Bitcoin Price Prediction: Nearing a Historic Milestone

In the dynamic world of cryptocurrency, Bitcoin price prediction continues to capture the interest of investors and analysts alike. As Bitcoin’s value hovers around $101,251, traders are keenly watching for signals that may indicate the next significant price movement towards its all-time high, which is just 7.44% away. This ongoing Bitcoin price analysis reveals a bullish sentiment underpinned by a robust technical landscape and positive market trends. With a keen focus on BTC price forecasts, it’s essential to consider the potential impact of cryptocurrency market trends, which play a crucial role in shaping trader strategies. As enthusiasts develop varied Bitcoin trading strategies, the anticipation for price movements grows stronger, making it an exciting time to observe this digital currency’s trajectory.

The forecasting of Bitcoin’s future valuation is a hot topic among traders and crypto enthusiasts. As market participants delve into a comprehensive Bitcoin price outlook, they reflect on the bullish signals and market dynamics influencing this cryptocurrency’s journey. Analyzing the BTC price trajectory, alongside emerging crypto market behaviors, reveals pivotal trends that could steer Bitcoin closer to its previous high. Investors are strategically positioning themselves with various methods to capitalize on potential price surges, showcasing a broad spectrum of trading approaches. With the ongoing shifts within the digital currency landscape, understanding these evolving factors is essential for anyone looking to engage in Bitcoin trading.

Understanding Bitcoin Price Analysis

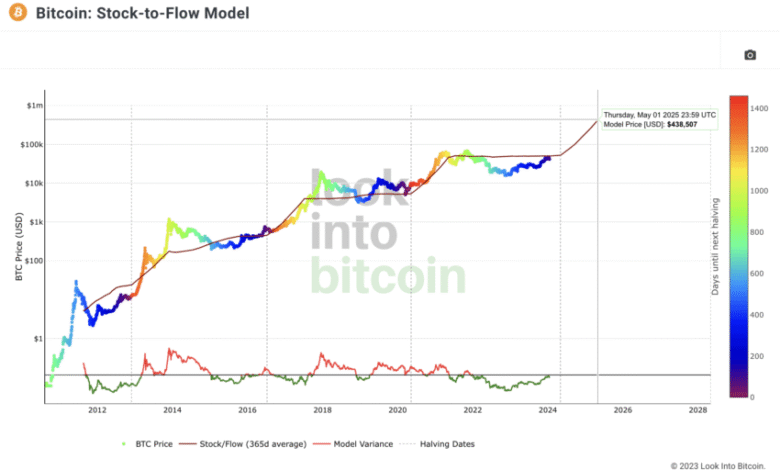

Bitcoin price analysis is essential for traders and investors looking to navigate the volatile cryptocurrency market. This involves studying various factors such as historical price movements, market sentiment, and technical indicators. With Bitcoin currently priced at $101,251 and hovering close to its all-time high, these analyses become more critical as they offer insights into potential future movements. Traders utilize various charting techniques and models to predict price behaviors, accounting for everything from trading volumes to macroeconomic factors affecting digital currency.

Key indicators in Bitcoin price analysis include moving averages, support and resistance levels, and oscillators like the Relative Strength Index (RSI). These tools help investors gauge market momentum and establish risk management strategies. For instance, with the RSI currently showing a value near 73, it may suggest that Bitcoin is overbought. However, momentum indicators like the MACD indicate bullish sentiment, highlighting the complexity of making predictions in a constantly shifting market.

Bitcoin Price Prediction: Future Trends and Insights

Considering Bitcoin’s current price of $101,251 and its potential to breach the all-time high, price predictions for BTC are becoming increasingly exciting. Analysts are beginning to anticipate price targets beyond the previous peaks, particularly if supportive trading conditions persist. A crucial factor influencing these predictions is the current support and resistance framework; traders are eyeing a stable support range between $99,000 and $100,000 which could facilitate a stronger upward momentum.

Another element to focus on in Bitcoin price predictions is the growing institutional interest. Recently, reports have shown that institutional investments are moving into Bitcoin, providing a solid foundation for its price to accelerate. Analysts believe that as more institutional capital flows into the market, it can significantly influence BTC’s price trajectory and stability. Therefore, watching for any shifts in investor sentiment or market policies will be vital to refine any long-term Bitcoin price forecasts.

Cryptocurrency Market Trends Influencing Bitcoin

The cryptocurrency market is constantly evolving with new trends influencing Bitcoin’s price and trading dynamics. Currently, there’s a notable trend toward higher institutional involvement, as evidenced by firms allocating significant resources to Bitcoin investments. This trend is transforming Bitcoin into more of a mainstream asset, akin to commodities or equities, thereby affecting its market psychology and driving prices upwards.

Additionally, macroeconomic factors such as inflation rates, regulatory developments, and technological advancements in blockchain are shaping cryptocurrency market trends. As Bitcoin becomes increasingly integrated into financial systems, its price movements reflect broader market trends, highlighting the importance of contextual analysis to forecast its future performance accurately.

Bitcoin Trading Strategies for Success

Engaging in Bitcoin trading requires well-informed strategies to navigate the asset’s volatility effectively. One popular approach is the trend-following strategy, where traders capitalize on market trends. Since Bitcoin has shown strong bullish momentum lately, adopting such strategies could yield positive results. Investors often look for entry points during pullbacks, making the current support levels between $99,000 and $100,000 attractive for traders looking to capitalize on upward movements.

Risk management is another critical component of Bitcoin trading strategies. Many traders implement stop-loss orders to protect against significant downturns, particularly when breaking previous support levels. For instance, placing stop-loss orders beneath support zones can help minimize losses if market conditions change swiftly. This calls for traders to remain vigilant to ensure that their strategies adapt to evolving market conditions while maximizing their profit potential.

The Role of Bitcoin’s All-Time High in Price Movements

Bitcoin’s all-time high serves as a critical psychological barrier that influences both trader sentiment and market dynamics. With Bitcoin prices approaching $101,251, many traders are eager to see whether it can break its prior records. Historically, once an asset reaches an all-time high, it attracts more speculative trading and can lead to increased volatility, often resulting in rapid price surges or corrections.

The significance of the all-time high also extends into the realm of market analysis and forecasting. Past behavior surrounding all-time highs can offer valuable insights for predicting future price movements. Traders often look for retracement patterns and accumulation phases after achieving new highs, enhancing their understanding of potential exhaustion points that could precede a downtrend.

Analyzing Bitcoin’s Market Capitalization Trends

Bitcoin’s market capitalization is a key metric that reflects the overall health and stability of the cryptocurrency market. Currently standing at $2.01 trillion, its market capitalization supports the notion of Bitcoin’s increasing legitimacy as an asset class. A growing market cap can indicate a healthy inflow of investor confidence, which correlates with rising prices and trading volumes.

Furthermore, shifts in Bitcoin’s market capitalization often signal broader market trends. For instance, an increase in market cap alongside rising prices may suggest bullish sentiment across the cryptocurrency sector. Conversely, declining market capitalization during downward price movements can contribute to heightened volatility and decreased investor confidence, serving as an essential indicator for traders looking to make informed decisions.

The Influence of Institutional Investors on Bitcoin

Institutional investors play a crucial role in the current dynamics of Bitcoin’s price movements. As larger entities allocate capital into Bitcoin, they contribute not only to price stability but also to overall market credibility. Factors contributing to this institutional interest include a shift in perception of Bitcoin as a hedge against inflation and a legitimate asset class, thus driving prices higher.

The impact of institutional investments can also extend to market volatility and liquidity. As institutions typically bring larger capital inflows, their movements can lead to significant price changes. The prevailing trend suggests that as institutional investors become more active participants in the market, Bitcoin’s price fluctuations may become less erratic, fostering a more stable trading environment that benefits all market participants.

Understanding the Current Bitcoin Market Sentiment

Market sentiment is a critical component when analyzing Bitcoin’s price movements, reflecting the collective emotions and attitudes of investors. Currently, sentiment appears bullish, with many traders exhibiting optimism over Bitcoin’s potential to reach new highs. Indicators such as increasing trading volumes and the derivative market trends support this notion, contributing to a robust bullish outlook in Bitcoin’s trading environment.

However, it is essential to approach sentiment analysis with caution. Market sentiment can change rapidly, driven by news events, regulatory announcements, or macroeconomic developments. As Bitcoin nears its all-time high, traders must remain vigilant and assess sentiment shifts closely, as these dynamics can significantly impact trading strategies and market behaviors.

Future Implications for Bitcoin Investors

As Bitcoin continues to push towards its all-time high, investors must consider the future implications of their positions. The current bullish sentiment, underpinned by solid technical indicators and strong market support, suggests potential growth opportunities for those aiming to invest in Bitcoin. Long-term holders may particularly benefit if Bitcoin’s journey beyond previous highs is accompanied by sustained buying pressure and institutional support.

Nevertheless, investors should also prepare for potential volatility and price corrections, particularly if Bitcoin fails to maintain its current support levels. Short-term traders might find profitable opportunities in fluctuations, but fundamental analysis should guide decisions to mitigate risks effectively. Understanding Bitcoin’s evolving market dynamics will be crucial for all investors looking to make the most of this increasingly popular asset class.

Frequently Asked Questions

What are the current factors influencing Bitcoin price prediction for May 2025?

As of May 8, 2025, Bitcoin price prediction is influenced by several key factors including market sentiment driven by institutional investments, reduced volatility metrics, and bullish technical indicators. With Bitcoin trading around $101,251, the pressing 7.44% gap to its all-time high reflects a complex but optimistic outlook, supported by significant trading volume and bullish trends.

How do Bitcoin price analysis techniques predict future trends?

Bitcoin price analysis techniques primarily use historical price data, market sentiment, and technical indicators such as moving averages and oscillators to forecast future price movements. By analyzing patterns and market trends, traders can make informed predictions on potential price fluctuations and set strategic trading plans.

What is the BTC price forecast for breaking its all-time high this year?

The BTC price forecast suggests that Bitcoin could break its all-time high if it maintains support above the $99,000–$100,000 range. Given the current bullish momentum and signs of institutional interest, along with increasing trading volume, a move past the previous high is seen as viable if key support levels hold.

What trading strategies work best with current cryptocurrency market trends?

In light of current cryptocurrency market trends, effective Bitcoin trading strategies include buying on pullbacks to the support ranges between $96,000–$98,000 and using stop-loss orders just below critical support levels. Day traders may also scalp profits from bounces off key support levels while being cautious of resistance at $101,711.

What key signals should traders look for in Bitcoin’s price analysis?

Traders should closely monitor several key signals in Bitcoin’s price analysis, including moving averages indicating bullish alignments, volume spikes validating upward trends, and oscillators like the RSI and MACD that reveal market momentum. Alongside these, observing support and resistance levels is crucial for smart trading decisions.

How significant is the $100,000 support level in Bitcoin price prediction?

The $100,000 support level is critical in Bitcoin price prediction as maintaining this level is essential for sustaining bullish momentum. If Bitcoin can consistently hold above this mark in conjunction with strong trading volume, it strengthens the likelihood of pushing toward and potentially surpassing its all-time high.

What does a bullish signal in Bitcoin price analysis indicate?

A bullish signal in Bitcoin price analysis suggests that there is strong upward momentum, indicating the potential for price increases. This is often reflected in positive readings from moving averages, oscillators showing overbought conditions, and rising volume, signaling confidence among traders and investors in future price appreciation.

What could cause a downturn in Bitcoin price, according to current analysis?

A downturn in Bitcoin price could be triggered by failing to hold the $99,000–$100,000 support level, coupled with declining trading volume and resistance rejections at levels like $101,711. Increased selling pressure and decreased buyer interest could also prompt a significant price drop, leading traders to reassess their positions.

| Key Points | Details |

|---|---|

| Current Price | $101,251, only 7.44% from all-time high. |

| Market Capitalization | $2.01 trillion |

| 24-hour Trading Volume | $58.84 billion |

| Current Support Level | Between $93,000 and $95,000 |

| Resistance Level | Projected above $102,000 |

| Technical Momentum | Bullish with a recent breakout and increasing volume. |

| Cautionary Signals | If support fails below $99,000, deeper retracement may occur. |

Summary

Bitcoin price prediction continues to indicate an imminent opportunity as the cryptocurrency approaches its all-time high, with only 7.44% left to close the gap. The technical indicators reveal a bullish sentiment supported by strong market fundamentals. If Bitcoin can maintain its current support above the $99,000 level, it is likely to make further moves toward striking new highs, driven by institutional interest and optimistic trading patterns. However, caution is warranted amidst fluctuating momentum and potential support breaks, reminding investors to stay vigilant.