially in how they respond to inflation concerns driven by external trade dynamics. A proactive approach, combining labor market strategies with sound monetary policy, will not only bolster job growth but can also enhance overall economic stability.

The Role of Household Employment in Job Market Assessments

The assessment of household employment plays a critical role in understanding the broader employment landscape in the U.S. The report highlighted a significant increase of 436,000 new jobs reported by households, which complements the nonfarm payroll findings. This household survey provides insights into employment trends beyond the conventional payroll metrics and can indicate areas of economic strength not captured by the latter alone.

Tracking household employment data is vital for gauging the sentiment of the labor market among workers themselves. Additionally, disparities in job growth across demographic lines can inform policymakers on where to focus efforts to enhance job accessibility and training opportunities, ensuring that the benefits of employment growth reach a diverse array of communities.

The Influence of Federal Reserve Policy on Employment Trends

The Federal Reserve’s monetary policy decisions can greatly influence employment trends within the economy. As job growth remains stable, the Fed is currently deciding on whether to adjust interest rates in response to underlying economic conditions, including inflation concerns due to tariff implications. Analysts expect that maintaining lower interest rates may help support continued job creation by making borrowing more affordable for businesses.

Changes to Federal Reserve policies can play a pivotal role not just in influencing the speed of job growth but also in shaping broader economic strategies. Keeping a close eye on how monetary policy evolves will be essential for understanding future labor market shifts, particularly as the global economic landscape continues to develop.

Frequently Asked Questions

What does the latest April job report indicate about U.S. job growth?

The April job report indicates that U.S. job growth has been robust, with nonfarm payrolls increasing by 177,000, surpassing expectations despite the downward revision of the previous month’s figures. This growth suggests resilience in the labor market.

How did the unemployment rate change in the context of U.S. job growth reported in April?

The unemployment rate remained stable at 4.2% in April, reflecting a relatively stable labor market amidst ongoing economic uncertainties. This consistency in the unemployment rate demonstrates the strength of U.S. job growth.

What impact did average hourly earnings have on U.S. job growth in the latest report?

In April, average hourly earnings increased by just 0.2%, which was below expectations. This modest growth indicates that, while U.S. job growth is positive, wage growth is lagging, affecting overall economic sentiment.

How does the April job report reflect labor market stability in the U.S.?

The April job report, showing a nonfarm payroll increase of 177,000 and a stable unemployment rate, highlights labor market stability in the U.S. This stability is crucial as the economy navigates potential challenges from tariffs and other external factors.

What sectors contributed most to U.S. job growth in April according to the job report?

The April job report indicates that health care led job creation, adding 51,000 positions, followed by transportation and warehousing with 29,000 jobs and financial activities contributing 14,000 jobs, showcasing diverse areas of U.S. job growth.

What are the current expectations for interest rates following the April job growth report?

Following the strong April job growth report, expectations for an interest rate cut by the Federal Reserve have been pushed back, with traders now anticipating potential cuts starting in July, reflecting positive labor market indicators.

What does a nonfarm payroll increase signify for the U.S. economy?

A nonfarm payroll increase, such as the 177,000 jobs added in April, signifies ongoing expansion in the U.S. economy. This growth can enhance consumer confidence and spending, vital for sustaining economic momentum.

How do revisions of previous job estimates affect perceptions of U.S. job growth?

Revisions of previous job estimates, such as those reported in March, show a downward adjustment that can alter the perception of U.S. job growth. While April’s figures were strong, these revisions highlight the volatility and inconsistency sometimes seen in labor market data.

| Key Metrics | April 2025 | March 2025 |

|---|---|---|

| Nonfarm Payrolls | 177,000 | 185,000 (revised down) |

| Unemployment Rate | 4.2% | 4.2% (unchanged) |

| Average Hourly Earnings (Monthly Change) | 0.2% | Adjustments made, initially reported as higher |

| Annual Rate of Earnings Growth | 3.8% | 3.9% (adjusted down) |

| Health Care Job Creation | 51,000 | N/A |

| Transportation and Warehousing Job Creation | 29,000 | N/A |

Summary

U.S. job growth in April 2025 showcased a robust addition of 177,000 nonfarm payrolls, exceeding analyst expectations and revealing a stable labor market. Despite external pressures from tariffs, the economy demonstrated resilience. With a steady unemployment rate of 4.2% and a growth of average hourly earnings lagging slightly, the month reflects a cautious yet positive outlook for the U.S. job market as it navigates potential economic challenges ahead.