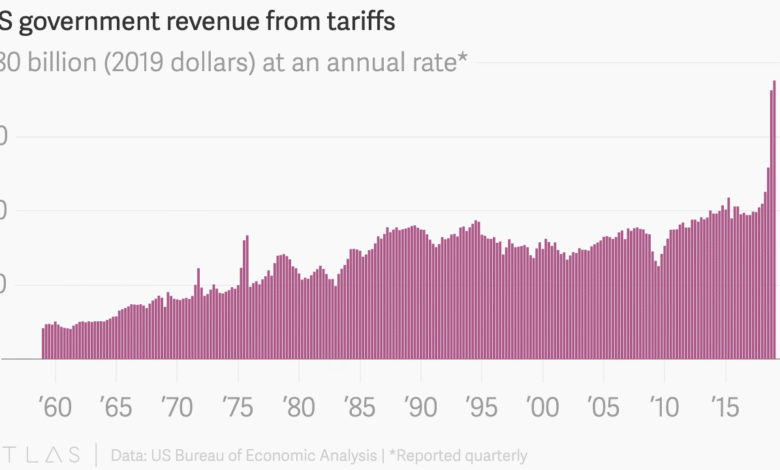

U.S. Tariff Revenues Hit Record Heights in April

U.S. tariff revenues soared to unprecedented levels in April, reaching over $16 billion and marking a significant milestone in the nation’s fiscal landscape. This impressive figure, generated primarily through customs duties, represents an 86% increase from the previous month and highlights the profound effects of the ongoing trade war. Together with the total customs duties for the month amounting to $16.3 billion, this revenue boost plays a crucial role in efforts toward budget deficit reduction. Although the deficit for the fiscal year remains at a staggering $1.05 trillion, the surge in record tariff collections has provided a timely respite amidst financial pressures. As policy decisions continue to shape trade dynamics, understanding the implications of tariff revenues on overall fiscal year revenue becomes increasingly critical.

Trade revenue from tariffs, often referred to as customs duties, has experienced a remarkable surge recently, particularly in April when collections exceeded $16 billion. As the nation grapples with a substantial fiscal imbalance, these revenues have become pivotal in addressing the budget deficit and reflect the punitive measures of the ongoing trade conflicts. The notable increase in collections not only highlights the aggressive tariff policies but also the broader economic implications tied to international trade relationships. With these recent developments painting a complex picture of fiscal planning, gauging the impact of such revenues on overall economic health is essential for policymakers and economists alike. By exploring the intersections of tariff income and national financial strategies, we can better understand the dynamics at play in the current economic climate.

Record U.S. Tariff Revenues Transforming Economic Landscape

In April, the U.S. witnessed its all-time high in tariff revenues, with customs duties amounting to $16.3 billion. This unprecedented collection reflects a staggering 86% increase from March’s $8.75 billion and more than doubled the $7.1 billion recorded at the same time last year. Such monumental increases in customs duties highlight the significant effects of recent trade policies, particularly those initiated by the previous administration’s trade war. These tariffs have not only altered trade relationships but also contributed substantially to the overall fiscal landscape of the nation.

With a cumulative customs duty revenue of $63.3 billion year-to-date, the current figures indicate an 18% surge compared to the same period last year. The colossal tariff revenues are a direct result of the focused trade strategies that aim to support U.S. industries against foreign competition. As trade tensions continue, the government has managed to leverage these tariffs to not only bolster revenue streams but also to strategically address the growing budget deficit, signaling a new era of fiscal awareness in addressing national debt.

Impact of Customs Duties on Budget Deficit Reduction

The increase in customs duties has played a pivotal role in reducing the budget deficit, which currently stands at $1.05 trillion for the fiscal year. Although this figure remains 13% higher than the previous year, the contribution of tariff revenues provides a silver lining to an otherwise concerning financial outlook. The surplus recorded in April reached $258.4 billion, a notable 23% increase from the same month last year, indicating that strategic tariff collections are becoming a vital tool in financial management.

Despite the significant increase in tariff revenue, the budget deficit remains a substantial challenge for federal financial health. Notably, while receipts were up by 10% in April and overall expenditures dropped by 4%, the compounding effect of high interest rates on national debt continues to be a weighty concern. Tariff revenues have proven effective in offsetting some of these costs, with interest payments exceeding $89 billion for April alone, which underscores the importance of maintaining robust tariff collections for ongoing budgetary support.

The Trade War’s Financial Ripple Effects

The financial implications of the trade war have reverberated throughout the U.S. economy, particularly reflected in the spike of tariff revenues. Customs duties, which act as a financial buffer against the costs incurred by tariffs, have become an essential element in negotiating the challenges of international trade relations. The higher revenues from tariffs illustrate the government’s attempt to level the playing field for American manufacturers while simultaneously generating necessary funds to manage the budget deficit.

As the dynamics of global trade evolve, the trade war continues to impact various sectors of the economy, prompting significant changes in how customs duties are perceived and utilized. Enhanced tariff collections not only serve to diminish the fiscal imbalance but also reflect the U.S. government’s aggressive posture towards trade negotiations. Consequently, the trade war’s legacy will likely inform future fiscal policies, suggesting an ongoing reliance on tariffs as a mechanism to secure economic stability.

Analyzing Fiscal Year Revenue Trends

The fiscal year has displayed interesting revenue trends, predominantly influenced by recent tariff strategies. Customs duties have thus far contributed significantly to the overall revenues, showcasing a more aggressive stance towards international trade and tax collection. With revenues increasing steadily, the fiscal strategies seem to pivot towards maximizing tariff collections to complement traditional income sources, portraying a more diversified revenue portfolio for the government.

Year-over-year comparisons reveal a substantial increase in receipts, with the month of April contributing a 10% rise relative to the previous year. Such trends suggest that the administration’s policies on tariffs and duties are generating a visible shift in revenue collection mechanisms. As expenditures continue to climb, examining these revenue streams becomes vital for addressing the budget deficit and ensuring the financial health of the nation into the future.

Consequences of High Interest Rates on Tariff Revenue allocations

High interest rates remain a significant challenge affecting fiscal policy decisions, particularly concerning how tariff revenues are allocated. With net interest on the national debt exceeding $89 billion in April alone, these costs overshadow many government expenditures and underscore the need for effective revenue usage. Consequently, while tariffs yield substantial income, the ongoing obligations of interest payments create a challenging economic environment that policymakers must navigate carefully.

As the government grapples with the perennial issues of high debt and rising interest rates, the role of custom duties becomes increasingly critical. The surge in tariff revenues has provided a necessary financial cushion, contributing to broader economic plans. However, managing the proceeds from tariffs effectively in light of interest liabilities remains a focal point for maintaining fiscal health and reducing the budget deficit.

The Future of U.S. Trade Policies

The trajectory of U.S. trade policies appears to be evolving, especially in light of recent contributions from customs duties. The record-high tariff revenues underscore not only the current administration’s approach but also suggest a potential reset in how the U.S. interacts with global markets. Moving forward, it’s expected that these trade policies will continue to adapt, potentially shaping the landscape of international trade agreements.

With such significant tariff collections influencing budget management, there may be a shift towards a more protectionist stance, aimed at ensuring economic viability. The impact of these trade policies will likely resonate across various sectors, prompting discussions on the long-term sustainability of relying heavily on customs duties as a revenue source. As global trade dynamics shift, the U.S. may continue to recalibrate its strategies to maximize economic gains while ensuring compliance with international obligations.

The Role of Tariff Collections in National Debt Management

The role of tariff collections extends beyond immediate revenue generation; it provides a crucial mechanism for managing national debt. As customs duties reached new heights, their function in stabilizing fiscal health becomes increasingly vital. By alleviating some budget strain, tariff revenues are allocated towards debt management, potentially reducing reliance on other financial instruments.

In light of continuing increases in national debt, the importance of customs duties cannot be overstated. These revenues contribute to funding essential government services and reducing overall fiscal exposure. As policies continue to evolve, integrating tariff revenues into a comprehensive debt management strategy may prove essential for maintaining economic stability.

Examining the Link Between Trade Battles and Fiscal Outcomes

The ongoing trade battles have a profound connection to fiscal outcomes that merit closer examination. The substantial rise in tariff revenues captured during the trade war illustrates the effects of aggressive fiscal policy on the economy. These battles have led to both immediate economic impacts and longer-lasting implications for tariff collection, affecting budgeting decisions at multiple levels.

As these trade skirmishes unfold, it’s important to analyze how sustained increases in customs duties bolster federal revenues while shaping future fiscal narratives. Understanding the implications of trade wars helps to contextualize the role of tariffs in broader economic strategies aimed at reducing deficits and supporting growth, indicating that the battles fought in the realm of trade are intricately linked to America’s fiscal health.

Strategizing for Sustainable Customs Revenue Streams

Strategizing for sustainable customs revenue streams is paramount as tariff revenues continue to play a critical role in fiscal management. As the landscape of global trade changes, the U.S. must innovate its approaches to ensure that tariff collections remain robust and responsive to international dynamics. Sustainable revenue generation through tariffs could lead to more predictable fiscal outcomes, lessening the strain on budgetary processes.

Future strategies may involve conducting thorough reviews of import tariffs, analyzing the potential for expanding tariff bases and increasing rates on additional products to enhance revenue streams. Building a resilient framework for customs duties will be essential for managing the evolving economic landscape, ensuring not only fiscal survival but also growth amid ongoing trade complexities.

Frequently Asked Questions

What is the impact of U.S. tariff revenues on the budget deficit?

U.S. tariff revenues have a significant impact on reducing the budget deficit. For example, in April 2024, customs duties reached $16.3 billion, which contributed to a reduction in the fiscal year-to-date deficit to $1.05 trillion. Although the deficit remains high, increased tariff collections from customs duties help alleviate some fiscal pressure.

How have customs duties changed in recent months regarding U.S. tariff revenues?

U.S. tariff revenues from customs duties have surged recently, with collections in April 2024 reaching $16.3 billion, up approximately 86% from March’s $8.75 billion. This dramatic increase highlights the contribution of tariffs to overall federal revenue.

What are the record tariff collections for the recent fiscal year?

In the recent fiscal year, record tariff collections totaled $63.3 billion for U.S. customs duties, reflecting an 18% increase compared to the same period in the previous year. This substantial revenue comes amidst broader economic challenges.

How is the trade war impacting U.S. tariff revenues?

The trade war initiated by President Trump, which included implementing 10% tariffs on various imports starting in April 2024, has significantly impacted U.S. tariff revenues. These tariffs contributed to a record $16.3 billion in customs duties for April, highlighting the financial effects of the trade policies.

What role do U.S. tariff revenues play in fiscal year revenue?

U.S. tariff revenues constitute a crucial part of fiscal year revenue, with customs duties contributing to over $16 billion in April 2024. This revenue assists in managing the federal budget, especially as ongoing deficits necessitate diverse funding sources.

Can increased tariff revenues help alleviate the budget deficit?

Yes, increased U.S. tariff revenues can help alleviate the budget deficit by providing additional revenue for the federal government. In April 2024, customs duties significantly contributed to a surplus of $258.4 billion, aiding in reducing the total deficit for the year.

What were the total customs duties collected in April compared to previous years?

In April 2024, U.S. customs duties amounted to $16.3 billion, which was more than double the $7.1 billion collected in April last year, showcasing a significant year-over-year increase and contributing to heightened tariff revenues.

Why is April typically characterized by a surplus in U.S. fiscal revenue?

April is usually characterized by a surplus in U.S. fiscal revenue due to the income tax filing deadline, leading to increased government receipts. In April 2024, the surplus was $258.4 billion, aided by record customs duties amidst ongoing trade dynamics.

| Key Points |

|---|

| Tariff revenues reached $16.3 billion in April 2023, a record high contributing to deficit reduction. |

| April’s tariff collections were 86% higher than March’s total of $8.75 billion. |

| Compared to the same month last year, tariff revenues more than doubled from $7.1 billion. |

| Year-to-date customs duties totaled $63.3 billion, up 18% from 2024. |

| The budget deficit as of April decreased to $1.05 trillion, still 13% higher than the prior year. |

| April typically sees a surplus due to income tax filings, which this year stood at $258.4 billion, reflecting a 23% increase from last year. |

| Interest on national debt in April reached $89 billion, the second highest government expenditure after Social Security. |

Summary

U.S. tariff revenues reached a historic high in April 2023, contributing significantly to reducing the budget deficit. The surge in tariff collections, marking an 86% increase from March, reflects the far-reaching impacts of recent trade policies, particularly under the Trump administration. As tariff duties more than doubled compared to last year, they played a crucial role in offsetting the budget imbalance amid ongoing pressures from high national debt interest rates. This scenario underscores the importance of U.S. tariff revenues in mitigating fiscal challenges.