Crypto Regulation: Blackrock Urges SEC Overhaul for ETPs

Crypto regulation is increasingly becoming a focal point in discussions surrounding the digital asset market, especially following Blackrock’s recent advocacy for an overhaul at the SEC. With major players like Blackrock pushing for clarity on issues such as staking regulations and crypto ETP approval, it is evident that the need for structured oversight is urgent. The SEC’s engagement with the world’s largest asset manager highlights a pivotal moment in the evolution of crypto governance, particularly concerning Bitcoin and other digital assets. As the landscape continues to evolve, establishing a robust regulatory framework will be essential to ensure market integrity and investor protection. In this fast-paced arena, the outcome of these discussions could significantly shape the future of crypto markets, aligning them more closely with traditional financial regulations.

The realm of cryptocurrency oversight is witnessing significant shifts as leading institutions like Blackrock actively engage with regulatory authorities to forge a clearer compliance pathway. This dialogue around the governance of virtual currency, including the management of staking practices and the approval of digital asset investment vehicles, signals a transformative phase for the industry. As the SEC navigates these complexities, the concept of digital currency regulation gains momentum, influencing how assets such as Bitcoin are treated within legal frameworks. The evolving landscape also encompasses the approval processes for crypto-based exchange-traded products, raising questions about current practices and future adaptations. By addressing these crucial topics, stakeholders aim to harmonize digital securities with mainstream investment protocols, fostering a more compliant and innovative financial ecosystem.

Blackrock’s Influence on Crypto Regulation

Blackrock’s recent discussions with the SEC highlight its pivotal role in shaping the future of crypto regulation. As the world’s largest asset manager, Blackrock’s engagement underscores the importance of having industry leaders at the forefront of regulatory dialogues. The firm not only brought a wealth of experience to the discussions but also proposed structured solutions to many of the regulatory hurdles faced by the digital asset market. This effort could lead to a more transparent framework that encourages innovation while protecting investors.

The agenda set by Blackrock during the meeting with the SEC included critical topics such as staking regulations, tokenization of assets, and the approval processes for crypto exchange-traded products (ETPs). By addressing these key areas, Blackrock aims to ensure that the regulation of crypto assets evolves in a manner that reflects the reality of the rapidly changing market landscape. This strategic engagement significantly improves the likelihood of creating sustainable and effective regulations that can adapt to the needs of the digital asset ecosystem.

Examining SEC Bitcoin Regulation

SEC Bitcoin regulation stands at the center of the metamorphosis within the digital asset market. As the regulatory body tasked with overseeing securities, the SEC has been cautious yet deliberate in its approach to cryptocurrencies, particularly Bitcoin. With a backdrop of fluctuating market dynamics and increasing adoption by institutional investors, clear regulations would greatly benefit both seasoned and new participants in the crypto space.

The dialogue between Blackrock and the SEC not only represents an opportunity to define Bitcoin’s classification but also to clarify the regulatory framework related to investment vehicles that include Bitcoin. The development of explicit guidelines and criteria for Bitcoin-related products could enhance the integrity of the market while potentially attracting a broader range of institutional investors who have been waiting for more regulatory clarity before participating.

The Role of Crypto ETP Approval

The approval of crypto ETPs is a significant milestone in legitimizing digital assets as a viable investment option within traditional financial markets. Blackrock’s approach to discussing necessary changes in the approval process with the SEC indicates a strategic push towards fostering a more inclusive framework for crypto investments. By seeking clarity on the standards required for ETP approval, Blackrock aims to establish a clear pathway for future products that harness the potential of cryptocurrencies.

The benefits of crypto ETPs include enhanced liquidity and accessibility for retail investors, allowing for an easier entry point into the digital asset market. If adequately regulated, crypto ETPs could pave the way for a new investment paradigm, encouraging both innovation and investor protection. As Blackrock advocates for a shift in the SEC’s approach, there is potential for a significant transformation in how crypto assets are perceived and integrated into broader financial portfolios.

Staking Regulations in the Digital Asset Landscape

Staking has emerged as a vital element in the cryptocurrency ecosystem, offering a way for investors to earn rewards while supporting network operations. During the meeting with the SEC, Blackrock highlighted the necessity for specific regulations surrounding staking practices, particularly concerning investment products like crypto ETPs. Clear guidelines are essential to ensure that institutional and retail investors are adequately informed about the risks and opportunities associated with staking.

With the rise of staking, especially among popular cryptocurrencies, it is crucial for regulatory bodies to define the parameters under which staking can be offered within ETPs. This not only will protect investors but also ensure that the market remains competitive and innovative. By advocating for staking regulations, Blackrock could foster an environment where institutional adoption of cryptocurrency continues to grow, paving the way for a more robust financial infrastructure.

Tokenization of Traditional Assets

Tokenization refers to the process of converting real-world assets into digital tokens that exist on a blockchain. As Blackrock and the SEC explore this fascinating intersection of technology and finance, the potential to integrate conventional securities into the digital asset world becomes increasingly apparent. Tokenization could significantly enhance liquidity, reduce transaction costs, and democratize access to various asset classes across the capital markets.

However, the introduction of tokenized assets into existing regulations poses challenges that must be addressed. Blackrock’s proposal for a regulatory framework surrounding tokenization could lead to clearer guidelines that facilitate the responsible development of this new asset class. As regulations evolve to accommodate tokenization, it is paramount that both regulatory bodies and market participants collaborate to ensure compliance while promoting innovation in this changing landscape.

The Future of Digital Assets Under New Regulations

The future of digital assets hinges on the outcome of regulatory discussions and decisions made by the SEC and other governing bodies. With Blackrock taking a prominent role in advocating for meaningful changes, there is a growing sense of urgency to implement regulations that keep pace with the evolution of the market. A tailored regulatory framework can help foster innovation while mitigating potential risks associated with the rapid growth of the digital asset sector.

As more financial institutions consider entering the digital asset space, regulatory clarity becomes paramount. This transformation could lead to a more resilient market capable of withstanding volatility and fostering investor trust. The continued engagement of major industry players such as Blackrock with regulators signifies a commitment to building a cohesive and comprehensive approach to governing the dynamic landscape of cryptocurrencies and digital assets.

Investing in the Digital Asset Market

Investing in the digital asset market presents both opportunities and challenges for individuals and institutions alike. With the rise of Blackrock’s digital asset offerings, investors have begun to recognize the potential for substantial returns in this burgeoning market. However, as the landscape continues to evolve, it is crucial for investors to stay informed about regulatory developments that could impact their investment decisions.

The involvement of established financial institutions such as Blackrock in advocating for clearer regulations could significantly enhance investor confidence. By aligning investment practices with regulatory expectations, firms can provide more secure and enjoyable investment experiences. With continued advancements in crypto regulation, the digital asset market could see a surge of new participants eager to explore the possibilities presented by cryptocurrencies and blockchain technology.

Navigating Regulatory Challenges in Cryptocurrency

Navigating the intricate web of regulatory challenges in cryptocurrency requires vigilance and adaptability from all market participants. The recent discussions between Blackrock and the SEC exemplify the complex regulatory landscape that surrounds digital assets. As the landscape shifts, staying ahead of compliance and understanding the implications of proposed regulations will be essential for those engaged in cryptocurrency investment and trading.

With evolving regulatory frameworks and the SEC’s proactive approach in addressing stakeholder concerns, the market may experience a period of significant transformation. Companies in the crypto space must remain agile and responsive to regulatory adjustments while innovating to meet investor demands. By prioritizing regulatory adherence, firms can establish their legitimacy and foster a more stable investment environment.

The Importance of Industry Collaboration

The success of crypto regulation and the growth of the digital asset market hinge on collaboration between regulatory bodies, financial institutions, and market participants. Blackrock’s initiative to work closely with the SEC highlights the necessity of bridging the gap between the evolving crypto landscape and the established financial regulations. Collaboration can foster a conducive environment for innovation while ensuring investor protection.

As the industry matures, open dialogue among stakeholders becomes imperative in addressing the unique challenges presented by digital assets. The willingness of firms like Blackrock to engage regulators in discussions about the future of crypto regulation exemplifies a collective commitment to shaping a well-regulated market. This collaboration will be crucial in fostering confidence among investors and paving the way for sustainable growth in the digital asset ecosystem.

Frequently Asked Questions

What is the significance of Blackrock’s efforts in crypto regulation?

Blackrock’s engagement with the SEC signifies a bid for a comprehensive overhaul of crypto regulations, particularly focusing on urgent reforms in staking, tokenization, and the approval processes for crypto ETPs (Exchange-Traded Products). This initiative aims to shape the future regulatory landscape of the digital asset market.

How does the SEC’s approach to crypto regulation impact the digital asset market?

The SEC’s evolving approach to crypto regulation impacts the digital asset market by establishing clearer guidelines, especially regarding staking and ETPs. These changes can enhance investor protection and foster innovation, allowing traditional financial practices to integrate with crypto assets.

What are the regulatory challenges surrounding staking in crypto ETPs?

Regulatory challenges regarding staking in crypto ETPs include the need for defined rules that allow staking features while ensuring compliance with existing securities laws. Blackrock’s discussions with the SEC emphasize the importance of establishing clear regulations to address these complexities.

Why is Blackrock advocating for clearer guidelines on crypto ETP approval?

Blackrock advocates for clearer guidelines on crypto ETP approval to streamline the process for issuers and investors alike. Specific criteria for adherence to Section 6(b) of the Exchange Act would help ensure that crypto ETPs are compliant and viable within the regulatory framework.

What role does the SEC’s Crypto Task Force play in shaping crypto regulation?

The SEC’s Crypto Task Force, led by Commissioner Hester Peirce, plays a crucial role in addressing regulatory issues in the digital asset market. It engages with industry players, including Blackrock, to facilitate discussions on market practices and investor protection in the evolving crypto landscape.

How can tokenization of conventional securities influence crypto regulation?

Tokenization of conventional securities can influence crypto regulation by necessitating the integration of these products into the existing regulatory framework. Blackrock’s dialogue with the SEC aims to explore how this integration can be achieved while maintaining compliance with federal securities regulations.

What are the key topics discussed by Blackrock with the SEC regarding crypto regulations?

Key topics discussed by Blackrock with the SEC regarding crypto regulations include updates on digital asset offerings, staking in ETPs, the regulatory framework for tokenized securities, standards for crypto ETP approvals, and guidelines for options trading on such products.

| Key Points | Details |

|---|---|

| Blackrock’s Meeting with SEC | On May 9, Blackrock discussed urgent reforms in crypto regulation with SEC’s Crypto Task Force. |

| Focus Areas for Reform | Blackrock emphasized regulation of staking, tokenization, and ETP approval processes. |

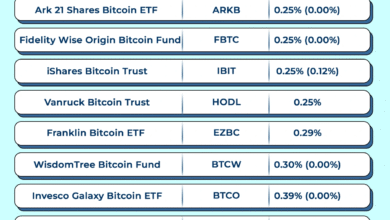

| Blackrock’s Five-Point Agenda | 1. Update on their digital asset offerings including IBIT, ETHA, and BUIDL. 2. Discussion on staking regulation for ETPs. 3. Framework for tokenizing conventional securities. 4. Criteria for approving crypto ETPs. 5. Guidelines for trading options on crypto ETPs. |

| SEC’s Response and Structure | The SEC, led by Commissioner Hester Peirce, has shifted to a more crypto-friendly approach. |

Summary

Crypto regulation is currently at a pivotal point as Blackrock actively engages with the SEC in advocating for an essential overhaul of the regulatory framework governing digital assets. This dialogue highlights the urgency for clearer guidelines on staking, tokenization, and exchange-traded products (ETPs), which are critical for the evolution and stability of the crypto market. As Blackrock pushes for defined regulatory standards, it signals a collaborative effort to align practices in the industry with the evolving landscape of cryptocurrency.