Stablecoins: VCs See Them as Crypto’s Killer App

Stablecoins are revolutionizing the cryptocurrency landscape by offering a stable alternative to the often volatile digital assets found in the crypto investment sphere. These innovative coins are designed to peg their value to stable assets, such as fiat currencies, effectively mitigating price fluctuations and providing a safe haven for investors. Venture capitalists have shown a keen interest in the stablecoin market growth, having recognized it as a potential “killer app” for the crypto industry, especially in light of ongoing geopolitical tensions. Notably, companies like Circle, which is preparing for an IPO, further highlight the growing institutional embrace of stablecoins as a practical solution for payment and remittance applications. With these developments, the utility of stablecoins in the broader crypto ecosystem continues to expand, attracting more interest from both retail and institutional investors alike.

Digital currencies known as stablecoins are capturing the attention of investors who are seeking reliable options in a fluctuating market. These assets maintain their value by being linked to more stable commodities, promising a degree of predictability that many traditional cryptocurrencies lack. The increasing backing from venture capitalists emphasizes the role of stablecoins in reshaping financial transactions, as highlighted by the recent trends in market capitalizations and anticipated IPO movements, particularly from Circle. Such innovations suggest a promising trajectory for the sector, where stable assets serve not only as a store of value but also enhance intercompany exchanges and daily transactions. As these tools become integral to the crypto utility landscape, their significance in financial operations is becoming undeniably clear.

The Rise of Stablecoins in Cryptocurrency Investment

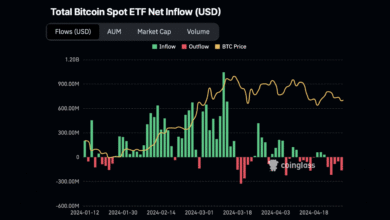

Stablecoins are rapidly gaining traction within the cryptocurrency investment space, providing a stable alternative to the volatility typically associated with traditional cryptocurrencies. As the market experienced significant fluctuations influenced by geopolitical tensions, such as the U.S. trade war, stablecoins proved their resilience by increasing in market capitalization. With a growing capital inflow of $25 billion, reaching $227.1 billion, stablecoins encapsulate a pivotal moment in crypto investment by offering a reliable medium for transactions and risk mitigation during turbulent market conditions.

Venture capitalists (VCs) are beginning to sharply focus on the utility of stablecoins, viewing them as a cornerstone of the crypto ecosystem. Their ability to facilitate dollar-denominated transactions positions stablecoins as crypto’s ‘killer app’. This perception encourages VCs to invest in businesses that integrate stablecoin functionality into their operations, enhancing the overall stability and usability of cryptocurrencies as a financial tool. Furthermore, the persistent demand for reliable payment solutions underlines the growing integration of stablecoins within traditional financial frameworks.

Venture Capital Trends Surrounding Stablecoin Market Growth

The stablecoin market’s growth coincides with increasing interest from venture capitalists looking to innovate within the cryptocurrency landscape. The Pitchbook report highlights that even amidst market volatility, VCs are optimistic about investments in companies that harness the capabilities of stablecoins, especially in the realms of payment processing and treasury management. This reflects a broader trend where VC firms search for ventures that ensure revenue generation through stablecoin velocity, solidifying the financial infrastructure necessary for cryptocurrency to thrive.

Interestingly, this investment trend signals a transformation in how VCs view the crypto market post-U.S. trade tensions. While some areas experienced downturns, the focus on stablecoins has emerged as a beacon of opportunity. Predictions suggest that as businesses begin to innovate around stablecoin applications, there will be an influx of funding directed toward solutions that address current market weaknesses, particularly regarding security and proof of reserves. Therefore, the stablecoin narrative continues to develop, strengthening its investment appeal among VCs.

Circle’s IPO: A Potential Catalyst for Crypto Utility and Stablecoins’ Validation

Circle’s impending initial public offering (IPO) stands out as a significant development for the stablecoin market and the broader cryptocurrency ecosystem. The successful launch of Circle’s IPO could validate the stablecoin model, potentially providing the necessary credibility that could boost stablecoin adoption across various sectors. As the IPO garners attention, it might stimulate further investment into crypto payments and infrastructure, showcasing the stability that investors seek in uncertain times.

If Circle’s IPO succeeds, it could push the stablecoin narrative to new heights, attracting more institutional investors toward crypto assets. The implications of this event could also lead to increased demand for more efficient payment solutions bolstered by stablecoins. Such advancement in the market could pave the way for growth in venture capital funding directed toward projects that guarantee stability and security in crypto utility, further consolidating the role of stablecoins as essential instruments in the evolving financial landscape.

Addressing Security Concerns in the Stablecoin Ecosystem

Recent incidents, including the Bybit hack, have brought security concerns within the cryptocurrency space to the forefront, emphasizing the need for robust protective measures in the stablecoin ecosystem. For venture capitalists to feel confident in investing in startups that leverage stablecoins, there is an urgent need for enterprises to implement real-time proof-of-reserve systems and sophisticated middleware solutions. This distinguishes stablecoin-backed applications as trustworthy options amidst concerns about data breaches and financial security.

The recent security challenges have highlighted the importance of addressing vulnerabilities not just for market stability but also for attracting institutional interest. Startups focusing on enhancing security protocols for stablecoin management could see a surge in investments from VCs eager to mitigate risks. As these measures become increasingly crucial, the symbiotic relationship between stablecoins and security advancements will likely set a strong foundation for future growth in the overall crypto market.

The Future of Stablecoins and Crypto Infrastructure

The ongoing evolution of stablecoins is expected to shape the future of the cryptocurrency infrastructure dramatically. With venture capital backing and increasing market adoption, stablecoin applications are set to expand, allowing crypto utility to permeate various industries, from fintech to retail. This widespread integration will establish stablecoins not just as transactional mediums but as essential components of a more resilient financial ecosystem.

As we move toward a more ‘fundamentals-driven’ investment climate, reinforced by improvements in crypto infrastructure, stablecoins will play a pivotal role in this transformation. By bridging the gap between traditional finance and the digital asset space, stablecoins are set to redefine payment processes and investment strategies. By supporting innovations and security adaptations, the stablecoin ecosystem can foster a new wave of crypto adoption and application.

Frequently Asked Questions

What are stablecoins and why are they important in the crypto investment space?

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve asset, typically a fiat currency like the US dollar. They are important in the crypto investment space as they provide a hedge against volatility, enabling investors to enter and exit positions in a more stable manner, thus making them critical for trading and remittance applications.

How is the stablecoin market benefiting from venture capital stablecoins?

Venture capital firms are increasingly investing in stablecoins because they see them as a ‘killer app’ in the crypto environment. As the stablecoin market grows, both in terms of market capitalization and infrastructure, these investments help foster innovations and real-world applications that enhance transactional efficiency and reliability across various crypto initiatives.

What is driving the stablecoin market growth despite broader market downturns?

The stablecoin market growth, which has seen an increase in market capitalization by $25 billion, is driven by its perceived stability and utility. Even amid volatility in most cryptocurrencies, stablecoins offer a reliable means for transactions and settlements, making them attractive to both institutional and retail investors looking for safer investment avenues.

What implications does Circle’s IPO have for stablecoins and the broader crypto market?

Circle’s IPO is anticipated to be a pivotal event for the stablecoin market, as it could validate the stablecoin model and spur increased participation from institutional investors. A successful IPO could enhance the credibility of stablecoin solutions in crypto payments and infrastructure, driving further adoption and potentially increased valuations in related sectors.

How are security concerns impacting stablecoin adoption in the crypto sector?

Security concerns, highlighted by incidents like the Bybit hack, have prompted venture capitalists to demand more robust security measures in the stablecoin sector. Startups that focus on addressing these security issues, including real-time proof-of-reserve tooling, will likely attract increased funding, as VCs seek to ensure stablecoins are safe for broader adoption.

What role do stablecoins play in payment and treasury management startups?

Stablecoins are crucial for payment and treasury management startups as they facilitate instant transactions and reduce risk exposure typically associated with traditional currencies. This capability makes stablecoins a preferred choice for businesses that require a stable digital currency for operational efficiency and improved financial management.

Why have retail speculations cooled down in the stablecoin market?

Retail speculations have cooled down in the stablecoin market due to the overall decline in memecoin volumes and shifting liquidity towards more promising blockchains. This slowdown has resulted in reduced trading activity within speculative scenarios, leading investors to focus more on stable investments, including stablecoins for security during market fluctuations.

What is the future outlook for stablecoins in the crypto ecosystem?

The future outlook for stablecoins in the crypto ecosystem appears to be promising, driven by continued VC interest, growth in infrastructure, and evolving market dynamics. As stablecoins become more integrated into payment systems and face fewer regulatory challenges, they are likely to play an essential role in the overall maturation and adoption of cryptocurrencies.

| Key Point | Description |

|---|---|

| VCs’ Focus Amidst Geopolitical Tensions | Despite market declines due to trade wars, VCs are focusing on the utility of cryptocurrencies, specifically stablecoins. |

| Growth in Stablecoin Market Cap | The market cap for stablecoins increased by $25 billion to $227.1 billion, demonstrating their resilience and appeal to VCs. |

| Dollar-Denominated Settlement | Stablecoins are seen as crypto’s ‘killer app’ for their ability to offer stability and insulation from volatility. |

| Increasing VC Investments | VC investments in payment, remittance, and treasury management startups utilizing stablecoins are expected to rise. |

| Security Concerns and Institutional Demand | Addressing security issues like hacks is essential; institutional investors seek proof-of-reserve solutions. |

| IPO Prospects | Circle’s IPO may validate the stablecoin model and boost the overall crypto market. |

| Future Market Outlook | The market is shifting towards a fundamentals-driven environment as stablecoins and infrastructure improve. |

Summary

Stablecoins are emerging as a pivotal component in the cryptocurrency landscape, especially as venture capitalists recognize their potential as a stable and reliable investment. The significant growth in stablecoin market capitalization highlights their resilience amidst market volatility influenced by geopolitical factors. As the cryptocurrency ecosystem continues to evolve, the increasing focus on addressing security concerns and the potential validation from future IPOs like Circle’s further solidify stablecoins’ role in transforming the financial landscape.