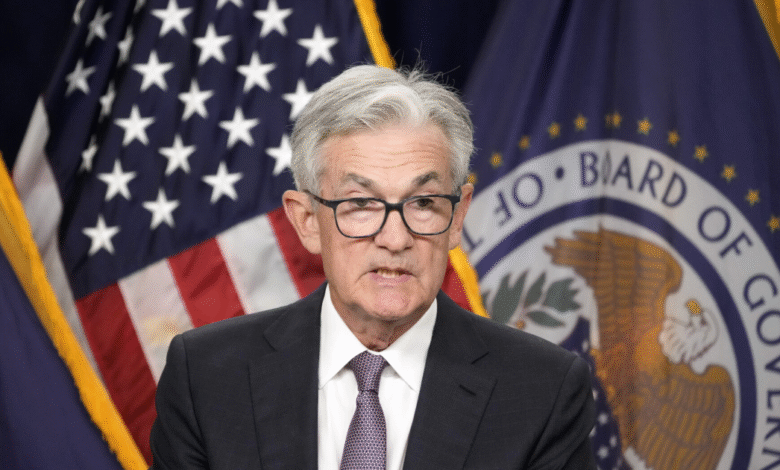

Jerome Powell Federal Reserve: Facing Trump’s ‘Too Late’ Label

Jerome Powell Federal Reserve faces a daunting challenge as the economic landscape shifts under his stewardship. As the chair of the U.S. Federal Reserve, his decisions on interest rate policy are scrutinized in light of President Trump’s sharp criticism and the assigned “Too Late” label. Historical precedents suggest that central bank actions often lag behind critical economic indicators, making swift responses elusive. While critics argue that prompt action is necessary to safeguard against potential downturns, Powell’s current stance champions caution in navigating this volatile fiscal environment. As such, the ongoing Federal Reserve history wrestles with a legacy of hesitancy, impacting both employment rates and inflation targets.

In the realm of monetary policy, the figure of Jerome Powell stands as a pivotal leader, navigating the turbulent waters of the U.S. financial system. His role as head of the nation’s central bank, particularly in the context of interest rate management, bears significant weight. Amid allegations of delayed reactions reminiscent of previous Fed chairmen, the current economic climate prompts an examination of the broader implications of these monetary strategies. Observers are keenly aware of how economic trends and Trump’s combative stance affect public perception of Powell’s decisions. Ultimately, this discourse highlights the delicate balance between proactive measures and the historical tendency of central banks to react too slowly to emerging crises.

Understanding Jerome Powell’s Position as Federal Reserve Chair

Jerome Powell, serving as the chair of the Federal Reserve, finds himself in a historically complex and often criticized role. The Federal Reserve’s actions are closely monitored, and any delay in responding to economic shifts can lead to significant repercussions, both politically and economically. Critics have pointed to past instances where Fed leaders have acted too slowly, allowing economic problems to escalate before they were addressed. In this context, Powell’s decisions are scrutinized against a backdrop of historical inflation and employment trends, often reflecting the challenges that come with balancing dual mandates.

The ongoing debate about whether Powell’s approach—characterized by caution and a hesitance to adjust interest rates—will ultimately label him as ‘Too Late’ is reminiscent of past Federal Reserve officials. Each decision or indecision could lead to economic outcomes that contradict their intended goals of stability. Observing how Powell navigates these turbulent waters provides insight into the broader implications of monetary policy on economic indicators like inflation and employment rates.

Federal Reserve History: Lessons Learned

The history of the Federal Reserve is marked by instances of both rapid response and lagging action in the face of economic turmoil. Notable episodes include the persistent low rates maintained by Arthur Burns during the stagflation of the 1970s and Alan Greenspan’s delayed acknowledgment of the dot-com bubble in the late 1990s. These historical examples serve as a cautionary tale, illustrating how the consequences of insufficient action can lead to more dire economic circumstances. Consequently, Jerome Powell must tread carefully to avoid falling into the same traps as his predecessors.

Despite these historical lessons, Powell faces unique challenges with external pressures, such as President Trump’s economic policies, particularly tariffs that threaten to complicate the inflationary landscape. Understanding the nuances of these historical precedents can offer clarity to Powell’s current predicament and how he might navigate the need for timely interventions in monetary policy without IGNORING the signals from economic data.

Economic Indicators: The Fed’s Balancing Act

Economic indicators play a critical role in guiding the decisions of the Federal Reserve, as they inform the central bank’s approach to interest rate policy. Jerome Powell is currently grappling with mixed signals from various sectors, where consumer sentiment has recently dipped, even as some reports indicate a solid economy. This disconnect can create challenges in determining the best course of action for the Fed. With inflation rates being touted as low by some, the hesitation to make preemptive rate cuts intensifies.

Furthermore, as Powell assesses these indicators, he must remain vigilant against the ever-changing economic landscape, influenced by factors such as Trump’s tariffs and their potential repercussions. The interaction between these tariffs and economic indicators raises significant questions about the Fed’s ability to act swiftly enough to preemptively address signs of recession. Thus, the stakes are high for Powell, as he must balance timely intervention against the risk of impulsivity that could lead to unwelcome economic consequences.

Analyzing Trump’s Criticism of the Federal Reserve

President Trump has not shied away from criticizing Jerome Powell and the Federal Reserve, particularly regarding interest rate policies. Trump’s use of the ‘Too Late’ label encapsulates a broader dissatisfaction with the Fed’s decision-making process, indicating a preference for immediate monetary easing. This dynamic complicates Powell’s position as he navigates internal Fed policies while external pressures mount from political leadership advocating for specific economic actions.

Trump’s assertion that inflation has been defeated, despite evidence of fluctuating conditions, raises questions about how political narratives can influence economic policy. Powell’s ability to maintain independence as Fed Chair while responding to such pressures will be paramount to preserving the integrity of the central bank’s actions, especially amid concerns of whether the Fed will act quickly enough in response to evolving economic indicators.

The Risks of Waiting: What History Tells Us

The history of the Federal Reserve is filled with moments where hesitation led to missed opportunities for preemptive action. Comments from economists like Dan North indicate that Powell may be repeating history by pausing in the current volatile policy environment. The fear of making premature moves can create a perception of inaction, as past experiences show that waiting too long often leaves policymakers with fewer tools to stabilize the economy at a critical juncture.

Understanding this historical context is essential for analyzing Powell’s current strategies. Economists warn that unless the Fed becomes more forward-looking in its approach, it may find itself in a position where it is too late to respond effectively to incoming economic challenges. This risk heightens as external factors like tariffs and geopolitical tensions continue to exert pressure on growth and inflation.

Deciphering Powell’s Economic Strategy

Jerome Powell’s economic strategy is increasingly scrutinized as he navigates the complexities of the current economic environment. His cautious approach, characterized by avoidance of ‘preemptive’ rate cuts, raises questions about the effectiveness of the Fed’s strategy in the context of emerging threats. Economists argue that by waiting for clearer signals from economic indicators, Powell risks being labeled ‘Too Late,’ reminiscent of previous Fed leaders who faced the consequences of delayed action.

However, this careful navigation also has its merits. By refusing to jump into haste, Powell is ensuring that the Federal Reserve does not overreact based on transient economic data. His strategy reflects a careful consideration of inflationary trends and employment statistics, which can inform more measured responses to evolving economic challenges, hence preserving the Fed’s long-term stability.

The Consequences of Fed Policy Missteps

Missteps in Federal Reserve policy can have far-reaching consequences, affecting everything from consumer behavior to global markets. Powell’s decisions regarding interest rates can dictate the cost of borrowing, housing market dynamics, and overall economic growth. A miscalculation now could lead to intensified economic fluctuations down the line, reinforcing the importance of historical insight into these decisions.

With Trump labeling Powell as ‘Too Late,’ the stakes are high for the Fed to avoid these missteps. Maintaining a balanced approach while addressing the criticisms from political figures is vital for ensuring economic continuity. Historical trends suggest that the Fed often faces criticism for being behind the curve, and Powell’s challenge is to devise a proactive strategy that mitigates such risks.

The Role of the Federal Reserve in Economic Recovery

The Federal Reserve plays a crucial role in facilitating economic recovery through its monetary policy actions. Powell’s leadership has been characterized by careful consideration of economic indicators to guide decisions about interest rates. The Fed’s capacity to stimulate growth through effective policy can accelerate recovery times in economic downturns, showcasing the serious nature of Powell’s decisions amidst current economic challenges.

In analyzing the broader implications of the Fed’s impact on recovery, it becomes evident that Powell must navigate a complex landscape filled with both opportunities and risks. The balance of stimulating the economy without igniting inflation reflects the dual mandate of the Fed, emphasizing the critical nature of Powell’s role in steering the economy back to health while minimizing potential backlash from various economic stakeholders.

Preparing for Future Economic Challenges

As the economy evolves, the Federal Reserve must proactively prepare for potential future challenges that could disrupt economic stability. Powell’s strategy should include monitoring a range of economic indicators to ensure that the Fed remains agile in its responses. This forward-looking approach can potentially avert periods of economic slowdowns that could warrant drastic measures if left unchecked.

Current volatility, driven in part by geopolitical tensions and domestic economic policies, calls for a nuanced understanding of how these elements influence the Fed’s interest rate policy. By analyzing patterns and adapting to emerging trends, Powell can position the Federal Reserve to respond effectively, thereby reducing the risks associated with being labeled ‘Too Late’ in the face of crisis.

Frequently Asked Questions

What are Jerome Powell’s key actions as Federal Reserve Chair regarding interest rate policy?

As Federal Reserve Chair, Jerome Powell has prioritized a cautious approach to interest rate policy. His decisions often reflect careful evaluation of economic indicators, focusing on balancing the dual mandate of maximum employment and stable inflation while responding to evolving economic conditions.

How has President Trump influenced Jerome Powell and the Federal Reserve’s actions?

President Trump’s influence on Jerome Powell has been significant, especially with his public criticisms and call for rate cuts. Trump’s nickname for Powell, ‘Too Late,’ reflects frustration over perceived slow responses by the Federal Reserve, which adds political pressure on Powell as he navigates complex economic challenges.

What historical patterns can inform Jerome Powell’s decisions at the Federal Reserve?

History shows that Federal Reserve chairs, including Jerome Powell, have often delayed necessary actions due to a desire for concrete data. This pattern, demonstrated by past leaders like Alan Greenspan and Ben Bernanke, suggests that waiting can lead to missteps, a concern echoed in current discussions about interest rate adjustments.

What economic indicators is Jerome Powell monitoring to guide the Federal Reserve’s policies?

Jerome Powell is closely monitoring various economic indicators, such as inflation rates, employment statistics, and overall economic growth trends, to guide the Federal Reserve’s policies. Recent data suggest that Powell remains vigilant amid changing market conditions and the impacts of Trump’s tariffs.

Why is Jerome Powell facing criticism for possibly being ‘Too Late’ in responding to economic challenges?

Jerome Powell faces criticism for potentially being ‘Too Late’ because of the historical tendency of the Federal Reserve to delay interventions in times of economic distress. Critics argue that hesitance to adjust interest rates promptly could exacerbate economic downturns, especially as inflation pressures continue to evolve.

What are the implications of Jerome Powell’s refusal to implement pre-emptive rate cuts?

By refusing to implement pre-emptive rate cuts, Jerome Powell is signaling a commitment to a wait-and-see approach. This strategy may backfire if economic conditions worsen unexpectedly, as it may result in missed opportunities to mitigate downturns and keep inflation in check.

How does Jerome Powell’s approach compare to previous Federal Reserve chairs in terms of timing?

Jerome Powell’s approach, characterized by caution and a reliance on substantial economic data, mirrors similar strategies of previous Federal Reserve chairs. However, historical critiques point out that such delayed actions have often resulted in missed chances to stabilize the economy effectively.

What challenges is Jerome Powell currently facing as head of the Federal Reserve?

Jerome Powell is currently facing significant challenges, including managing the impacts of tariffs imposed by Trump, addressing inflation concerns without triggering a recession, and balancing the need for economic growth with the Federal Reserve’s dual mandate. These pressures complicate his decision-making regarding interest rate policies.

| Key Points |

|---|

| Jerome Powell, the Federal Reserve Chair, faces criticism for acting too slowly, potentially earning Trump’s ‘Too Late’ label. |

| Historical precedents show that Fed leaders have repeatedly delayed necessary actions, leading to negative economic consequences. |

| Despite current economic indicators being stable, Powell’s decision to maintain rates may be viewed as inaction amidst rising concerns. |

| Trump is vocally urging for rate cuts, despite claiming that inflation is under control, highlighting a conflict between fiscal policies and the Fed’s cautious approach. |

| Experts say Powell may be correct to wait but warn that hesitance could lead to being perceived as ‘Too Late.’ |

Summary

Jerome Powell, the Federal Reserve chair, is currently navigating a precarious economic environment that could lead to confusion and criticism. The potential for earning President Trump’s ‘Too Late’ label is real, as historical trends suggest that federal responses to economic indicators are often delayed. As Powell continues to balance the mandate of full employment and low inflation while facing external pressures from tariffs and market sentiment, the decision to refrain from immediate rate cuts could either prove prudent or problematic in the long run. Investors and economists alike are closely watching Powell’s next moves, knowing that the Fed’s history could repeat itself if caution leads to inaction.