Bitcoin Rally: Surging Over $97,000 at Token2049 Dubai

The recent Bitcoin rally has captivated the attention of investors and enthusiasts alike, with prices soaring above $97,000 this past week. This notable Bitcoin price surge is not merely a blip; it signifies a substantial 18% recovery since March, fueled by burgeoning institutional Bitcoin interest and favorable crypto market trends discussed at the recent Token2049 conference in Dubai. As more investors become aware of the potential impacts of Bitcoin ETFs, the outlook for the cryptocurrency seems increasingly bright. Escaping the shadow of trade war concerns, the crypto ecosystem is thriving, with a renewed focus on Bitcoin as a store of value akin to gold. With excitement coursing through the entire crypto landscape, many are wondering how high this rally could take Bitcoin in the coming months.

The latest surge in Bitcoin prices reflects a broader shift in the cryptocurrency landscape, often referred to as a Bitcoin price resurrection. Such a rejuvenation is drawing significant attention in discussions surrounding digital assets, especially during key events like Token2049 in Dubai. As players in the financial sphere, including institutional investors, explore avenues such as Bitcoin ETFs, the dynamics of market engagement are rapidly evolving. The decline of trade tensions further strengthens the case for Bitcoin’s value as a hedge in uncertain times. Observers are excitedly tracking these developments, keen to discern the implications for future market positioning.

The Recent Bitcoin Rally and Market Response

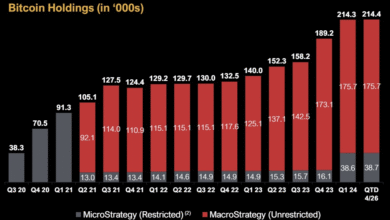

The Bitcoin price surged above $97,000 last week, marking a significant 18% increase since March. This rally has been attributed to multiple factors including the resurgence of institutional interest, particularly through increased investments in Bitcoin ETFs. As traditional markets embrace diversified financial products, Bitcoin is increasingly being regarded as a hedge similar to gold, thus appealing to a wider range of investors.

Moreover, the absence of trade war news has provided a conducive environment for this price increase. With markets focusing less on geopolitical tensions, both crypto and traditional assets are benefiting from a renewed sense of stability. Investors are closely monitoring crypto market trends, with many believing that this bullish momentum will continue as institutions continue to integrate Bitcoin into their portfolios.

Highlights from Token2049 Dubai

Token2049 in Dubai created an exhilarating atmosphere for the crypto community, showcasing the convergence of innovation and networking. During the event, industry leaders, including Eric Trump, discussed integrating Bitcoin into mainstream real estate transactions, highlighting growing institutional Bitcoin interest. Such initiatives are crucial for boosting Bitcoin’s legitimacy and its usability as a transactional currency.

The event was a vivid representation of the crypto ecosystem’s vibrancy. From interactive spectacles like zipliners and climbing walls to crucial discussions about crypto regulations, Token2049 served as a melting pot for ideas. Keynotes from figures like Changpeng Zhao (CZ) emphasized the disparity between regions in adopting cryptocurrency frameworks, while also hinting at initiatives that could potentially shape the future of crypto in Europe, reflecting the ongoing shifts in the global crypto landscape.

Understanding Bitcoin ETFs and Their Influence

The rising popularity of Bitcoin ETFs has significantly influenced the cryptocurrency market, playing a crucial role in driving Bitcoin’s recent price surge. As an ETF allows traditional investors to gain exposure to Bitcoin without directly holding the asset, it functions as a bridge connecting conventional finance with crypto innovation. This surge in inflows is a testament to institutional confidence in Bitcoin, which in turn fuels further interest and investment from retail traders.

However, the competition brewing between spot Bitcoin ETFs and cryptocurrency custodians raises important questions about the future dynamics of the market. Some experts caution that crypto-native platforms may underestimate the impact of ETFs, which have proven transformative in traditional markets. The shifts in market sentiment, driven by both institutional and retail interest, indicate that as Bitcoin becomes more entrenched in the financial system, its price will continue to respond to evolving trends in investor behavior.

The Impact of Geopolitical Stability on Bitcoin

Geopolitical tensions have historically affected asset prices across the board, and Bitcoin is no exception. The recent calm regarding trade wars has allowed Bitcoin to thrive as investors search for a safe haven asset. With heightened uncertainty in traditional markets, Bitcoin’s resilience is increasingly appealing to those looking for stability amidst chaos, reinforcing its narrative as ‘digital gold’.

Analysts predict that if geopolitical stability continues, we might see sustained interest in Bitcoin and other cryptocurrencies, as investors look to diversify their portfolios. The relationship between decreasing geopolitical risks and rising Bitcoin value suggests that societal and market factors will continue to shape the trajectory of the crypto landscape.

Institutional Interest: A New Era for Bitcoin

The influx of institutional investors into the Bitcoin market marks a transformative phase for the cryptocurrency. With the advent of Bitcoin ETFs, large financial institutions are now able to invest in Bitcoin while mitigating certain risks associated with direct investments. This represents a paradigm shift, where Bitcoin is no longer viewed solely as a speculative asset but as a legitimate component of diversified investment strategies.

Moreover, institutional interest does not only increase Bitcoin’s price but also contributes significantly to its maturation as a financial asset. As more organizations begin to allocate funds into Bitcoin, it enhances market liquidity and stability, enabling a more robust trading environment. The ongoing dialogue at conferences like Token2049 reinforces this notion, as industry leaders emphasize the importance of institutional participation in legitimizing Bitcoin further.

Future Trends: Where is Bitcoin Headed?

Looking ahead, the future of Bitcoin is intertwined with several predictable trends. The integration of Bitcoin into mainstream finance through ETFs and increased institutional interest is a primary driver that will shape its trajectory. As potential regulatory developments arise, institutions are likely to respond by ramping up their Bitcoin holdings, influencing broader adoption and acceptance of cryptocurrency as a serious asset class.

Additionally, advancements in blockchain technology and the introduction of new financial products surrounding Bitcoin will play crucial roles in its evolution. These innovations could pave the way for enhanced security and usability, appealing to a broader audience and potentially ensuring Bitcoin’s sustained growth in the coming years.

The Role of Global Regulations in Bitcoin’s Evolution

As Bitcoin navigates through the financial landscape, the role of global regulations remains pivotal. Different countries are adopting diverse approaches to cryptocurrency regulation, which can either facilitate or hinder the growth of Bitcoin. For instance, some nations have embraced regulatory frameworks that promote innovation and protect investors, which could lead to increased market confidence and participation.

However, the lack of a cohesive regulatory approach globally can lead to uncertainty, potentially deterring institutional investment. Stakeholders in the crypto community are constantly advocating for clear guidelines that can help stabilize the market and attract further institutional and retail investor interest in Bitcoin, aligning it with traditional financial systems.

Token2049 Dubai: A Catalyst for Innovation

The Token2049 event in Dubai served as an important platform for showcasing innovation within the crypto sector. Engaging discussions on blockchain advancements and the potential applications of Bitcoin filled the agenda, emphasizing the connection between technological development and market trends. Participants had the opportunity to engage with various projects, sparking inspiration and collaboration among key players.

Such gatherings are crucial for cementing the legitimacy of cryptocurrencies and Bitcoin in particular. By bringing together stakeholders and enthusiasts, Token2049 not only addressed current challenges but also looked forward to future innovations that could define the trajectory of Bitcoin and the broader crypto ecosystem.

Understanding the Broader Crypto Market Trends

To contextualize Bitcoin’s recent performance, it is essential to explore broader crypto market trends. As Bitcoin continues to experience price fluctuations, other cryptocurrencies and assets are also impacted, showcasing the interconnectedness of the crypto ecosystem. Trends such as increased DeFi participation, NFT popularity, and regulatory developments across the globe contribute to the overall sentiment within the crypto market.

In observing these market dynamics, one can gain insights into potential future developments. As institutional interest grows and the crypto community continues to innovate, Bitcoin is expected to remain at the forefront of these evolving trends, navigating challenges and continuing to capture the interest of investors worldwide.

Frequently Asked Questions

What contributed to the recent Bitcoin Rally above $97,000?

The recent Bitcoin Rally above $97,000 can be attributed to several factors, including a significant rebound of 18% since March. A key driver has been the resurgence of institutional Bitcoin interest, particularly through increased ETF inflows. Additionally, the reduced focus on trade war news has positively impacted both traditional and crypto markets, further fueling the Bitcoin price surge.

How has Token2049 influenced the Bitcoin price surge?

Token2049 played a crucial role in the recent Bitcoin price surge by providing a platform for discussions that highlighted renewed institutional interest in Bitcoin. The event showcased insights from industry leaders and emphasized Bitcoin as a long-term asset, which aligns with the growing adoption of Bitcoin ETFs, thereby contributing to the bullish sentiment boosting the Bitcoin Rally.

What are the implications of increased institutional interest in Bitcoin on market trends?

Increased institutional interest in Bitcoin is leading to significant market trends, particularly around Bitcoin ETFs. This heightened interest suggests a growing acceptance of Bitcoin as a legitimate asset class, akin to gold. As institutions invest more in Bitcoin, it enhances market liquidity and stability, contributing to ongoing Bitcoin price surges and a more robust crypto market overall.

How are Bitcoin ETFs impacting the current Bitcoin Rally?

Bitcoin ETFs are having a transformative impact on the current Bitcoin Rally by facilitating easier access for institutional and retail investors to Bitcoin. The inflow of capital into Bitcoin ETFs has significantly contributed to the price surge, as these products help legitimize Bitcoin investment. As ETFs gain traction, their influence on Bitcoin’s price dynamics is expected to increase, further driving the rally.

What trends were highlighted during Token2049 regarding Bitcoin and the crypto market?

During Token2049, several trends were highlighted, including the integration of Bitcoin into everyday transactions, as evidenced by discussions about real estate purchases with Bitcoin. Additionally, the event emphasized the increasing institutional Bitcoin interest and the potential impacts of Bitcoin ETFs on market dynamics, providing insights into the future trajectory of the crypto market.

| Key Point | Details |

|---|---|

| Bitcoin Surges | Bitcoin exceeded $97,000 this week, reflecting an 18% increase since March. |

| Institutional Interest | Renewed institutional interest, ETF inflows, and Bitcoin being increasingly recognized as a commodity similar to gold are fueling the surge. |

| Trade War Impact | The decline in trade war news has positively affected both traditional and crypto markets. |

| Token2049 Dubai | A major crypto event that showcased innovations, speakers, and discussions about the future of crypto markets. |

| Eric Trump & Crypto | Eric Trump discussed digital sovereignty, indicating that Dubai real estate can be purchased with Bitcoin. |

| Regulatory Landscape in Europe | Despite the EU’s MiCA framework, many countries lack crypto initiatives compared to the U.S. and Asia. |

| ETF Significance | The influence of ETFs on Bitcoin’s price cannot be underestimated, as they have transformed the traditional equity market. |

| Event Highlights | Token2049 featured various attractions including a zipline, climbing wall, and other engaging activities for attendees. |

Summary

The Bitcoin Rally has captivated investors and analysts alike as Bitcoin surpasses $97,000 amid renewed institutional interest and positive market conditions. This growth reflects a broader acknowledgment of Bitcoin’s value as a reliable asset, similar to gold. With events like Token2049 showcasing the vibrant crypto culture and the influential role of ETFs, it’s clear that the momentum surrounding Bitcoin is not just a fleeting moment but indicative of its potential for sustained growth in the financial market.