Bitcoin ETFs Surpass $5 Million in Net Inflows

Bitcoin ETFs are currently capturing significant attention in the financial markets as they continue to demonstrate resilience despite fluctuating trends in crypto investment. The latest reports indicate that these exchange-traded funds have managed to sustain a net inflow momentum, with a modest gain of $5 million largely attributed to Blackrock’s IBIT. This consistent performance has fueled discussions around Bitcoin trading activity, emphasizing the growing interest in this digital asset class. However, contrasting trends are emerging in the ether ETF sector, where substantial outflows have been recorded, creating a complex landscape for crypto investors. As we dive deeper into Bitcoin ETF inflows, it becomes clear that they are playing a pivotal role in shaping the future of cryptocurrency investments.

Alternative investment vehicles such as Bitcoin exchange-traded funds are seeing a surge in popularity amid the evolving dynamics of the cryptocurrency market. These financial instruments, which allow investors to gain exposure to Bitcoin without directly purchasing the underlying asset, have recently been bolstered by significant inflows, particularly from influential firms like Blackrock. Meanwhile, other crypto funds, such as ether ETFs, are facing challenges as outflows increase, highlighting a stark contrast in investor sentiment. The ongoing patterns of Bitcoin ETF investments signify crucial shifts in crypto trading trends, offering insights into broader market behaviors. As the landscape continues to evolve, understanding different crypto fund performance is essential for strategic investment development.

Bitcoin ETFs Show Strong Inflows Amid Market Volatility

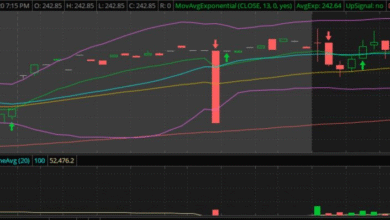

Bitcoin ETFs are demonstrating remarkable resilience in the face of fluctuating market conditions, marking their fourth consecutive day of inflows with a modest gain of $5 million. The primary source of this growth can be attributed to Blackrock’s Innovative Bitcoin Trust (IBIT), which attracted significant investor interest, pulling in $69.41 million alone. This development highlights the continuing appeal of Bitcoin as a leading investment amid broader crypto investment trends, with net assets across all Bitcoin ETFs now totaling $119.67 billion. As more institutional investors show willingness to enter the Bitcoin space, the inflow momentum presents a positive signal for the asset’s future performance.

Despite the overall mixed performance of cryptocurrencies, the Bitcoin ETF landscape remains particularly strong. The trading activity within these instruments remains vibrant—totaling $3.42 billion across the sector—indicating a healthy interest from traders looking to capitalize on Bitcoin’s price movements. This resilience contrasts strikingly with the ether ETFs, which have faced their share of challenges. As Bitcoin continues to uphold its position in the market, the success of ETFs like IBIT suggests a shaping narrative of institutional endorsement that could further stimulate Bitcoin prices and overall market confidence.

Ether ETFs Struggle with Outflows: A Shift in Crypto Trends

In stark contrast to the Bitcoin ETF’s recent performance, ether ETFs have encountered significant setbacks, evidenced by a collective outflow of $17.6 million. The primary culprits behind this decline are Grayscale’s ETHE and Fidelity’s FETH, both of which reported substantial losses. This bearish trend marks a noticeable shift in investor sentiment, as the current crypto investment landscape appears to favor Bitcoin over ether—a narrative that has been gaining traction amid broader market discussions. The lack of inflows across any of the nine ether ETFs highlights a growing skepticism among investors regarding ether’s immediate prospects.

The dynamics surrounding ether ETFs could be attributed to shifting market forces, where traders may be reevaluating their positions given recent trading data. With total trading volume remaining solid at $678.24 million, it seems the market participants are cautious and actively reallocating their investments towards more appealing opportunities. As the cryptocurrency space evolves, this divergence between Bitcoin and ether ETF activity raises pertinent questions about the sustainability of ether’s growth potential in light of Bitcoin’s current upward trajectory.

Blackrock’s IBIT: Catalyzing Bitcoin ETF Success

Blackrock’s IBIT has emerged as a significant player in the Bitcoin ETF arena, contributing greatly to the recent inflow momentum. With $69.41 million of new investments flowing into the fund, it is clear that investors are increasingly trusting Blackrock’s management and expertise. This trust not only enhances the credibility of Bitcoin ETFs but also indicates a shift where institutional players are beginning to view Bitcoin as a legitimate asset class worthy of investment. The confidence in IBIT serves as a benchmark for other Bitcoin ETFs, potentially catalyzing more funds to perform similarly.

Moreover, the strategic positioning of IBIT in a volatile market underlines the importance of strong management practices and investor relations. As market conditions fluctuate, investor confidence in stable and reputable funds like IBIT can act as a buffer against broader market declines. It also reflects a growing trend where large asset managers are harnessing the potential of Bitcoin for long-term growth, adding legitimacy to the crypto investment narratives that continue to evolve. The performance of IBIT may very well set a precedent for future Bitcoin ETF launches and their acceptance in mainstream financial portfolios.

Current Trends in Bitcoin Trading Activity

The trading activity in Bitcoin continues to showcase vitality, with a substantial $3.42 billion in total trading volume reported recently. This level of activity not only underscores the ongoing interest in Bitcoin as an investment vehicle but also reflects the broader trends seen within the cryptocurrency markets. High trading activity typically indicates robust participation from both retail and institutional investors, which is crucial for sustaining liquidity and forming price stability. Given the recent inflows into Bitcoin ETFs, it is evident that the trading landscape is increasingly leaning towards Bitcoin-centric strategies.

Furthermore, the correlation between heightened trading activity and Bitcoin price movements cannot be understated. As institutions continue to favor Bitcoin investments, this could lead to enhanced market dynamics where liquidity is amplified, facilitating smoother trading processes. The trends observed in Bitcoin trading activity highlight not only the maturity of the crypto markets but also the significant role that institutional players are beginning to assume, thereby reshaping perceptions about cryptocurrencies as reliable investment options.

Market Divergence: Bitcoin vs Ether ETFs

The contrasting fortunes of Bitcoin and ether ETFs illustrate a wider market divergence that has implications for investors. While Bitcoin ETFs enjoy a winning streak of inflows, ether ETFs have fallen into outflows, raising eyebrows about future performance expectations. This divergence prompts a closer examination of the factors influencing investor sentiment across different digital assets. As Bitcoin continues to attract interest, ether’s challenges show that despite being a pioneering blockchain technology, it faces hurdles in maintaining its appeal to investors, particularly in an environment increasingly favoring Bitcoin.

As such, this market separation showcases the importance of targeted investment strategies and the necessity for investors to remain informed about ongoing developments in both asset classes. Investors are weighing the current dynamics, including performance history, regulatory news, and technological advancements that can influence their decisions. Consequently, the stark contrast in ETF performances could encourage investors to reassess their allocations based on emerging trends, thereby shaping future trading behavior and investment strategies.

Institutional Interest Drives Bitcoin ETF Growth

Institutional interest has been a quintessential driver of growth within the Bitcoin ETF sector, spearheaded by funds like Blackrock’s IBIT. The increasing participation of institutional investors marks a significant shift, affirming Bitcoin’s status as a credible asset class. This heightened interest not only supports Bitcoin’s price stability but also fosters a more comprehensive acceptance of cryptocurrencies in the financial mainstream. As these institutions provide liquidity and foster confidence, their influence is evident in the recent inflows experienced by Bitcoin ETFs, emphasizing how critical institutional support is for sustained market development.

The presence of large financial entities entering the Bitcoin space brings considerable scrutiny and resource allocation, leading to improvements in product offerings and investor education. Such developments are likely to encourage a wider investor base, leading to a more resilient Bitcoin ecosystem. As institutional players advocate for the establishment of more regulated and transparent platforms, the resultant growth in Bitcoin ETF liquidity may help to stabilize volatility associated with earlier stages of cryptocurrency trading.

Comparative Performance of Bitcoin vs Ether Funds

A comparative analysis of Bitcoin and ether ETFs reveals an intriguing performance landscape characterized by stark contrasts. While Bitcoin ETFs are experiencing sustained inflows—largely driven by institutions—ether ETFs have seen notable outflows, with significant losses reported from prominent funds such as Grayscale’s ETHE. This divergence can serve as a crucial indicator for investors seeking to navigate the rapidly shifting crypto markets. The prevailing narrative indicates a renewed focus on Bitcoin as the market leader, leaving ether at a crossroads that it must navigate to regain investor confidence.

The shifts in performance highlight varying market strategies being employed by investors in the cryptocurrency realm. Bitcoin’s resilience is bolstered by growing institutional support, while ether must address concerns surrounding its fundamental utility and scalability as an investment. Therefore, the performances observed in Bitcoin and ether ETFs provide insights into broader market trends and investor preferences, suggesting a future where Bitcoin may assert dominance, while ether seeks to reclaim its footing in the digital asset hierarchy.

Future Predictions for Bitcoin ETFs and Market Dynamics

Looking ahead, the future prospects for Bitcoin ETFs appear promising, fueled by continual institutional interest and increasing regulatory support. As Bitcoin solidifies its place in investors’ portfolios, it is likely that additional funds will emerge, designed to capture diverse segments of the Bitcoin market. This anticipated growth will also bring along enhanced trading freedom and access to more sophisticated investment strategies. Market dynamics suggest that Bitcoin ETFs may continue their inflow streak, becoming indispensable tools for investors navigating the complex cryptocurrency landscape.

Conversely, the challenges faced by ether ETFs underscore the necessity for innovation and responsiveness to market needs. The potential for ether ETFs hinges not only on regaining investor confidence but also on substantive developments within the Ethereum network. Future predictions indicate that while Bitcoin may continue to dominate in the short term, ethereal markets could rebalance as new use cases and applications emerge, bridging gaps in utility and investor engagement. The evolving landscape forecasts ongoing adaptation within crypto investment trends.

The Role of Regulatory Frameworks in Bitcoin ETF Success

Regulatory frameworks play a pivotal role in shaping the landscape for Bitcoin ETFs, influencing both investor reception and market stability. The growing acceptance and clarity of regulations surrounding Bitcoin have contributed significantly to the positive inflow momentum seen in recent days. As governments and financial authorities take steps to formalize the regulatory environment, they provide a clearer pathway for institutional investments, reducing fears associated with market volatility and uninformed risks. This clarity is crucial for sectors like Bitcoin ETFs that thrive on solidified investor trust.

Moreover, the collaboration between regulatory bodies and cryptocurrency firms can lead to enhanced market integrity and consumer protection. As more structured frameworks are brought into place, they will inevitably attract institutional capital, reinforcing the relevance of Bitcoin within the broader financial system. Future developments in regulation will likely furnish Bitcoin ETFs with the credibility required to maintain their upward trajectory and further establish Bitcoin as a key player in investment portfolios.

Frequently Asked Questions

What are Bitcoin ETFs and how do they work?

Bitcoin ETFs (Exchange-Traded Funds) are investment funds that track the performance of Bitcoin, allowing investors to gain exposure to Bitcoin without directly purchasing the cryptocurrency. They are traded on traditional stock exchanges, making Bitcoin more accessible to a broader range of investors.

What factors are driving Bitcoin ETF inflows recently?

Recent Bitcoin ETF inflows can be attributed to increased institutional interest, particularly represented by Blackrock’s IBIT, which has captured significant investment momentum. This influx highlights a growing acceptance of crypto investment trends among traditional investors.

Why are Bitcoin ETFs still gaining inflows while ether ETFs are experiencing outflows?

Bitcoin ETFs have shown resilience with sustained inflows, such as the recent $5.10 million gain, primarily fueled by significant investments in products like Blackrock’s IBIT. In contrast, ether ETFs are facing outflows due to market fluctuations and less favorable crypto investment trends, leading to net losses.

How does trading activity impact Bitcoin ETF performance?

Robust trading activity, evidenced by $3.42 billion in total trading for Bitcoin ETFs, reflects investor confidence and engagement in the market. High trading volumes can positively influence Bitcoin ETF performance by driving liquidity and interest in the asset.

What is the significance of Blackrock’s IBIT in the context of Bitcoin ETF inflows?

Blackrock’s IBIT has played a pivotal role in the recent Bitcoin ETF inflows, contributing over $69 million in new investments. This trend underscores the growing confidence of institutional investors in Bitcoin ETFs as a viable investment vehicle within crypto markets.

How do Bitcoin ETF inflows affect the overall cryptocurrency market?

Bitcoin ETF inflows often signal increased institutional participation in the cryptocurrency market, which can lead to elevated Bitcoin prices and overall market stability. Additionally, as Bitcoin ETFs attract more capital, they may enhance Bitcoin’s legitimacy among traditional investors.

What are the current trends in crypto investment regarding Bitcoin and ether ETFs?

Current trends show a stark contrast between Bitcoin and ether ETFs, with Bitcoin experiencing consistent inflows while ether ETFs face ongoing outflows. This differentiation illustrates varied investor sentiment and the potential impact of market conditions on different crypto assets.

What are the total net assets currently held by Bitcoin ETFs?

As of now, Bitcoin ETFs hold total net assets of approximately $119.67 billion, reflecting a significant investment commitment by the market despite varying trends in individual ETFs.

| Key Point | Details |

|---|---|

| Bitcoin ETFs Inflows | Bitcoin ETFs saw a net inflow of $5 million, marking four consecutive days of inflows. |

| Role of Blackrock’s IBIT | The inflow was primarily driven by Blackrock’s IBIT, attracting $69.41 million in new investments. |

| Performance of Other Bitcoin ETFs | Other ETFs experienced significant outflows, with Grayscale’s GBTC facing a loss of $32.93 million. |

| Ether ETFs Outflows | Ether ETFs had a net outflow of $17.6 million, led by Grayscale’s ETHE losing $9.61 million. |

| Trading Volume | Total trading activity for Bitcoin ETFs was $3.42 billion, while ether ETFs saw $678.24 million. |

| Market Assets | Bitcoin ETFs’ total net assets stood at $119.67 billion; ether ETFs closed with $8.46 billion. |

Summary

Bitcoin ETFs have demonstrated resilience by achieving a modest net gain of $5 million over four consecutive days of inflows. The continued performance of Bitcoin ETFs, particularly through the support of Blackrock’s IBIT, indicates a strong investor interest despite the contrasting trends in ether ETFs. As the market figures fluctuate, the divergence between Bitcoin and ether ETFs will be a key area to monitor for investors looking to navigate potential opportunities in the crypto landscape.