Bitcoin Price Prediction: $100K Milestone in Reach

Bitcoin price prediction has become a hot topic among investors and analysts as the cryptocurrency market shows signs of significant recovery. With Bitcoin edging closer to the coveted $100,000 mark, the excitement is palpable within the trading community. Recent trends suggest a bullish momentum, as Bitcoin experienced a near 3% upswing, a move not observed since February. Coupled with supportive indicators and a favorable market landscape, this price analysis reveals growing investor confidence. As stakeholders focus on the potential for future gains, understanding the implications of these movements in Bitcoin’s value becomes essential for anyone interested in the cryptocurrency market.

When considering the future trajectory of Bitcoin, many are turning their attention to various forecasts and analyses concerning this leading digital currency. Price assessments are not only crucial for Bitcoin but also extend to related assets like Ethereum, which have shown upward trends as well. Analysts are dissecting the dynamics of the cryptocurrency ecosystem to support their insights. This exploration into Bitcoin’s expected performance can provide valuable context for both seasoned traders and newcomers alike, highlighting the ongoing evolution of the crypto landscape and its interconnectedness.

Bitcoin Price Prediction: Tracking the Path to $100K

As Bitcoin continues its push toward the coveted $100,000 mark, market analysts are closely watching its price movements. Currently trading at around $97,030 with a market capitalization of $1.927 trillion, Bitcoin’s recent uptrend indicates a potential breakout. Analysts believe that a sustained increase in volume could propel the asset beyond its resistance at $98,000, potentially leading to new all-time highs. Given the favorable macroeconomic backdrop—with interest rates remaining unchanged—investors are increasingly seeking refuge in cryptocurrencies, further supporting Bitcoin’s bullish forecast.

Technical indicators reinforce the optimism surrounding Bitcoin’s price prediction. The ongoing bullish structure suggests that momentum may continue to build, especially if there’s a confirmed breakout above $98,000. Key support levels around $92,000 and $95,500 offer safety nets in case of a pullback, strengthening the bullish case. If Bitcoin can maintain its position above these significant thresholds, particularly in the wake of declining volumes, the pathway to $100,000 seems more attainable. Investors should remain vigilant, as market conditions can quickly change in the volatile cryptocurrency market.

Ethereum’s Rise: Overcoming the $1,900 Barrier

In addition to the impressive performance of Bitcoin, Ethereum has also made significant strides by surpassing the critical $1,900 barrier. This price level has not been seen since April, and its breakthrough reflects increasing investor confidence in the cryptocurrency market as a whole. The movements in Ethereum often parallel those of Bitcoin, indicating a robust market environment that is buoying altcoins alongside Bitcoin’s ascent. As Ethereum continues to rise, analysts are speculating on its potential to capitalize on Bitcoin’s gains while capturing a larger share of the market.

Ethereum’s recent rally not only highlights its recovery but also signals a broader trend within the cryptocurrency landscape. With institutional adoption growing and innovations on platforms like Ethereum 2.0 in the pipeline, the outlook for ETH remains positive. Just as Bitcoin’s price analysis reflects a bullish sentiment, Ethereum’s fundamentals will likely drive further investments, especially as traders look for alternatives within the cryptocurrency ecosystem. The ongoing developments within the crypto space make it a compelling narrative for both new and seasoned investors alike.

Understanding Market Volatility: The Dynamics of Crypto Investing

The cryptocurrency market is notorious for its volatility, which can present both lucrative opportunities and significant risks for investors. Bitcoin’s recent price fluctuations, where it oscillated between $93,592 and $97,511, exemplify this dynamic nature. This volatility necessitates a deep understanding of market trends and timing, as quick reactions can either lead to substantial profits or unexpected losses. The recent surge following the Federal Reserve’s interest rate decision highlights how macroeconomic factors influence investor behavior in the cryptocurrency market.

Investors must equip themselves with the right tools to navigate this ever-changing landscape. Utilizing strategies such as technical analysis, which examines price trends through historical data, can help in making informed decisions. Furthermore, analyzing market sentiments and external events, such as geopolitical tensions or regulatory changes, becomes critical in formulating a reasoned approach to trading. As Bitcoin and other cryptocurrencies continue to evolve, understanding their behavior in light of these factors is essential for anyone looking to capitalize on their potential.

The Impact of Federal Reserve Policy on Cryptocurrency Investments

The Federal Reserve’s decisions regarding interest rates hold significant sway over the cryptocurrency market. By maintaining low interest rates, the central bank creates an environment where investors seek non-traditional assets like Bitcoin and Ethereum. This shifting trend has been noticeable in the recent rally of these cryptocurrencies as investors pivot away from traditional financial instruments. The absence of immediate corrective measures from the Federal Reserve indicates a continuation of this trend, setting the stage for further price appreciation in the cryptocurrency market.

As the U.S. economy grapples with various challenges, including tariff uncertainty and potential geopolitical tensions, the role of cryptocurrencies in investment portfolios becomes increasingly relevant. Market analysts argue that cryptocurrencies serve as a hedge against inflation and economic instability. Consequently, Bitcoin’s current climb and Ethereum’s breakout above $1,900 can be attributed, in part, to a search for alternative value stores amidst a backdrop of uncertainty in traditional finance. Investors must stay aware of how macroeconomic factors will continue shaping the future of crypto investments.

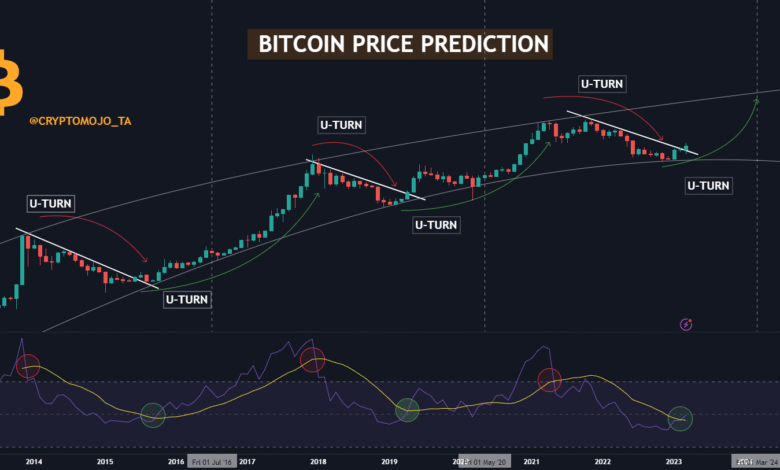

Technical Analysis: Bitcoin’s Multi-Timeframe Strength

A closer look at Bitcoin’s multi-timeframe chart reveals distinct bullish characteristics that underline its potential for future gains. With the daily chart suggesting a strong uptrend that commenced in mid-April, Bitcoin’s price action from $74,434 to its recent local peak signifies a healthy bullish phase. The consolidation phase currently being experienced highlights the market’s efforts to solidify gains before a breakout. Analysts note that maintaining support levels around $92,000 could pave the way for Bitcoin to challenge higher resistance zones, especially as market momentum remains upbeat.

Moreover, chart indicators such as the relative strength index (RSI) and moving average convergence divergence (MACD) point toward a favorable outlook for Bitcoin. Despite oscillators showing near-neutral conditions, a convergence of momentum indicators issuing buy signals strengthens the argument for a potential uptrend. Understanding these technical aspects helps investors navigate Bitcoin’s price analysis and make informed decisions about when to enter or exit positions, ultimately contributing to a more strategic engagement with the cryptocurrency market.

Market Sentiment: The Role of Investor Psychology in Crypto Trends

Market sentiment is a powerful force in the cryptocurrency world, often impacting price movements significantly. As prices rise, as seen with Bitcoin approaching the $100,000 mark, investor confidence typically increases, encouraging more buying activity. This psychological aspect of investing cannot be overlooked; traders often react emotionally to market changes, which can exacerbate volatility. Therefore, keeping tabs on market sentiment provides crucial insights into potential future price movements.

In tandem with technical and fundamental analysis, gauging the market’s overall mood can enhance trading strategies. Social media, news outlets, and forums often reflect the collective sentiment, illustrating how external perceptions can sway decisions. For instance, positive news regarding Bitcoin’s adoption or Ethereum’s technological advancements can lead to increased enthusiasm and further price appreciation. Conversely, negativity surrounding regulatory challenges or market downturns can create panic selling, emphasizing the need for investors to understand this psychological dimension fully.

Global Factors Influencing the Cryptocurrency Market

The cryptocurrency market does not operate in a vacuum; global events often shape its trajectory. Factors such as economic sanctions, geopolitical tensions, and major financial news can have immediate impacts on Bitcoin and Ethereum’s prices. For example, recent developments surrounding potential conflicts between major nations have spurred interest in cryptocurrencies perceived as safe havens against instability. Thus, market participants must stay informed about global events that could influence investor sentiment and, subsequently, the market’s direction.

As global economies grapple with inflationary pressures and trade uncertainties, the flight to cryptocurrencies becomes more pronounced. Investors often look for alternative assets that provide long-term growth potential while hedging against traditional market risks. This trend is particularly prominent in the current economy, where Bitcoin’s trajectory reflects broader market sentiments tied to global economic health. As such, understanding these global dynamics is fundamental for anyone participating in the vibrant cryptocurrency space.

Long-Term Outlook: Navigating Future Trends in Cryptocurrency

Looking ahead, the long-term outlook for Bitcoin and Ethereum remains promising, driven by advancements in technology and growing acceptance in mainstream finance. As institutional investments continue to flow into the cryptocurrency market, these assets are increasingly recognized as viable components of diversified investment portfolios. The historical price patterns also suggest that despite intermittent volatility, Bitcoin possesses a tendency to recover and forge ahead toward new heights, amplifying the calls for its bullish future.

Moreover, the rapid evolution of DeFi (decentralized finance) and NFT (non-fungible token) markets tied to Ethereum showcases the innovative potential embedded within cryptocurrency ecosystems. As these sectors mature, they are expected to drive heightened interest and participation, enhancing the overall valuation of associated assets. Investors should take advantage of current market sentiments while remaining anchored in the long-term trends that continue to shape cryptocurrency, ensuring a balanced approach to navigating this exciting financial frontier.

Frequently Asked Questions

What is the current Bitcoin price prediction for reaching $100,000?

The current Bitcoin price prediction indicates that BTC is edging closer to the $100,000 milestone, showing significant bullish strength following recent market movements. As of now, Bitcoin has reached prices over $99,000, and analysts suggest that a breakout above $98,000 with strong volume could catalyze a move towards $100,000.

How does Bitcoin price analysis suggest bullish trends for the cryptocurrency market?

Recent Bitcoin price analysis highlights a bullish trend, particularly on the daily chart where Bitcoin has maintained an upward trajectory since mid-April. Indicators such as the MACD show buy signals, suggesting continued buyer interest in the market. This sentiment is further compounded by recent market recoveries following stable interest rates.

What factors influence Bitcoin price forecasts in the cryptocurrency market?

Bitcoin price forecasts in the cryptocurrency market are influenced by various factors, including market sentiment, regulatory news, and macroeconomic conditions. Recent decisions by the Federal Reserve to maintain interest rates have fueled interest in non-traditional assets like Bitcoin, impacting price movements positively.

How are Bitcoin and Ethereum price predictions related within the cryptocurrency market?

Bitcoin and Ethereum price predictions are closely related as both cryptocurrencies often reflect overall market trends. Recent momentum has seen Bitcoin nearing $100,000 while Ether has also shown a substantial recovery surpassing $1,900, indicating synchronized bullish behavior in the cryptocurrency market.

What does the volatility in Bitcoin price mean for future price predictions?

The volatility in Bitcoin price suggests potential for both upward and downward movements in future price predictions. Current analysis shows Bitcoin trading within a consolidative range, with key resistance at $98,000 and support around $92,000. Depending on whether Bitcoin can breach these levels, future price predictions could vary significantly.

What is the significance of resistance and support levels in Bitcoin price forecasts?

Resistance and support levels are crucial in Bitcoin price forecasts as they define price ceilings and floors. Current resistance is noted near $98,000, while strong support exists around $95,500. A sustained move above resistance could signal a bullish continuation, while a breakdown below support may shift momentum toward selling.

| Key Points | Details | |

|---|---|---|

| Bitcoin Price Movement | Bitcoin is trading near $99,000, marking a recovery not seen since February, with nearly a 3% upswing. | |

| Ether Performance | Ether has surpassed the $1,900 mark, reaching levels not observed since April. | |

| Market Conditions | Federal Reserve’s decision to keep interest rates unchanged may drive investments toward cryptocurrencies. | |

| Technical Analysis | Bitcoin’s price is experiencing volatility, with support at $92,000 and resistance at around $98,000. | |

| Breakout Potential | A breakout above $98,000 with volume confirmation could push Bitcoin toward the psychological $100,000 level. | |

| Bearish Indicators | Caution arises from waning volume and potential double-top formation near $97,900. | |

Summary

Bitcoin price prediction hinges on current market dynamics, with Bitcoin displaying bullish potential as it approaches the $100,000 milestone. The cryptocurrency’s recovery, bolstered by supportive technical indicators and a favorable market backdrop post-Federal Reserve’s decision on interest rates, sets an optimistic tone. However, traders must remain vigilant of bearish signals that could lead to a price pullback. Overall, the path forward looks promising, and achieving the $100,000 mark may soon be within reach for Bitcoin.