Crypto Adoption: Why Payment Potential Remains Untapped

Crypto adoption is at a critical juncture as it continues to struggle in the payments sector, where traditional systems still dominate. Despite optimistic projections, many enthusiasts find themselves questioning why digital currency has not yet displaced established payment methods. Wei Dai, a pioneer who designed the b-money system, a precursor to Bitcoin, voiced his concerns regarding the slow uptake of crypto payments. His observations highlight the systemic issues in the financial landscape that hinder stablecoin adoption and everyday use of cryptocurrencies. As the market evolves, it becomes increasingly essential for stakeholders to address these barriers to foster a genuine transformation in how we perceive and utilize money.

The integration of cryptocurrency into everyday transactions represents a significant shift in the financial ecosystem. As various forms of digital currency emerge, the potential for alternative payment systems to redefine commerce grows. Industry leaders like Wei Dai are calling for improved mechanisms to facilitate crypto acceptance among businesses and consumers alike. The concept of utilizing stablecoins, which aim to provide price stability, is gaining attention as a viable solution for enhancing transaction efficiency. If the momentum for cryptocurrency continues, it could pave the way for a new era of financial innovation.

The Importance of Crypto Payments in Today’s Economy

In the digital age, the importance of crypto payments cannot be overstated. As more consumers seek fast and efficient transactions, cryptocurrencies offer a compelling alternative to traditional payment systems. With the advent of technologies such as the b-money system proposed by Wei Dai, the potential of cryptocurrencies to facilitate seamless payments has been recognized. However, despite the promising features of digital currency, widespread adoption remains elusive, highlighting the challenges that crypto payment systems must overcome to appeal to mainstream consumers.

One of the key elements driving the push for crypto payments is the need for lower transaction fees compared to the existing banking system. Currently, merchants incur hefty fees—often between 2-3%—for processing credit card transactions. The question arises: why haven’t crypto solutions gained significant traction in retail? Addressing this issue requires a multifaceted approach, including the development of user-friendly payment apps, robust incentives for consumers, and stablecoin options that provide yield. By tackling these barriers, crypto payments can redefine the financial landscape.

Wei Dai’s Criticism of Current Crypto Adoption Trends

Wei Dai, a pioneer who laid the groundwork for cryptocurrencies, has expressed disappointment over the stagnation of crypto adoption, especially in the payments sector. Despite having developed the b-money system decades ago, Dai notes that the current environment still favors traditional financial systems. His insights shed light on the fundamental issues that hinder widespread crypto adoption, such as the lack of consumer and business incentives that make transactions effective and appealing.

Dai emphasizes that for crypto payments to thrive, specific enhancements are essential. He advocates for token incentives and streamlined payment applications that offer features mirroring traditional finance, such as comprehensive account statements and user-friendly interfaces. By aligning technological advancements in digital currency with consumer expectations, the potential for increased crypto adoption in retail payments could significantly improve.

Stablecoin Adoption: A Double-Edged Sword

Stablecoins have been heralded as a solution for the volatility associated with traditional cryptocurrencies, yet their adoption raises critical questions. Wei Dai pointed out that although stablecoins could facilitate transactions, they do not inherently solve the issues related to credit that fiat currencies successfully address. This duality presents a challenge for wallets and exchanges aiming to promote stablecoin usage. The reality remains that consumers and merchants need reliable credit options that currently lack in the crypto ecosystem.

Furthermore, as Congress discusses the GENIUS Act to regulate stablecoins, the ramifications of this legislation will shape the future of crypto payments. If passed, it could provide a framework that enhances the credibility and usability of stablecoins, potentially increasing their adoption. However, without addressing the fundamental issues, such as user incentives and transaction efficiency, even properly regulated stablecoins may fall short of achieving widespread acceptance in the marketplace.

The Role of Regulations in Fostering Crypto Payments

Regulation plays a crucial role in shaping the future landscape for crypto payments. As Wei Dai pointed out, clear guidelines for stablecoin use can foster an environment conducive to greater acceptance among businesses and consumers alike. The GENIUS Act, currently being debated in Congress, aims to clarify the rules surrounding stablecoins, offering hope to advocates of crypto innovation. Proper regulatory structures could facilitate smoother interactions between traditional finance and the crypto world, potentially leading to increased adoption.

However, regulation must balance consumer protections with the need for innovation. It is essential for lawmakers to consider the challenges faced in the crypto payments arena, such as high transaction costs and usability concerns, while crafting policies that do not stifle growth. By creating a regulatory framework that encourages experimentation and supports stablecoin infrastructure, lawmakers can set the stage for transformative changes within the digital currency market.

Consumer Perspectives on Crypto Payments

Understanding consumer perspectives on crypto payments can provide insight into the barriers hindering adoption. Many consumers are still unfamiliar with digital currencies and how they can offer advantages over traditional payment methods. Key factors influencing consumer decisions include security, ease of use, and transaction costs. For widespread crypto adoption in payments to occur, educational initiatives that demystify digital currencies are vital, empowering consumers to actively engage with these new technologies.

Moreover, enticing consumers with tangible benefits such as loyalty rewards or reduced fees for using crypto payments can spur interest. If businesses can illustrate direct advantages of transacting in cryptocurrency over fiat, including faster processing times and potential savings, consumers may become more willing to embrace these innovations. Addressing these aspects is crucial in overcoming the skepticism surrounding crypto payments and facilitating their adoption.

Business Stakeholders and the Future of Crypto Payments

For businesses, adopting crypto payments presents unique challenges and opportunities. While there is potential for cost savings, particularly by bypassing traditional banking fees, many merchants remain hesitant. Wei Dai pointed out the need for point-of-sale applications compatible with crypto transactions to encourage businesses to transition. If effective solutions can address logistics and security concerns, it may pave the way for broader acceptance of cryptocurrencies as valid payment options.

To support this shift, companies must also consider integrating stablecoin options that provide yield to enhance customer engagement. By developing features that align with consumer needs and preferences, business stakeholders can drive crypto payments into the mainstream. This could lead to a shift in the market landscape, where digital currencies play a significant role in day-to-day transactions, ultimately altering the dynamics of commerce.

Technological Innovations Driving Crypto Acceptance

Technological innovations are at the forefront of increasing crypto acceptance in the payments sector. Features such as blockchain technology, decentralized finance (DeFi), and the advent of stablecoins have the potential to revolutionize how transactions are executed. Without these advancements, the obstacles to crypto payments would remain significant, impeding the growth of adoption in both the retail and business landscapes.

Furthermore, the integration of cryptocurrencies into existing payment infrastructures can substantially enhance transaction speed and reduce costs. As platforms recognize the benefits of adopting a hybrid model that incorporates traditional and digital currencies, the path to mainstream acceptance for crypto payments will become clearer. This blend can create a more inclusive financial environment that caters to diverse consumer and business needs.

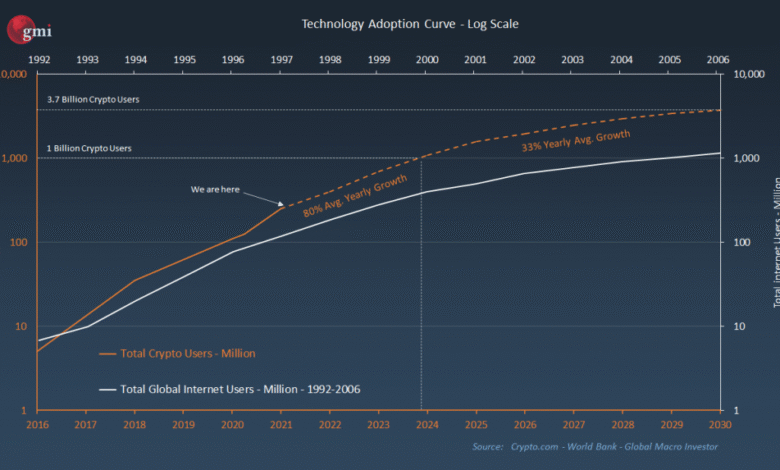

Global Trends in Cryptocurrency Adoption

Global trends in cryptocurrency adoption are indicative of its growing acceptance, yet disparities remain across different regions. While some countries have embraced digital currencies as a means of payment, others have imposed stringent regulations or outright bans. The conversation around crypto payments continues to gain momentum as more stakeholders advocate for a standardized approach, enabling cryptocurrencies to coexist with traditional payment systems.

Examining these trends reveals a nuanced picture of crypto adoption, showing varying levels of comfort and familiarity among consumers. For instance, markets with high inflation rates have seen a surge in crypto usage as individuals look for stable alternatives to traditional currencies. This situation has catalyzed further innovation and dialogue around regulatory measures, inspiring efforts designed to harmonize the coexistence of crypto and fiat in the global economy.

The Future of Payments: Embracing Digital Currency

The future of payments lies in embracing digital currency, with crypto playing an essential role in this paradigm shift. Innovations such as faster transaction processing times and lower fees make cryptocurrencies an attractive option for consumers and businesses alike. Although challenges remain, developments in stablecoins and regulatory clarity can help propel this sector forward, paving the way for a more integrated financial ecosystem.

As societal norms evolve, it will be essential for both consumers and businesses to adapt to the growing prominence of digital currencies. The drive for a more efficient payment system can lead to increased collaboration between traditional financial institutions and crypto companies to create hybrid solutions that blend the best of both worlds. This progression toward a future that actively embraces digital currency holds the potential to reshape not just how we transact, but also how we perceive value in the economy.

Frequently Asked Questions

What are the challenges facing crypto adoption for payments according to industry experts?

Industry experts, including pioneer Wei Dai, point out that crypto adoption for payments faces several challenges. These include the lack of consumer incentives, inadequate payment apps, and the need for traditional finance-grade account statements. Furthermore, the absence of robust regulations and technical infrastructure to facilitate seamless crypto payments hampers growth in this sector.

How can stablecoin adoption improve crypto payments for consumers?

Stablecoin adoption can significantly enhance crypto payments for consumers by offering price stability and yield on savings. This encourages usage, as consumers are more likely to spend digital currencies that maintain their value. Clear regulations surrounding stablecoins can further nurture trust and facilitate smoother interactions between crypto wallets and bank accounts.

Why has crypto not significantly impacted the C2B payments sector?

Despite its potential, crypto has struggled to impact the C2B payments sector largely due to environmental concerns, transaction speed, and the dominance of traditional payment methods. Wei Dai notes that crypto’s shortcomings in these areas prevent it from competing effectively with established systems, which continue to charge high fees for processing transactions.

What role does regulation play in boosting crypto adoption amongst merchants?

Regulation plays a crucial role in boosting crypto adoption among merchants by providing a framework for the use of stablecoins and ensuring compliance with financial standards. Clear guidelines can mitigate concerns about volatility and security, making it easier for businesses to integrate crypto payments using stablecoin accounts, thus expanding the overall market for digital currencies.

What are the key technological requirements for enhancing crypto payment systems?

To enhance crypto payment systems, key technological requirements include user-friendly payment apps, point-of-sale solutions, and reliable off-ramps to convert digital currencies back to fiat. As suggested by Wei Dai, incorporating features like traditional account statements and yield-bearing accounts for stablecoins will further facilitate crypto acceptance among both consumers and businesses.

How does the b-money system relate to current trends in crypto adoption?

The b-money system, designed by Wei Dai, laid the groundwork for modern cryptocurrencies by introducing concepts of digital currency that prioritize privacy and decentralization. Its ideological roots continue to influence discussions on crypto adoption today, particularly regarding efficient payment systems and the potential role of stablecoins in facilitating smoother transactions.

What incentives are necessary to drive consumer crypto adoption?

To drive consumer crypto adoption, incentives must include token rewards, the provision of yield through stablecoin savings accounts, and robust digital payment apps that simplify transactions. Additionally, ensuring seamless on-ramps from traditional banking to crypto ecosystems can encourage wider acceptance and everyday use.

Why is the conversation around stablecoin regulations important for crypto adoption?

The conversation around stablecoin regulations is pivotal for crypto adoption as it can determine how stablecoins can be used and integrated into mainstream finance. Effective regulation will address safety, consumer protection, and encourage broader use of stablecoins for payments, ultimately facilitating a smoother transition in consumer habits from fiat to digital currencies.

What strategies can businesses implement to adopt crypto payments successfully?

Businesses can adopt crypto payments successfully by implementing point-of-sale applications that accept digital currencies, offering stablecoin accounts with attractive yields, and establishing clear off-ramps to facilitate conversions back to fiat when necessary. Additionally, staying updated with regulatory developments will help navigate compliance effectively.

How is the discussion around the GENIUS Act affecting stablecoin adoption in the U.S.?

The GENIUS Act aims to provide clearer regulatory guidelines for stablecoins in the U.S., which could significantly enhance their adoption by ensuring consumer protection and encouraging business integration. If passed, it would create a more favorable environment for financial innovation, fostering greater trust in digital currencies and their potential for widespread payment use.

| Key Point | Details |

|---|---|

| Critique from Wei Dai | Wei Dai criticizes the lack of significant crypto adoption in retail payments despite inefficiencies in fiat systems. |

| Consumer Needs for Adoption | Key developments needed include token incentives, user-friendly payment apps, and stablecoin savings with yield. |

| Business Needs for Adoption | Businesses require point-of-sale apps and stablecoin solutions to streamline operations and enhance adoption. |

| Regulatory Considerations | Clear regulations for stablecoins, as proposed in the GENIUS Act, could facilitate better market adoption. |

Summary

Crypto adoption has yet to realize its full potential, particularly in the payments sector. Despite the effectiveness of traditional payment methods, Wei Dai’s insight highlights significant gaps in the infrastructure and market incentives needed for widespread usage of cryptocurrencies in retail. Addressing these gaps through regulatory clarity and innovative solutions tailored for consumers and businesses alike is crucial for enhancing crypto’s role in everyday transactions.