Bitcoin Price Prediction: Will It Hit $100,000 Soon?

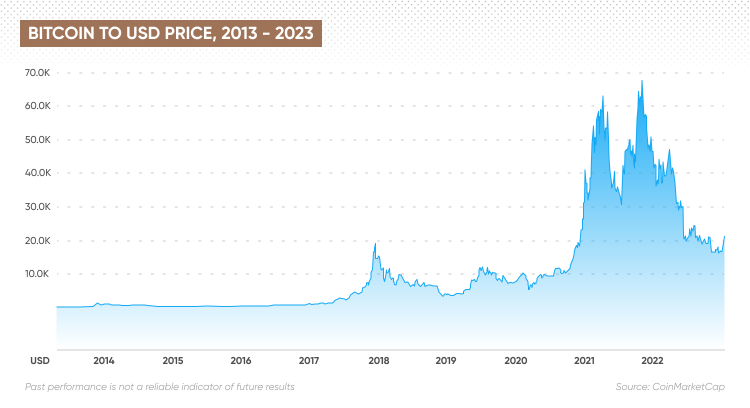

Bitcoin price prediction has become a hot topic among cryptocurrency enthusiasts as the leading digital asset makes waves in the market once again. After a prolonged period of stagnation, Bitcoin has re-emerged, triumphantly reclaiming the crucial $100,000 threshold, sparking excitement among investors and analysts alike. With a Bitcoin bull run in 2023 seemingly underway, many are speculating on how high BTC could soar. Notable figures such as Adam Back and Arthur Hayes have shared bullish forecasts, suggesting that Bitcoin could reach even more astonishing heights, potentially making millionaires out of savvy investors. In this rapidly evolving landscape, understanding Bitcoin’s market analysis and investor outlook becomes essential in navigating the cryptocurrency forecast and capitalizing on future opportunities.

As the cryptocurrency market gains momentum, the conversation around Bitcoin’s future price trajectory intensifies. Many experts are delving into BTC predictions, assessing not only historical trends but also current market dynamics that could propel the cryptocurrency towards unprecedented valuations. Factors such as investor sentiment, economic indicators, and technological advancements play pivotal roles in shaping these forecasts. With Bitcoin’s recent resurgence and the anticipation of a robust bull market, stakeholders are keenly observing the potential for significant price movements. Understanding these underlying elements helps both novice and seasoned investors make informed decisions in this fluctuating financial environment.

Bitcoin Price Prediction: What Lies Ahead for BTC?

Bitcoin’s recent reclaiming of the significant $100,000 mark has sparked renewed optimism among investors regarding future price movements. Many market analysts are now actively discussing Bitcoin price predictions, contemplating whether this upward trajectory is sustainable and could usher in a Bitcoin bull run in 2023. Influential figures, including Adam Back, are echoing similar sentiments, emphasizing that the current price levels may only signify the beginning of a larger rally. With investors’ psychology playing a pivotal role in market dynamics, the recent surge in Bitcoin’s price could stimulate greater buying activity, propelling BTC to new heights.

However, it’s essential to consider the varying outlooks on Bitcoin’s potential price movements. While some analysts project a substantial increase, estimating Bitcoin could reach as high as $500,000 during this bull market, others maintain a more cautious stance. This divergence in cryptocurrency forecasts reflects the inherent volatility and unpredictability of the crypto market. Bitcoin investors need to remain vigilant, analyzing market trends and expert predictions closely, as the path to a successful investment can vary significantly within the ever-changing landscape of cryptocurrencies.

The Role of Market Sentiment in BTC’s Price Movements

Market sentiment plays a crucial role in shaping Bitcoin’s price trajectory. As witnessed in previous bull runs, when Bitcoin’s price begins to rise, a psychological phenomenon triggers a wave of bullish sentiment among investors. The behavior noted by Adam Back, where rising prices attract more buyers, is a classic example of how market psychology can lead to exponential growth. This feedback loop becomes even more pronounced during periods of significant price recovery, contributing to the belief that Bitcoin’s ascent could dominate the financial news cycle.

Investors often look for signs of broader adoption and institutional investment as indicators of long-term growth potential. As Bitcoin’s price rebounds, strong public interest and social media discussions amplify the hype around BTC, drawing more individuals into the market. This trend has been bolstered by the increasing legitimacy of cryptocurrencies and the growing acceptance among financial institutions worldwide. However, investors must balance optimism with caution, ensuring they remain informed about market conditions and external factors that could influence Bitcoin’s ongoing growth.

Comparative Analysis: Bitcoin vs. Gold Valuation

The ongoing debates surrounding Bitcoin’s valuation often draw comparisons to traditional assets, particularly gold. Financial analysts highlight the potential for Bitcoin to outperform gold, especially during market conditions that favor digital assets. The projected market capitalization of gold being at $22.6 trillion has led some experts to assert that Bitcoin could realistically achieve prices exceeding $500,000, especially when market dynamics are taken into consideration. This correlation suggests that Bitcoin might not only compete with gold but also command a dominant position in the digital asset realm.

The argument presented by analysts likening Bitcoin’s future price to gold’s market value provides a compelling narrative for prospective investors. With estimates suggesting Bitcoin could pursue a trajectory that doubles its value relative to gold’s future price, the strategy for speculative gains remains firmly on the table. As Bitcoin continues to carve out its niche and gain traction within financial markets, informed investment strategies will likely incorporate sophisticated analyses of both crypto and traditional asset performances.

Crypto Investors Outlook: Optimism Amidst Caution

Despite the bullish sentiments floating around, crypto investors continue to harbor a mix of hope and caution. The optimism stems from Bitcoin’s impressive performance and historical resilience, yet the specter of volatility looms large. Investors are not only eager to ride the waves of upward trends but are also maintaining a vigilant stance, preparing for potential corrections. Opinions vary widely, with some seasoned investors advocating for a methodical approach, encouraging new entrants to the market to conduct thorough research before taking positions in Bitcoin.

As discussions unfold regarding potential price levels, the outlook for Bitcoin remains positive, especially from a long-term investment perspective. Notable figures in the crypto space, like BitMEX co-founder Arthur Hayes, support the thesis that Bitcoin could disrupt existing financial paradigms. However, investors should keep an eye on macroeconomic factors and institutional trends influencing market dynamics, ensuring they don’t overlook critical indicators of Bitcoin’s performance moving forward.

Understanding the Bitcoin Bull Run of 2023

The Bitcoin bull run of 2023 is poised to be a defining moment in cryptocurrency history, evoking strong predictions from various financial analysts. The surge to the $100,000 mark has incited discussions about the market’s path towards unprecedented valuations. With key figures like Adam Back and Changpeng Zhao voicing bullish predictions of $1 million and more, many are keenly interested in understanding the drivers that could fuel this bull run. Market conditions, investor behavior, and macroeconomic factors will play a significant role in determining the trajectory of BTC’s price.

Moreover, the participation of significant institutional players adds a layer of complexity to the current landscape. Institutional investment in Bitcoin has been rising steadily, enhancing its legitimacy and perceived value among traditional finance critics. As more institutions adopt Bitcoin into their portfolios, this could solidify the groundwork for a prolonged bull run. Investors should stay informed of upcoming developments and strategies being implemented, ensuring they are positioned strategically for any changes in market direction.

The Psychology Behind Bitcoin’s Price Movements

Understanding the psychology of Bitcoin investors can provide profound insights into its price movements. The cyclical nature of belief around Bitcoin’s valuation often reflects collective psychological behavior, where rising prices generate further interest and investment. As Bitcoin recently surged past the $100,000 mark, market sentiment has started to shift toward a more bullish outlook, fueled by optimism about the potential for higher prices in the near future. The patterns observed in previous market cycles demonstrate how psychological phenomena can dramatically influence investor behavior and subsequent price changes.

Discussions around the dangers of FOMO (fear of missing out) have been prevalent among Bitcoin investors. As prices rise and the media amplifies the success stories of those who invested early, new entrants flock to the market, often contributing to further price surges. This cycle of increase and subsequent hype can lead to significant price volatility, making it crucial for investors to remain informed and adopt rational strategies over purely emotional reactions. By understanding the psychological aspects of trading and investment, Bitcoin enthusiasts can navigate the complexities of this vibrant financial landscape.

Future Trends in Cryptocurrency Markets

As Bitcoin continues to attract attention, investors should keep a keen eye on emerging trends in the cryptocurrency market. The evolution of blockchain technology, improvements in regulatory frameworks, and rising public interest in decentralized finance (DeFi) are all factors that will influence the future of Bitcoin and other cryptocurrencies. The trend towards integration with traditional financial systems signifies a shift where Bitcoin could be viewed not just as a speculative asset but as a viable alternative currency, shaping the financial ecosystem.

Furthermore, within the context of the impending digital currency revolution, cryptocurrencies may not just coexist with traditional finance but can also complement and redefine economic transactions. As financial institutions increasingly turn to blockchain technology for efficiency and security, Bitcoin’s role as a pioneer in this domain can effectively position it as a mainstay in the investment landscape. For investors, recognizing and aligning with these trends will be key in maximizing their potential returns in the ever-evolving cryptocurrency markets.

Bitcoin Market Analysis: Insights and Predictions

Conducting thorough market analysis is vital for understanding Bitcoin’s current standing and forecasting its future. With recent price movements challenging previous records, many analysts focus on multifaceted indicators to assess the health of the BTC market. Metrics such as trading volumes, market capitalization, and investor sentiment form a basis for predictions and strategies. As Bitcoin approaches the $100,000 threshold, analysts are dissecting market signals to gauge whether this price point is sustainable or if it sets the stage for a more significant rally.

Experts are utilizing comprehensive models to predict Bitcoin’s value based on historical data and emerging market trends. These models often rely on a mixture of quantitative analysis and qualitative insights, focusing on investor behavior and external economic factors that can impact Bitcoin’s trajectory. The confluence of these data points creates a robust framework for investors, allowing them to navigate the complexities of Bitcoin’s market dynamics while formulating informed predictions about its future.

Navigating The Cryptocurrency Market: Tips for Investors

Entering the cryptocurrency market can be daunting, especially for new investors diving into the Bitcoin space. To maximize potential gains and minimize risks, it’s essential to adopt strategies that encompass both aggressive and cautious approaches. Investors should consider diversifying their portfolios and starting with small investments to measure the waters before committing significant funds. Staying updated with market news, expert analyses, and broader economic indicators can equip investors with the knowledge to make informed decisions.

Additionally, becoming part of the Bitcoin community can provide support and insights into emerging trends and strategies. Engaging with online forums, following market influencers, and attending webinars can enhance an investor’s understanding of the market landscape. Establishing a well-researched investment plan and setting clear goals—whether for short-term trading or long-term holding—enables investors to maintain perspective amid the market’s intense volatility. By employing disciplined strategies and being receptive to learning, investors can effectively navigate the cryptocurrency market.

Frequently Asked Questions

What is the current Bitcoin price prediction for 2023?

The current Bitcoin price prediction for 2023 sees the cryptocurrency potentially reaching impressive milestones, with some experts optimistic about BTC hitting $100,000. This prediction is fueled by the recent bullish sentiment in the market and historical trends indicating that Bitcoin tends to rally significantly during bull runs.

Can Bitcoin really reach $100,000 this year?

Many analysts believe that Bitcoin can indeed reach $100,000 this year, considering the market’s bullish momentum and psychological factors that drive investor behavior. As past performance suggests, Bitcoin often breaks through psychological price barriers during bull runs.

How does the BTC market analysis predict future price movements?

BTC market analysis utilizes various factors, including historical price patterns, investor sentiment, and macroeconomic indicators, to predict future price movements. Analysts are closely monitoring current trends that may indicate a strong potential for Bitcoin to climb significantly in the near term.

What are the implications of the Bitcoin bull run in 2023?

The Bitcoin bull run in 2023 could lead to substantial price increases and higher investor interest, potentially pushing BTC to new all-time highs. Predictions such as a target of $500,000 are based on market capitalization comparisons with gold, indicating a bullish outlook for Bitcoin investors.

What is the Bitcoin investors’ outlook for the upcoming years?

The Bitcoin investors’ outlook remains optimistic, with many anticipating significant price increases driven by both institutional investment and increasing retail interest. Predictions range from $250,000 to even $1,000,000, reflecting strong confidence in Bitcoin’s long-term growth trajectory.

What is the cryptocurrency forecast for Bitcoin this decade?

The cryptocurrency forecast for Bitcoin this decade is notably bullish, with predictions suggesting that BTC could reach prices of up to $1,000,000 by 2028. This forecast is based on the asset’s historical performance in previous bull markets and a growing market capitalization comparable to gold.

How are experts predicting Bitcoin’s price rise in relation to gold?

Experts predict Bitcoin’s price rise in relation to gold by comparing market capitalizations. With gold’s current market cap around $22.6 trillion, projections suggest that Bitcoin could mirror this growth, potentially reaching values of $500,000 or more should it outperform gold as it has in previous cycles.

What role do macroeconomic factors play in Bitcoin’s price prediction?

Macroeconomic factors play a significant role in Bitcoin’s price predictions. Analysts consider aspects like inflation rates, global economic stability, and regulatory developments, which can all impact investor sentiment and ultimately influence Bitcoin’s price movements on the market.

| Key Point | Details |

|---|---|

| Bitcoin Hits $100,000 | Bitcoin has reclaimed the $100,000 mark after a three-month dry spell, raising hopes for a potential all-time high in the near future. |

| Adam Back’s Optimism | Adam Back believes the price increase is just the beginning of a larger rally, highlighting Bitcoin’s reflexive nature. |

| Historical Patterns | Similar psychological patterns from previous years are observable, with skeptics often proving wrong as prices rise. |

| Future Predictions | Experts predict a potential Bitcoin price between $250,000 to $500,000 in the current bull run, with varying degrees of optimism. |

| Gold Comparison | Bitcoin’s price predictions often reference gold, with analysts suggesting Bitcoin could surpass gold market capitalization significantly. |

| Support from Influential Figures | Notable figures like Arthur Hayes and Changpeng Zhao support bullish price predictions for Bitcoin, emphasizing its potential growth. |

Summary

Bitcoin price prediction indicates an optimistic outlook as it recently reclaimed the $100,000 mark, suggesting that we may be on the brink of an even larger rally. Influential figures in the crypto space echo this sentiment, citing historical patterns and comparisons to gold market trends that could lead to Bitcoin prices reaching between $250,000 and $500,000 in this bull run. As the market evolves, many investors and analysts remain positive about Bitcoin’s future, indicating a promising trajectory for the leading cryptocurrency.