Bolivia Digital Currency: Launch of Virtual Boliviano Soon

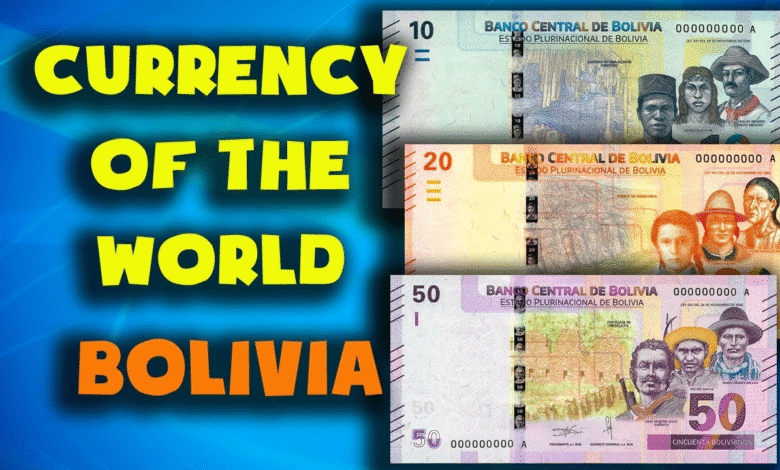

Bolivia is making significant strides towards the future by planning to launch its digital currency, the “virtual boliviano.” Spearheaded by the Central Bank of Bolivia, this initiative aims to streamline cross-border payments and promote the country’s economic sovereignty amid global shifts towards de-dollarization. By introducing a national cryptocurrency, Bolivia is setting the stage for greater financial autonomy, reducing reliance on foreign currencies like the US dollar. The virtual boliviano will not only facilitate international transactions but also enhance the efficiency of domestic financial operations. As Bolivia steps into the realm of digital currency, it joins a growing trend among nations exploring the potential of blockchain technology and cryptocurrency for economic innovation.

The introduction of a digital currency in Bolivia, often referred to as a national cryptocurrency, marks a pivotal shift in the country’s financial landscape. This move towards a virtual currency, namely the virtual boliviano, is a response to the challenges posed by cross-border payments in an increasingly digitized world. By exploring avenues for de-dollarization, Bolivia aims to safeguard its economy and promote the use of its financial system in a competitive global market. The Central Bank of Bolivia is taking decisive steps towards integrating advanced digital solutions that will not only streamline transactions but also adapt to the evolving demand for cryptocurrency usage. This development reflects a broader trend among countries seeking to innovate their payment systems and enhance financial inclusion.

Understanding Bolivia’s Digital Currency Initiative

Bolivia’s move to launch its digital currency, tentatively called the ‘virtual boliviano,’ signals a pivotal shift in the country’s monetary policy and digital economy. Spearheaded by Edwin Rojas Ulo, president of the Central Bank of Bolivia, this initiative aims to enhance international settlements, particularly for cross-border payments. The virtual boliviano is expected to streamline financial transactions, reduce dependency on traditional currencies, and modernize Bolivia’s payment system. The planned unveiling during the bicentennial celebration signifies the importance of this development in not only the economic landscape but also in the national identity of Bolivia.

This digital currency initiative comes at a time when many countries are exploring the potential of cryptocurrencies and central bank digital currencies (CBDCs) to foster economic resilience and efficiency. By consulting with international organizations, Bolivia aims to learn from global experiences in cryptocurrency adaptation, which could help them design a robust framework for the virtual boliviano. As the nation aims for de-dollarization, the virtual boliviano could serve as a crucial tool to minimize the reliance on the US dollar and introduce more stability in the local economy.

The Role of the Central Bank of Bolivia in Cryptocurrency Adoption

The Central Bank of Bolivia’s proactive stance on creating a digital currency marks a significant departure from its previous ban on cryptocurrency transactions. The change is centered around the belief that adopting a state-sanctioned digital currency would enhance Bolivia’s financial infrastructure and usher in new payment methodologies. Rojas Ulo emphasized that designing the virtual boliviano has involved learning from the successes and challenges faced by other central banks in the region. This approach not only showcases the importance of international collaboration but also highlights Bolivia’s determination to modernize its financial systems.

As the central bank opens the door to cryptocurrency through the virtual boliviano, it also acknowledges the parallel rise of digital assets in Bolivia. Over the past few months, the easing of restrictions on cryptocurrency purchases has led to a surge in adoption among Bolivians. This increased activity contributes to a more dynamic financial ecosystem, aligning with the central bank’s objectives of facilitating cross-border payments while conserving foreign reserves. The evolving relationship between the Central Bank of Bolivia and digital currencies exemplifies the broader trend of central banks worldwide exploring the potential of CBDCs.

De-Dollarization Efforts through Digital Currency Solutions

Bolivia’s digital currency initiative forms part of a larger strategy aimed at de-dollarization, a term used to describe the efforts to reduce reliance on the US dollar within the economy. By introducing the virtual boliviano, the aim is to create a more autonomous and resilient financial system that can thrive independently of foreign currencies. This strategy responds to challenges faced in the international money market and seeks to stimulate domestic economic growth through enhanced financial independence.

The incorporation of a national digital currency can enable Bolivia to better manage its foreign currency reserves, particularly in the context of cross-border transactions. With the virtual boliviano in place, businesses and individuals might find it easier to engage in international trade without the complexities often associated with dollar conversion and reliance. This move not only aligns with de-dollarization efforts but represents a significant step toward financial innovation within the country.

Implications of the Virtual Boliviano for Local Businesses

The introduction of the virtual boliviano is expected to have far-reaching implications for local businesses in Bolivia. With a digital currency designed to facilitate cross-border payments, entrepreneurs can expect faster and more efficient transaction processes that can help in expanding their market reach beyond national borders. Moreover, the economic climate created by the digital currency could boost investor confidence, encouraging investment in various sectors such as e-commerce and fintech.

As businesses adapt to this new payment system, there will likely be increased opportunities for collaboration with international partners. The virtual boliviano can enable smoother cross-border trade operations, reducing delays and associated costs. Local businesses that embrace this digital transformation may find themselves at the forefront of a burgeoning digital economy, leveraging the advantages of blockchain technology and innovative financial solutions to enhance competitiveness in a global marketplace.

The Future of Cryptocurrency in Bolivia

As Bolivia prepares to launch its digital currency, the future of cryptocurrency in the country looks increasingly promising. The existing regulatory framework set by the Central Bank of Bolivia signals a recognition of the changing financial landscape and the role digital currencies may play in it. The virtual boliviano will not only function as a means of payment but may also serve as a catalyst for broader acceptance of cryptocurrencies in various economic sectors.

Future developments may involve the integration of other digital assets into Bolivia’s financial system, encouraging innovation and investment in blockchain technologies. The shift towards a more digitally-savvy economy, propelled by the virtual boliviano, could position Bolivia as a notable player in the regional cryptocurrency landscape. Continued collaboration with international financial institutions may further solidify Bolivia’s approach to optimizing the benefits of cryptocurrency while safeguarding financial stability.

Challenges Ahead for Bolivia’s Digital Currency Launch

Despite the ambitious plans surrounding the virtual boliviano, there are several challenges that Bolivia must navigate in the digital currency rollout. One significant concern is the existing infrastructure and technology necessary to support widespread adoption. A robust digital payment infrastructure needs to be established to ensure smooth transactions, security, and accessibility for all citizens. Investment in technology and collaboration with tech companies will be crucial in overcoming these challenges.

Furthermore, public education and awareness about the new digital currency will be vital for its acceptance. Many citizens may still harbor skepticism towards cryptocurrencies due to previous regulatory bans. The Central Bank of Bolivia will need to undertake proactive measures to educate the population on the benefits and functionalities of the virtual boliviano, fostering a positive perception that encourages adoption.

Impact of Stablecoins on Bolivia’s Financial Landscape

The rise of stablecoins as alternatives for traditional currencies in Bolivia presents a unique opportunity for stabilizing the financial landscape. Given the country’s earlier struggles with foreign currency scarcity, especially in energy imports, stablecoins could act as a viable proxy for dollars, offering greater flexibility and asset protection. As Bolivia considers options for incorporating stablecoins along with its own virtual boliviano, the implications for trade and fiscal stability could be profound.

The integration of stablecoins not only provides a mechanism for mitigating volatility but also opens avenues for Latin American countries to establish a more cohesive economic environment. By embracing stablecoins alongside its upcoming digital currency, Bolivia can enhance cross-border payment efficiency and economic resilience, ultimately contributing to the country’s broader de-dollarization strategy.

International Cooperation in Designing Bolivia’s Digital Currency

Bolivia’s Central Bank has taken a collaborative approach in designing its digital currency, soucing advice and insights from international organizations and regional central banks. This collaboration is crucial for ensuring that the virtual boliviano aligns with global best practices in digital currency development. By understanding and implementing lessons learned from other nations, Bolivia can enhance the effectiveness and security of its digital financial system.

International cooperation also opens doors for potential partnerships that can facilitate technical support, training, and resources essential for launching the virtual boliviano. In a region where many countries are exploring similar initiatives, leveraging collective experiences can provide Bolivia with a unique competitive advantage in developing its digital economy.

The Economic Advantages of Embracing Digital Currencies

Embracing digital currencies, particularly in the form of the virtual boliviano, offers numerous economic advantages for Bolivia. Digital currencies can enhance transactional efficiency, significantly reducing the time and costs associated with traditional banking methods. With the implementation of secure and traceable digital transactions, businesses may experience improved cash flow management, leading to better economic outcomes at both the local and national levels.

Additionally, as digital currencies facilitate broader access to financial services, they promote inclusiveness by allowing unbanked populations to participate in the economy. The adoption of the virtual boliviano could lead to increased financial literacy and engagement, empowering individuals and fostering a more robust economic environment where entrepreneurship can thrive.

Frequently Asked Questions

What is the ‘virtual boliviano’ in relation to Bolivia’s digital currency plans?

The ‘virtual boliviano’ is the proposed digital currency by the Central Bank of Bolivia, aimed at facilitating international settlements and modernizing the payment system, particularly for cross-border payments.

How does the Central Bank of Bolivia plan to implement the virtual boliviano?

The Central Bank of Bolivia is currently consulting with international organizations to design the virtual boliviano and aims to reveal a structured proposal during the bicentennial anniversary of Bolivia’s independence on August 6.

What role does the virtual boliviano play in Bolivia’s de-dollarization efforts?

The virtual boliviano is seen as a key component in Bolivia’s de-dollarization strategy, potentially reducing dependency on the US dollar for cross-border transactions and conserving foreign currency reserves.

How has the lifting of the cryptocurrency purchasing ban affected digital asset adoption in Bolivia?

Since the ban on using bank accounts for cryptocurrency purchases was lifted by the Central Bank of Bolivia, the adoption of digital assets has surged, doubling transaction volumes within three months.

What are some benefits of the virtual boliviano for cross-border payments?

The virtual boliviano is expected to streamline cross-border payments, enhance transaction speed and security, and help conserve foreign currency reserves, thereby modernizing Bolivia’s payment infrastructure.

Will the virtual boliviano be compatible with other cryptocurrencies?

While specific details on compatibility have not been released, the Central Bank of Bolivia has indicated an openness to incorporating cryptocurrency solutions, including stablecoins, to facilitate payments.

What are the risks associated with adopting the virtual boliviano in Bolivia?

Potential risks include regulatory challenges, technical security concerns, and the need for public education on digital currencies, which the Central Bank is likely to address in its implementation plan.

How is the Central Bank of Bolivia collaborating with other nations regarding digital currency?

The Central Bank of Bolivia is leveraging advice and experiences from other central banks and international organizations that are exploring virtual currencies to inform the development of the virtual boliviano.

| Key Point | Details |

|---|---|

| Launch of Digital Currency | Bolivia plans to launch the ‘virtual boliviano’ to enhance international settlements. |

| Bicentenary Announcement | The announcement is set for August 6, during the bicentennial celebrations of Bolivia’s independence. |

| Consultations with International Organizations | Consultations are ongoing with international organizations for advice on the digital currency system. |

| Adoption of Cryptocurrency | Since allowing bank purchases of cryptocurrency, usage has doubled within three months. |

| Use of Stablecoins | Bolivia is considering stablecoins to overcome foreign currency shortages. |

| Modernizing Payment Systems | The virtual boliviano aims to modernize cross-border payment systems and preserve foreign reserves. |

Summary

The Bolivia digital currency, specifically the upcoming ‘virtual boliviano’, is poised to revolutionize the country’s financial landscape by enhancing efficiency in cross-border payments. With plans to unveil this digital asset during the bicentennial anniversary of Bolivia’s independence, the Central Bank is aligning itself with international best practices to ensure successful implementation. As Bolivia embraces cryptocurrency within its financial system, the move represents a significant shift towards modernizing its economy and responding to changing global monetary dynamics.