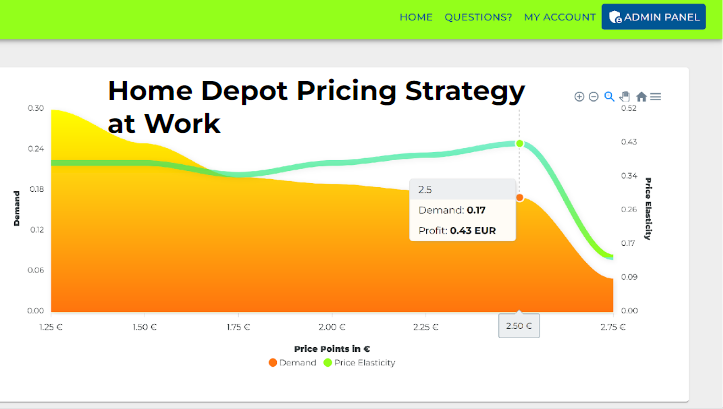

Home Depot Pricing Strategy: No Plans to Raise Prices

Home Depot’s pricing strategy has become a focal point in the ongoing discussion about retail economics, especially as tariffs pose new challenges to the industry. Despite recent pressures, Home Depot CFO Richard McPhail assures investors that the retailer will not raise prices, setting it apart from competitors like Walmart, which is prepared to adjust pricing in response to tariff impacts. Instead, Home Depot aims to maintain its competitive edge by diversifying merchandise sourcing, which is expected to bolster Home Depot sales forecasts. With the company reaffirming its full-year guidance amidst mixed earnings, the implications of such a pricing strategy are significant not just for Home Depot’s profitability but also for its approach in navigating the complexities of tariff impacts on retail. As interest rates climb and the housing market shifts, understanding the home improvement giant’s methods could offer valuable insights into its long-term business strategy.

The strategic approach to pricing at Home Depot has drawn attention due to its implications for both corporate earnings and consumer behavior. As the home improvement retailer navigates a challenging economic landscape marked by fluctuating tariff conditions, maintaining steady prices reflects a calculated decision that may set it apart from its peers in the retail space. CFO Richard McPhail has indicated that, through careful diversification of sourcing and strong supplier relationships, Home Depot is positioning itself to shield its customers from the impact of rising costs. This proactive stance not only aligns with current sales forecasts but also highlights the company’s extensive focus on accommodating the needs of its primarily affluent customer base. Ultimately, the ramifications of this pricing strategy will resonate across the industry, highlighting the interconnected dynamics of consumer trends and retail management.

Home Depot’s Pricing Strategy Amidst Tariffs

Home Depot’s Chief Financial Officer, Richard McPhail, has made it clear that the retailer has no intentions of raising prices despite the increasing tariffs imposed on imports from various countries. This decision is rooted in Home Depot’s robust pricing strategy, which benefits from the company’s scale and long-standing partnerships with suppliers. McPhail emphasized the importance of these partnerships, stating that they have enabled Home Depot to diversify its merchandise sourcing significantly, thereby reducing reliance on a single country like China. This strategic move not only helps mitigate tariff impacts but also allows the company to maintain stable pricing for its customers.

Additionally, Home Depot’s commitment to sustaining its pricing strategy is indicative of its strong business model, which anticipates continued sales growth, despite recent earnings fluctuations. The retailer’s ability to navigate complex tariff landscapes without passing costs onto consumers sets it apart from competitors like Walmart, which has announced impending price increases due to similar tariff pressures. By keeping prices stable, Home Depot aims to retain customer loyalty and ensure consistent sales as they forecast a 2.8% growth in total sales for the year.

Impact of Tariffs on Retail: Home Depot’s Strategy

The recent tariffs imposed by the government have sent ripples through the retail sector, compelling many companies to reconsider their pricing strategies. However, Home Depot has taken a proactive approach by not only diversifying its sourcing but also planning ahead to mitigate potential negative effects of these tariffs. The company’s CFO, Richard McPhail, noted that by reducing dependency on specific countries for imports, Home Depot shields itself from sudden price hikes that could alienate customers. This strategic diversification enables Home Depot to keep prices steady while still offering a wide range of products to home improvement enthusiasts.

This focused strategy highlights Home Depot’s resilience in the face of economic pressures affecting the retail market. As other retailers grapple with the implications of increased tariffs, Home Depot’s ability to maintain its pricing stands as a testament to its financial and operational strategies. The company’s foresight in establishing alternative sources of inventory and commitment to consumer engagement has solidified its position as a leader in the home improvement sector, allowing it to navigate turbulent economic times effectively.

Home Depot Earnings Forecast: Navigating Challenging Markets

Despite an overall challenging market, Home Depot has reaffirmed its earnings forecast for the year, anticipating a modest growth of approximately 2.8% in total sales. CFO Richard McPhail remarked that the retailer has outperformed sales expectations, even while admitting to missing earnings estimates for the first quarter. This performance pattern underscores the company’s resilience and adaptability in a fluctuating economy, where consumer spending dynamics are evolving due to rising interest rates and housing market slowdowns.

The focus on home improvement professionals and the acquisition of SRS Distribution significantly bolster Home Depot’s sales forecast. By targeting a demographic that comprises a robust customer base of homeowners and professionals, the company plays to its strengths. With more than half of its business occurring within the U.S., and strong underlying market fundamentals, Home Depot is well-positioned to weather economic downturns while achieving its sales projections.

Understanding Home Depot’s Business Strategy

Home Depot’s business strategy revolves around significant diversification and understanding market trends to stay ahead of the competition. This approach has allowed the company to remain a preferred choice for home improvement needs among consumers. By focusing on both retail pricing and professional contractor services, the company amplifies its market reach. Additionally, part of their strategy includes targeting affluent customers who are more likely to undertake home improvement projects, contributing to steady sales even in uncertain economic climates.

Moreover, Home Depot’s acquisitions, such as that of SRS Distribution, highlight a strategic shift towards solidifying relationships with contractors and professionals in the industry. These initiatives not only diversify revenue streams but also position the retailer to leverage a growing trend in the home improvement market, as more consumers invest in renovations. Ultimately, Home Depot’s comprehensive business strategy, focused on resilience against market fluctuations, sets a foundation for robust sales and customer loyalty.

Home Depot’s Sales Performance in Fiscal First Quarter

In the fiscal first quarter, Home Depot reported mixed results that highlighted the complexities of the current retail landscape. While the company surpassed revenue expectations with nearly $40 billion, it did not meet earnings per share estimates, indicating pressures on profit margins. This was the first earnings miss since May 2020, reflecting the underlying economic challenges and altered consumer behaviors amid rising interest rates. However, a year-on-year sales increase attributed significantly to the acquisition of SRS Distribution demonstrates Home Depot’s ability to adapt and grow even when traditional metrics are adversely impacted.

McPhail noted that the sales trajectory improved through spring, particularly with seasonal projects ramping up. The company’s commitment to engaging with customers has proven effective, with a 2.1% increase in transactions during the quarter. This growth in customer engagement can be attributed to effective marketing strategies and preparedness for peak sales seasons, indicating that even amidst challenges, Home Depot remains an essential player in the home improvement sector.

How Home Depot Adapts to Seasonal Sales Trends

Seasonality plays a crucial role in Home Depot’s sales, with spring representing a peak period for the retailer. As homeowners engage in home improvement projects related to warmer weather, McPhail emphasized that Home Depot relies heavily on its capacity to capture this seasonal demand. The recent spring Black Friday event, designed to entice customers with discounts, has been well-received, correlating with increasing sales figures in departments like plumbing, electrical, and garden supplies.

However, McPhail also acknowledged that not all categories experienced growth; sales in major renovation projects, such as kitchens and bathrooms, have slowed due to consumer hesitance amidst higher borrowing costs. Therefore, the company must continuously refine its business strategies to align with these shifting trends, ensuring that it remains an attractive option for consumers looking to make their homes a priority as seasons change. This adaptability is key in navigating seasonal downturns while maximizing peak periods.

Customer Engagement Strategies at Home Depot

Customer engagement is at the heart of Home Depot’s strategy to maintain its competitive edge in the retail market. McPhail highlighted how the company has focused on enhancing the shopping experience both online and in physical stores. With the significant growth in e-commerce and over 2% increase in customer transactions during the last fiscal quarter, Home Depot is capitalizing on its online presence while also making in-store shopping more convenient and engaging.

By utilizing data-driven insights and understanding customer preferences, Home Depot can offer tailored promotions and suggestions that resonate with its core audience. This commitment to customer engagement not only strengthens loyalty but also adapts to changing consumer behaviors, a practice that is vital in an evolving retail environment. As homeowners and professionals seek resources for their projects, Home Depot aims to be the leading supplier through strategic engagement across its platforms.

Comparative Analysis: Home Depot vs Competitors

When comparing Home Depot to its competitors, it becomes evident that the company’s unique strategies set it apart in the retail landscape. Unlike retailers such as Walmart, which have struggled with raising prices due to tariff impacts, Home Depot’s resilience in maintaining pricing strategy without sacrificing quality or service showcases its strong operational management. McPhail’s assertions of successfully diversifying supplier sources allow Home Depot to mitigate price increases that could hinder customer relationships.

Furthermore, Home Depot’s focus on affluent customers and professionals enhances its market positioning, attracting a demographic more inclined to invest in home improvement. The company has adeptly positioned itself to capitalize on industry trends, and with a broader selection of products and services, it retains a competitive advantage. These factors have contributed to Home Depot’s strong market performance in the face of challenges that competitors may struggle to overcome.

Frequently Asked Questions

How does Home Depot’s pricing strategy respond to tariffs and market conditions?

Home Depot’s pricing strategy aims to avoid raising prices despite tariffs, as CFO Richard McPhail indicated. The retailer has diversified its merchandise sourcing, maintaining pricing levels through partnerships with suppliers and productivity improvements. This strategy contrasts with competitors who have announced price increases due to tariff impacts, reinforcing Home Depot’s focus on customer retention and competitive pricing.

What impact do tariffs have on Home Depot’s sales forecast?

Home Depot’s sales forecast for the year remains optimistic, expecting a 2.8% growth in total sales and a 1% increase in comparable sales. The company attributes this resilience in its sales forecast to strategic sourcing decisions that mitigate the tariff impact, allowing for stable pricing strategies while maintaining strong customer engagement.

What role does Home Depot’s CFO Richard McPhail play in the pricing strategy?

CFO Richard McPhail plays a crucial role in shaping Home Depot’s pricing strategy. He has emphasized that the company does not plan to raise prices due to tariffs by leveraging its scale and strong supplier relationships. His guidance is vital in navigating financial performance and assuring stakeholders amidst fluctuating tariffs and changing market conditions.

How has Home Depot’s pricing strategy affected its earnings performance?

Home Depot’s pricing strategy has influenced its earnings performance by ensuring stable prices for consumers while still attracting business from home professionals. Despite missing earnings estimates in the first quarter, the company exceeded sales forecasts, indicating that its cautious approach to pricing amid tariff concerns has supported overall business growth.

What are the key factors influencing Home Depot’s pricing strategy amid rising interest rates?

Home Depot’s pricing strategy is influenced by several factors, including rising interest rates which slow the housing market, tariff impacts, and customer behavior trends. The company responds by maintaining pricing levels, attracting professional customers, and expanding its product offerings through acquisitions, such as SRS Distribution, to ensure competitive positioning in a challenging market.

How does Home Depot’s pricing strategy compare to that of Walmart?

Home Depot’s pricing strategy remains stable while Walmart has announced price increases to offset tariff costs. Home Depot leverages its scale and strong supplier relationships to avoid raising prices, a strategy that differentiates it from competitors and allows it to maintain customer loyalty during challenging economic times.

What seasonal impacts does Home Depot expect on its pricing strategy?

Home Depot anticipates seasonal impacts on its pricing strategy, especially during peak sales seasons like spring. The company has adjusted its pricing strategy to attract customers during this critical period, avoiding price hikes and focusing on promotions that cater to both DIY customers and home professionals looking to undertake spring projects.

| Key Points |

|---|

| Home Depot maintains pricing levels amidst tariff increases. The CFO states that the retailer does not plan to raise prices due to tariffs. |

| Diversified sourcing strategy: Home Depot has worked to diversify its imports and reduce reliance on any single country. |

| First-quarter results showed a slight miss on earnings estimates while exceeding sales expectations, indicating resilience in the market. |

| Focus on professionals: Home Depot acquires SRS Distribution to tap into the professional market as consumer spending fluctuates. |

| Sales trends indicate a mixed performance with notable growth in certain categories like appliances, while others show softness. |

Summary

Home Depot pricing strategy aims to maintain stable prices despite rising tariffs, positioning the retailer uniquely against competitors like Walmart. The company’s diversified sourcing and focus on attracting home professionals illustrate its adaptive market strategy. Maintaining pricing levels is a vital component of Home Depot’s approach as it navigates through challenging economic conditions, ensuring that it continues to provide value to its customers.