Long-Term Care Costs: Understanding the Financial Impact

Long-term care costs are a pressing concern for many Americans, with estimates suggesting that about 1 in 7 individuals will face out-of-pocket expenses exceeding $100,000 over their lifetime. Despite the significant financial implications associated with the cost of long-term care, many families remain unprepared for this reality, often lacking adequate long-term care insurance. Health insurance and Medicare typically fall short in covering these expenses, creating a substantial gap that can lead to financial strain. This situation is aggravated by the fact that eligibility for Medicaid long-term care benefits often requires individuals to deplete their financial resources. Planning for long-term care is not just a personal concern; it’s a critical family discussion that needs to take place to navigate the complex landscape of long-term care expenses effectively.

The financial implications of extended care services, often referred to as custodial care or nursing home services, highlight an essential aspect of elder care planning. Many individuals may find themselves unprepared for the costs associated with personal support or supervision when facing medical conditions such as Alzheimer’s or other degenerative illnesses. In light of rising costs for care services, it becomes increasingly important for families to explore options beyond traditional health coverage, such as long-term care insurance policies or state-supported programs. Discussions surrounding future care needs should incorporate various financial strategies, including potential reliance on Medicaid resources and self-insurance plans. By being proactive and informed, families can better navigate the complexities of long-term care financial planning.

Understanding Long-Term Care Costs

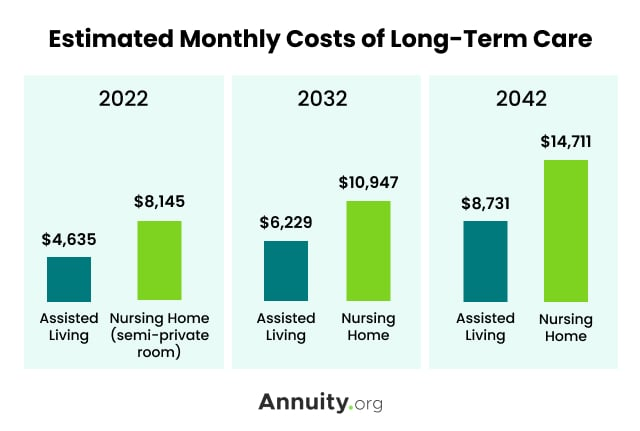

Long-term care costs can be staggering, often exceeding six figures, making them one of the most significant financial challenges for aging Americans. Statistics reveal that approximately 1 in 7 Americans will have to spend at least $100,000 out of pocket on long-term care, a circumstance that can financially devastate many families. The average expected cost for someone turning 65 today is estimated at around $122,400—a number that can rapidly increase depending on the duration of care needed. With the projected rise in the aging population, understanding these costs has never been more critical.

The financial strain of long-term care is exacerbated by the fact that many individuals and families are largely unprepared for this eventuality. Traditional health insurance and Medicare typically provide limited assistance for long-term care expenses, focusing instead on acute medical costs. This creates a scenario where families may find themselves grappling with significant out-of-pocket expenses for years of care, which could easily consume their savings and retirement funds.

The Importance of Long-Term Care Insurance

Given the daunting statistics surrounding long-term care costs, seeking long-term care insurance can be a wise decision for many families. However, it’s essential to note that fewer than 8 million Americans had some form of long-term care insurance as of 2020, which reflects a lack of awareness regarding the potential benefits. Long-term care insurance helps cover the high expenses associated with extended care facilities, home health aides, and other necessary services, yet misconceptions about these policies often deter individuals from considering them.

Families should consider a hybrid insurance policy that includes both long-term care benefits and life insurance, as these options tend to provide better value and coverage. Planning for long-term care insurance early can ease the financial burden and provide peace of mind for aging loved ones. Without such planning, many families risk substantial financial strain, often forcing them to rely on public programs like Medicaid, which can have stringent eligibility requirements.

Planning for Long-Term Care Expenses

Proactive planning for long-term care expenses can significantly alleviate future financial stress. As many individuals fail to recognize the costs associated with long-term care, it’s crucial to discuss these potential needs among family members before a crisis arises. By talking about long-term care options, families can create a clear roadmap that includes logistics around who will provide care, how much they may need to spend, and what kind of long-term care insurance might be appropriate.

Establishing a dialogue about long-term care planning can help reduce the shock of unexpected financial burdens later on. Families should consider factors such as personal health risks, the desire to self-insure, and the establishment of advance healthcare directives to formalize their wishes. Engaging in open discussions can foster a supportive environment that prepares everyone involved for the realities associated with aging and potential care needs.

Exploring Medicaid Options for Long-Term Care

Many families turn to Medicaid as the largest payer of long-term care costs in the U.S. However, not everyone qualifies for its benefits, which often require individuals to exhaust their savings and assets before assistance is granted. This can place a significant burden on families who assume they will be covered by Medicaid without understanding the complex rules and qualifying criteria involved. The potential cuts to Medicaid programs also further complicate the landscape, making it vital for families to plan well in advance.

To navigate the Medicaid system effectively, families should be aware of the asset limits that might affect their eligibility and the importance of strategic planning. Working with a financial planner familiar with Medicaid benefits can provide clarity on how to structure finances effectively to qualify for aid while still protecting personal assets wherever possible. Taking these proactive steps can ensure better access to necessary care when it’s needed most.

The Growing Demand for Long-Term Care Services

As life expectancy continues to rise, the demand for long-term care services is expected to increase dramatically. Current estimates suggest that about 57% of individuals turning 65 today will require some form of long-term care, often driven by chronic conditions or disabilities associated with aging. This anticipated surge underscores the urgency for families to recognize the implications of these statistics and to prepare accordingly. With proper planning, families can avoid the financial pitfalls that many face when long-term care becomes a necessity.

As populations age and more individuals require assistance, the average costs for long-term care services will likely trend upwards, making it crucial to save and invest for these future needs. Establishing a clear understanding of local costs, types of services required, and personal health risks can significantly shape how families plan for long-term care. By being proactive, the emotional and financial impacts of needing long-term care can be mitigated.

Strategies for Affording Long-Term Care

Affording long-term care requires strategic financial planning that takes into account the potential for substantial costs. With health insurance typically covering little to no long-term care expenses, families should explore various funding strategies early on to ensure they can meet future needs. This may include considering long-term care insurance, savings accounts specifically for healthcare expenses, or Hybrid policies that provide life insurance along with long-term care benefits.

Moreover, families might also assess their existing savings and elaborate a plan to manage long-term care expenses while maintaining their lifestyle. Engaging with financial advisors who specialize in elder care can also provide insights into how to allocate resources wisely and consider scenarios like self-insuring or establishing a family fund to address future care needs.

Navigating the Long-Term Care Insurance Market

The long-term care insurance market is diverse and can be challenging to navigate without proper guidance. Policymakers and financial advisors suggest individuals start researching and comparing policies as early as possible to take advantage of lower premiums. Understanding the various coverage options, including daily benefit amounts and benefit periods, can help individuals tailor policies to fit their potential care needs while preserving their financial stability.

Additionally, being aware of state-specific programs that may provide supplemental coverage or benefits can be advantageous. Many states are beginning to implement public options designed to help mitigate long-term care costs, which could be beneficial for families considering long-term care planning. Ultimately, individuals should weigh the costs and benefits of various long-term care insurance policies in the context of their overall retirement strategy.

The Emotional Impact of Long-Term Care Planning

The emotional implications of long-term care planning can be profound, as families confront difficult decisions about their futures. Discussion around aging, health needs, and the financial realities of long-term care can be laden with anxiety and uncertainty. However, initiating these conversations early can help reduce stress and foster understanding among family members about potential care scenarios.

Taking the time to plan for emotional support, in addition to financial resources, can create a more steadfast family unit. When individuals feel empowered by knowing there’s a plan in place, the fear of unexpected circumstances tends to lessen. By approaching long-term care planning with openness and compassion, families can better navigate the trials ahead.

The Future of Long-Term Care Solutions

As the landscape of long-term care evolves, several innovations and solutions are emerging that aim to enhance the quality and affordability of care. Technology plays a vital role in this transformation, with telehealth services and remote monitoring becoming more commonplace. These advancements can offer some level of care and assistance without the financial burden of traditional facilities, aligning with the growing need for cost-effective options.

Moreover, as more states recognize the impending demands of an aging population, public policy initiatives are being explored to create accessible long-term care solutions. From community-based programs to subsidies for those in need, innovative approaches are being discussed to provide families with better access to essential services. Moving forward, maintaining awareness of these evolving solutions will be crucial for families planning their long-term care.

Frequently Asked Questions

What are the average long-term care costs in the United States?

The average future cost of long-term care for someone turning 65 today is approximately $122,400. Monthly expenses can vary, such as around $6,300 for a home health aide and $9,700 for a private room in a nursing home as of 2023.

How does long-term care insurance help with long-term care costs?

Long-term care insurance provides financial support to cover some or all long-term care expenses, helping policyholders manage the potentially high costs of long-term care services, which can exceed $100,000.

What types of long-term care expenses are typically not covered by Medicare?

Medicare generally does not cover most long-term care costs. It may partially cover ‘skilled’ care for the first 100 days but excludes ‘custodial’ care, which includes assistance with daily activities.

What are the eligibility requirements for Medicaid long-term care coverage?

To qualify for Medicaid long-term care coverage, individuals typically must exhaust a significant portion of their financial assets, leading many to consider it as a last resort for funding long-term care.

How can families prepare financially for long-term care costs?

Families can prepare for long-term care costs by discussing care needs early, exploring long-term care insurance options, and considering the logistics of caregiving and possible self-insurance strategies.

Why is it important to plan for long-term care expenses in advance?

Planning for long-term care expenses in advance is crucial as many households are unprepared for the high costs, which may include over $100,000 in out-of-pocket expenses, leading to financial strain if not addressed.

What percentage of Americans are likely to require long-term care, and what might that entail?

Approximately 57% of Americans turning 65 today will develop a disability severe enough to require long-term care, encompassing conditions like dementia or complications from past health issues.

What are the potential costs of long-term care services by state?

The cost of long-term care services varies significantly by state. It is essential to research local rates to understand the financial implications of long-term care in specific areas.

Can families self-insure against long-term care costs?

Yes, families can consider self-insuring against long-term care costs, which involves saving and planning assets to cover potential expenses. However, this requires a careful assessment of one’s financial situation and future care needs.

What additional steps should one take when considering long-term care planning?

In addition to considering long-term care insurance, individuals should create advance healthcare directives and discuss potential caregiving roles with family members to ensure a well-rounded plan.

| Key Points |

|---|

| 1 in 7 Americans will spend at least $100,000 out-of-pocket for long-term care. |

| Health insurance and Medicare do not generally cover long-term care services. |

| Many households lack long-term care insurance and public programs like Medicaid have strict qualification criteria. |

| 57% of Americans aged 65 today are expected to require long-term care. |

| The average future cost of long-term care for someone turning 65 is around $122,400. |

| Monthly costs can average $6,300 for home health aide services and $9,700 for nursing home care. |

| Planning and discussing long-term care needs early can help mitigate financial burdens. |

Summary

Long-term care costs can be a significant concern for many Americans, with 1 in 7 expected to spend over $100,000 out-of-pocket. The lack of coverage from health insurance and Medicare leaves many unprepared for the potential expenses associated with long-term care. With the aging population and increasing longevity, it is crucial for families to proactively address long-term care needs to mitigate financial risks. Early discussions, proper planning, and exploring insurance options may help alleviate some of the inevitable costs associated with long-term care.