Premarket Stock Movements: Home Depot, Viking & More

Premarket stock movements can reveal significant trends ahead of the official stock market opening. Today, notable companies like Home Depot and Viking Holdings are making headlines, reflecting varied reactions to recent earnings reports and forecasts. For instance, Home Depot stock rose 2.4% after the retailer reaffirmed its annual guidance, showcasing stability amid potential tariff challenges. In contrast, Viking Holdings faced a 5.6% drop despite outperforming expectations in its first-quarter results, emphasizing the unpredictability of premarket trading. As investors tune into stock market news, keeping an eye on these premarket trends can offer valuable insights into the day’s trading dynamics.

The fluctuations observed in early stock trading provide a glimpse into the potential performance of major companies before the market officially opens. Noteworthy movements such as the 2.4% increase in Home Depot’s shares contrast sharply with Viking Holdings, which saw a 5.6% decline despite better-than-expected financial results. These early indicators can significantly influence investor sentiment and decisions throughout the day. Monitoring trends in pre-trade activity allows traders to capitalize on emerging opportunities, making it crucial to stay updated on developments in sectors like autonomous vehicle stocks and major retailers. Engaging with premarket trading is essential for navigating the complexities of stock dynamics and discovering promising investments.

Premarket Stock Movements Impacting Investors

In today’s premarket trading, several stocks are showing significant movements that could impact investor sentiment and market dynamics. Home Depot, a major player in the home improvement sector, is up by 2.4%, attributing this boost to their strong financial guidance for the year and the decision to keep prices stable despite external pressures such as tariffs. This resilience may suggest to investors that Home Depot is adapting well to economic challenges, making its stock a point of interest for those seeking stability in their portfolios.

On the flip side, Viking Holdings has seen a sharp decline, with shares dropping 5.6% even after reporting better-than-expected quarterly results. This dichotomy illustrates the unpredictable nature of premarket stock movements. While solid results typically inspire confidence, investors might be grappling with concerns regarding larger market trends or company-specific issues that could affect future performance.

Analyzing Home Depot’s Stock Performance

Home Depot’s recent stock performance serves as a crucial example of how strategic company decisions can influence market perceptions. By reaffirming its earnings guidance, Home Depot aims to mitigate any fears surrounding inflation or supply chain issues that might compel other retailers to raise prices. Investors are likely to see this as a positive indicator, further contributing to the stock’s upward momentum in premarket trading.

Moreover, Home Depot’s stance reveals a commitment to customer retention and profitability, which can be particularly appealing to investors seeking stocks with strong fundamentals. As the company navigates through revised market conditions, its ability to maintain price stability while achieving sales growth positions it favorably against competitors in the stock market news landscape.

The Status of Viking Holdings in the Stock Market

Viking Holdings’ recent performance highlights the nuances of stock market reactions to earnings reports. Despite a narrower loss than expected, the market responded negatively, resulting in a 5.6% drop in shares. This suggests investors may have anticipated a more substantial recovery or clearer strategies from the cruising company as it moves forward. The cruise sector continues to face challenges post-pandemic, and Viking’s stock performance may reflect broader investor apprehensions about recovery in this space.

The ongoing fluctuations in Viking Holdings’ stock could serve as a cautionary tale for investors in sectors still reeling from market disruptions. As analysts dissect Viking’s performance against competitors in the leisure segment, scrutiny of operational improvements or revenue strategies may become crucial for regaining investor confidence.

The Rise of Autonomous Vehicle Stocks

The autonomous vehicle industry is witnessing sensational growth, as highlighted by the performance of stocks like Uber Technologies and Pony AI. Uber’s collaborations and investments in ridesharing technology have resulted in a 1% increase in shares, showing optimistic market sentiment around its future in an evolving mobility landscape. Furthermore, the announcement of a partnership with Waymo to promote autonomous ridesharing in Atlanta signifies a strategic move to enhance competitiveness within the sector.

Pony AI’s impressive surge of over 5% in the market underscores the growing demand for autonomous vehicle technologies. The company’s announcement to expand its fleet of robotaxis to 1,000 vehicles this year aligns perfectly with consumer interest in innovative transportation solutions. This attention towards autonomous vehicle stocks is indicative of a broader trend in the stock market favoring companies that are pioneering advancements in technology.

Shifts in Stock Valuations for Cloud Technology

Cloud technology remains a pivotal area for investment, with Hewlett Packard Enterprise showing positive movement in premarket trading. An upgrade to an ‘outperform’ rating reflects the growing recognition of its risk-to-reward profile, suggesting that analysts see potential for continued growth. Investors are attracted to such upgrades as they often signify strong fundamentals and the opportunity for value appreciation in the technology space.

The upward trajectory of Hewlett Packard Enterprise by 3% suggests an increasing confidence among stakeholders in the company’s future strategies. The cloud sector is rapidly evolving, and businesses demonstrating strong growth in profitability and market expansion, like HPE, can capture attention amid a competitive landscape. This trend signals to investors to consider companies within cloud technology as viable options for sustainable growth.

Market Reactions to Amer Sports’ Performance

Amer Sports has rallied significantly, with shares soaring 10% following a stellar earnings report that exceeded analyst expectations. The company announced a substantial increase in earnings per share, reflecting effective cost management and strategic planning that resonate well with investors looking for strong performance in the sports equipment sector. This upward move showcases how positive financial outcomes can dramatically shift stock valuations.

By consistently surpassing projections, Amer Sports is positioning itself as a strong contender in the sports equipment market, which can attract both institutional and retail investors. Additionally, the favorable response from the market may inspire other companies in the sector to reassess their strategies to achieve similar investor confidence and market exuberance.

Bilibili’s Growth in the Competitive Video Sharing Sector

Bilibili’s stock saw a notable increase of 3% as it reported first-quarter results that outperformed analyst estimates. With a rise in daily active users, this demonstrates the platform’s ability to engage audiences within the heavily contested video sharing market. Investors are keenly observing Bilibili as it continues to innovate and attract more users, which is essential for growth in the digital media industry.

This rising user engagement suggests that Bilibili is successfully capturing market share, positioning itself favorably against larger competitors. Analysts and investors alike will be interested in how the company plans to leverage its growing user base to enhance advertising revenue and sustainability in a highly competitive environment.

Quantum Computing Stocks Surge Amid Innovation

The quantum computing sector is capturing investor interest, especially following the remarkable 18% increase in D-Wave Quantum’s shares after the launch of its latest computing system, Advantage2. Innovations like this highlight the rapid advancements in technology that can drive shareholder value in the tech landscape. Such developments indicate a robust potential for growth as industries begin to adopt quantum solutions.

D-Wave’s strong performance has encouraged a ripple effect in the quantum computing market, with stocks of competitors like Rigetti and Quantum Computing also enjoying gains. This collective uptick reflects a growing investor confidence in the viability and future application of quantum technologies, suggesting that opportunities for innovation are expansive in the market. Investors are likely to keep an eye on this sector for new breakthroughs that could lead to increased valuation.

Understanding the Broader Stock Market Trends

Studying premarket stock movements like those seen today can provide valuable insights into broader stock market trends. Changes in stock prices during this window often set the stage for the trading day ahead, highlighting the sentiment investors have towards specific sectors and companies. This early trading activity acts as a barometer for market health and dynamics, providing clues about potential volatility as the day progresses.

Tracking premarket movements also helps investors make informed decisions based on emerging news and trends. Staying abreast of significant fluctuations, such as those of Home Depot, Viking Holdings, or innovations in the autonomous vehicle sector, is essential for managing portfolios actively and strategically responding to market shifts.

Frequently Asked Questions

What are the notable premarket stock movements for Home Depot?

In premarket trading, Home Depot stock saw a gain of 2.4% after the company confirmed its full year guidance. CFO Richard McPhail reassured investors that there would be no price increases due to tariffs, positively influencing premarket trading sentiment.

How did Viking Holdings perform in premarket stock trading?

Viking Holdings experienced a premarket decline of 5.6% despite posting first-quarter results that exceeded expectations. The loss of 24 cents per share was better than analysts’ predictions, yet the overall reaction in premarket trading reflected investor caution.

What has been the impact of stock market news on autonomous vehicle stocks in premarket trading?

Premarket stock movements in the autonomous vehicle sector were positive, particularly for Pony AI, which surged over 5% after reporting strong quarterly results and plans to expand its fleet. This reflects the growing interest and optimism surrounding autonomous vehicle stocks in premarket trading.

Which companies showed significant premarket trading movements and why?

Several companies made headlines in premarket trading, including Home Depot with a 2.4% increase due to stable guidance, Amer Sports soaring 10% on strong earnings, and D-Wave Quantum jumping 18% after announcing its new computing system. Such stock market news can significantly impact investor sentiment in premarket trading.

What are some factors influencing premarket trading for stocks like Amer Sports?

Amer Sports’ impressive premarket stock movement, with a rise of 10%, was driven by earnings that surpassed analyst expectations. This type of strong performance in stock market news can greatly influence premarket trading, attracting both institutional and retail investors.

How does new technology impact premarket stock movements for companies like D-Wave Quantum?

The introduction of innovative technology, such as D-Wave Quantum’s Advantage2 computing system, can result in significant premarket stock movements. Following the announcement, D-Wave’s stock surged by 18%, demonstrating how advancements in technology can drive investor interest and premarket trading performance.

What role does analyst ratings play in premarket trading movements for stocks?

Analyst ratings can significantly sway premarket trading movements. For instance, Hewlett Packard Enterprise saw a 3% increase in premarket trading after receiving an upgrade to ‘outperform’ from Evercore ISI, highlighting how favorable analyst assessments can positively affect investor sentiment.

Can we expect ongoing volatility in premarket trading related to stocks like Home Depot and Viking Holdings?

Yes, ongoing volatility in premarket trading can be expected, particularly as new earnings reports, analyst ratings, and macroeconomic factors emerge. For example, Home Depot’s stability in its guidance contrasts with Viking Holdings’ mixed performance, indicating that different stocks may have varied volatility in premarket trading.

| Company | Premarket Movement | Key Details |

|---|---|---|

| Home Depot | +2.4% | Maintained full-year guidance; no price hikes planned due to tariffs. |

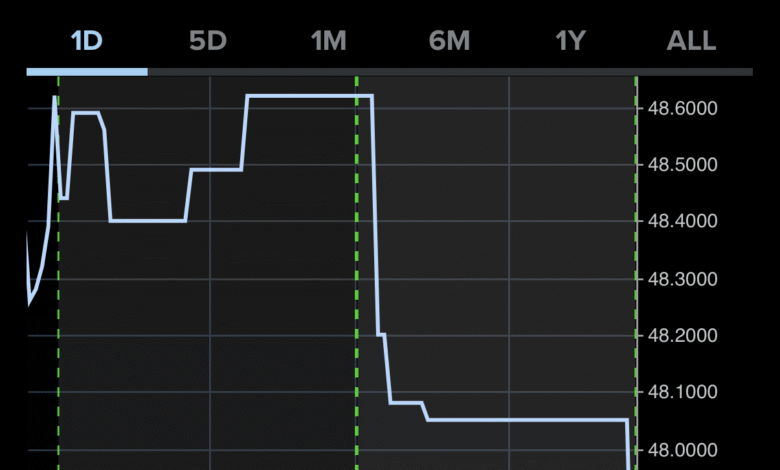

| Viking Holdings | -5.6% | Quarterly results exceeded expectations but reported a loss of 24 cents per share. |

| Hewlett Packard Enterprise | +3.0% | Upgraded to ‘outperform’, considered a promising investment entry point. |

| Uber Technologies | +1.0% | Collaborating with Waymo on autonomous ridesharing in Atlanta. |

| Pony AI | +5.0% | Strong quarterly results; expanding fleet to 1,000 vehicles. |

| MongoDB | -2.0% | Downgraded to ‘hold’; concerns about market adoption of Atlas platform. |

| Amer Sports | +10.0% | Quarterly results surpassed expectations with earnings higher than forecast. |

| Bilibili | +3.0% | Quarterly results exceeded estimates; active users increased significantly. |

| D-Wave Quantum | +18.0% | Unveiled new computing system; other quantum firms also saw gains. |

Summary

Premarket stock movements showed significant activity, with notable gains for Home Depot, Amer Sports, and D-Wave Quantum, among others. While Home Depot rose on maintaining its guidance and not raising prices, Viking Holdings faced a decline despite exceeding earnings expectations. Other companies like Hewlett Packard Enterprise and Uber also made headlines with positive premarket shifts. Overall, the premarket trading reflected a mix of optimism and caution among investors amidst varying company performances.