Stock Market Outlook for May 19-23, 2025: Key Insights

The stock market outlook for the coming week is filled with anticipation as Wall Street gears up for important developments regarding trade agreements and consumer sentiment. With investors keenly focused on how the market will respond to last week’s surge, key indicators will play a significant role in shaping expectations. As news unfolds around potential tax cuts and their impact on economic conditions, traders will be on the lookout for signs of life in consumer spending. Recent stock market news indicating a rebound from April’s lows has sparked optimism, but uncertainty surrounding trade agreements could dampen enthusiasm. Ultimately, the upcoming week will be pivotal for the stock market outlook, as it navigates between recovery and volatility.

In assessing the financial markets, analysts are increasingly examining Wall Street’s trajectory as it heads into a crucial period next week, specifically from May 19 to 23, 2025. The dynamics of stock performance are influenced not just by trade negotiations but also by prevailing consumer attitudes and their spending habits. With ongoing discussions about tax legislation, the ramifications on economic stability are substantial, reverberating through the market. Traders are particularly interested in how retailers adjust pricing strategies in response to tariff changes, which could provide insights into consumer behavior. As these elements converge, understanding the market’s pulse will require careful monitoring of these evolving economic indicators.

Stock Market Outlook: Key Factors to Watch Next Week

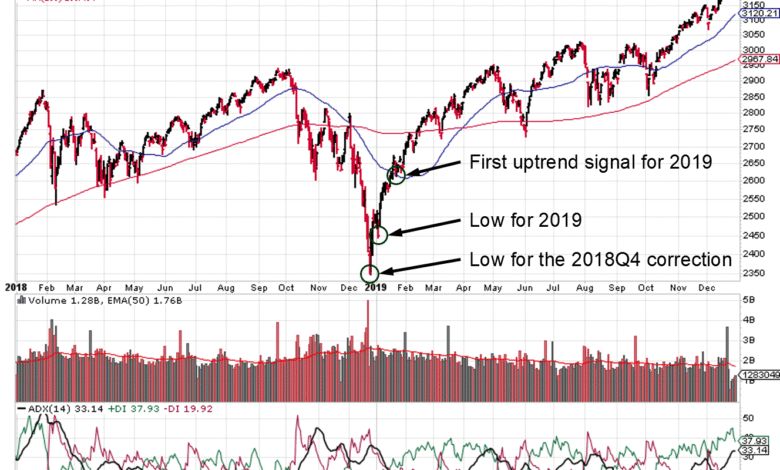

As Wall Street gears up for the upcoming week of May 19-23, 2025, attention will be focused on critical developments that could impact the stock market. Key indicators such as consumer sentiment and ongoing trade negotiations between the U.S. and China will set the tone for investor reactions. Analysts remain cautiously optimistic, suggesting that while recent agreements may indicate stability, the market’s ability to sustain momentum is uncertain without continued positive developments. Investors will be keen to observe how the S&P 500 reacts, especially after its recent rebound from April’s trough.

In the wake of significant tariff negotiations, the underlying sentiment among traders reflects a blend of hope and caution. The S&P 500’s impressive recovery, driven mainly by tech giants, demonstrates a short-term bullish trend. However, historical patterns warn against over-optimism, as investors should remain aware of potential volatility that may arise due to fluctuating economic data. The outcome of next week’s consumer reports and any further announcements regarding tax cuts will play a pivotal role in shaping the stock market outlook.

The Impact of Consumer Sentiment on Market Trends

Consumer sentiment is a crucial metric that can significantly influence stock market trends. Recent data showing a drop to the second-lowest reading on record points to uncertainty among consumers, which may manifest as cautious spending habits. Retailers, such as Home Depot and Target, are set to report earnings that could provide insights into consumer behavior. The impacts of tariffs imposed by the Trump administration could affect retail pricing strategies and, consequently, consumer confidence.

Furthermore, the varying responses of major retailers to potential price increases due to tariffs will be closely monitored. Analysts predict that insights from earnings reports will reveal how companies are adjusting their pricing structures in light of elevated tariffs. This anticipation creates a pivotal moment for investors, as retail earnings may herald changes in consumer behavior that could ripple through the stock market. If companies show resilience in the face of increasing prices, it could bolster confidence among investors leading into a potentially explosive fiscal quarter.

Trade Agreement Effects: What’s Next for Wall Street

The recent agreement between the U.S. and China presents a glimmer of hope for Wall Street, yet the sustainability of this rally is in question. The temporary reduction of tariffs has sparked optimism, but traders remain acutely aware of the fragility of trade relations. Continuous positive headlines are essential for maintaining investor confidence and ensuring stocks do not retreat from their recent gains. Market strategists highlight that amidst the positive developments, vigilance regarding new trade negotiations is necessary as they can dramatically influence investor sentiment.

As discussions evolve, it will be critical to monitor how new agreements affect various sectors, particularly technology, which has been a major driver of the recent market surge. Companies in the tech sector, like Nvidia and Meta Platforms, have shown significant growth due to favorable trade conditions. However, uncertainty related to upcoming negotiations could create waves of volatility if expectations fall short, urging investors to weigh their positions carefully in the face of these unfolding trade dynamics.

The Influence of Tax Cuts on Market Stability

As House Republicans push forward with President Trump’s tax agenda, market analysts are acutely aware of the potential ramifications for the stock market. The recent approval of tax breaks by the House Ways and Means Committee highlights a significant policy shift that may invigorate investor confidence. If successful, the tax cuts could lead to enhanced disposable income and spending, thus supporting economic growth and benefiting corporate profits, which directly influences stock prices.

However, the challenges faced in advancing this comprehensive agenda raise concerns regarding market stability. A setback encountered by House Republicans could lead to increased skepticism among investors about the government’s ability to stimulate economic growth through fiscal policy. This uncertainty may create headwinds as markets react to the conflicting signals from Washington. Analysts advise investors to stay updated on legislative progress, as any significant changes in tax policy could ripple across sectors and influence market performance.

Analyzing the Economic Landscape: Volatility Ahead?

Given the mixed economic indicators, investors should brace for potential volatility ahead. As various economic reports emerge, the stock market may react strongly to data reflecting consumer spending, tariffs, and employment trends. The recent caution expressed by experts in light of the S&P 500 reaching new heights serves as a reminder of the unpredictability inherent in market dynamics. Investors are encouraged to keep an eye on broader economic trends which may contradict optimistic headlines, thereby influencing stock market stability.

Additionally, historical data suggests a cautious approach towards investing during periods of uncertainty. The looming possibility of increased volatility can be attributed to conflicting economic indicators that may lead to market corrections. With analysts forecasting that lower consumer sentiment may persist, awareness of the broader economic landscape is vital for informed investment strategies. It’s critical that investors remain adaptable and prepared for unforeseen market shifts.

Tech Stocks: The Driving Force Behind Market Gains

The resurgence of tech stocks has been a significant factor in the recent rally observed in the stock market. Companies like Tesla and Amazon have posted remarkable gains, contributing to the overall positive trend seen in the S&P 500. This sector has benefited substantially from favorable trade conditions, and their performance offers a glimpse into the market’s resilience. Given that major tech firms account for a large share of market gains, their ongoing success is crucial for sustaining investor confidence.

However, as political and trade uncertainties persist, the tech sector must navigate potential headwinds that could impede growth. With tariffs threatening profit margins, investors are keenly interested in how tech giants will adapt to maintain growth trajectories. The ability of these companies to pass on costs without losing consumer demand will be pivotal in their upcoming earnings reports. Thus, market participants should closely monitor this sector, as its fortunes may very well dictate broader market trends moving forward.

Earnings Reports: What They Mean for Investor Decisions

Next week’s earnings reports from key retailers such as Walmart and Target promise crucial insights into consumer sentiment and spending behavior. These earnings will not only reflect the companies’ performance but also their responses to the prevailing economic conditions, including tariffs and fluctuating consumer confidence. Retail sector performance underpins vital facets of the economy and thus holds significant implications for investor strategies.

Investors will scrutinize these reports for signs of resilience or vulnerability that could influence stock prices. Should retailers signal strong earnings despite ongoing tariff pressures, it could bolster confidence in the broader market. Conversely, if results come in weaker than expected, this might lead to caution and a re-evaluation of investment strategies focusing on consumer-driven sectors. Ultimately, these upcoming earnings reports will serve as barometers for market expectations in a fluctuating economic landscape.

The Relationship Between Trade Policy and Market Recovery

The ongoing uncertainty surrounding U.S. trade policy poses significant challenges for market recovery efforts. Investors are keenly aware that any developments regarding tariffs could dramatically shift the current market momentum. The recent optimism following tariff reductions risks being countered by frustration or uncertainty stemming from new negotiations. The potential shifts in trade agreements are of utmost significance to investors looking to gauge future market movements.

Furthermore, any retraction in trade policies may lead to a reconsideration of stock valuations across various sectors. The market’s ability to sustain its recent rally will depend heavily on how policymakers navigate these negotiations moving forward. Continued discussions are likely to stir investor sentiment, emphasizing the importance of maintaining a watchful eye on trade developments as they unfold over the coming weeks.

Market Predictions: Navigating Uncertain Waters

As Wall Street prepares for the week ahead, predictions abound regarding market performance in an environment characterized by uncertainty. Experts forecast that while the market could stabilize based on recent agreements, potential volatility remains a credible concern. Analysts predict that stock prices may be influenced dramatically by incoming economic data and trade developments, emphasizing the importance of strategic navigation for investors.

Consequently, investors should consider maintaining a diversified portfolio and leveraging insights from market analysts to weather potential shifts in sentiment. Understanding the intricate relationship between fiscal policies, consumer behaviors, and trade agreements is critical for making informed decisions. In light of these complexities, setting realistic expectations and being prepared for unexpected market reactions will be essential for capitalizing on opportunities while mitigating risks.

Frequently Asked Questions

What is the stock market outlook for May 19-23, 2025, concerning trade agreements?

The stock market outlook for the week of May 19-23, 2025, suggests cautious optimism, with a focus on trade agreements between the U.S. and China. Investors are eager for further details that could influence market momentum as trade uncertainty looms. Analysts highlight that while recent agreements have spurred growth, maintaining this momentum hinges on continued positive trade news.

How do upcoming retail earnings impact the stock market outlook this week?

The stock market outlook this week is significantly influenced by upcoming retail earnings reports from major companies like Home Depot and Target. These reports will provide critical insights into consumer sentiment and spending patterns, which are vital for understanding the economic landscape amid ongoing trade tensions and potential inflation due to tariff impacts.

What role does consumer sentiment play in the stock market outlook?

Consumer sentiment is a key factor in the stock market outlook, especially as uncertainty around tariffs affected confidence, leading to a drop in sentiment readings. A positive shift in consumer sentiment can support stock prices, whereas continued challenges may lead to volatility and weigh on market performance as investors monitor consumer spending closely.

How might tax cuts influence the stock market outlook this week?

The stock market outlook this week is also affected by the progress of tax cuts proposed by Republican lawmakers. If the tax bill moves forward, it could provide a short-term boost to investor sentiment and spending. However, concerns about potential increases in the deficit associated with these tax cuts could pose risks for market stability.

What factors could lead to volatility in the stock market next week?

Several factors could contribute to volatility in the stock market outlook next week, including the reaction to retail earnings, consumer sentiment trends, and ongoing trade agreements. Additionally, uncertainty around tax legislation could create further market fluctuations as investors react to new economic data and political developments.

What key indicators should investors watch for in the stock market outlook next week?

In the stock market outlook for next week, investors should watch for trade agreement updates, consumer sentiment reports, and retail earnings results. These indicators will be crucial for gauging economic health and potentially influencing market trends amidst the current climate of uncertainty and recent market surges.

How does Wall Street’s current sentiment impact the stock market outlook?

Wall Street’s current sentiment, marked by a recent surge in stock prices, plays a significant role in the stock market outlook. If investors remain optimistic about trade progress and consumer spending, stocks may maintain upward momentum. However, analysts caution that if sentiment shifts due to economic data or lack of trade clarity, it could lead to a pullback.

What does the recovery of the S&P 500 indicate for the stock market outlook?

The recovery of the S&P 500, which has reclaimed its losses from the April tariff announcement, suggests a potentially positive stock market outlook. Yet, experts warn that this recovery may face challenges if trade uncertainties or economic indicators do not align with current investor optimism.

| Key Points | Details |

|---|---|

| Market Overview | Wall Street is focusing on trade details and consumer spending, with a recent surge in the S&P 500 after a U.S.-China trade agreement. |

| Trade Developments | Investors are waiting for more trade news as market momentum could struggle without additional positive developments. |

| Consumer Sentiment | Consumer sentiment dropped in April, and retail earnings reports from Home Depot and Target are awaited for further insight. |

| Tax Legislation | House Republicans are making efforts to advance a tax bill, but have faced setbacks that could complicate the legislative process. |

| Market Predictions | Caution is advised as historical trends suggest potential volatility ahead, with concerns about sustaining current levels. |

Summary

The stock market outlook for the coming week indicates a critical juncture for investors, with various underlying factors shaping market dynamics. As we look forward to the week of May 19-23, 2025, Wall Street’s performance will heavily rely on the unfolding trade relations between the U.S. and China, along with upcoming consumer sentiment insights. The recent rally spurred on by tariff reductions may face challenges in maintaining momentum if positive trade signals do not materialize. Thus, the stock market outlook suggests a blend of cautious optimism and anticipation of potential volatility.