Bitcoin Predictions: Kiyosaki Sees $250K This Year

As the financial landscape continuously evolves, many enthusiasts are eagerly awaiting bitcoin predictions that hint at the cryptocurrency’s future trajectory. Notable voices in the investment world, such as Robert Kiyosaki, have forecast that bitcoin could reach astonishing heights—$250,000 this year—thanks to the turmoil faced by central banks and the increasing value of hard assets. With 2023 shaping up to be a pivotal year for bitcoin price prediction, investors are keen to understand why buy bitcoin is becoming a common question for many seeking to navigate these turbulent times. Amidst discussions of bitcoin vs gold, Kiyosaki’s insights bolster the argument for investing in bitcoin as a strategic move to safeguard one’s wealth against economic uncertainty. This trend of seeking refuge in cryptocurrencies is not just rooted in speculation; it reflects a deeper understanding of financial resilience in the face of rampant devaluation.

In today’s rapidly shifting economy, the conversation around cryptocurrency is heating up, especially regarding forecasts surrounding digital currencies like bitcoin. Financial thought leaders, including Robert Kiyosaki, are shedding light on the potential surge of bitcoin as traditional banking systems face unprecedented challenges. With many investors asking about the predicted bitcoin value and its appeal compared to traditional assets, the shift towards digital currencies seems inevitable. The dialogue around hard assets, including bitcoin, is highlighted as essential for preserving wealth, particularly as economic anxieties mount globally. This intriguing intersection of inflationary fears and the allure of blockchain technology is shaping a new narrative for those considering their options in an increasingly volatile market.

Robert Kiyosaki’s Bitcoin Predictions for 2023

In the face of deteriorating economic conditions, Robert Kiyosaki has made a bold prediction for bitcoin, anticipating it could surge to $250,000 within this year. His viewpoint is deeply influenced by the instability of central banking systems, which he claims are a ticking time bomb for traditional fiat currencies. Kiyosaki firmly believes that as these banks face increasing collapses and bankruptcies, investors will flock to hard assets such as bitcoin to preserve their wealth. With the supply cap of bitcoin set at 21 million coins, he sees it as a more reliable store of value compared to gold, especially in times of economic turmoil.

According to Kiyosaki, the impending financial crises are not just hypotheticals; they are already underway. He asserts that the failure of major central banks could result in mass panic, propelling assets like bitcoin into an unprecedented demand. This trajectory may not only help bitcoin reach soaring prices but also cement its status as a digital gold. Despite skepticism from more traditional investors, Kiyosaki urges individuals to buy into bitcoin rather than sell, framing it as a necessary decision in preparation for the financial upheaval he envisions.

The Case for Investing in Bitcoin

Investing in bitcoin has become increasingly popular, and Robert Kiyosaki strongly endorses this trend, asserting its superiority over conventional investment assets, including gold. He emphasizes that bitcoin represents a revolutionary shift from the traditional system plagued by inflation and economic instability. The transformative nature of bitcoin not only lies in its decentralized attributes but also in its unique ability to act as a hedge against the current financial landscape’s unpredictability.

With central banks printing money at alarming rates, the devaluation of the U.S. dollar raises legitimate concerns for investors across the globe. Kiyosaki’s sentiment resonates with many who are seeking to protect their financial future. The potential for bitcoin to appreciate significantly in value makes it an attractive option for those looking to maintain purchasing power. As more investors begin to realize the implications of the current economic climate, the question remains: why buy bitcoin? Kiyosaki believes that the answer is clear—it is a safeguard against economic collapse.

Why Buy Bitcoin: Insights from Kiyosaki

Kiyosaki’s advocacy for bitcoin is rooted in his belief that purchasing power will continue to diminish as traditional financial systems falter. His warning about the impending collapse of central banks supports the argument for bitcoin as a valuable asset to acquire now. He identifies key reasons to buy bitcoin, including its finite supply, established network security, and its capability to appreciate significantly during market difficulties. These features position bitcoin as an appealing alternative for seeking both wealth preservation and growth.

Moreover, Kiyosaki has presented the argument that as more individuals lose trust in government-backed currencies, the demand for decentralized options like bitcoin will only rise. His views mirror a growing consensus that bitcoin could outperform long-established assets like gold during times of crisis. In a market where asset inflation is rampant, Kiyosaki’s recommendation to ‘keep HODLing’ bitcoin serves as a reminder that patient investors may ultimately reap significant rewards as the financial landscape evolves.

Bitcoin vs Gold: The Investment Debate

The ongoing debate of bitcoin versus gold as a store of value has been rekindled by Robert Kiyosaki’s provocative statements on the superiority of bitcoin. Kiyosaki argues that while gold has traditionally been regarded as the go-to asset in times of economic strife, bitcoin presents unique advantages that make it a stronger candidate for long-term investment. The limited supply of bitcoin sets it apart from gold, offering a digital alternative that could outshine the age-old precious metal as the global economic climate worsens.

Furthermore, Kiyosaki points out that the accessibility and portability of bitcoin make it a more favorable option for modern investors. Where gold requires physical storage and carries additional security concerns, bitcoin can be easily transferred and held in digital wallets. This contrast highlights a pivotal shift in investment strategies as new generations of investors seek more efficient, innovative means to safeguard their financial futures, potentially leading to a significant pivot away from gold in favor of bitcoin.

The Impact of Central Bank Policies on Bitcoin Investments

Kiyosaki’s predictions about bitcoin are tightly woven with his viewpoints on central bank policies and their profound impacts on the economy. He posits that the reckless financial maneuvers of central banks are leading to an inevitable collapse, which in turn could trigger a boon for hard assets like bitcoin. As individuals witness the repercussions of ineffective monetary policy, the demand for alternative assets is likely to escalate, driving bitcoin prices higher on the market.

By urging potential investors to focus on bitcoin, Kiyosaki implies that understanding central bank operations is crucial for making informed decisions in today’s investment landscape. He believes that bitcoin, as a hedge against inflation and economic failure, is not just a speculative digital currency, but a key component of a robust investment strategy. As central banks face increasing scrutiny, Kiyosaki’s call to action serves as both a warning and an opportunity for those willing to adapt to a changing economic reality.

Understanding Bitcoin’s Limited Supply and Its Value

One of the fundamental strengths of bitcoin—fortified by Kiyosaki’s insights—is its limited supply of 21 million coins. This characteristic distinguishes bitcoin from fiat currencies, which can be printed in unlimited amounts by central banks, leading to inflation and potential loss of value. Kiyosaki emphasizes this point to illustrate why bitcoin could be a more reliable investment, propelling his prediction that its value may soar amid economic turbulence. The scarcity of bitcoin is a crucial factor in its valuation, as it ensures that demand can potentially outstrip supply.

As more investors come to terms with the realities of inflation and currency devaluation, the demand for scarce assets like bitcoin is likely to increase. Kiyosaki’s advocacy reflects a broader trend wherein individuals and institutions are recognizing the importance of asset scarcity in wealth preservation. This situation suggests that as central banking systems falter, the psychological and economic factors propelling investors towards bitcoin will continue to grow, underpinning its value and solidifying its place in investment portfolios.

Kiyosaki’s Perspective on Economic Recession and Bitcoin

Robert Kiyosaki has consistently asserted that we are on the brink of an economic recession that could have far-reaching consequences. With his emphasis on the potential pitfalls associated with traditional investment avenues, he has positioned bitcoin as a safe harbor amid a stormy financial climate. According to Kiyosaki, the ongoing turmoil reflects a need for investors to rethink their strategies and prepare for a potential downturn by including alternative assets like bitcoin in their portfolios.

His assertive predictions about the recession underline the urgency for individual investors to take proactive measures. Kiyosaki advocates for buying bitcoin, suggesting that it could act as a buffer against the economic fallout he anticipates. By diversifying investments to include bitcoin, individuals can better shield themselves from the potential devaluations of traditional currencies and the fallout from mass bankruptcies, making it an appealing option during volatile times.

Navigating the Bitcoin Market: Tips for Investors

Kiyosaki’s insights extend beyond just making bold predictions about bitcoin prices; he offers practical advice for navigating the tumultuous bitcoin market. One of his key recommendations is to maintain a long-term perspective when investing in bitcoin. He believes that, despite the current volatility, patient investors willing to hold their assets will ultimately see significant returns as bitcoin adoption grows and its value stabilizes, particularly during economic upheavals.

In addition, Kiyosaki emphasizes the importance of information and education in boosting investor confidence in bitcoin. By understanding the intricacies of how bitcoin operates, including its distinct advantages over traditional assets, investors can make more informed decisions. Keeping abreast of market trends and economic developments is also critical; as Kiyosaki suggests, awareness of external factors affecting central banks must inform your investment strategy in bitcoin. Such knowledge empowers investors to not only buy bitcoin responsibly but also to hold it through market fluctuations.

The Future of Bitcoin Investment: Kiyosaki’s Vision

Looking forward, Kiyosaki envisions a future where bitcoin is not just a speculative asset but a fundamental component of sound financial planning. As the global economic landscape shifts and more people recognize the failings of traditional banking systems, Kiyosaki argues that bitcoin could become an integral part of everyday transactions as well as long-term wealth accumulation. He challenges investors to see the potential for bitcoin to redefine the notion of currency and value in a modern economy.

Kiyosaki’s vision resonates with a growing movement toward cryptocurrency as the ‘future of money.’ By predicting high bitcoin valuations amidst central bank failures, he encourages both novice and seasoned investors to rethink how they perceive wealth preservation and investment strategies. As societal acceptance and regulatory frameworks evolve, Kiyosaki foresees bitcoin not just as an investment vehicle, but as a cornerstone of a new financial system.

Frequently Asked Questions

What is Robert Kiyosaki’s bitcoin price prediction for 2023?

Robert Kiyosaki predicts that bitcoin will reach $250,000 by the end of 2023, citing the collapse of central banks and increasing interest in hard assets.

Why should I consider investing in bitcoin according to Robert Kiyosaki?

Investing in bitcoin is encouraged by Robert Kiyosaki as a response to the devaluation of the U.S. dollar and the predicted economic downturn, emphasizing bitcoin’s limited supply as a safeguard for wealth.

How do Bitcoin predictions relate to the current economic situation?

Bitcoin predictions are linked to the current economic climate where failing central banks are expected to trigger mass bankruptcies, driving investors towards hard assets like bitcoin.

Is it better to buy bitcoin or gold according to expert predictions?

Experts like Robert Kiyosaki suggest that bitcoin may outperform gold due to its limited supply and potential for massive growth in the face of economic instability.

What are the long-term forecasts for bitcoin value based on expert opinions?

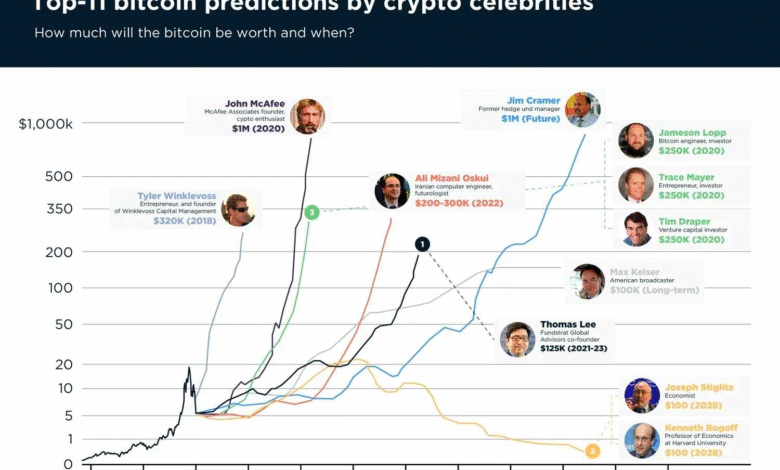

Long-term forecasts for bitcoin suggest significant price increases, with predictions of $1 million per bitcoin in the future, especially as concerns about the U.S. dollar’s devaluation rise.

Why is Robert Kiyosaki’s bitcoin prediction taken seriously?

Robert Kiyosaki’s bitcoin prediction is taken seriously because of his influential voice in financial literacy and his consistent, pessimistic outlook on traditional banking systems. His advice to keep buying bitcoin is based on perceived secure value amidst economic chaos.

Can bitcoin be a safeguard against economic collapse as suggested by predictions?

Yes, predictions suggest that investing in bitcoin can serve as a safeguard against economic collapse, aligning with Kiyosaki’s views on bitcoin’s resilience during financial crises.

What factors influence bitcoin vs gold discussions in market predictions?

Factors such as limited supply, market demand, and economic uncertainty influence discussions around bitcoin vs gold, with many experts advocating for bitcoin as a more dynamic investment choice.

What did Robert Kiyosaki say about holding onto bitcoin during economic turmoil?

Robert Kiyosaki has emphasized the importance of holding onto bitcoin during economic turmoil, urging investors to ‘HODL’ as he believes its value will continue to rise amid financial instability.

How can I stay updated on bitcoin predictions and market trends?

To stay updated on bitcoin predictions and market trends, follow reputable financial news sources, subscribe to various financial analysis platforms, and monitor social media updates from influential figures like Robert Kiyosaki.

| Key Points |

|---|

| Robert Kiyosaki predicts bitcoin will reach $250,000 this year due to bank failures and economic collapse. |

| He believes that the collapse of central banks will increase the value of hard assets like bitcoin, gold, and silver. |

| Kiyosaki emphasizes the limited supply of bitcoin (21 million) as a key reason for its value. |

| He warns of economic turmoil and encourages investors to continue holding onto these assets and buy more bitcoin. |

| Previous forecasts indicated Bitcoin could even rise to $1 million amid global panic and economic downturn. |

Summary

Bitcoin predictions reveal a bullish outlook for the cryptocurrency, driven by the anticipated collapse of central banks and economic instability. Robert Kiyosaki’s unwavering confidence in bitcoin’s potential to soar to $250,000 this year stems from his belief in high demand for hard assets during financial crises. As economic pressures mount and central authorities face increasing scrutiny, Kiyosaki’s advice to invest in bitcoin reinforces the notion that it may serve as a critical hedge against declining fiat currencies. Investors are urged to stay the course and HODL as the market evolves.