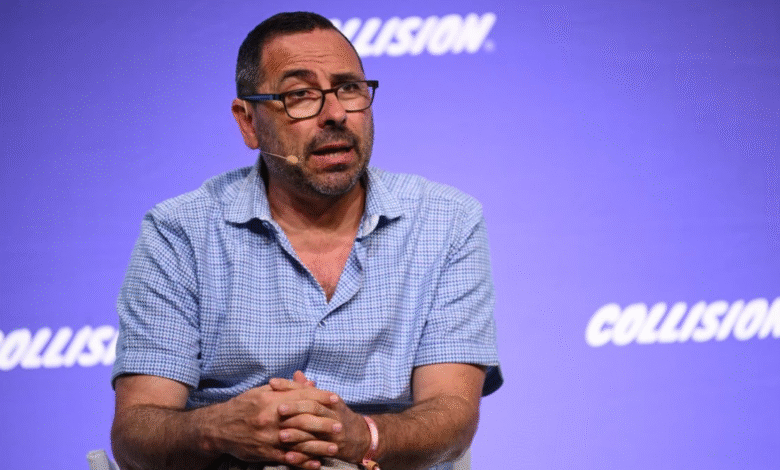

Cerebras IPO Plans: CEO Andrew Feldman Eyes 2025 Launch

The anticipated Cerebras IPO is capturing attention as CEO Andrew Feldman sets his sights on making the AI chip maker public by 2025, following a recent postponement. During a company event in San Francisco, Feldman revealed this exciting news, sparking discussions in the tech community about the significant implications for Cerebras Systems. The recent approval from a U.S. committee to sell shares to Group 42 marks a crucial milestone on the path to an AI IPO in 2025. As Cerebras continues to innovate in AI technology, competing with giants like Nvidia, the interest surrounding the upcoming Cerebras IPO is palpable, especially among investors looking to capitalize on the booming AI sector. With their impressive portfolio of processors tailored for artificial intelligence workloads, Cerebras Systems is poised to make waves in the tech industry, making the upcoming IPO a highly anticipated event in the world of Cerebras news.

In the world of technology investing, the Cerebras public offering is being closely watched as it signifies a pivotal shift for the AI hardware sector. Andrew Feldman, the visionary behind Cerebras Systems, aims to take the company public by 2025, building momentum following previous delays. This milestone is bolstered by a recent endorsement from U.S. authorities for the sale of shares to Group 42, a move that could pave the way for a successful AI IPO in the near future. As the company navigates the complexities of market dynamics, the buzz around this IPO is growing, particularly as Cerebras positions itself against leading players like Nvidia. The news of Cerebras’s advancements in AI chip technology not only excites investors but also illustrates the company’s potential impact in the rapidly evolving landscape of artificial intelligence.

Cerebras Systems Aims for a 2025 IPO

Cerebras Systems, under the leadership of CEO Andrew Feldman, has set its sights on a public offering in 2025. This announcement comes after a postponement originally slated for the previous year, reflecting the company’s strategic planning in the dynamic tech landscape. At a recent company event in San Francisco, Feldman shared insights on the potential IPO timeline, reinforcing their commitment to making this ambitious step a reality. The aspiration to go public symbolizes a pivotal moment for Cerebras, which is renowned for producing innovative AI chips that cater to the demanding requirements of artificial intelligence workloads.

The approval received from the U.S. Committee on Foreign Investment to sell shares to Group 42 marks a significant milestone in Cerebras’s journey toward an IPO. This move is crucial for the company as it strengthens financial backing ahead of their anticipated initial public offering. Despite filing for a public offering in September, details regarding the size and exact timing remain undisclosed. As Cerebras Systems navigates these challenges, they remain focused on enhancing their competitive edge in the AI chip market.

The Significance of Cerebras in AI Technology

Cerebras Systems has emerged as a formidable player in the AI chip manufacturing industry, primarily due to its unique processors designed explicitly for handling complex AI workloads. This innovation sets Cerebras apart from traditional chip manufacturers like Nvidia, whose graphics processing units (GPUs) are widely used in AI model training. The technology developed by Cerebras has the potential to revolutionize AI computation, offering capabilities that could overshadow existing models like OpenAI’s GPT-4.1, especially when cost and efficiency are considered.

As reported, over 85% of Cerebras’ revenue in the first half of 2024 came from its relationship with Group 42, which is backed by tech giant Microsoft. This substantial revenue stream underscores the company’s growing influence in the AI landscape. In a market that has been sluggish since early 2022 due to macroeconomic factors, Cerebras’s ability to attract significant contracts with industry leaders such as Meta and IBM highlights its importance and reliability within the sector.

Cerebras’s Competitive Advantage in the AI Market

Cerebras Systems is positioning itself strategically to compete with other major players in the AI market. CEO Andrew Feldman emphasized that the narrative surrounding Cerebras is broader than what has been publicly disclosed, indicating that exciting developments are on the horizon. The company’s ability to forge partnerships with ‘hyperscalers’—large tech enterprises that require immense computational power—demonstrates its commitment to scaling innovative solutions to meet the demands of advanced AI applications.

The technology landscape is rapidly evolving, and Cerebras is keenly aware of the necessity to stay ahead. With the potential addition of a new hyperscaler client by mid-2025, the company is leveraging its insights into market needs to enhance its offerings. This foresight is critical as the demand for more efficient AI infrastructure continues to grow, giving Cerebras a unique opportunity to capitalize on its cutting-edge technology while preparing for its future IPO.

Navigating the IPO Landscape: Challenges and Opportunities

The IPO market has faced significant hurdles over the past couple of years, primarily due to rising inflation and interest rates that have made investors cautious. However, as signs of recovery begin to surface, companies like Cerebras Systems are poised to take advantage of renewed interest in tech IPOs. With competitors like CoreWeave successfully going public and experiencing heightened market value, Cerebras’s approach to timing and strategy in their IPO preparations will be critical.

Feldman’s recognition of the need to maintain competitiveness amidst these fluctuations is indicative of Cerebras’s proactive stance. While there is uncertainty regarding the size and specifics of their IPO, the company is dedicated to delivering innovative products that appeal to both investors and AI clients. The successful navigation of the IPO landscape could solidify Cerebras’s status as a leader in AI technology and a potentially lucrative investment opportunity.

Cerebras’s Innovations in AI Processing Technology

At its core, Cerebras Systems is committed to advancing AI processing capabilities through innovative chip designs that cater to the complexities of modern AI models. Recent developments include the ability to run an open-source model from Alibaba on its chips, touted to be more cost-effective and faster than established competitors like OpenAI’s GPT-4. This technological edge not only enhances Cerebras’s credibility in the AI sector but also showcases its potential to redefine how AI computations are executed across various applications.

These advancements signal a promising future for Cerebras as it continues to build on its competitive advantages. By aligning with major stakeholders and consistently innovating its product offerings, the company is enhancing its appeal to potential investors and clients alike. As Cerebras prepares for its IPO, this technological prowess could play a significant role in attracting investment and securing its position as a leader in the AI chip market.

Strategic Partnerships and Their Impact on Cerebras

Strategic partnerships have been instrumental in positioning Cerebras Systems as a key player in the AI chip industry. The association with Group 42, particularly with backing from Microsoft, has provided essential support and resources that can propel the company toward its public offering aspirations. Partnering with such prominent organizations not only validates Cerebras’s technology but also opens up avenues for expanding its market reach and exploring new innovation fronts.

These collaborations highlight the growing importance of strategic relationships in the tech sector, where companies often rely on alliances to bolster their capabilities and market presence. As Cerebras further develops its strategic partnerships, it not only enhances its operational capacity but also builds confidence among potential investors and industry stakeholders. This proactive approach to establishing synergies will be crucial as Cerebras continues its journey towards a successful IPO.

The Future of AI IPOs: Cerebras as a Pioneer

The landscape of AI IPOs is evolving, with Cerebras Systems standing at the forefront of this transformative wave. As CEO Andrew Feldman eyes a public offering in 2025, the company positions itself to potentially be the first significant pure-play AI IPO since the market downturn. This pioneering spirit not only showcases their commitment to innovation but also demonstrates confidence in the recovery of the tech IPO landscape.

With tech companies gradually re-entering the IPO market and garnering positive responses, Cerebras’s timing may prove to be fortuitous. If successfully executed, their IPO could attract substantial interest and investment, paving the way for other AI firms to follow suit. The commitment to driving growth and producing premier AI chips could establish Cerebras as a benchmark for future AI IPOs, signaling a rejuvenated interest in the sector.

Key Players and Competitors in AI Chip Manufacturing

Within the realm of AI chip manufacturing, Cerebras faces competition from established entities like Nvidia, known for its robust GPUs widely used in AI training. However, the unique offerings of Cerebras’s processors are designed specifically for AI workflows, providing distinct advantages in processing speed and efficiency. Understanding the competitive landscape is essential for Cerebras as it seeks to carve out a niche that leverages its strengths.

In addition to Nvidia, other companies, including startups and tech giants, are vying for market share in the burgeoning AI sector. This presents both challenges and opportunities for Cerebras. As they prepare for their IPO, demonstrating market differentiation through superior technology and strategic partnerships will be key to attracting investors who seek growth in the AI domain.

Cerebras’s Role in the Broader AI Ecosystem

Cerebras Systems plays a critical role in the broader AI ecosystem, providing the computational backbone necessary for advancing AI research and applications. By focusing on creating specialized processors tailored for AI needs, Cerebras contributes significantly to the evolution of machine learning and deep learning technologies. This specialization enhances not just their own offerings but also the overall capabilities of AI solutions available in the market.

As the demand for AI continues to surge across various industries, Cerebras’s innovations support organizations striving to harness the full potential of artificial intelligence. Their prominence in the AI chip market positioning further solidifies their role as a provider of essential technology, setting the stage for a successful IPO and future growth in this vital sector.

Frequently Asked Questions

What is the timeline for the Cerebras IPO in 2025?

Cerebras Systems, the AI chip maker led by CEO Andrew Feldman, has announced that their aspiration is to go public in 2025. This comes after a previous postponement, and while they filed for an IPO in September, specific details regarding the offering size or timing are still pending.

How has Cerebras Systems prepared for its IPO?

Cerebras Systems is preparing for its IPO by securing key approvals, such as the clearance from the Committee on Foreign Investment in the United States (CFIUS) to sell shares to Group 42, a significant milestone on their path towards a successful public offering.

Who are Cerebras Systems’ key clients as they approach their IPO?

As Cerebras Systems prepares for its IPO, they are already serving notable clients such as Meta and IBM. These partnerships highlight their strong position in the AI chip market and add credibility to their upcoming public offering.

What challenges is Cerebras facing in the lead-up to its IPO?

Cerebras Systems faces challenges typical in the tech IPO market, which has struggled due to rising inflation and interest rates since early 2022. However, they remain focused on competing with industry giants like Nvidia, and Feldman expresses optimism for a strong entry into the public market.

How does Cerebras’ technology compare to other AI platforms ahead of its IPO?

Cerebras Systems has demonstrated impressive capabilities with their processors, launching open-source models that are said to run at lower costs and higher speeds than existing models like OpenAI’s GPT-4.1. This showcases their competitive edge as they approach their IPO.

What recent developments have occurred regarding Cerebras and Group 42?

Recent developments indicate that over 85% of Cerebras’ revenue in the first half of 2024 was generated from their relationship with Group 42, which is backed by Microsoft. This partnership not only supports their financial growth but also strengthens their positioning ahead of the anticipated IPO.

How might the current IPO landscape affect Cerebras’ public offering?

The current IPO landscape, which shows signs of recovery with recent successful launches like CoreWeave, could positively impact Cerebras’ public offering. A revived market provides a more favorable environment for their expected IPO in 2025.

What innovations has Cerebras Systems introduced as they move towards their IPO?

Cerebras Systems has recently unveiled the ability to effectively run advanced AI models on their specialized chips, offering improved speed and cost efficiency. These innovations not only enhance their market appeal but also bolster their prospects leading up to the IPO.

| Key Point | Details |

|---|---|

| Cerebras IPO Timeline | Cerebras aims to go public in 2025 after postponing plans from the previous year. |

| Recent Developments | CEO Andrew Feldman revealed details about the IPO timeline during a company event. |

| Approval from CFIUS | Cerebras received clearance to sell shares to Group 42, a key step towards the IPO. |

| Revenue Source | Over 85% of Cerebras’ revenue in early 2024 came from Group 42. |

| IPO Market Conditions | Tech IPO market remains stagnant but shows signs of revival with recent successful public offerings. |

| Competitive Landscape | Cerebras competes with industry giants like Nvidia and has major clients including Meta and IBM. |

| Technology Advances | Cerebras demonstrated a new capability to run an open-source model from Alibaba on their chips. |

Summary

Cerebras IPO is shaping up as the company plans to enter the public market in 2025. After overcoming hurdles like regulatory approvals and a challenging tech IPO environment, Cerebras is well-positioned to leverage its unique offerings in the AI chip manufacturing sector. With substantial revenue from partnerships and a clear roadmap for growth, the upcoming IPO stands as a significant milestone in Cerebras’ journey, spotlighting its innovations and competitive edge in the rapidly evolving AI landscape.