Consumer Sentiment Drops as Inflation Expectations Surge

Consumer sentiment is facing significant challenges, as demonstrated by the latest figures from the U.S. consumer index, which report a drop to 50.8, the second-lowest level ever recorded. Concerns regarding inflation expectations are growing, particularly as individuals fear that recent tariff impacts will lead to rising prices in the near future. This sentiment reflects a broader economic perception that hinges on ongoing trade policy effects, particularly in light of tensions between the U.S. and China. Economists are now analyzing this shift in consumer outlook, especially since the survey was largely conducted before a temporary 90-day tariff pause was announced. As inflation rates fluctuate, understanding consumer sentiment becomes crucial for policymakers and businesses aimed at navigating the complexities of the current economic landscape.

The current mood among buyers and spenders showcases a deeply rooted apprehension about economic conditions, particularly as they relate to price stability and international trade. Terms like consumer confidence and market attitude encapsulate a heightened concern regarding inflation trends, which have surged in recent months. This anxiety is amplified by observable shifts in tariff legislation and its pronounced effects on future purchasing decisions. Observers are increasingly aware of how recent decisions on trade restrictions might either alleviate or exacerbate current economic pressures. With so many variables at play, especially concerning inflation expectations, understanding this psychological framework is essential for gauging the overall health of the economy.

Impact of Tariffs on Consumer Sentiment

The recent downturn in the consumer sentiment index, which has now sunk to 50.8, underscores the profound effect that tariff policies have on U.S. consumer psychology. This decline reflects a growing unease among consumers, especially in the face of rising inflation expectations. With a significant portion of respondents linking their concerns directly to trade policies, it’s clear that tariffs are reshaping economic perception. As consumers see tariffs as a potential trigger for increased prices, their confidence in financial stability wanes, resulting in decreased spending and investment decisions.

Moreover, the spike in year-ahead inflation expectations to 7.3% suggests that consumers are increasingly pessimistic about the economic landscape. Responses from the University of Michigan’s survey indicate a palpable anxiety surrounding trade wars and their ripple effects on everyday prices. With tariffs being spontaneously mentioned by nearly three-quarters of consumers, it illustrates a shift towards prioritizing trade policy impacts in their economic outlook.

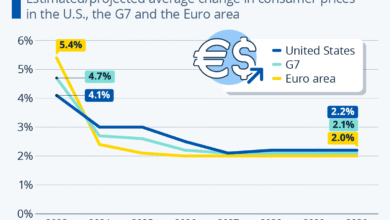

Inflation Expectations: A Growing Concern

As inflation expectations climb higher, consumers are becoming increasingly wary of their financial futures. The jump from 6.5% to 7.3% in every-year inflation expectations signals a shift in consumer sentiment that could have significant implications for economic growth. High inflation expectations not only deter consumer spending but can also lead to increased saving rates as people prepare for tighter financial times ahead. This cautious behavior can further dampen economic activity, creating a vicious cycle that policymakers will find challenging to break.

Concerns over inflation are heightened by the effective tariff rates, which remain elevated despite a temporary pause in new tariffs between the U.S. and China. Consumers are acutely aware that trade policies can lead to inflated prices on everyday goods, enhancing their sensitivity towards changes in distribution costs. This scenario is not just a theoretical risk; it’s a reality reflected in their responses and government officials’ assessments of consumer behavior and economic health.

Trade Policy Effects on Economic Perception

Trade policies are crucial in shaping the economic perception of consumers, as evidenced by the current climate of uncertainty surrounding U.S.-China trade relations. The announcement of a 90-day pause on tariffs might provide some relief, but the consumer sentiment index still indicates widespread anxiety about the future. The way tariffs influence prices and availability of goods makes people reevaluate their personal economic situations, leading to a potential short-term slowdown in consumer spending.

Economic perception among consumers is largely colored by their views on trade policy. As tariffs affect not only prices but also the overall marketplace, consumers’ anticipation of future trade negotiations and their outcomes plays a significant role in shaping expectations. This ongoing uncertainty creates an environment where consumers feel less secure in their financial choices, leading to a further decline in the consumer sentiment index.

The Role of Government in Stabilizing Consumer Confidence

Government actions play a significant role in stabilizing consumer confidence, especially amidst uncertain economic conditions driven by tariff impacts. Policymakers, including the Federal Reserve, closely monitor consumer sentiment as indicators to make necessary adjustments in monetary policy. By signaling intentions to keep inflation expectations in check, they can help restore consumer confidence that may foster spending and economic growth.

In this context, the role of communication about trade policies and inflation expectations becomes crucial. Policymakers must offer transparency and reassurance to consumers that strategies are in place to mitigate adverse effects. Such approaches can help stabilize public sentiment, making it essential for government entities to engage in clear, proactive dialogues regarding trade negotiations and their inflationary implications.

Monitoring the Future Consumer Sentiment Index

The upcoming release of the final consumer sentiment index on May 30 is highly anticipated, as it will provide insight into how effectively the 90-day tariff pause has influenced consumer outlook. Analysts will be keen to see if consumers feel any improvement in sentiment or if the anxiety surrounding inflation persists. Given the historical significance of this index, it serves as a vital tool for gauging economic health.

The findings from this index will also impact decisions made by investors and policymakers alike. An improved sentiment index may foster hope for better economic conditions and higher consumer spending, while a continued decline could signal deeper systemic issues that need addressing. Understanding these dynamics is essential for predicting future economic trends and formulating appropriate responses.

Consumer Responses to Economic Policies

Consumers are not just passive recipients of economic shifts; they actively respond to changes in policies, particularly those concerning tariffs and trade. As tariffs directly influence prices, consumer behavior reflects their views on economic stability. The connection between consumer sentiment and policy adaptations showcases the necessity for governments to be responsive to public concern. Individuals are adjusting their spending and saving behaviors in direct correlation to their sentiments about policy impacts.

Every economic policy, particularly trade-related decisions, can evoke distinct responses from consumers. As inflation fears mount, consumers begin reassessing their financial strategies. This shift emphasizes the need for businesses and government agencies to remain attuned to consumer narratives, enabling more informed decisions that can help alleviate concerns stemming from economic policy effects.

Impacts of Inflation on Spending Behavior

Inflation has a profound impact on spending behavior, with rising expectations often leading to a more conservative approach from consumers. Increased fears about future costs cause individuals to tighten their budgets and curtail discretionary spending. As they perceive their purchasing power diminishing, consumers are likely to prioritize essential needs over luxuries, which directly affects business revenues and overall market dynamics.

In an environment where inflation expectations surge, the likelihood of consumers delaying major purchases increases. This anticipated behavior can stymie growth as lower consumer spending can lead to reduced business investment, creating a feedback loop that can prolong economic downturns. Understanding these consumer patterns becomes critical for businesses aiming to adapt to changing market conditions.

Tariffs and Long-Term Economic Forecasts

While current sentiment reflects concerns about tariffs and inflation, it raises questions about long-term economic forecasts. Tariffs may provide short-term motives such as protection for local industries, but they also carry long-term implications that can distort market dynamics. Economists emphasize the need for comprehensive assessments of how tariffs will ultimately shape economic growth, considering consumer behavior and price adjustments.

Furthermore, the persistence of high tariffs may lead to structural changes in the economy, prompting shifts in supply chains and consumer choices. Businesses must remain agile, ready to adapt to evolving economic landscapes shaped by trade policies. By anticipating these changes, companies can better position themselves for future growth even amidst tariff-related uncertainties.

Strategies for Companies Amid Tariff Uncertainties

In the face of ongoing tariff uncertainties, companies must develop resilient strategies to navigate volatile market conditions. Diversifying supply chains, seeking alternative raw material sources, and adjusting pricing strategies can mitigate the potential negative impacts of tariffs on operational costs. Such proactive measures not only safeguard profitability but also bolster consumer trust.

Moreover, clear communication with consumers about how businesses are managing the effects of tariffs is essential. By demonstrating transparency and responsiveness, companies can strengthen their connections with consumers, potentially counteracting negative sentiments regarding economic conditions. Adapting to tariff impacts while maintaining consumer relationships will be crucial for long-term success.

Frequently Asked Questions

What is the current status of U.S. consumer sentiment regarding inflation expectations?

As of May 2025, U.S. consumer sentiment has declined significantly, with the consumer sentiment index dropping to 50.8, reflecting growing concerns about inflation expectations. This decline indicates apprehension among consumers, particularly regarding the financial impacts of tariffs.

How do tariffs affect economic perception among U.S. consumers?

Tariffs have a profound impact on economic perception, as indicated by a recent University of Michigan survey where nearly 75% of consumers expressed concern about their effects on prices. This heightened awareness contributes to declining consumer sentiment as individuals worry about higher inflation due to trade policies.

What role do inflation expectations play in the U.S. consumer index?

Inflation expectations are crucial for the U.S. consumer index, as recent data showed a rise in one-year inflation expectations to 7.3%. Such expectations significantly influence consumer sentiment, shaping perceptions of economic stability and future spending behavior.

What are the expected trade policy effects on consumer sentiment?

Trade policy effects are currently creating uncertainty that negatively impacts consumer sentiment. As many consumers are vocal about their concerns regarding tariffs and potential price increases, this uncertainty shapes their overall economic outlook.

How has consumer sentiment changed in response to recent inflation data?

Recent inflation data, with the consumer price index falling below expectations, has not alleviated concerns. In fact, rising long-term inflation expectations indicate a growing apprehension among consumers, contributing to a drop in sentiment levels, now at a near-historic low.

What is the significance of the 90-day tariff pause on consumer sentiment?

While the 90-day tariff pause announced between the U.S. and China could potentially improve consumer sentiment, most survey responses were collected before this announcement. Therefore, its effects on consumer sentiment and inflation expectations remain to be fully determined in upcoming assessments.

How do economic perceptions influence consumer spending habits in light of inflation fears?

Economic perceptions significantly influence consumer spending habits, particularly during times of high inflation expectations. When consumers feel uncertain about future economic conditions, such as rising prices due to tariffs, they may limit spending, further impacting the overall economy.

| Key Point | Details |

|---|---|

| Consumer Sentiment Index Change | The index fell to 50.8 from 52.2, making it the second-lowest record. |

| Survey Timing | Most responses were collected before the 90-day tariff pause announcement. |

| Impact of Tariffs on Sentiment | Tariffs are a significant concern for consumers, with many citing them as a driver of inflation. |

| Inflation Expectations | Year-ahead inflation expectations rose to 7.3%; long-term expectations increased to 4.6%. |

| Federal Reserve Response | The Fed is monitoring inflation closely and aims to prevent long-term expectations from rising due to tariffs. |

| Future Outlook | A final consumer sentiment index is expected on May 30, to assess the tariff pause’s impact. |

Summary

Consumer sentiment has significantly declined, reaching its second-lowest level ever recorded, primarily due to increasing inflation expectations linked to tariffs. Despite a pause in tariffs between the U.S. and China, the initial responses from the consumer sentiment survey indicate deep-rooted concerns about rising prices and economic instability. Overall, the outlook on consumer sentiment remains cautious, reflecting widespread anxiety about future economic conditions.