Bitcoin Ponzi Scheme: O’Malley’s Controversial Remark Sparks Fury

In a controversial speech, former Maryland Governor Martin O’Malley ignited a firestorm of discussion by likening Bitcoin to a Ponzi scheme while advocating for the integrity of the U.S. Social Security Administration (SSA). This provocative comparison has drawn sharp criticism from Bitcoin supporters, who quickly defended the cryptocurrency, suggesting that it is Social Security itself that resembles a Ponzi scheme. With discussions centered around the implications of O’Malley’s statement, many are questioning how assets like Bitcoin stack up against traditional systems funded by taxpayer dollars. Critics argue that such Ponzi scheme comparisons only serve to illuminate the fears surrounding the financial future, especially in light of recent political maneuvers related to Social Security funding. As we delve deeper into this debate, we uncover the tensions between traditional government programs and emerging digital currencies, capturing the attention of both financial analysts and everyday citizens alike.

The explosive dialogue surrounding Bitcoin can also be viewed through the lens of investment sustainability and governmental responsibility. Former governor Martin O’Malley’s remarks have positioned Bitcoin as a focal point in the ongoing debate about Social Security’s financial structure and long-term viability. This analogy to a Ponzi scheme not only opens up discussions about the legitimacy of cryptocurrencies but also paves the way for critical analysis of conventional financial systems like Social Security. Proponents of digital currency contend that while O’Malley attempts to draw a parallel, the reality is that government-led programs can embody many characteristics of a Ponzi scheme. This juxtaposition invites a fresh examination of the relationship between innovative financial solutions and time-honored social safety nets, highlighting a crucial moment in economic discourse.

Understanding the Bitcoin Ponzi Scheme Comparison

The recent remarks by former Maryland Governor Martin O’Malley equating bitcoin with a Ponzi scheme stirred a significant discourse in the cryptocurrency community. Critics from the bitcoin side argue that O’Malley’s statement reflects an outdated view of cryptocurrency, failing to understand its peer-to-peer nature and decentralized framework. Bitcoin supporters believe that labeling bitcoin a Ponzi scheme undermines the genuine growth and adoption of blockchain technology, which operates independently of central authorities. The rise of digital assets like bitcoin has transformed the financial landscape, creating opportunities for investment and wealth generation that are not typically available in traditional structures like Social Security.

In defending his statement, O’Malley emphasized his concern over the sustainability of both Social Security and bitcoin. This criticism has fueled an ongoing debate about the long-term viability of governmental financial systems versus emerging digital currencies. While he celebrates the history of Social Security, many bitcoin advocates retort that its structure mimics Ponzi characteristics due to its reliance on new contributions to pay out existing beneficiaries. This analogy challenges perceptions about both systems, encouraging deeper scrutiny of how funds are managed and the generational responsibility for their sustainability.

Criticism of Social Security as a Modern Ponzi Scheme

As Martin O’Malley draws parallels between bitcoin and what he describes as a Ponzi scheme, supporters of Social Security face increasing scrutiny about their own system’s structure. The idea that Social Security could be viewed as a Ponzi scheme is not new, with critics highlighting that current payouts rely heavily on the contributions of newer participants to sustain benefits for current retirees. This interdependence raises substantial questions about the long-term viability of the program, especially when workforce demographics shift.

Moreover, as the aging population increases, the financial burden placed on the working-age population intensifies, making the sustainability of Social Security more precarious. Activists, including members of the bitcoin community, argue that by labeling both systems as Ponzi-like, the narrative shifts to a critical examination of failure and dependency within governmental systems versus empowering individuals with digital assets. As this conversation evolves, more voices are likely to join the discussion, advocating for reform or reevaluation of both systems to ensure their resilience in uncertain economic times.

Political Responses: Trump, Social Security, and Bitcoin

The remarks from O’Malley come at a time when political responses regarding Social Security are deeply polarized, especially in light of the Trump administration’s approach to fiscal policy. The former governor voiced concerns that figures like Trump, alongside influential tech moguls such as Elon Musk, are ideologically positioned to challenge the integrity of Social Security, potentially eyeing its impressive $2.6 trillion surplus. This political tension highlights how bitcoin and other cryptocurrencies are intertwined with larger socio-economic policies, pushing digital currency supporters to defend their investments against political narratives that favor traditional financial safety nets.

Bitcoin advocates argue that, rather than attacking cryptocurrencies, political figures should focus on solutions that bolster economic freedom for individuals. They propose that the decentralization that bitcoin represents could actually serve as an alternative to the perceived deficiencies in systems like Social Security. As conversations evolve, it becomes increasingly vital for policymakers to engage with the realities of digital asset ownership and its potential benefits in providing secure investment avenues, rather than suppressing innovation through criticism that resembles opposition to Social Security’s sustainability.

The Future of Bitcoin and Social Security Debates

The ongoing discourse comparing bitcoin to Social Security not only ignites debates within financial communities but also reflects a broader uncertainty about the future of both systems. As the popularity of cryptocurrencies continues to rise, it forces traditional institutions, like Social Security, to reexamine their frameworks against novel financial models. The pushback from bitcoin supporters emphasizes a desire for adaptability within both realms, urging traditional systems to innovate or risk losing relevance as public sentiment shifts toward embracing digital currencies.

Furthermore, as demographic shifts occur and technological advancements redefine the economic landscape, the dialogues surrounding intergenerational funding methods will likely gain momentum. Discussions about whether Social Security can evolve to meet these challenges or must adapt to coexist with decentralized systems like bitcoin are crucial. Stakeholders from both sides must engage constructively, promoting policies that recognize the advantages of innovation while securing the financial future for generations to come.

Economic Implications of Bitcoin vs. Social Security

Examining the economic implications of Bitcoin compared to Social Security reveals significant insights into societal investment habits. As contributors to Social Security observe the security concerns raised by public figures, the need for diversification in investment becomes evident. Bitcoin, characterized by volatility yet high potential returns, appeals to individuals looking to safeguard their future from economic fluctuations commonly associated with traditional systems. The dynamic nature of cryptocurrency sits in stark contrast to the perceived stability of Social Security, igniting a discussion on the responsible allocation of resources for personal financial security.

The volatility of bitcoin serves as a double-edged sword; while it offers high returns, it also invites risk. Conversely, Social Security is designed to provide guaranteed returns, albeit based on predictable, often diminishing returns in retirement funds. This comparison encourages individuals to weigh their choices carefully, illustrating the necessity for public discourse that informs on the financial responsibilities necessary for both retirement and contemporary wealth-building strategies. As economic conditions evolve, individuals and policy makers must find common ground to address the financial futures of all demographics.

The Role of Technology in Shaping Financial Futures

The rise of bitcoin symbolizes more than just a digital currency; it represents a technological shift that is reshaping financial futures. As discussions around Social Security entrenched in traditional economic paradigms continue, the question arises: can technology bridge the gap between old and new financial systems? This notion is becoming increasingly relevant as technologies like blockchain promise transparency, security, and efficiency in financial transactions, features often criticized in government-funded programs like Social Security.

Advances in fintech highlight the need for institutional acceptance of new methodologies that promote innovation alongside security. By integrating technological improvements, both bitcoin advocates and defenders of Social Security can explore potential synergies that honor the legacy of existing systems while embracing the efficiency of modern financial technology. As such, stakeholders of all backgrounds may use technology as a lens through which to evaluate the efficacy of governmental programs against a backdrop of rapidly evolving digital economic landscapes.

Public Perception and Awareness of Bitcoin

Public perception of bitcoin and, consequently, its interrelation with traditional systems like Social Security remains a crucial aspect of the ongoing debate. For many, the anonymity and independence associated with bitcoin appeal to individuals disillusioned by government oversight and traditional finance. This dynamic enhances discussions on the credibility of existing systems and elevates awareness regarding the potential for systemic reform prompted by innovation. The clash between enthusiastic supporters of bitcoin and institutional defenders of Social Security reflects broader cultural shifts concerning financial trust.

Enhancing public awareness of both Bitcoin and Social Security’s complexities can contribute to a more informed populace. As the conversation about financial systems evolves, creating avenues for dialogue can help demystify the apprehensions surrounding cryptocurrencies. By equipping individuals with knowledge of both traditional and emerging assets, we foster critical thinkers better prepared to navigate financial landscapes effectively, thereby enhancing societal investment habits.

Legislative Impacts on Bitcoin and Social Security

Legislative actions surrounding both bitcoin and Social Security carry significant implications for their future. O’Malley’s remarks highlight fears that the political landscape may hinder the positive evolution of systems that must adapt to societal needs. Legislative efforts to regulate cryptocurrencies could yield both potential benefits in investor protection but also unintended consequences that stifle innovation. Conversely, solidifying the stability and trustworthiness of Social Security is paramount as policymakers address the budgetary concerns looming over its sustainability.

As discussions emerge within legislative chambers about both bitcoin’s regulatory environment and the future of Social Security, active participation from stakeholders is crucial. Engaging diverse voices can encourage comprehensive policies. Advocating for a system that allows for the coexistence of traditional and innovative solutions is likely to stimulate economic growth and ensure that essential social programs maintain their relevance amidst evolving dynamics.

Social Movements Encouraging Financial Reform

The eruption of social movements advocating for financial reform, often incorporating cryptocurrency discussions alongside traditional systems like Social Security, illustrates the changing tides of public sentiment. Advocates consider the limitations of Social Security’s structure and are increasingly vocal about potential alternatives represented by bitcoin and other digital currencies. These movements underscore a growing desire for financial independence and diversification in how individuals secure their futures.

Active participation in these movements creates platforms for dialogue that blend cryptocurrency adoption with criticism of existing government programs. Engaging the younger generation in these conversations connects their values with burgeoning technologies that allow them to challenge the status quo while ensuring that all voices are heard in matters concerning financial welfare. As movements gain momentum, they pave the way for potential reformations that could harmonize traditional financial systems with innovative approaches.

Frequently Asked Questions

Is Bitcoin considered a Ponzi scheme like Social Security according to critics?

Critics, including former Maryland Governor Martin O’Malley, have compared Bitcoin to a Ponzi scheme, particularly in the context of its perceived lack of intrinsic value. This comparison has sparked significant backlash from Bitcoin supporters, who argue that Social Security operates similarly, relying on new contributions to pay existing beneficiaries.

What did Martin O’Malley say about Bitcoin and Social Security?

Martin O’Malley controversially compared Bitcoin to a Ponzi scheme while defending Social Security, suggesting that the program is more stable. This statement has upset Bitcoin advocates, who defend crypto as a legitimate asset class, contrasting it with the government’s handling of Social Security.

How do Bitcoin supporters react to criticisms likening Bitcoin to a Ponzi scheme?

Bitcoin supporters have responded strongly to criticisms that liken Bitcoin to a Ponzi scheme. They argue that Social Security itself resembles a Ponzi scheme since it relies on the contributions from current workers to fund payments to retirees, thereby highlighting the sustainable nature of Bitcoin as a decentralized currency.

What are the implications of O’Malley’s Ponzi scheme comparison for Bitcoin adoption?

O’Malley’s comparison of Bitcoin to a Ponzi scheme may hinder mainstream acceptance, as it paints a negative picture of cryptocurrency. However, Bitcoin supporters use this opportunity to highlight the flaws in traditional systems like Social Security, promoting Bitcoin as a viable alternative for financial independence and security.

Why do some people argue Social Security is a Ponzi scheme?

Some critics consider Social Security a Ponzi scheme because it uses the current workers’ contributions to pay retirees, similar to how a Ponzi scheme functions by using new investments to pay returns to earlier investors. They argue that the system’s sustainability hinges on continuous contributions, which echoes Ponzi scheme mechanics.

How does Trump administration policy affect perceptions of Bitcoin and Social Security?

Policies from the Trump administration, especially regarding fiscal responsibility and welfare reform, have influenced the narrative around both Bitcoin and Social Security. Supporters of Bitcoin see the conversation as an opportunity to challenge the traditional financial landscape while calling attention to potential vulnerabilities in Social Security.

What role does public perception play in the debate over Bitcoin and Social Security?

Public perception is crucial in the debate surrounding Bitcoin and Social Security, as remarks from figures like Martin O’Malley can shape attitudes. Many Bitcoin supporters argue that fostering a negative view of crypto can distract from legitimate issues within the Social Security system, ultimately impacting both funding and legislation.

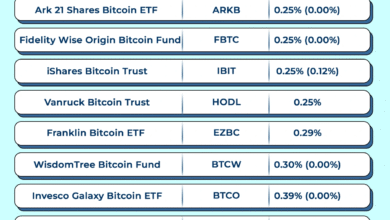

| Key Point | Details |

|---|---|

| O’Malley’s Comparison | Martin O’Malley compared Bitcoin to a Ponzi scheme while defending the U.S. Social Security Administration (SSA). |

| Criticism from Bitcoin Supporters | Bitcoin supporters criticized O’Malley’s remarks, arguing that Social Security itself can be viewed as a Ponzi scheme. |

| Trump Administration and SSA Surplus | O’Malley accused the Trump administration, particularly Elon Musk, of targeting Social Security’s $2.6 trillion surplus. |

| Response from Advocates | Privacy advocates reacted against the Musk-led Department of Government Efficiency’s attempts to access SSA databases. |

| Political Implications | O’Malley’s comments have heightened tensions between the Democratic Party and the cryptocurrency community, especially after the party’s renewed opposition to crypto regulations. |

Summary

The comparison of Bitcoin to a Ponzi scheme by former Maryland Governor Martin O’Malley has ignited significant debate within financial and political circles. In this climate, the discourse surrounding Bitcoin Ponzi schemes and the viability of Social Security continues to evolve. Advocates for cryptocurrency argue that traditional systems such as Social Security may themselves exhibit characteristics similar to Ponzi schemes, combining public perception with societal expectations about financial security. As political tensions rise regarding the future of financial systems in America, debates like these underscore the shifting dynamics in how both Bitcoin and Social Security are perceived by the public.