Bolivia Digital Currency: Crypto Developments in Latam

Bolivia is making headlines with its ambitious plan to introduce a digital currency, which marks a significant turn in the country’s approach to digital finance. After previously banning cryptocurrency usage within its borders, Bolivia is ready to modernize its payment landscape by embracing its own digital currency. This move aligns with the ongoing trend of de-dollarization in Bolivia, aiming to enhance cross-border payments and boost economic independence. As the nation prepares for its bicentennial celebration, the Central Bank of Bolivia is working closely with international organizations to ensure a successful rollout. With the emergence of Bolivia cryptocurrency, the country stands to benefit from innovative financial solutions while joining its neighbors, like Brazil, in exploring exciting crypto assets such as Solana and Ether futures.

The evolution of digital finance in Bolivia signifies a broader transformation in the region’s economic policies. By launching its digital currency, Bolivia seeks to revitalize its financial ecosystem and strengthen economic resilience amid a global shift towards virtual assets. This initiative could position Bolivia as a key player in the cryptocurrency landscape, particularly as the world witnesses an increasing acceptance of decentralized finance. Furthermore, with significant movements in Brazil regarding Ether and Solana futures, the Bolivian government is keen to adopt cutting-edge financial technologies to facilitate smoother transactions. As the push for de-dollarization gains momentum, Bolivia’s digital currency could pave the way for a new era of financial innovation.

Bolivia’s Digital Currency Initiative: A Game Changer for Cross-Border Transactions

Bolivia’s recent announcement regarding its digital currency marks a significant shift in its monetary policy, aimed at enhancing cross-border payments and modernizing its financial infrastructure. Historically, Bolivia has taken a conservative stance toward cryptocurrencies, having outright banned their use within its borders. However, with the advent of a digital currency spearheaded by the Central Bank of Bolivia, the country is poised to leverage technology to facilitate smoother transactions between Bolivia and neighboring nations. This move not only reflects a broader trend of de-dollarization in the region but also aims to make cross-border payments more efficient and less costly.

The Central Bank of Bolivia is currently collaborating with international organizations and financial experts to design a robust digital currency framework. According to Edwin Rojas Ulo, president of the bank, the intention is to unveil this new currency during the bicentennial celebrations of Bolivia’s independence. This highlights a strategic approach to capitalize on national pride while also signaling to the local population the potential benefits of adapting to a digital economy. As the project progresses, many are watching closely to see how it aligns with the rise of Bolivia cryptocurrency, which could reshape the country’s economic landscape.

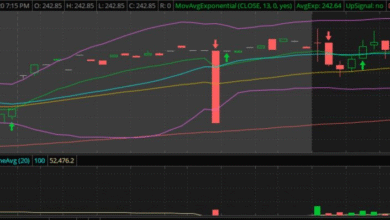

Brazil’s B3 Stock Exchange: The Rise of Ether and Solana Futures

As the Brazilian stock exchange (B3) moves to offer ether and solana futures contracts, it represents a crucial development in richening Brazil’s cryptocurrency landscape. Approved by the Brazilian Securities and Exchange Commission (CVM), these futures are designed to address the growing interest from institutional investors seeking to tap into the cryptocurrency market without the burden of asset custody. This initiative indicates a significant acceptance of digital assets in traditional financial markets, paving the way for more structured and safer investment opportunities for those hesitant to navigate the complexities of cryptocurrencies directly.

The launch of these futures contracts comes at a pivotal moment for Brazil, with crypto investments gaining traction amid increasing global interest. The features of these products are tailored to provide investors with a way to hedge their exposure to the price volatility characteristic of cryptocurrencies. This move not only speaks to the demand for regulated financial instruments but also underscores Brazil’s ambition to establish itself as a leader in the crypto space within Latin America. With conversations around Solana futures Brazil heating up, it’s evident that the country’s financial framework is evolving to accommodate the future of investment.

Transforming Belo Horizonte: The New Bitcoin Capital

Belo Horizonte is positioning itself as a central hub for cryptocurrency innovation through a newly passed bill aimed at fostering a conducive environment for bitcoin and related businesses. The legislation, driven by local lawmakers, encourages companies to accept bitcoin as a payment method, integrated with marketing incentives designed to promote such transactions. The city’s commitment to becoming a bitcoin capital not only seeks to attract businesses but also focuses on educating its citizens about the benefits and practicality of using digital currencies. This transformative initiative reflects a broader commitment to embracing financial technology and advancing economic opportunities within Brazil.

The approval of this bill amidst fervent debates indicates a strong political will to embrace cryptocurrencies and the potential growth they offer. By promoting educational events centered on bitcoin and cryptocurrency adoption, Belo Horizonte aims to equip its residents with the knowledge necessary to navigate this evolving economic landscape. Such initiatives are critical in creating a balanced ecosystem where both businesses and consumers can thrive together in the digital economy. As the city’s ambitions unfold, Belize’s evolution into a center of bitcoin activity might inspire other regions in Brazil and beyond to explore similar pathways.

Frequently Asked Questions

What is Bolivia’s digital currency and its purpose?

Bolivia’s digital currency is an initiative by the Central Bank of Bolivia aimed at modernizing the financial ecosystem and enhancing cross-border payments. This cryptocurrency is designed to provide a secure and efficient payment method, moving away from traditional banking restrictions and ensuring financial inclusion.

How does Bolivia’s digital currency relate to the de-dollarization efforts?

Bolivia’s digital currency is part of broader de-dollarization efforts, which aim to reduce the dependency on the US dollar for international transactions. By introducing its own cryptocurrency, Bolivia seeks to facilitate cross-border payments and strengthen its economic sovereignty.

What lessons is Bolivia’s Central Bank learning from other countries regarding digital currencies?

The Central Bank of Bolivia is analyzing the experiences of other central banks and international organizations regarding the implementation of digital currencies. This research aims to adopt best practices and ensure a successful launch of Bolivia’s digital currency, aligning it with global trends in cryptocurrency.

What implications does the approval of Solana and Ether futures in Brazil have for Bolivia’s digital currency?

The approval of Solana and Ether futures in Brazil may indicate a rising acceptance of cryptocurrencies in South America, paving the way for Bolivia’s digital currency. The successful integration of these futures can motivate Bolivia to offer a well-regulated digital currency that complements regional developments.

How can Bolivia’s digital currency impact local businesses and the economy?

Bolivia’s digital currency is expected to provide local businesses with a modern payment alternative, streamline transactions, and reduce costs associated with cross-border payments. Additionally, it could attract investment and foster innovation, contributing to economic growth in Bolivia.

What innovations are being promoted in Belo Horizonte to enhance its position as a bitcoin capital?

Belo Horizonte is promoting innovative initiatives through a new bill that incentivizes businesses to accept bitcoin. This includes advertising support and educational programs to help local citizens adapt to cryptocurrency, positioning the city as a hub for bitcoin activities.

How does the launch of Bolivia’s digital currency compare to developments in Brazil’s cryptocurrency market?

While Brazil is advancing with the launch of futures contracts for Solana and Ether, Bolivia’s digital currency aims to establish a national cryptocurrency framework. Both developments reflect a strengthened regional interest in cryptocurrencies, but Bolivia’s focus is on addressing local economic needs and de-dollarization.

| Topic | Key Points |

|---|---|

| Bolivia’s Digital Currency | Announcement of a digital currency as part of efforts to modernize payments and tackle cross-border transactions. |

| Launch Date | The currency design will be presented during Bolivia’s bicentennial independence celebration on August 6. |

| Advice from International Institutions | The Central Bank of Bolivia is consulting international organizations and regional central banks for guidance in designing the digital currency. |

| Brazil’s B3 Stock Exchange | Launch of ether and solana futures contracts approved by the CVM to facilitate institutional crypto market entry and asset custody solutions. |

| Belo Horizonte’s Bitcoin Capital Bill | New legislation aims to promote bitcoin adoption through business incentives and educational events, officially establishing the city as a bitcoin hub. |

Summary

Bolivia digital currency is set to revolutionize cross-border payments as the country takes bold steps towards modernizing its financial ecosystem. Following a historic ban on cryptocurrency, Bolivia is preparing to launch its own digital currency, aiming to enhance its payment systems by aligning with international best practices. Coupling this with Brazil’s foray into ether and solana futures, the Latin American region is demonstrating a dynamic shift in embracing digital currencies. Furthermore, Belo Horizonte’s ambition to become a bitcoin capital underscores the growing acceptance and innovation surrounding cryptocurrency in the region. As these developments unfold, they will significantly impact the financial landscape in Bolivia and beyond.