Tariffs Surpass AI Mentions on Corporate Earnings Calls

Tariffs have taken center stage in the ongoing economic dialogue, particularly as corporate earnings calls reflect a significant shift in focus dictated by President Trump’s recent trade policies. In 2025, the term “tariffs” has eclipsed discussions surrounding artificial intelligence, appearing in over 350 earnings calls among S&P 500 companies, sharply highlighting its importance in today’s economic landscape. These import taxes are raising alarms as businesses grapple with the implications of potential price hikes and decreased consumer spending, which may lead to an economic slowdown. CEOs are increasingly voicing concerns about how tariffs might undermine consumer confidence amidst warnings of impending recession. As companies navigate this evolving terrain, the impact of tariffs remains a pivotal issue that could reshape financial forecasts and corporate strategies in the months to come.

In the realm of international trade, duties and levies have become pivotal discussion points, especially given their influence on corporate performance across various sectors. The recent focus on these financial barriers, notably under recent leadership, has shifted conversations away from the once-dominant narrative surrounding advanced technologies. Currently, executives are expressing unease about how these economic measures will affect not just their bottom lines, but also the overall market climate for consumers and investors alike. The implications of import taxes loom large, with forecasts indicating potential repercussions such as inflationary pressures and waning consumer trust. With an atmosphere of uncertainty enveloping the business landscape, companies must now adjust their projections and responses to accommodate the unfolding changes.

The Rising Influence of Tariffs in Earnings Calls

In 2025, the term ‘tariffs’ has overtaken ‘AI’ as the focal point of discussions during corporate earnings calls, signaling a significant shift in the business landscape. According to a recent CNBC analysis, mentions of tariffs have climbed to over 350 in the first quarter alone among S&P 500-listed companies. This marks a substantial increase in corporate focus on the effects of Trump’s trade battle, which has ignited concerns over the upcoming economic repercussions and the potential for rising import taxes.

As the economic context evolves rapidly, corporate executives are increasingly prioritizing discussions about tariffs. With rising tensions surrounding trade policies, it’s imperative for businesses to acknowledge the implications on consumer behavior and market conditions. Companies like Cummins and Solventum have made it clear that tariffs complicate their forecasting abilities, highlighting how significantly trade disputes impact corporate strategy and capital allocation.

Impact of Tariffs on Economic Confidence

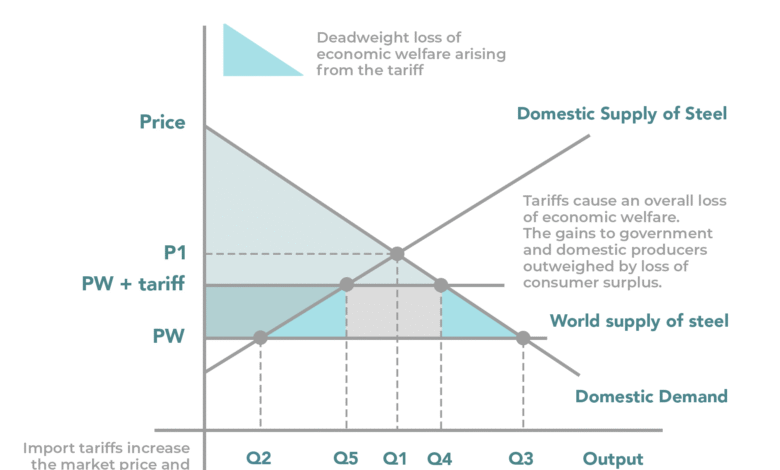

The recent surge in tariff discussions is tied to broader concerns regarding economic stability and consumer sentiment. Economic forecasts suggest that tariffs will negatively impact spending and could push the economy toward a potential recession. A significant percentage of CEOs surveyed expect an economic slowdown, further contributing to a climate of uncertainty as businesses grapple with fluctuating import taxes and their implications.

Moreover, the University of Michigan’s consumer sentiment index reflects a decline, with consumer confidence dropping to one of its lowest recorded levels in decades. This downturn can be attributed to fears that rising import costs, driven by tariffs, will lead to increased prices for consumers. As a result, companies feel pressure not only to manage their operational costs but also to maintain healthy relationships with consumers amid growing dissatisfaction.

Navigating Uncertainty from Tariff Policies

The introduction and adjustment of tariffs have created a level of unpredictability for companies looking to optimize their forecasts and strategic plans. Many executives express caution in adjusting financial outlooks as they await clarity on the evolving tariff landscape. Cummins’ head of investor relations noted the challenges in providing accurate guidance when tariffs significantly alter business operations.

This uncertainty is particularly challenging for emerging companies and small businesses, who may lack the resilience of larger firms. The shifting nature of tariffs necessitates ongoing adjustments to business strategies, as seen in Solventum’s decision to maintain its earnings per share guidance despite a positive business trend. For many in the corporate sector, navigating the implications of tariffs will remain a critical component of strategic planning.

Corporate Earnings Amid Trade Disputes

The ongoing trade disputes and the resulting tariffs have compelled companies to not only rethink their financial forecasts but also to communicate effectively with their investors. As the focus on tariffs grows, managers are dedicating more time during earnings calls to address the impact of these levies on their operations. The emphasis on tariffs has shifted attention away from technology advancements, such as AI, that previously dominated corporate dialogue.

This change illustrates the complexity of the current economic environment, where executives must now balance innovation with the realities of external trade policies. Market analysts are keenly observing how companies adapt their strategies to mitigate the effects of tariffs while still striving for growth and profitability, showcasing the delicate interplay between domestic policy and international commerce.

Tariffs and Adjusted Business Strategies

In response to the uncertainty caused by tariffs, many companies are finding it necessary to adjust their business strategies substantially. This includes re-evaluating supply chains and exploring domestic production alternatives to mitigate costs associated with import taxes. As the corporate landscape shifts in response to Trump’s trade battle, the importance of resilience and adaptability in business planning is becoming more evident.

For instance, several executives have highlighted the need for contingency plans that can swiftly react to tariff changes, ensuring that businesses can maintain operational efficiency. This proactive approach not only protects companies from potential losses but also enables them to seize new market opportunities that may arise from shifting trade policies.

Consumer Confidence and Price Sensitivity

As tariffs continue to influence market dynamics, consumer confidence is becoming increasingly susceptible to shifts in economic conditions. Rising prices linked to tariffs can lead to reduced consumer spending, fundamentally altering the way companies approach their price strategies. As noted by eBay’s CEO, the uncertainty surrounding tariffs has raised significant concerns about how consumers perceive the overall economic landscape.

The tension between maintaining competitive pricing and addressing the pressure from tariffs places additional challenges on corporate executives. With consumers becoming more price-sensitive, companies must navigate the fine line between passing costs onto consumers or absorbing them to protect market share, making pricing strategy a crucial area of focus in this tariff-influenced economy.

Long-term Implications of Tariffs on Business Outlook

Companies are facing long-term implications as they respond to the restructured landscape brought about by tariffs. As many firms express a cautious, wait-and-see approach, the uncertainty surrounding future tariff policies can hamper investment decisions and development initiatives. Analysts are indicating that the effects of these trade policies may linger well beyond their initial implementation, reshaping the market dynamics on a larger scale.

Looking ahead, businesses will need to prepare for potential shifts in consumer behavior as both confidence and spending patterns evolve in response to ongoing tariff discussions. With uncertainty likely to persist, corporate executives must balance immediate responses to tariff impacts while simultaneously planning for a future landscape that could be fundamentally different, necessitating agile management practices.

Direct Criticism of Tariff Policies

As businesses encounter the ramifications of rising tariffs, some corporate leaders have chosen to speak out against these policies directly. Notably, Eli Lilly’s CEO articulated concerns over the efficacy of tariffs as a means to promote domestic investment. This critique resonates with many executives who fear that the intended benefits of tariffs may not justify the associated risks and challenges.

The ability of CEOs to express these concerns publicly highlights a shifting narrative in corporate America, where leaders are increasingly willing to confront policies that they believe hinder economic performance. This raises the stakes as companies engage in a broader dialogue about trade policy and its implications for growth, innovation, and sustainability across various sectors.

The Future of Trade and Tariffs in Corporate Strategy

The future of trade and tariffs poses significant questions for corporate strategy as businesses navigate a landscape marked by unpredictability and potential regulatory shifts. With the focus on tariffs growing, corporations are restructuring their strategic priorities to address immediate economic pressures, including fluctuating import taxes and evolving consumer perceptions. This strategic overhaul may encompass re-evaluating supply chain logistics, pricing models, and market engagement strategies.

As companies adapt to these changes, the importance of flexibility in strategy becomes paramount. Organizations that can pivot quickly in response to external pressures will likely fare better in a complex economic environment. Consequently, firms are investing in analytical capabilities that enhance their ability to forecast and respond proactively to tariff changes, ensuring they remain competitive and resilient.

Frequently Asked Questions

How are tariffs affecting corporate earnings calls in 2025?

In 2025, tariffs have become a prevalent topic during corporate earnings calls, surpassing mentions of AI. This shift has been driven by President Trump’s new import taxes, compelling many CEOs to discuss the potential repercussions on pricing, consumer confidence, and economic forecasts. With over 350 earnings calls referencing tariffs, businesses are increasingly concerned about the uncertainties surrounding these levies.

What impact do tariffs have on consumer confidence?

Tariffs can significantly undermine consumer confidence as they lead to higher prices for imported goods. For instance, many consumers fear that increased import taxes may force companies to raise their prices, leading to reduced spending. This concern is reflected in the University of Michigan’s consumer sentiment index, which recently hit one of its lowest levels since its inception.

Why are tariffs raising concerns about an economic slowdown?

Concerns about tariffs contributing to an economic slowdown are prevalent among business leaders. With more than 60% of CEOs anticipating a slowdown due to increased import taxes, many are refraining from adjusting financial outlooks. The uncertainty caused by tariffs could depress consumer spending and investment, exacerbating economic challenges.

How are companies adjusting their forecasts in response to new tariffs?

Companies are struggling to provide accurate forecasts amid evolving tariff policies. Many, like Cummins and Solventum, have opted to keep their guidance unchanged despite stronger underlying business performance, citing tariffs as a significant headwind. This caution reflects how tariffs create unpredictability in business planning and financial outlooks.

What did CEOs say about tariffs during earnings calls?

During recent earnings calls, many CEOs expressed concerns over the impact of tariffs. For example, Solventum’s CEO highlighted that without the headwind of tariffs, the company would consider raising its EPS guidance. Others, such as Eli Lilly’s CEO, criticized the use of tariffs as a tool for domestic investment, advocating for alternative strategies.

| Key Point | Details |

|---|---|

| Surge in Mentions of Tariffs | Over 350 S&P 500 earnings calls mentioned ‘tariffs’, surpassing ‘AI’ for the first time. |

| Impact of Trump’s Tariff Policy | President Trump’s plan for steep levies has raised concerns among CEOs. |

| Economic Forecasts | 60% of CEOs anticipate an economic slowdown within six months due to tariffs. |

| Uncertainty Among Businesses | Companies are maintaining or adjusting their financial outlooks amidst tariff uncertainties. |

| Consumer Sentiment | Falling consumer confidence attributed to potential price hikes from tariffs. |

| Criticism of Tariff Mechanism | Some executives argue that tariffs are not the right approach for boosting domestic investment. |

Summary

Tariffs have rapidly become a key focus in corporate earnings discussions, reflecting the significant impact of trade policies on the economy. As businesses grapple with the implications of these tariffs, understanding their effects on pricing and consumer confidence is crucial for forecasting and strategic planning. With increased discussions around tariffs, companies are expressing their uncertainty and adjusting their projections, indicating that tariffs are not just a political issue, but a formidable factor affecting corporate performance in 2025.