Stock Market Outlook: Key Insights for May 27-30, 2025

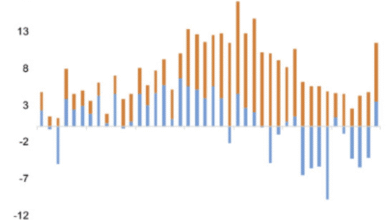

The Stock Market Outlook for the coming days remains uncertain as investors grapple with the impacts of global trade tensions and recent tariff announcements. President Trump’s threat to impose substantial tariffs has reignited concerns over economic stability, causing a notable dip in major indices such as the Dow Jones and S&P 500. Market participants are advised to stay tuned to the latest Stock Market News to gauge potential shifts driven by these geopolitical events. As we look ahead to this week’s economic reports, including durable goods orders and consumer confidence statistics, the sentiment in investing in stocks may fluctuate substantially. Observing these developments is crucial for understanding S&P 500 predictions and adjusting strategies amid a backdrop of volatility.

As we shift our focus to the financial landscape, the market’s forecast reveals a challenging environment for traders and investors alike. The recent escalation of trade tariffs has made navigating the equities market increasingly complex, heightening the need to analyze various financial indicators and economic data diligently. With the impending release of key reports, including job claims and GDP figures, it is essential to consider how such influences might contribute to the broader market decline. Analysts and trade experts are expecting these factors to shape the landscape for capital allocation and investment strategies significantly. Engaging with comprehensive stock evaluations and market analytics will be vital for making informed decisions in this turbulent trading climate.

Impact of Trade Tariffs on Stock Market Performance

The recent tariff threats issued by President Trump have significantly impacted the stock market, resulting in a notable decline in major indices like the Dow Jones and S&P 500. Investors have reacted with caution as the possibility of escalating trade tensions looms over the market. The announcement of a steep 50% tariff on European goods has led to fears of a new wave of volatility, driving a wedge between growth expectations and actual performance in stock prices.

Understanding the delicate balance of trade relations is crucial for investors. The ongoing trade war demonstrates how tariffs can inflict harm across multiple sectors, particularly affecting multinational companies like Apple, who are faced with increased costs on imported goods. Consequently, equities could be pressured as companies grapple with rising expenses, leading to diminished profit margins and investor sentiment that prefers safety over speculative buying.

Stock Market Outlook for May 27-30, 2025

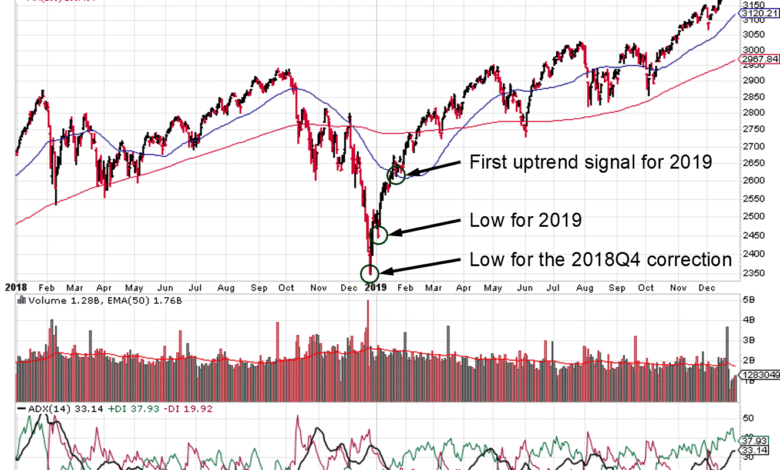

As we head into the last week of May, investors are bracing for a series of economic reports that could provide insight into the overall health of the economy. With the stock market having rebounded since the lows of March, the S&P 500’s performance will be closely examined to determine whether it can maintain its upward trajectory. However, the threat of tariffs complicates this outlook, posing an obstacle that might inhibit further gains.

Investors’ reactions will also be influenced by developments in the trade situation with the EU. The forthcoming Durable Orders and Consumer Confidence reports are critical indicators that could either bolster investor optimism or reinforce concerns about a market decline. Keeping a close eye on these metrics may offer guidance for strategic investing moves in the face of fluctuating market conditions.

Navigating the Stock Market During Trade Uncertainty

Navigating the stock market amidst trade uncertainty brings forth a complex challenge for investors. With President Trump’s latest tariff threat, the volatility within the market has once again surged. Investors must develop strategies to mitigate risks associated with potential trade wars that can unpredictably impact stock values. Stocks that are heavily reliant on exports may face significant headwinds, making diversification a key strategy for minimizing potential losses.

Moreover, staying informed on trade negotiations is increasingly critical for making educated investing decisions. The market’s reaction to tariff announcements can be swift, leading to fluctuations that may not reflect the long-term fundamentals of the companies involved. By utilizing tools such as stop-loss orders and keeping abreast of stock market news, investors can better position themselves to act swiftly to shield their portfolios from sudden market declines.

Understanding S&P 500 Predictions for the Upcoming Week

As forecasts for the S&P 500 emerge, analysts emphasize the importance of both technical and fundamental indicators for the week of May 27-30, 2025. Recent market forecasts suggest cautious optimism as investors weigh earnings reports against potential negative impacts from trade policies. The trade dynamics present a double-edged sword that could either support or hinder the index’s advance depending on the unfolding geopolitical context.

Additionally, watching the S&P 500’s response to economic reports will be paramount. The durable goods orders and consumer sentiment data, released later this week, could sway market predictions. An uptick in these metrics may buoy investor confidence, while negative surprises could lead to a reassessment of risks associated with investing in equities amid trade uncertainty.

Investment Strategies Amidst Market Decline

In the wake of recent market declines fueled by tariff threats, investors must reevaluate their strategies. The current environment calls for a mix of caution and resilience, encouraging a focus on sectors more likely to thrive in uncertain conditions. Defensive stocks, utilities, and consumer staples may offer stability, while investors should also consider opportunities in value stocks that have been oversold due to immediate market reactions.

Furthermore, investors might look toward adopting dollar-cost averaging, as this method allows for spreading investments over time to lessen the impact of volatility. By consistently investing regardless of market conditions, one can take advantage of lower stock prices during downturns. This adaptive strategy can create a robust investment approach that withstands the fluctuations of market reactions to trade tariffs.

Key Economic Indicators to Watch This Week

This upcoming week will feature the release of several key economic indicators that can significantly influence market direction. Investors are slated to monitor the Consumer Confidence Index, as it reflects the willingness of consumers to spend and invest, which are crucial elements of economic growth. A positive report here could provide a much-needed boost to investor sentiment, potentially calming fears tied to trade wars.

Other significant data points include the initial jobless claims and GDP figures, vital in assessing overall economic health. A solid GDP report may bolster market confidence and help alleviate concerns over the negative impact of trade tariffs on economic performance. Thus, creating a well-diversified portfolio will help mitigate risks while capitalizing on growth opportunities in this ever-shifting landscape.

Trade Tariffs and Their Long-Term Implications

The imposition of trade tariffs has both immediate and long-lasting implications for the stock market and broader economy. Concerns over increasing costs for manufacturers can lead to squeezed profit margins, altering investor perceptions on growth potential. As companies assess the long-term impact of these tariffs, a shift in strategy may be necessary, such as diversifying supply chains or passing costs onto consumers.

Moreover, the uncertainty surrounding the administration’s trade policies necessitates a vigilant approach in investment decisions. Investors should remain cognizant of how these tariffs can reshape competitive landscapes across sectors. Those who anticipate cost increases may pivot towards sectors that are less exposed to foreign markets or capable of withstanding price pressures, thus promoting a more strategic allocation of investments.

Market Volatility: Risks and Opportunities

Market volatility is an inherent risk that investors face, especially during periods of increased geopolitical tension and trade disputes, such as the current situation with tariffs. This volatility, while unsettling, can also present unique investment opportunities for savvy traders willing to engage at lower price points. Such strategies can enable investors to capitalize on market corrections that often follow significant trade news or economic updates.

Investors are advised to take a disciplined approach during times of flux. Utilizing options and hedging strategies can provide an avenue to protect against potential declines while still participating in upside momentum. By understanding the underlying factors that drive market movements, investors can better position themselves to take advantage of mispriced stocks as the market reacts to external events.

The Role of Economic Reports in Stock Market Predictions

Economic reports play an instrumental role in shaping stock market predictions, providing investors with essential data to assess the health of the economy. Reports such as the Chicago PMI and consumer sentiment provide insights into spending habits and business conditions that can directly influence stock prices. Investors increasingly rely on these metrics to gauge potential market movements and adjust their strategies accordingly.

As we approach the report releases scheduled for this week, anticipation builds. A positive showing in consumer spending could buoy stock prices and offset ongoing concerns over trade tensions. Conversely, disappointing data could deepen fears, leading to potential market declines. Understanding these nuances will enable investors to navigate the complexities of stock market trends effectively.

Frequently Asked Questions

What is the current Stock Market Outlook for trading in late May 2025?

The Stock Market Outlook for late May 2025 is cautious due to President Trump’s announcement of potential new tariffs on the European Union. After a recent drop, the Dow Jones and S&P 500 indicators show vulnerability as investors react to the trade situation, with predictions of continued volatility in the coming days.

How do trade tariffs impact the Stock Market Outlook?

Trade tariffs significantly influence the Stock Market Outlook by creating instability and uncertainty among investors. Trump’s announcement of a 50% tariff could lead to further market declines as seen recently when the Dow Jones lost 256 points, underscoring the sensitivity of stocks to trade-related news.

What should investors consider in the Stock Market Outlook this week?

Investors should closely consider economic indicators scheduled for release, like the Consumer Confidence and GDP data, as well as ongoing trade developments. The Stock Market Outlook indicates that these factors could shape market sentiment and reactions significantly during the week.

Are there any predictions for the S&P 500 this week?

The S&P 500’s predictions for this week are mixed, suggesting a cautious approach as it is facing potential declines due to rising bond yields and trade tariff concerns. Investors should watch these developments closely to gauge future movements and potential rebounds.

What role does market sentiment play in the Stock Market Outlook amid trade issues?

Market sentiment plays a crucial role in the Stock Market Outlook, especially amidst trade issues. Investor attitudes toward tariffs and economic data influence stock performance, as fear of escalated trade conflicts can lead to swift market reactions, as demonstrated in recent sessions.

How are trade tariffs affecting investing in stocks currently?

Currently, trade tariffs are diminishing investor appetite for stocks, as seen in the recent downturn triggered by Trump’s tariff announcement. The Stock Market Outlook suggests that this leads to a more cautious investment approach, with many waiting for clearer signs of resolution in trade relations.

What external factors should be monitored for a favorable Stock Market Outlook?

Key external factors include trade negotiations, inflationary pressures, consumer sentiment data, and interest rate decisions. Monitoring these elements is vital for an optimistic Stock Market Outlook, as they can dramatically influence stock performance and investor decisions.

What are analysts’ opinions on the future Stock Market Outlook related to tariffs?

Analysts express divided opinions on the future Stock Market Outlook concerning tariffs. Some believe that ongoing tariff threats will keep pressure on the market, while others see potential stability if negotiations progress positively. Consistent monitoring is essential as the situation evolves.

| Date | News/Event | Market Impact | Commentary |

|---|---|---|---|

| May 27, 2025 | Durable Orders preliminary release (April) | Expectations of mixed performance in stocks due to tariffs. | Investor sentiment remains cautious amid trade tensions. |

Summary

The Stock Market Outlook for the upcoming week from May 27-30, 2025 shows a cautious environment with investors braced for potential volatility due to President Trump’s tariff threats. As the market grapples with the implications of a 50% tariff on the European Union and its effects on major companies like Apple, the broader market indexes have shown declines. Upcoming economic reports, particularly concerning consumer confidence and GDP, will be pivotal in shaping investor sentiment. Traders are advised to stay vigilant as developments unfold, especially regarding international trade relations, which are likely to continue affecting market performance.