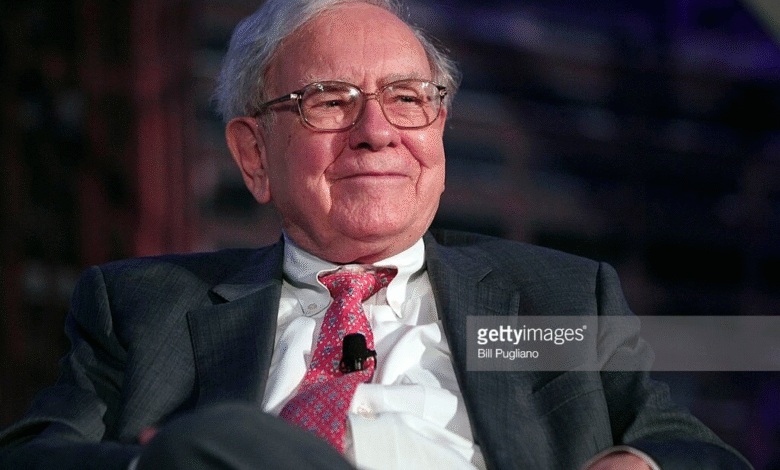

Warren Buffett Retirement Shocks Berkshire Hathaway Shareholders

Warren Buffett’s retirement marks a monumental shift for Berkshire Hathaway and signals the close of an era that has captivated investors for over sixty years. At the recent annual meeting, the 94-year-old tycoon announced his intention to step down as CEO by year-end, leaving shareholders in stunned silence. This transition is not merely a personal milestone for Buffett; it raises critical questions surrounding the Buffett succession plan and the future of the conglomerate. With the recent Berkshire Hathaway news emphasizing the CEO transition, many investors are keen to understand how this decision will affect the long-standing principles of value investing that Buffett championed. As we ponder his legacy, one cannot help but reflect on the profound influence of Buffett’s philosophy on both the stock market and corporate governance.

The announcement of Warren Buffett’s retirement has reverberated throughout the financial landscape, leaving investors and enthusiasts pondering the implications of this significant change. This shift in leadership at Berkshire Hathaway is not just about the departure of a legendary figure; it represents the culmination of decades of strategic insights and financial acumen that have shaped the principles of successful investing. As discussions about the upcoming CEO transition and succession plan take center stage, analysts are closely watching how this will affect the future trajectory of the conglomerate once led by the ‘Oracle of Omaha.’ The conversation about Buffett’s lasting legacy emphasizes the impact of his value investing strategies and how they will be carried forward in the years to come. As we turn the page on this chapter, the focus shifts to how Berkshire will navigate challenges and opportunities in a post-Buffett era.

Warren Buffett’s Retirement: A Historic Decision for Berkshire Hathaway

The recent announcement by Warren Buffett regarding his impending retirement has left many shareholders in disbelief. After an impressive six-decade tenure at the helm of Berkshire Hathaway, Buffett’s decision marks a monumental shift in the company’s future direction. This announcement not only leaves an indelible mark on the corporation but also raises questions about its legacy. As the heir apparent, Greg Abel will step into the role of CEO, but what this transition means for the company’s culture and investment strategies remains to be seen.

Buffett’s retirement is not just the end of an era; it’s a pivotal moment that signals the evolution of Berkshire Hathaway. The impact Buffett has had on value investing and the stewardship of Berkshire Hathaway’s diverse portfolio cannot be overstated. Over the years, shareholders have witnessed the growth of the company from a struggling textile firm to a global powerhouse under Buffett’s strategic insights. With his exit, the company will have to navigate its future while upholding the principles Buffett instilled, and maintaining its commitment to long-term growth.

Understanding the Buffett Succession Plan and CEO Transition

As Buffett prepares to transition from CEO, questions around the succession plan for Berkshire Hathaway take center stage. The man stepping into this significant role, Greg Abel, has been groomed for leadership for several years, overseeing Berkshire’s vast energy sector. This carefully orchestrated succession plan is critical, as it aims to preserve Buffett’s legacy of value investing while adapting to the modern market’s demands. Stakeholders are keen to see how Abel’s leadership style will affect the company’s operational decisions and capital allocation strategies moving forward.

The CEO transition at Berkshire Hathaway comes at a time of increased scrutiny, particularly following the passing of Charlie Munger, Buffett’s close confidant and business partner. With Munger’s death earlier in 2023, many investors are left contemplating how this loss will impact the strategic vision of the company. Although Buffett’s retirement has been anticipated over the years, the execution of this succession will be carefully monitored, as it holds profound implications for the company’s future and stability.

Buffett’s Legacy: The Essence of Value Investing

Warren Buffett’s contributions to the philosophy of value investing have established him as a towering figure in the financial world. His ability to identify undervalued companies and invest in their long-term potential has attracted a loyal following among shareholders and aspiring investors alike. As he steps down, it is crucial to reflect on what this legacy entails for Berkshire Hathaway, particularly in maintaining its core investment principles. Embodying patient capital allocation, Buffett has always encouraged a long-term perspective, something that Greg Abel will need to carry forward to ensure continued success.

Buffett’s legacy goes beyond just financial acumen; it encompasses a way of thinking and a culture that defines Berkshire Hathaway. The annual shareholder meetings, often referred to as a celebration of his life lessons and wisdom, have become iconic events, drawing thousands eager to hear from the Oracle of Omaha. As the company transitions into this new chapter, shareholders and analysts are tasked with ensuring that the essence of Buffett’s investment philosophy continues to thrive in the hands of the new leadership.

Berkshire Hathaway News: Staying Ahead of the Curve

In the wake of Buffett’s retirement announcement, Berkshire Hathaway is amidst a whirlwind of speculation and analysis, with news outlets buzzing about the implications for the company’s growth trajectory. Staying updated on Berkshire Hathaway news is vital for investors navigating this transition. As Abel assumes the role of CEO, the focus will shift towards how he adapts the company’s strategy in response to today’s rapidly changing market landscape. Investors should remain vigilant, keeping an eye on announcements regarding potential shifts in investment philosophy or operational changes.

Additionally, the evolving landscape of value investing will be critical for Berkshire Hathaway’s future. With advancements in technology and growing interest in sustainable investments, there may be opportunities for Abel to innovate on Buffett’s traditional strategies. By staying informed about the latest developments within Berkshire, shareholders can better prepare for potential market reactions and investment opportunities that may arise during this period of transition.

Looking Ahead: The Future of Berkshire Hathaway

With Warren Buffett stepping down, the future of Berkshire Hathaway is filled with both challenges and opportunities. As the company enters a new era with Greg Abel at the helm, many shareholders are curious about how Berkshire will maintain its growth and adaptation in a shifting global economy. The success of this transition will largely depend on Abel’s ability to uphold the values that have defined the company while also injecting fresh perspectives to navigate modern economic realities.

Investors will likely monitor the performance of Berkshire Hathaway closely, particularly regarding its diverse portfolio of subsidiaries and how they may evolve under new leadership. The company’s adaptability and continued commitment to value investing principles will be critical in this next chapter. Shareholders are hopeful that with the right strategies and leadership, Berkshire Hathaway can sustain its legacy and thrive in an increasingly complex business environment.

The Importance of Shareholder Communication During Transitions

Effective communication with shareholders is paramount during times of leadership change, as seen with Buffett’s retirement announcement. Berkshire Hathaway’s management team has a responsibility to keep investors informed about the transition, addressing uncertainties that may arise from changes in leadership. By openly discussing the new CEO’s vision and the strategic direction for the company, Berkshire can help alleviate concerns and reinforce confidence among its investors, ensuring alignment during this pivotal period.

Regular updates from management, transparent discussions about operational changes, and reassurances about the continuity of value investing principles will be essential. Shareholders expect clarity regarding how Buffett’s departure will be handled, notably in terms of decision-making processes and ongoing initiatives. By fostering an environment of open dialogue, Berkshire Hathaway can not only strengthen its relationships with shareholders but also reinforce its reputation as a leader in corporate governance.

Navigating Market Reactions to Leadership Changes

Market reactions to the announcement of Warren Buffett’s retirement are expected to be significant, with many investors taking a cautious approach in the short term. The unpredictability that comes with a leadership transition can prompt volatility in stock prices, making it crucial for Berkshire Hathaway to manage market expectations effectively. Investors should remain vigilant about shifts in stock performance, particularly as Abel steps into his new role and begins to implement his vision for the company.

To mitigate negative reactions, it’s essential for Berkshire Hathaway to reiterate its commitment to sound investment practices and the solid fundamentals that underpin its business model. Through strategic communication and demonstrating ongoing business performance, the company can help stabilize investor confidence. Shareholders and analysts alike will be keenly observing the company’s adaptive strategies as it recalibrates under new leadership, anticipating how changes might affect capital allocation and long-term growth.

Buffett’s Impact on Omaha and Beyond: A Local Legend

Beyond his role as a business mogul, Warren Buffett has become a beloved figure in Omaha, significantly impacting the local economy and community. His presence has drawn attention to the city, fostering a culture of entrepreneurship and investment that resonates with locals and visitors alike. As shareholders express their gratitude for his contributions, it’s essential to consider how Buffett’s influence has shaped Omaha and the wider business landscape, creating opportunities that extend far beyond the realm of finance.

Omaha’s growth and its connection to Berkshire Hathaway underscore the symbiotic relationship between the company and the community. With Buffett’s retirement, questions arise about how his legacy will influence both the local economy and the company’s philanthropic endeavors. Many are hopeful that, under Abel’s leadership, Berkshire will continue its commitment to community engagement and support, ensuring that the impact Buffet has had on both Omaha and the investment community endures.

Frequently Asked Questions

What does Warren Buffett’s retirement mean for Berkshire Hathaway?

Warren Buffett’s retirement signals a significant transition for Berkshire Hathaway, as the company will be led by Greg Abel starting in 2025. Buffett has confirmed that while he will step down as CEO, he will remain involved in some capacity, ensuring a degree of continuity as the company adapts under new leadership.

How has Warren Buffett’s succession plan been received by shareholders?

Warren Buffett’s succession plan has generally been met with understanding among shareholders, especially given the announcement of Greg Abel as his successor. Though shareholders expressed shock at the news of Buffett’s imminent retirement, many valued the foresight that allowed for a smooth transition and recognized the importance of maintaining Berkshire Hathaway’s value investing philosophy.

What legacy does Warren Buffett leave behind after his retirement?

Warren Buffett leaves behind a remarkable legacy as a pioneer of value investing and a respected leader of Berkshire Hathaway. His approach to investing has shaped the strategies of countless investors, and his philanthropic efforts in Omaha and beyond have had a lasting impact on the community. Buffett’s influence extends far beyond finance.

Why is Warren Buffett’s retirement considered an end of an era in investing?

Warren Buffett’s retirement is seen as the end of an era in investing due to his iconic status and the transformative changes he brought to Berkshire Hathaway. As a leader for over six decades, Buffett has not only changed the company but also fundamentally influenced the investing world, making this transition highly significant for both the company and its shareholders.

What is the anticipated impact of Buffett’s retirement on Berkshire Hathaway’s stock?

The anticipated impact of Buffett’s retirement on Berkshire Hathaway’s stock remains uncertain. While some investors may be concerned about the transition in leadership, others are optimistic about Greg Abel’s capability to uphold Buffett’s value investing principles. Market reactions will depend on how well the new CEO adapts and leads the company moving forward.

How does the CEO transition reflect on the future of value investing?

The CEO transition from Warren Buffett to Greg Abel reflects both continuity and change in the realm of value investing. Abel’s leadership is expected to uphold the principles that have guided Berkshire Hathaway’s success, while also allowing for fresh strategies and perspectives that may adapt to changing market conditions.

What should investors know about the implications of Buffett’s retirement for Berkshire Hathaway’s operations?

Investors should be aware that Buffett’s retirement may lead to operational changes at Berkshire Hathaway under Greg Abel. While the fundamental principles of value investing will likely remain intact, strategies regarding capital allocation and day-to-day operations may evolve, impacting how Berkshire approaches its diverse holdings.

Will Warren Buffett still be involved with Berkshire Hathaway after his retirement?

Yes, Warren Buffett has indicated that he will remain involved with Berkshire Hathaway in some capacity after his retirement, which may help facilitate a smoother transition and reassure investors about the company’s ongoing commitment to its foundational values.

How will shareholders commemorate Warren Buffett’s retirement?

Shareholders are likely to commemorate Warren Buffett’s retirement through various tributes at future meetings, celebrating his long-term contributions and leadership at Berkshire Hathaway. These events may include discussions of his legacy, further publications on his investing philosophy, and opportunities to support charitable initiatives he championed.

What is the significance of Buffett’s announcement regarding his stepping down?

Buffett’s announcement regarding his stepping down is significant as it marks the culmination of his remarkable 60-year tenure at Berkshire Hathaway. This shift not only affects company dynamics but also symbolizes a broader change in the investing landscape, as clients and investors will now look to new leadership for guidance on the firm’s future direction.

| Key Point | Details |

|---|---|

| Announcement of Retirement | Warren Buffett announced his plan to step down as CEO of Berkshire Hathaway, astonishing shareholders who attended the annual meeting. |

| Duration of Tenure | Buffett’s retirement marks the end of a 60-year tenure, transforming Berkshire Hathaway from a struggling company into a $1.2 trillion conglomerate. |

| Successor Identification | Buffett has named Greg Abel, head of Berkshire’s energy unit, as his successor before formally stepping down. |

| Shareholder Reactions | Many shareholders expressed surprise and sadness at the announcement, reflecting on Buffett’s immense influence and leadership. |

| Legacy and Impact | Buffett has not only been a successful businessman but also a pivotal figure in Omaha, contributing to its economy and culture. |

Summary

Warren Buffett retirement marks a significant transition not only for him personally but also for Berkshire Hathaway and its shareholders. As Buffett steps down after six decades at the helm, his legacy as an exceptional investor and leader will undoubtedly leave a lasting impact on the investment community and the operating model of the company. His choice of Greg Abel as successor indicates a well-thought-out succession plan that aims to maintain Berkshire’s core values and investment philosophy. This historic moment underscores the importance of having a robust leadership strategy in place for sustaining company growth and stability.