Bitcoin Ownership Insights: How 50 Million Americans Invest

Bitcoin ownership is rapidly gaining traction across the United States, with nearly 50 million Americans, or 14.3% of the population, actively investing in this digital currency. This impressive statistic highlights not only the growing enthusiasm for Bitcoin among everyday investors but also underscores the significance of Bitcoin adoption statistics in shaping market trends. The recent surge in Bitcoin corporate investments, characterized by 32 American public companies holding Bitcoin as a treasury asset, signals a shift towards mainstream acceptance within the financial landscape. As Americans increasingly engage with this innovative asset, the implications of Bitcoin, including the potential impacts of a Bitcoin ETF, are key focal points for both individual and institutional investors. The rise of Bitcoin ownership reflects a broader cultural shift towards digital currencies, providing exciting opportunities for financial empowerment and diversification in today’s economy.

The phenomenon of digital currency ownership is reshaping the financial landscape, particularly in the United States where Bitcoin has found a significant foothold. This groundbreaking asset, renowned for its volatility and potential growth, has seen a remarkable percentage of Americans—around 14.3%—embracing it as part of their investment portfolio. The data surrounding Bitcoin ownership demographics not only showcases the enthusiastic participation of individual investors but also highlights the growing trend of corporate adoption, with many large firms now allocating resources towards this cryptocurrency. Furthermore, the introduction of cryptocurrency exchange-traded funds (ETFs) is revolutionizing access to Bitcoin, enabling broader participation in the market. Overall, the evolving narrative of Bitcoin is positioned as a transformative financial tool, impacting asset management approaches and the way individuals and corporations view investing.

Understanding Bitcoin Ownership in America

Recent research indicates that nearly 50 million Americans, constituting 14.3% of the U.S. population, now own Bitcoin, positioning the country as a leader in cryptocurrency adoption. This ownership rate significantly surpasses that of other regions globally, with North America’s overall Bitcoin ownership resting at 10.7%. Key factors contributing to this phenomenon include the strong culture of entrepreneurship and financial literacy in the U.S., which encourages individuals to invest in assets like Bitcoin. Increased access to cryptocurrency exchanges and the removal of stringent accreditation requirements further facilitate this ownership surge, allowing more Americans to participate in the growing Bitcoin market.

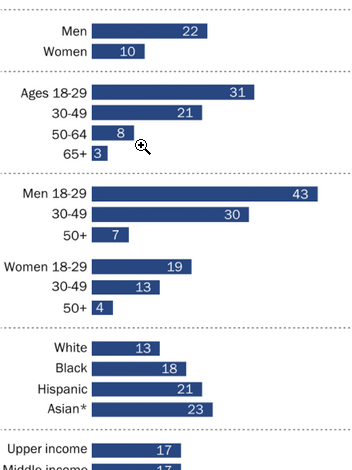

Demographically, it is noted that younger males tend to hold more Bitcoin than any other group, reflecting not only the robust interest among this demographic but also their willingness to embrace new investment opportunities. Research shows that Bitcoin ownership does not correlate with factors like race or religion; rather, it is more about individual choice and access to cryptocurrency resources. As society continues to evolve technologically, the potential for even greater adoption and integration of Bitcoin within the U.S. economy becomes increasingly real.

The Corporate Shift Towards Bitcoin Investment

The corporate landscape is also changing, with the River report highlighting that 32 American public companies currently hold Bitcoin as part of their treasury assets, collectively worth a staggering $1.26 trillion. This level of corporate investment represents 94.8% of the total Bitcoin holdings by publicly traded firms worldwide. Such significant adoption illustrates a shift in perception; companies are beginning to see Bitcoin not just as a speculative asset but as a legitimate diversification tool in their financial strategies. This trend mirrors global corporate interest in Bitcoin, reinforcing its role as a modern asset class.

Investment in Bitcoin by large firms indicates a confidence in its value proposition, often compared to traditional investments like gold. This growing trend could signal a shift in corporate treasury management, prompting other companies to consider cryptocurrency as part of their asset reserves. The strategic acquisition of Bitcoin by corporates showcases how businesses are embracing financial innovation, potentially leading to broader market trends. Moving forward, the impact of such corporate adaptations on the overall Bitcoin market and its acceptance as a standard investment asset will be crucial for its future trajectory.

Bitcoin ETFs and Their Influence on Investment Decisions

The introduction of Bitcoin exchange-traded funds (ETFs) marks a pivotal moment for individual investors and institutions alike, providing a more accessible way to invest in Bitcoin. With over half of the 25 largest hedge funds and investment advisors in America now holding Bitcoin via these ETFs, the financial landscape is witnessing a significant transformation. The availability of Bitcoin ETFs allows investors to partake in the cryptocurrency market without the complexities of direct ownership, making it a more appealing option for those wary of the volatility associated with cryptocurrencies.

Furthermore, these ETFs have opened the door for institutional investment, including pension funds. As a result, the broader market perception of Bitcoin is shifting, positioning it as a viable alternative to precious metals like gold during economic downturns. This injection of capital from various financial sectors is likely to fuel Bitcoin’s market trends, driving its valuation and influence even further as more individuals and firms explore the benefits of including BTC in their investment portfolios.

Impact of Bitcoin on Employment and Economic Growth

Bitcoin’s expansion is having a notable impact on employment in the United States, with over 20,000 individuals currently employed by more than 150 companies within the Bitcoin ecosystem. This surge in job creation underscores the ripple effect of Bitcoin adoption on the broader economy. Such jobs range from mining operations to tech development and service provision, showcasing Bitcoin’s ability to create diverse employment opportunities amidst evolving economic landscapes. This growth not only benefits individuals but also stimulates local economies as these companies expand their operations.

The rise of Bitcoin-related employment is complemented by the significant growth in Bitcoin mining activities. The United States accounts for 36% of the global Bitcoin hashrate, a figure that is more than double that of China’s contribution. This dramatic increase in hashrate dominance signifies a robust infrastructure being built around Bitcoin mining in the U.S. and represents an unprecedented investment in energy and technology. As the job market continues to adapt and grow in line with Bitcoin’s potential, employment in this sector looks set to play a crucial role in the economic landscape moving forward.

Bitcoin Market Trends and Future Predictions

As Bitcoin continues to gain traction among American investors, several emerging market trends are shaping the future of cryptocurrencies. The momentum generated by the recent surge in public interest and corporate investments is likely to set new precedents not just in Bitcoin, but in the entire cryptocurrency market. Investors are increasingly looking towards Bitcoin for its potential as a long-term store of value, which could lead to higher demand and subsequently influence market pricing dynamics. Additionally, the growing integration of Bitcoin within mainstream financial systems is suggesting an evolving marketplace that may soon offer even broader acceptance and utilization of digital currencies.

The fluctuation in Bitcoin prices has also drawn the attention of traditional investors, leading to discussions about how Bitcoin compares to other assets, especially in times of economic uncertainty. With corporations adopting Bitcoin as a treasury asset, it could bolster its price stability over time, drawing more stable institutional investment. Moving forward, how Bitcoin navigates regulatory landscapes and market challenges will be crucial for its sustainable growth and its positioning within the evolving financial ecosystem. Ultimately, investor confidence alongside market trends will play a pivotal role in determining Bitcoin’s place in the future of money.

The Evolution of Bitcoin Ownership and Adoption Statistics

Recent Bitcoin adoption statistics indicate a significant upward trend in ownership, particularly among Americans. With approximately 50 million individuals claiming ownership, this growing statistic underscores the increasing acceptance of Bitcoin as a financial asset. These statistics serve not only to highlight demographic shifts but also reflect broader societal changes regarding cryptocurrency’s role in everyday financial applications. As more users gain access to Bitcoin, its potential for widespread adoption may follow suit, leading to increased market engagement.

Tracking Bitcoin ownership data reveals interesting insights about investor behavior. As seen from the current statistics, trends indicate that younger generations are more inclined to invest in Bitcoin, likely owing to their familiarity with digital currencies and technology. The rise of Bitcoin ownership among different demographic groups signals crucial shifts in how financial literacy and investment strategies are evolving. As these changes persist, they are likely to inform future policies and educational initiatives aimed at promoting responsible Bitcoin investment.

Bitcoin and Its Role in Financial Resilience

The recent influx of Bitcoin as a treasury asset among corporate giants reflects a growing belief in the cryptocurrency as a hedge against economic uncertainty. As financial markets face volatility, many corporations are looking to Bitcoin not only as a speculative asset but as part of their long-term financial strategy. This shift represents a divergence from traditional investments and underscores the adaptability of companies willing to engage with newer financial instruments. By investing in Bitcoin, corporations are not only diversifying their portfolios but also signaling confidence in the cryptocurrency’s resilience.

Moreover, Bitcoin’s role in enhancing financial resilience offers opportunities for individuals to protect their investments during periods of economic downturn. As more people learn about Bitcoin and consider it as a potential store of value, its value proposition strengthens. The notion that Bitcoin could enhance individual financial security is becoming increasingly popular, leading to a larger cohort of investors who are willing to explore alternative asset classes for better protection of their wealth.

Corporate Influence on Bitcoin Market Trends

The active participation of corporate entities in Bitcoin investments is significantly shaping market trends. With major corporations embracing Bitcoin, the narrative around cryptocurrency is shifting from niche interest to essential financial consideration. Companies holding substantial Bitcoin reserves are influencing its market liquidity and pricing, creating a feedback loop that reinforces Bitcoin’s status as a key economic asset. Moreover, this corporate strategy suggests a trend that may lead to higher institutional adoption and further legitimization of Bitcoin within the financial sector.

The presence of corporate investments also brings increased scrutiny and potential regulation to the Bitcoin environment. As major players enter the space, they bring with them a demand for clearer guidelines and stability in the marketplace. This push for regulation may encourage even more firms and investors to engage with Bitcoin, paving the way for broader acceptance. As corporate influence continues to accentuate Bitcoin’s visibility in financial discussions, its potential to drive market trends becomes an undeniable factor in shaping its future.

Exploring Bitcoin’s Cultural Impact on American Society

The cultural impact of Bitcoin adoption within American society is profound, reflecting a significant shift in how financial resources are perceived and utilized. As Bitcoin gains traction, its influence on individual investment strategies encourages a broader examination of financial independence and asset management. This cultural shift is evident in the way cryptocurrency discussions have permeated everyday conversations, dispelling myths and fostering a community of informed investors willing to explore digital spaces for wealth generation.

Moreover, Bitcoin’s rise signals a transformation in the financial identity of younger generations. With the increasing prevalence of technology and digital assets in day-to-day financial interactions, younger Americans are more inclined to view Bitcoin as a standard investment comparable to traditional stocks and bonds. This embrace of Bitcoin not only empowers individuals but also reflects a larger cultural movement towards embracing innovation in the financial sector. As these cultural dynamics evolve, Bitcoin will likely continue to redefine how American society interacts with its financial future.

Frequently Asked Questions

What are the current Bitcoin ownership statistics in the United States?

Recent data indicates that nearly 50 million Americans, representing 14.3% of the population, own Bitcoin. This level of Bitcoin ownership is the highest of any geographical region, surpassing the overall North American ownership rate of 10.7%.

How significant is Bitcoin corporate investment in the U.S.?

Bitcoin corporate investments have gained substantial traction, with 32 American public companies investing in Bitcoin as a treasury asset, totaling a combined market capitalization of $1.26 trillion. This represents nearly 94.8% of all Bitcoin held by publicly traded firms worldwide.

What demographic trends are observed in Bitcoin ownership among Americans?

Bitcoin ownership among Americans is predominantly male and younger, with individuals under 40 showing the highest affinity for holding Bitcoin. The report emphasizes that ownership is influenced more by access and investment culture than by demographics such as race or religion.

How are Bitcoin ETFs impacting American investors?

The introduction of Bitcoin ETFs in early 2024 has provided individual investors and pension funds with easier access to Bitcoin. Currently, over half of America’s 25 largest hedge funds have incorporated Bitcoin into their portfolios via ETFs, reflecting a significant shift in investment strategies.

What is the employment impact of Bitcoin ownership in the U.S.?

Bitcoin ownership has contributed to job creation in the U.S., with over 20,000 Americans employed by more than 150 Bitcoin-related companies. This growth is indicative of Bitcoin’s broader economic influence and its role as a catalyst for employment opportunities.

How does the U.S. compare globally in Bitcoin mining?

The U.S. dominates Bitcoin mining, accounting for 36% of the global hashrate, which is significantly higher than China’s share. This dominance has surged by over 500% since 2020, underscoring America’s pivotal role in the Bitcoin ecosystem.

What are the cultural factors influencing Bitcoin ownership in the U.S.?

Cultural aspects like individual entrepreneurship and a strong belief in financial freedom play vital roles in Bitcoin ownership in the U.S. These factors have created an environment that encourages early adoption of Bitcoin compared to other developed countries.

What makes Bitcoin ownership more accessible in the United States?

The accessibility of Bitcoin ownership in the U.S. is attributed to its widespread availability and the absence of stringent accreditation requirements for cryptocurrency investments, making it easier for Americans to invest in Bitcoin.

| Key Point | Details |

|---|---|

| Bitcoin Ownership Rate | 14.3% of Americans own Bitcoin, the highest rate globally. |

| Demographic Factors | Ownership is influenced by the American culture of entrepreneurship and historic access to investments. |

| Gender and Age Distribution | Males and younger Americans are the primary holders of Bitcoin. |

| Corporate Adoption | 32 American public companies hold Bitcoin as a treasury asset, representing 94.8% of global Bitcoin owned by public firms. |

| ETF Adoption | The launch of Bitcoin ETFs in early 2024 has allowed larger institutional investors to enter the market. |

| Job Creation | Over 20,000 jobs have been created in the Bitcoin sector across the U.S. |

| Mining Dominance | The U.S. controls 36% of the global Bitcoin hashrate, significantly higher than China. |

Summary

Bitcoin ownership is on the rise in the United States, with a remarkable 14.3% of Americans investing in Bitcoin. This high ownership rate shines a light on the cultural acceptance and accessibility of cryptocurrency in the U.S., establishing it as a prominent asset for both individual and corporate investors. The growing trend of Bitcoin ETFs and the significant employment opportunities created in the sector further underscore Bitcoin’s impact on the American economy, marking it as a pivotal player in the future of finance.