Bitcoin Mining Difficulty Drops: Insights for Miners

Bitcoin mining difficulty is a crucial aspect of the cryptocurrency ecosystem, determining how hard it is for Bitcoin miners to validate transactions and secure the network. Recently, this difficulty experienced a significant drop of 3.34%, providing much-needed relief to miners who have faced consecutive increases for weeks. Understanding the implications of network difficulty adjustment is vital for those involved in Bitcoin mining, as it directly affects Bitcoin profitability and overall operational strategy. With the current difficulty now at 119.12 trillion, miners find themselves in a landscape where changes can dramatically influence their revenue prospects. In this ever-evolving world of Bitcoin mining news, such adjustments not only impact miners but also signify shifts in the broader cryptocurrency mining landscape and market dynamics.

The ease of mining Bitcoin often hinges on the concept of network difficulty, a metric that encapsulates the challenges faced by miners in validating transactions on the blockchain. This reduction in complexity marks a pivotal moment for miners, who have endured a series of hikes in difficulty that strained profitability. As the adjustment allows for a more favorable environment, it invites increased participation in Bitcoin mining as miners seek to optimize their operations amidst shifting conditions. By monitoring these fluctuations, stakeholders can gauge the overall health and viability of the cryptocurrency mining industry. Consequently, understanding these dynamics is fundamental for anyone invested in the future of digital currencies and blockchain technology.

Understanding Bitcoin Mining Difficulty

Bitcoin mining difficulty is a crucial aspect that influences the efficiency and profitability of miners across the globe. It acts as a benchmark, adjusting every 2,016 blocks—approximately every two weeks—based on the total hashing power of the network. When more miners join the network, the difficulty increases to ensure that the average time taken to mine a block stays around 10 minutes. The recent 3.34% decrease in difficulty marks a significant relief for miners after a protracted period of increases, highlighting the dynamic nature of the network’s operational landscape.

This adjustment in mining difficulty has direct implications on Bitcoin miners’ profitability. With a lower difficulty, miners can achieve a higher rate of success in mining new blocks, thereby earning more BTC. It represents a recalibration that allows existing miners to maximize their operational capacities as global hash rates fluctuate. Mining profitability is critical for miners to cover costs, including electricity and hardware expenses, and the recent news of lower difficulty could provide a much-needed boost in revenue, enabling miners to stabilize their operations.

Recent Trends in Bitcoin Mining News

The landscape of Bitcoin mining is continually evolving, and the latest trend showcased in recent Bitcoin mining news highlights the network’s first difficulty drop in several weeks. After witnessing four straight increases that spanned over two months, this 3.34% slide in difficulty comes as a relief to miners who were facing higher computational requirements. As reported, the new difficulty level of 119.12 trillion significantly eases the mining process, helping miners manage their resources more effectively while adapting to the fluctuating market conditions.

Moreover, such developments in Bitcoin mining news are essential for stakeholders in the cryptocurrency ecosystem. They shed light on how shifts in network difficulty can impact not only miners but also the overall health of the Bitcoin economy. As the need for more hash power to sustain profitability becomes evident, miners are closely monitoring these changes. They must adapt their strategies and operations in response to the ever-shifting landscape of network difficulty to ensure sustainable growth in the competitive field of cryptocurrency mining.

The Impact of Network Difficulty Adjustment on Miners

Network difficulty adjustment plays a pivotal role in the operational success of Bitcoin miners. This mechanism ensures that the average time to create a new block remains consistent, balancing the needs of the miners and the network’s integrity. A recent adjustment reducing mining difficulty by 3.34% signifies a shift that could enhance operational efficiency for miners. With reduced competition from increased computational demands, miners can now secure blocks more efficiently, eliminating some of the strains caused by previous increases in difficulty.

For miners, the adjustment not only alleviates immediate pressures but also creates opportunities to optimize their hardware and energy usage. Lower difficulty translates directly into increased likelihoods of mining rewards, thereby improving overall profitability. With the current average block time exceeding the desired target, this downward adjustment could lead to further strategic planning, including potential investments in new technologies or improved methods of operation to capitalize on this favorable change.

Analyzing Bitcoin Miner Profitability

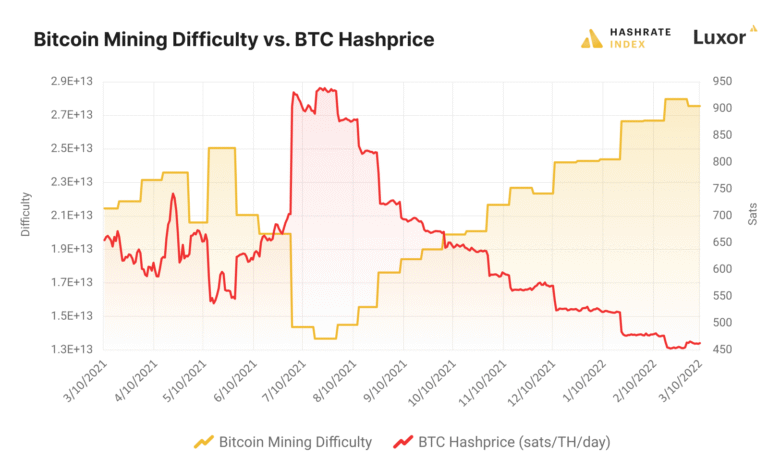

Bitcoin miner profitability remains a critical focal point for stakeholders in the cryptocurrency sector, particularly following the recent difficulties adjustments. The rise of hash price from $45.87 to $50.80 reflects an encouraging trend for miners, demonstrating that the financial rewards of mining can pivot dramatically with changes in network conditions. This trend also signifies a growing interest and influx of investment into the Bitcoin mining sector, which can increase hash rates and overall operational capacities for miners.

In a volatile market where fluctuations in Bitcoin prices can significantly impact operational margins, understanding profitability metrics is essential. The current uptick in mining profits, amidst lower Bitcoin mining difficulty, serves as both an incentive for existing miners and a magnet for new entrants into the mining arena. As miners continue to evaluate their profitability strategies, adapting swiftly to market trends and networking demands will become critical for sustained success in this competitive landscape.

Future Implications of Bitcoin Mining Trends

Looking ahead, the recent downward adjustment in Bitcoin mining difficulty holds substantial implications for the future of cryptocurrency mining. As miners begin to recalibrate their strategies and operational approaches based on this favorable shift, we can anticipate a renewed vigor in the sector. With the potential for further downward adjustments depending on network conditions, miners will be keen to exploit these opportunities for optimal earnings and efficiency.

Additionally, there may be broader market effects tied to these developments. Increased miner profitability could further drive investments into mining technology, fostering innovations that improve efficiency and reduce energy expenditures. This could lead to a more robust mining ecosystem, aligning with global shifts toward sustainable practices in cryptocurrency mining as environmental impacts become increasingly scrutinized.

The Role of Hash Rates in Bitcoin Mining

Hash rates play an instrumental role in the Bitcoin mining process, determining the speed at which miners can validate transactions and earn rewards. Recently, the global hash power has surged to 885.51 EH/s, showcasing the strength of the Bitcoin mining community despite the latest difficulty adjustment. This increase in hash power is a testament to miners’ resilience and technological advancements, allowing them to maintain competitiveness in a rapidly evolving market.

The relationship between hash rates and network difficulty is cyclical; as more miners contribute hash power, difficulty adjusts to ensure equilibrium in the mining process. The fluctuations in hash rates directly affect Bitcoin miners’ potential profitability and operational strategies. As miners identify patterns and adapt to changes, they position themselves to maximize outputs while minimizing costs in the competitive landscape of cryptocurrency mining.

Cryptocurrency Mining Landscape and Its Challenges

The cryptocurrency mining landscape is fraught with unique challenges, particularly as it relates to network difficulty and broader market conditions. The latest news regarding a reduction in mining difficulty has spotlighted some of these issues, highlighting how external factors can significantly impact miner operations. These challenges include rising energy costs, increased regulatory scrutiny, and the need for cutting-edge technology to remain competitive.

As the ecosystem evolves, miners must strategize to navigate these obstacles effectively. With the recent development of a 3.34% decline in difficulty, miners might find temporary relief, but sustainable operations will require adapting to ongoing challenges. Innovations in mining hardware, energy-efficient practices, and strategic partnerships are likely to play crucial roles in ensuring long-term success amid an increasingly complex cryptocurrency landscape.

Technological Advancements in Bitcoin Mining

Technological advancements are at the forefront of improving Bitcoin mining efficiency and profitability. The recent difficulty adjustment has rekindled interest in exploring innovative mining techniques and hardware upgrades that can help miners stay competitive. With a ticking clock on profitability, the need for efficient, high-performance hardware has never been more pressing, prompting miners to seek out the latest technological solutions that can handle increased hash rates while minimizing operational costs.

As new technology enters the market, it also contributes to the overall enhancement of the Bitcoin mining ecosystem. Enhanced ASIC miners and other specialized equipment are being developed to process transactions more quickly and cost-effectively. Moreover, as miners adopt more sustainable practices through renewable energy sources and smarter operational strategies, the landscape of cryptocurrency mining is bound to transform significantly—tying back into the cyclic nature of network difficulty and overall miner competitiveness.

Evaluating Market Sentiments in Bitcoin Mining

Market sentiment plays a significant role in shaping the future of Bitcoin mining, especially in light of recent adjustments to network difficulty. As miner profitability fluctuates, so does the overall perception of Bitcoin’s potential as a sustainable investment. The downward difficulty adjustment may positively affect market sentiment, fostering greater confidence among existing miners and encouraging new participants to enter the marketplace.

Crucially, understanding market sentiment encompasses not only the profitability of mining but also broad factors such as Bitcoin price, regulatory developments, and technological innovations. Monitoring these sentiments allows stakeholders to make informed decisions about their mining strategies, investments, and operations. As we see shifts in the market, the interrelationship between sentiment and actual networking conditions will remain pivotal for the ongoing success of Bitcoin mining endeavors.

Frequently Asked Questions

What is the current Bitcoin mining difficulty and how does it affect miners?

As of the latest adjustment, Bitcoin mining difficulty stands at 119.12 trillion after a decrease of 3.34%. This lower difficulty means miners can potentially find new blocks with less computational effort, improving their chances of profitability and easing operational strain.

How does network difficulty adjustment impact Bitcoin miners’ profitability?

Network difficulty adjustments directly influence Bitcoin miners’ profitability. With the recent drop in mining difficulty, miners can generate more revenue as their required computational workload decreases, allowing them to mine more efficiently and increased hashprice further enhances their earnings.

What factors contribute to changes in Bitcoin mining difficulty?

Bitcoin mining difficulty changes based on the total hash power within the network. If the combined computational power increases, difficulty rises to maintain the average block time. Conversely, if the hash rate declines or remains steady, such as in the recent case of a 3.34% drop in difficulty, adjustments become necessary to ensure blocks are still mined approximately every 10 minutes.

How does Bitcoin mining difficulty relate to cryptocurrency mining profitability?

Bitcoin mining difficulty is a critical factor in cryptocurrency mining profitability. A decrease in difficulty means that miners require fewer attempts to successfully mine a block, directly increasing their potential revenue while lowering operational costs.

What impact does the recent Bitcoin mining difficulty adjustment have on future mining?

The recent 3.34% decrease in Bitcoin mining difficulty may lead to improved mining efficiency and potentially increased hash rates as miners respond positively to the more favorable conditions. If block times remain above the target, further adjustments may follow, benefiting miners even more.

Why did Bitcoin mining difficulty drop after four consecutive increases?

The Bitcoin mining difficulty dropped after four consecutive increases due to changes in total network hash power. After consistently rising computational efforts, the recent reduced difficulty indicates a correction to maintain typical block intervals, leading to easier mining conditions for Bitcoin miners.

What does the term ‘hashrate’ mean in the context of Bitcoin mining difficulty?

Hashrate refers to the total computational power being used to mine Bitcoin and process transactions on the network. Currently, the network operates at 885.51 EH/s, and this collective hashrate directly influences Bitcoin mining difficulty, affecting how challenging it is for miners to validate transactions.

How can Bitcoin miners prepare for future difficulty adjustments?

Bitcoin miners can prepare for future difficulty adjustments by optimizing their mining setups, monitoring hashprices, and maintaining efficient operational practices. Keeping abreast of Bitcoin mining news ensures they can adapt quickly to changes in network conditions.

| Key Point | Details |

|---|---|

| Bitcoin Mining Difficulty Adjustment | Difficulty decreased by 3.34%, from 123.23 trillion to 119.12 trillion. |

| First Drop After Four Rises | This drop is the first since March 9, 2025, after four consecutive increases. |

| Average Hash Attempts | Miners must make approximately 119.12 trillion attempts to mine a block. |

| Current Network Hash Rate | As of May 4, 2025, the hash rate is 885.51 EH/s. |

| Block Time Situation | Average block times exceed 10 minutes at 10 minutes and 22 seconds. |

| Miner Profitability | Hashprice rose from $45.87 to $50.80 per PH/s of computation. |

Summary

Bitcoin mining difficulty has recently experienced a notable drop of 3.34%, providing relief to miners after a series of increases. This adjustment indicates a crucial shift in the Bitcoin mining landscape, as it reflects the current computational challenges miners face while striving to maintain consistent block production. With increased miner profitability and adjustments in network hash rate, the dynamics of Bitcoin mining continue to evolve, making it vital for miners to stay informed about the ongoing changes in Bitcoin mining difficulty.