Cava Revenue Growth Exceeds Expectations in Fiscal Quarter

Cava revenue growth has been a standout highlight as the Mediterranean restaurant chain exceeded Wall Street’s expectations for its recent fiscal quarter. With a remarkable 10.8% rise in same-store sales, Cava defies the broader trend of declining customer traffic that has plagued many competitors in the restaurant industry. While other chains struggle with decreasing consumer spending, Cava reaffirms its optimistic outlook for the fiscal year, forecasting continued growth of 6% to 8% in same-store sales. This strong financial performance is backed by increasing customer willingness to indulge in higher-priced menu items, which contributed to the company’s impressive revenue of $332 million. As Cava continues to demonstrate resilience amidst economic challenges, investors are closely monitoring the brand’s stock performance and long-term projections.

The remarkable increase in revenue for Cava highlights the restaurant chain’s ability to thrive in a challenging economic landscape dominated by rising inflation and shifting consumer habits. Cava’s remarkable same-store sales growth signifies a shift toward its fresh Mediterranean offerings, positioning the chain favorably against competitors experiencing downturns. With fiscal quarter results revealing a notable uptick in customer engagement and spending, Cava has successfully tapped into a growing market segment that prioritizes quality over quantity. The restaurant’s financial performance showcases a strategic focus on enhancing guest experiences with premium menu items, further reinforcing its market position. By continuing to expand its footprint across the nation, Cava is not only redefining casual dining but is also demonstrating robust growth potential for future fiscal years.

Cava Revenue Growth: A Strong Performance Amid Industry Struggles

Cava has notably exceeded Wall Street expectations with impressive revenue growth in its latest fiscal first-quarter results. The Mediterranean restaurant chain reported a remarkable net income of $25.71 million, translating to earnings of 22 cents per share, which significantly surpassed the anticipated 14 cents. This demonstrates Cava’s robust financial performance, particularly when comparing its same-store sales growth of 10.8% against the overall decline seen in the restaurant industry. In a market impacted by decreased consumer traffic and spending, Cava’s ability to deliver such a strong performance is a testament to its strategic positioning and effective business model.

Despite a backdrop of economic uncertainty and reduced dining out by consumers, Cava’s focus on high-quality offerings and an appealing menu have contributed to its growth trajectory. Chief Financial Officer Tricia Tolivar has indicated that the increase in customer spending—particularly on premium items—has allowed Cava to capture a larger share of the market. The projected forecast for same-store sales growth remains optimistic at between 6% to 8% for the fiscal year, which reassures investors and stakeholders about the company’s resilience and potential for ongoing expansion in the competitive landscape.

Analyzing Cava’s Same-Store Sales Performance

Cava’s same-store sales growth of 10.8% not only exceeds analyst expectations but also highlights the brand’s strength against declining sales reported by many of its competitors. Companies like Chipotle and McDonald’s have faced challenges, citing drops in transactions as consumers curtail dining expenses. Cava’s successful strategy focuses on appealing to the health-conscious diner, showcasing nutritious Mediterranean options that resonate well with today’s consumer trends. This alignment with consumer preferences has enabled Cava not only to maintain but to improve its traffic, with a 7.5% increase during the same period.

In a climate where others struggle, Cava’s performance is multifaceted: it draws diners looking for higher-quality, healthier choices over traditional fast food. The chain’s innovative menu, which includes bowls and pitas rich in fresh ingredients, continues to attract a loyal customer base. This trend has been visible for several quarters, suggesting that Cava’s growth strategy is effectively capitalizing on shifts in consumer behavior, allowing it to stand out as a leader within the fast-casual segment.

Cava’s Fiscal Quarter Results: Breaking Industry Trends

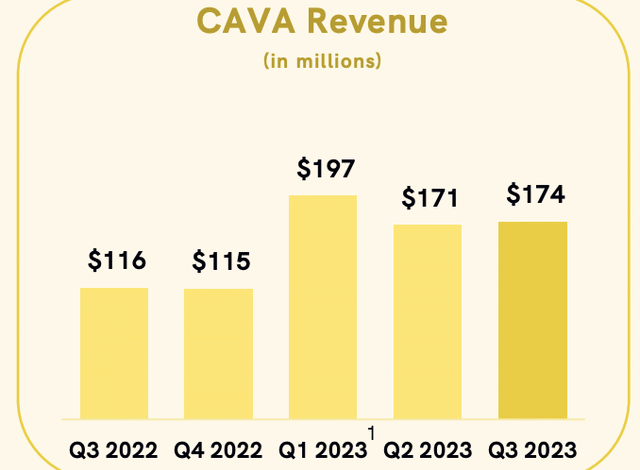

In their most recent fiscal quarter, Cava’s results presented a stark contrast to the challenging environment faced by the broader restaurant industry. With fiscal revenues reaching $332 million—an increase of 28%—the chain’s performance highlights its strong market position. By continually refining its offerings and enhancing customer experiences, Cava has not only managed to retain but also expand its customer base, a notable feat during such turbulent economic conditions. As many restaurants report declines, Cava’s ability to thrive underlines a strategic advantage rooted in its unique value proposition.

The successful announcement of earnings per share at 22 cents also reflects effective management and operational efficiency within the company. Cava’s commitment to innovation extends beyond the menu, with plans to increase its number of locations, projecting 64 to 68 new restaurants in the upcoming period. This planned expansion is vital for fostering long-term growth and investor confidence, setting Cava apart as one of the few bright spots in a beleaguered sector.

Financial Performance Metrics: A Look at Cava’s Fiscal Results

Cava’s fiscal results are not just a reflection of increased revenue; they are indicative of broader financial health within the company. The marked rise in net income—from $13.99 million in the previous year to $25.71 million—demonstrates efficient cost management alongside revenue growth. The company’s reported net sales of $332 million are backed by strong operational frameworks that facilitate sustainable growth. Investors would be wise to monitor these metrics, as they can provide insights into Cava’s future trajectory in the ever-evolving fast-casual dining market.

Additionally, the reported $10.7 million income tax benefit tied to stock-based compensation positively impacts earnings, showcasing Cava’s adept handling of financial complexities. The growth in adjusted EBITDA expectations—from $150 million to an estimated range of $152 million to $159 million—reflects strong operational execution and positive revenue trends. As Cava progresses, these financial indicators are essential for stakeholders looking for reassurance amidst an uncertain economic backdrop.

Cava’s Restaurant Chain Expansion: Future Prospects and Forecasts

As Cava plans to continue expanding its footprint, the projected opening of between 64 and 68 new restaurant locations illustrates a proactive approach to growth. This expansion strategy is critical for enhancing brand visibility and market penetration in new regions. By capitalizing on consumer trends favoring healthier dining options, Cava is poised to attract a diverse array of customers, increasing its overall market share. This approach not only fuels direct revenue growth but also positions the brand for long-term sustainability within the competitive fast-casual dining sector.

Moreover, Cava’s unwavering forecast for same-store sales growth between 6% and 8% hints at strong management confidence in its operational capability and consumer appeal. The balance between opening new locations and enhancing existing store performance indicates Cava’s comprehensive strategy to drive revenue. The operational commitment to expanding a culinary experience that prioritizes high-quality ingredients and unique offerings underscores Cava’s dedication to growing its restaurant chain effectively.

Cava Stock Performance: Market Reactions and Investor Sentiment

Following Cava’s recent fiscal announcements, the stock experienced a 5% drop in after-hours trading, despite strong revenue results. This reaction can be attributed to investor concerns over the company’s cautious outlook for the remainder of the fiscal year. The continued decline in stock value—down 11% for the year—highlights the importance of market sentiment and external economic factors affecting investor confidence in the restaurant chain. While Cava’s growth metrics are positive, navigating market expectations remains a delicate balancing act.

Investors typically assess not only the economic projections but also the competitive landscape. Cava’s resilience amid declining performance reported by other chains is a focal point for potential investors seeking value in equity. The correlation between Cava’s strong fiscal results and its stock performance illustrates the necessity for clear communication from management regarding growth strategies and market positioning to rebuild investor trust and interest.

Customer Preference Shifts: The Rise of Cava’s Unique Offerings

Cava’s success highlights a significant shift in consumer preferences, as individuals increasingly gravitate towards healthier, more innovative dining options. The brand’s array of Mediterranean choices, characterized by fresh ingredients and customizable meals, resonates with a health-conscious demographic. This trend is evidenced by the company’s sustained increase in customer traffic and spending. As diners move away from traditional fast food towards chains like Cava, the brand has effectively positioned itself to meet these emerging demands.

The chain’s commitment to quality and guest experience fosters a unique dining environment, encouraging repeat visits. Cava stands out in the fast-casual restaurant market by providing nutritious, flavorful meals that cater to modern consumers’ lifestyles. By continuously adapting its menu and marketing strategies, Cava not only meets but anticipates consumer desires, further solidifying its place in a competitive sector.

Competitive Landscape: How Cava Stands Out in the Restaurant Industry

As competition within the restaurant industry intensifies, Cava has carved out a distinctive niche that sets it apart from traditional fast food and other casual dining options. Its focus on fresh, Mediterranean cuisine coupled with a customizable menu appeals to diners seeking healthier alternatives. While many competitors such as Chipotle and McDonald’s report declining sales, Cava manages to thrive, showcasing not only resilience but also strategic prowess in menu development and customer engagement strategies.

The emphasis on quality and a convenient dining experience has placed Cava at a disadvantage to neither quality nor customer satisfaction. This positioning lesser-known alternatives within the restaurant segment continue to struggle highlights Cava’s competitive edge. Comparatively, by analyzing growth figures and consumer trends, it becomes apparent that Cava’s adaptive strategies in responding to market conditions provide a framework for success that other brands may seek to emulate.

Investor Insights: Evaluating Cava’s Future Potential

In analyzing Cava’s financial performance and growth trajectory, investors should remain vigilant about market trends and corporate strategies that impact the restaurant industry at large. As Cava plans for future expansions and navigates investor sentiments, understanding the nuances of its financial health becomes critical. Despite recent fluctuations in stock performance, the company’s robust same-store sales and revenue growth reflect a strong underlying business model. The anticipated adjusted EBITDA growth provides additional assurance to potential investors regarding the company’s operational health.

Moreover, by paying attention to industry shifts and consumer behavior analysis, investors can glean insights into Cava’s market positioning and potential profitability. Cava’s ongoing strategy to innovate and expand provides a roadmap for sustained growth and competitive advantage; therefore, the company remains an attractive option in the investment landscape. By monitoring these developments, interested stakeholders can align their investment strategies in accordance with Cava’s evolving market presence.

Frequently Asked Questions

What are the key factors driving Cava’s revenue growth in the fiscal quarter?

Cava reported a remarkable revenue growth fueled by a 10.8% increase in same-store sales and a 7.5% uptick in customer traffic. The Chain’s emphasis on higher-priced items and an overall positive spending trend contributed significantly to its financial performance, which surpassed Wall Street estimates.

How did Cava’s same-store sales compare to other restaurant chains in the recent fiscal quarter?

Cava’s same-store sales growth of 10.8% starkly contrasts with declines reported by other restaurant companies. While many competitors faced reduced consumer traffic and spending, Cava maintained robust growth, reaffirming its positive fiscal outlook for the year.

What does Cava’s fiscal quarter result indicate about its market position?

Cava’s fiscal quarter results indicate a strong market position, highlighted by a net income increase and significant revenue growth, surpassing projections. While other restaurant chains struggled with decreased sales, Cava’s strategic focus on appealing menu items and a positive customer traffic flow reflects its successful adaptation to changing consumer preferences.

How has Cava’s financial performance been impacted by national economic trends?

Despite broader economic challenges affecting the restaurant sector, Cava’s financial performance remains strong. The chain reported a substantial revenue increase alongside positive same-store sales, as consumer preferences shift toward its Mediterranean offerings instead of traditional fast food.

What forecasts did Cava provide regarding its future same-store sales performance?

Cava reaffirmed its forecast for same-store sales growth for the fiscal year, projecting an increase of 6% to 8%. This projection comes as Cava continues to experience positive trends, even while recognizing potential slower growth in the latter half of fiscal 2025.

How does Cava’s stock performance reflect its revenue growth and financial strategy?

Cava’s stock performance has been affected by mixed investor sentiment, despite strong revenue growth and exceeding earnings expectations. Following news of its cautious outlook, shares dropped 5% in after-hours trading. Nevertheless, recent achievements, including surpassing $1 billion in annual revenue, underscore its ongoing financial strategy’s strengths.

What are the implications of Cava’s new restaurant openings on its revenue growth?

Cava plans to open between 64 and 68 new locations, indicating an aggressive expansion strategy that should positively impact its revenue growth. Successful integration of new locations can further enhance Cava’s financial performance and market presence, aligning with its ambitious growth projections.

How significant is Cava’s revenue milestone of exceeding $1 billion?

Cava’s achievement of exceeding $1 billion in revenue marks a significant milestone, showcasing its robust growth and market strength. This achievement underlines its effective business model and strategy, particularly in distinguishing itself within a competitive restaurant landscape.

| Key Metrics | Cava | Industry Comparison | |

|---|---|---|---|

| Fiscal First-Quarter Revenue | $332 million | ||

| Earnings per Share | 22 cents | ||

| Same-Store Sales Growth | 10.8% | ||

| Projected Same-Store Sales Growth for FY | 6% to 8% | ||

| Net Income | $25.71 million | ||

| New Locations Planned | 64 to 68 | ||

| Consumer Trends | Shift towards higher-priced items | ||

| Competitors’ Performance | Declines in same-store sales and customer traffic | ||

Summary

Cava revenue growth has outperformed Wall Street’s expectations, showcasing resilience amid a challenging dining-out environment. In its fiscal first quarter, Cava reported significant increases in both revenue and same-store sales, reflecting a robust customer preference for its offerings. This growth is set against a backdrop of declines in the broader restaurant industry, highlighting Cava’s effective positioning and customer loyalty. The chain’s strategy to focus on higher-priced menu items appears to resonate well with consumers, leading to a promising outlook despite cautious projections for the remainder of the fiscal year.