Bitcoin Price Surges: Current Trends and Market Analysis

The Bitcoin price is currently causing a buzz in the cryptocurrency market, hovering around $106,831 after reaching a peak of $107,340. This recent performance marks day 13 of Bitcoin’s six-figure streak, tantalizing traders with the prospect of a new record being established. The current Bitcoin price reflects a 1.5% increase against the U.S. dollar, indicating stable bullish market trends. With a market capitalization of approximately $2.123 trillion, Bitcoin trading volume remains robust, showcasing over $36.27 billion worth of trades in the last 24 hours. As the leading cryptocurrency inches closer to its all-time high of $109,356, BTC price analysis suggests increased momentum and potential volatility in the upcoming days.

When discussing the valuation of Bitcoin, terms such as cryptocurrency value, digital currency price, and BTC market activity come to the forefront. The current valuation trends of Bitcoin reveal vital insights into market dynamics and trading engagements, with the digital asset maintaining its position well above the six-figure milestone. As investors evaluate Bitcoin’s recent price shifts, understanding trading volumes and market capitalization becomes crucial for informed decision-making. The latest Bitcoin performance captures the enthusiasm of traders as they explore the implications of reaching unprecedented price levels. Additionally, tracking Bitcoin’s journey to its all-time high offers a fascinating glimpse into the future trajectory of this leading digital asset.

Current Bitcoin Price Overview

As of the latest updates, the current Bitcoin price is hovering around an impressive $106,831 after an intraday high of $107,340 per coin. This extended six-figure streak marks the 13th consecutive day BTC has closed above the $100,000 milestone, showcasing strong bullish momentum in the market. Investors are closely monitoring this upward trend as Bitcoin approaches its all-time high of $109,356, creating a climate of anticipation and speculation.

The rise in Bitcoin’s price reflects a 1.5% increase against the U.S. dollar, pointing to a robust market interest and growing investor confidence. With a market capitalization of approximately $2.123 trillion, Bitcoin continues to dominate the cryptocurrency landscape, drawing significant trading volume. The continuous fluctuations support a dynamic trading environment, which is critical for traders and investors aiming to capitalize on market movements.

Bitcoin Market Trends and Analysis

Bitcoin market trends have shown remarkable resilience, especially following the bullish momentum observed since the beginning of the month. The positive sentiment around BTC is not merely a coincidence; it is backed by strong trading activity and speculative interest, contributing to its impressive market valuation. The current BTC price analysis indicates that traders are actively repositioning their strategies to gain exposure to Bitcoin, especially with the trading volume reaching approximately $36.27 billion over the last 24 hours.

Analysts predict that the ongoing market trends suggest potential for further price increases, especially with Bitcoin only 2.36% away from its all-time high. This crucial phase in Bitcoin’s price trajectory has led to a wave of liquidations, marking a significant sentiment shift among traders. Large liquidation amounts, such as the over $1.62 million lost in a single order, highlight the volatility within the market, forcing traders to reassess their positions as prices fluctuate.

Understanding Bitcoin’s All-Time High

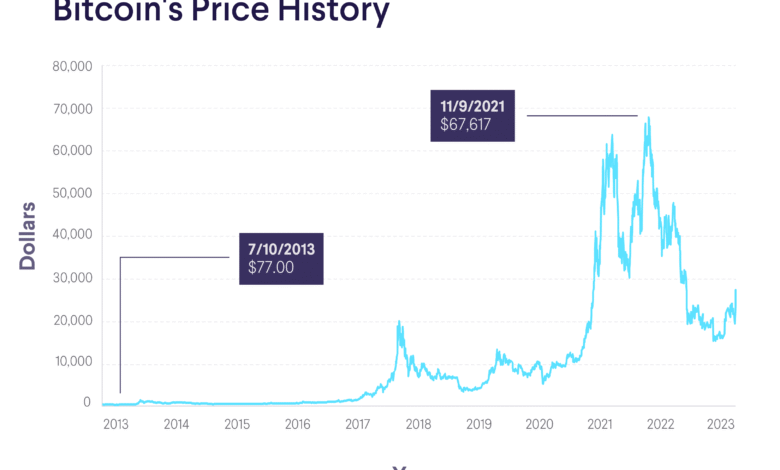

Bitcoin’s all-time high of $109,356 remains a pivotal target for both long-term investors and short-term traders. As BTC navigates through current market dynamics, many are reflecting on the previous market cycles that led to this peak. Each movement towards this historical price level is scrutinized carefully, with traders employing various strategies to maximize their gains as Bitcoin approaches this threshold.

The anticipation surrounding Bitcoin’s price reaching or surpassing its all-time high often leads to increased trading volume and heightened market activity. This recent price surge demonstrates that traders are not just holding onto their investments but actively engaging in transactions, motivated by the possibility of new financial milestones for Bitcoin. The next few days will be critical as BTC continues its rally, potentially breaking records and solidifying its position in the cryptocurrency market.

BTC Price Analysis and Speculation

Conducting a thorough BTC price analysis is essential for understanding the ongoing trends that influence Bitcoin’s market behavior. Recent data indicates that the price has consistently remained above the six-figure mark, fostering a climate of speculation about future price movements. Such behaviors from traders suggest they are optimistic about Bitcoin’s ability to maintain this trajectory.

Investors are analyzing historical price patterns and current market conditions to forecast potential breakout points. The technical indicators, coupled with investor sentiment, create a robust analytical framework for predicting whether Bitcoin will reach new highs or face corrections. As the price approaches critical levels, traders are advised to remain vigilant and informed to leverage potential opportunities.

Exploring Bitcoin Trading Volume Dynamics

The latest statistics reveal that Bitcoin’s trading volume has reached an impressive $36.27 billion in the past 24 hours, underscoring the active participation of market players. This elevated trading volume is often indicative of increased interest in Bitcoin and can serve as a predictive metric of upcoming price movements. The high volatility increases opportunities for traders to enter and exit positions profitably.

Furthermore, understanding the dynamics of Bitcoin trading volume can provide essential insights into market sentiment and potential price trends. When trading volume spikes, it often correlates with significant price shifts, highlighting the importance of following these metrics closely. The recent statistics show that an influx of traders are engaging with Bitcoin, further solidifying its position as a leading cryptocurrency.

Bitcoin Price Projections for the Coming Weeks

As Bitcoin continues its journey toward potential new highs, market analysts are keenly focused on its price projections for the coming weeks. With a record 13-day streak above $100,000, there’s considerable anticipation about whether this momentum can be maintained. Some experts believe that if BTC sustains this trajectory, it could not only break past its all-time high but also establish new benchmarks in the cryptocurrency world.

The speculation surrounding BTC price projections is greatly influenced by both macroeconomic factors and cryptocurrency market trends. Traders and investors alike are preparing for various scenarios, from optimistic breakthroughs to possible corrections, which could lead to significant shifts in trading strategies. Staying informed about these projections is crucial for anyone involved in Bitcoin trading.

Bitcoin Liquidation Statistics and Their Impact

The recent fluctuations in Bitcoin’s price have resulted in significant liquidation statistics, with over $247.10 million worth of positions being liquidated. This phenomenon, especially within both long and short positions, indicates the unpredictable nature of the cryptocurrency market. Particularly noteworthy is that over $47 million of liquidated positions were shorts, highlighting a potential bullish consensus among traders.

Liquidation events provide critical insights into market dynamics and can reveal underlying investor sentiment. For market participants, understanding these liquidation patterns can help inform strategies and risk management approaches. The large single liquidation order demonstrates how volatile Bitcoin can be, urging traders to adopt caution and enabling them to reassess their trading strategies in light of market conditions.

The Role of Leverage in Bitcoin Trading

Leverage plays a crucial role in Bitcoin trading, enabling traders to amplify their positions and potentially increase their returns. The recent surge in Bitcoin has led some traders to employ significant leverage, as seen with popular figures like James Wynn, who has engaged in a long position with 40x leverage. This strategy, while promising high returns, also carries substantial risks, particularly in a volatile market.

Given the current Bitcoin price dynamics, utilizing leverage can be double-edged; while it may lead to high rewards if the market performs favorably, it can also result in significant losses in adverse conditions. As Bitcoin continues on its bullish path, understanding the risks associated with leveraged trading is essential for maintaining a balanced and informed trading strategy.

Recent Trader Actions and Market Sentiment

Recent trader actions within the Bitcoin market have been characterized by heightened activity and shifting sentiment. For instance, the notable increase in BTC long positions indicates a bullish market sentiment, reflecting confidence in Bitcoin’s upward trajectory. The decision by traders to add significantly to their positions suggests that many believe the current price levels are a favorable entry point.

Market sentiment among Bitcoin traders is crucial, as it directly impacts price movements and overall trading activity. Influencers within the community, like James Wynn, demonstrate how proactive trading strategies can capitalize on market momentum, further driving interest and participation. Understanding these dynamics allows for better insights into future price actions and market corrections that could arise.

Frequently Asked Questions

What is the current Bitcoin price as of today?

The current Bitcoin price is hovering around the $106,831 mark, with an intraday high of $107,340. This represents a 1.5% increase against the U.S. dollar.

What are the recent Bitcoin market trends?

Recent Bitcoin market trends indicate a bullish outlook, as the BTC price has maintained a six-figure streak for 13 consecutive days. After a significant weekly close, the price trends upward towards the all-time high.

What is the all-time high for Bitcoin price?

Bitcoin’s all-time high is $109,356, which it is currently just 2.36% away from reaching, based on today’s trading activity.

How can I find a detailed BTC price analysis?

A thorough BTC price analysis can be found on cryptocurrency market analysis platforms or finance websites, which provide insights into Bitcoin price movement, trading volume, and market capitalization.

What is the current Bitcoin trading volume?

The current Bitcoin trading volume stands at approximately $36.27 billion over the past 24 hours, reflecting active trading and strong market engagement.

How have Bitcoin price fluctuations affected traders today?

Today’s Bitcoin price fluctuations led to the liquidation of about $247.10 million in long and short positions, indicating significant trading activity and market volatility.

Why is Bitcoin’s price hovering around $106,831?

Bitcoin’s price is hovering around $106,831 due to positive market sentiment, with a notable increase following a bullish weekly close, showing resilience and investor confidence.

| Key Points |

|---|

| Current Bitcoin Price |

| $106,831, with an intraday high of $107,340 |

| Price Movement |

| 1.5% increase against the U.S. dollar |

| Market Capitalization |

| Approximately $2.123 trillion |

| Trading Volume |

| $36.27 billion in the past 24 hours |

| Market Trends |

| Notable bullish trends since Sunday |

| All-Time High Distance |

| Only 2.36% away from $109,356 |

| Liquidation Statistics |

| $247.10 million in long and short liquidations, $1.62 million loss from biggest liquidation |

| Leverage Usage |

| James Wynn increased BTC long position with 40x leverage ($54.7 million deposited) |

| Days Above $100,000 |

| 13 consecutive days, record in sight with 4 more days needed |

Summary

The Bitcoin price currently stands at $106,831, maintaining a significant presence in the market for 13 consecutive days above the six-figure threshold. With bullish trends and a market capitalization of approximately $2.123 trillion, Bitcoin continues to show resilience and potential for growth, especially as it nears its all-time high. As trader activity intensifies, the volatility and potential for substantial gains remain prominent, making Bitcoin a continuing focal point in cryptocurrency discussions.