Stocks After Hours: Major Moves from Intuit, Workday & More

Stocks after hours are shaping the narrative of the financial landscape, particularly in the realm of extended trading. As the market closes, key players like Intuit, Workday, and Ross Stores often spark intense activity that can significantly impact investor strategies. Recent after hours stock market movements reveal surprising shifts in company fortunes, especially following earnings reports that may exceed or fall short of expectations. For traders and enthusiasts eager for up-to-the-minute updates, tracking stocks news is essential to navigate the evolving market dynamics. With financial market updates available regularly, understanding these after hours fluctuations can become a vital part of informed investment decisions.

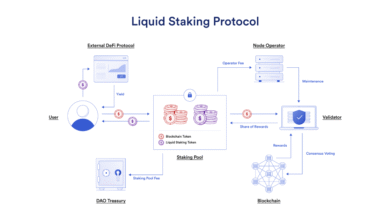

In the realm of trading, the period following the regular market session, often referred to as extended trading hours, provides unique opportunities for investors. This phase allows participants to react to critical information such as earnings disclosures and economic indicators outside the typical trading window. The after-market arena is often where the most dramatic stock price movements occur as companies, like AutoDesk and Deckers, release their quarterly performances and projections. Investors rely on these extended hours to glean insights into future market directions and enhance their portfolio strategies. Additionally, by analyzing company earnings reports during this time, traders can gain a competitive edge in making informed decisions.

Major Stock Movements in After Hours Trading

After hours stock trading has become a focal point for investors seeking to capitalize on stock movements outside the standard trading hours. Companies like Ross Stores and Intuit have made significant headlines with their post-market performances. Ross pulled back over 11% after announcing the withdrawal of its full-year guidance, which sent ripples through the after-hours trading sphere. Meanwhile, Intuit experienced a sharp increase of about 8% after providing a positive earnings forecast, showcasing the volatility that can occur in extended trading hours.

The after hours stock market is often marked by heightened activity as investors react to earnings reports and other news. For instance, Autodesk saw a gain of more than 2% after releasing an optimistic outlook for their second-quarter earnings, which exceeded analyst expectations. The fluctuations in stock prices during these extra trading sessions reflect broader financial market updates and investor sentiment, making it crucial for traders to stay informed.

Impact of Earnings Reports on After Hours Stocks

Earnings reports play a pivotal role in influencing stock prices during after hours trading. The announcements from companies like Workday and Deckers Outdoor highlight how projections can sway investor confidence. Workday’s forecast of subscription revenues that matched analysts’ expectations led to a 6% decline in its stock price, demonstrating how even meeting expectations can result in losses if the market sentiment leans toward disappointment.

On the other hand, companies that exceed earnings expectations, such as StepStone Group, which saw a remarkable 13% surge in shares, can dramatically shift market dynamics. With assets under management soaring, StepStone’s success reflects the interconnectedness of company performance and stock valuation. Understanding how these financial metrics influence the after hours market is essential for investors aiming to navigate the complexities of stock movements effectively.

Extended Trading: A Closer Look at Market Dynamics

Extended trading, including after hours sessions, provides investors with additional opportunities to react to market news and corporate earnings. For instance, the recent fluctuations in Ross Stores and Intuit stocks illustrate how extended trading can facilitate swift trading decisions based on new information. The ability to trade outside regular market hours can benefit traders looking to capitalize on immediate reactions to earnings reports.

The dynamics of extended trading are influenced by liquidity and trading volume, which are typically lower compared to regular hours. This can lead to more volatile price movements, as seen with Deckers Outdoor’s 14% drop due to uncertainties in guidance. Investors should be mindful of these risks when engaging in after hours trading, understanding that while opportunities abound, the inherent volatility requires careful strategy and consideration.

Understanding Market Reactions to Financial Updates

Financial market updates can lead to significant shifts in stock prices, especially during after hours trading. As highlighted by the recent performance of several companies, including Autodesk and Intuit, these updates often set the tone for investor sentiment. When reports exceed expectations, as Intuit’s did, we can see stocks surging in after hours sessions, indicating positive market perception.

Conversely, disappointing earnings forecasts, like those from Ross Stores and Workday, tend to trigger sell-offs. Investors are acutely aware of how earnings reports and financial guidance impact stock valuations, resulting in rapid buy or sell decisions in the after hours market. Keeping abreast of these financial updates is crucial for traders looking to make informed investment decisions in an increasingly unpredictable trading environment.

The Role of Tariffs in Stock Performance

Tariffs have become a significant factor affecting stock performances in recent years, particularly for companies like Ross Stores and Deckers Outdoor that are sensitive to changes in trade policies. Ross’s withdrawal of its full-year guidance and the anticipated pressure on profitability due to elevated tariffs exemplifies how external economic factors can severely impact stock valuations in the after hours trading environment.

As businesses navigate these complexities, awareness among investors about how tariffs influence earnings projections becomes critical. For example, Deckers’ lack of full-year guidance amid macroeconomic uncertainties speaks to the broader implications of trade policies on financial forecasting. Understanding these dynamics helps investors anticipate potential stock movements and adjust their strategies accordingly.

Investor Sentiment Driving After Hours Trading

Investor sentiment plays a crucial role in shaping the landscape of after hours trading, often leading to rapid reactions to financial news. Stocks such as StepStone Group experienced sharp movements driven by positive earnings reports, highlighting how favorable market conditions can spark investor confidence. The feelings of traders towards company performance can lead to increased buying activity post-market.

Conversely, when companies like Workday fall short of broader expectations, negative sentiment may lead to a sell-off. This duality emphasizes the need for investors to not only analyze the numbers but also gauge overall market sentiment. Being attuned to these emotional undercurrents in financial markets can provide a strategic advantage for traders involved in after hours trading.

The Significance of Analyst Estimates in Trading Decisions

Analyst estimates are pivotal in shaping investor expectations and subsequent trading actions, especially in after hours sessions. Companies like Autodesk and Intuit, which surpassed analyst expectations, saw their stock prices react positively. Conversely, when forecasts do not meet market consensus, as was the case with Ross Stores, the backlash in trading can be immediate and intense.

Understanding the implications of analyst estimates allows traders to better navigate the after hours landscape. This knowledge equips investors to anticipate potential stock reactions, tailoring their trading strategies to capitalize on discrepancies between actual results and market expectations. By doing so, traders can position themselves advantageously during these extended trading periods.

Long-term Strategies for After Hours Trading Success

Developing long-term strategies for after hours trading success requires a comprehensive understanding of market dynamics and investor sentiment. Traders need to incorporate various elements, such as financial updates and analyst estimates, into their decision-making processes. Companies like Intuit have demonstrated the importance of maintaining a positive outlook, which can be a key factor in driving stock performance after hours.

Additionally, integrating risk management practices and the awareness of external factors, such as tariffs and macroeconomic trends, can help traders mitigate potential losses. The volatility of stocks in after hours trading underscores the necessity for strategic planning and research, enabling investors to make informed choices that align with their long-term financial goals.

The Future of Stocks in After Hours Market

As the trading landscape evolves, the future of stocks in the after hours market presents exciting opportunities for investors. With technological advancements and the increasing accessibility of trading platforms, more investors are participating in extended trading sessions. Companies that consistently adapt to market trends are likely to capitalize on these developments, as seen with firms like StepStone Group.

Moreover, understanding how global events and economic indicators play into after hours trading can give investors a competitive edge. The interplay between domestic and international factors that affect stocks post-market is complex, yet those who stay informed and agile will find pathways for growth in this volatile trading environment. The future lies in adapting to changes while maintaining a firm grasp on the fundamental principles of stock trading.

Frequently Asked Questions

What does ‘after hours trading’ mean in the context of stocks?

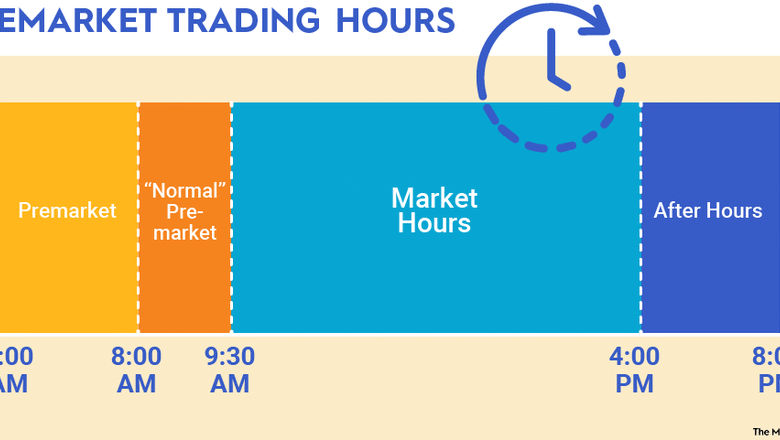

After hours trading refers to the buying and selling of stocks outside the regular trading hours of the stock market. It allows investors to trade stocks after the market closes, typically from 4:00 PM to 8:00 PM EST. This extended trading session is crucial for reacting to news events, earnings reports, and stocks news that may affect market performance.

How can after hours stock market movements impact investors?

Movements in the after hours stock market can significantly affect investors as they provide an early indication of how a stock might perform the following day. For example, if a company releases its earnings report after hours and the stock reacts positively or negatively, it sets the tone for trading on the next regular trading day.

What are the risks associated with trading stocks after hours?

Trading stocks after hours carries risks such as lower liquidity, which can lead to wider bid-ask spreads and high volatility. Additionally, the after hours stock market often has less volume, making it easier for large trades to impact stock prices unexpectedly. Investors should stay informed about financial market updates during these times.

Why do companies like Intuit and Workday often release earnings reports after hours?

Companies like Intuit and Workday typically release earnings reports after hours to allow analysts and investors the time to analyze the information before the next trading session. This timing helps to manage market reactions and gives investors a chance to digest financial results and make informed decisions.

What should investors look for in after hours stock market announcements?

Investors should pay attention to key factors such as earnings surprises, changes in guidance, and market reactions from significant companies during after hours trading. Company earnings reports and financial outlooks provide insight into potential future performance and can influence stock prices in the subsequent trading sessions.

How does extended trading affect stock price movements?

Extended trading can lead to significant stock price movements as investors react to news, earnings releases, or other market-driving events in real time. Stocks may experience larger fluctuations after hours due to the smaller volume of trades compared to regular trading hours, making them more susceptible to sharp price changes based on less liquidity.

What resources are available for tracking stocks news in after hours trading?

To track stocks news during after hours trading, investors can use financial news websites, brokerage platforms that provide extended trading hours data, and market analysis tools that deliver real-time updates and alerts on earnings reports and other relevant financial market updates.

Are there specific times when after hours stock market trading is more active?

Yes, after hours stock market trading tends to be more active around significant news events, such as major earnings reports or economic announcements. Typically, the most trading activity occurs immediately following the market close at 4:00 PM EST and can continue for several hours as investors react to the latest information.

| Company | Stock Movement | Key Points |

|---|---|---|

| Ross Stores | -11% | Withdrew full-year guidance; expects Q2 earnings of $1.40-$1.55, lower than analyst expectations. |

| AutoDesk | +2% | Issued a strong Q2 outlook with expected earnings of $2.44-$2.48 on revenues of $1.72-$1.73 billion. |

| Intuit | +8% | Forecasted positive full-year outlook with adjusted earnings of $20.07-$20.12, surpassing previous guidance. |

| Workday | -6% | Forecasted subscription revenue of $2.16 billion for Q2, matching consensus; Q1 results exceeded expectations. |

| StepStone Group | +13% | Assets under management increased to $189.4 billion in Q4, up from $156.6 billion year-over-year. |

| Deckers Outdoor | -14% | Did not provide FY 2026 guidance due to macroeconomic concerns but Q4 results exceeded estimates. |

Summary

Stocks after hours showcased significant fluctuations, with notable companies like Ross Stores experiencing declines due to lower earnings forecasts, while Intuit enjoyed gains from an optimistic outlook. The contrasting performances highlight the market’s volatile nature and the impact of corporate earnings reports on stock prices. Investors should remain vigilant and informed about such movements, as they provide insights into market trends and potential investment opportunities.