Saylor Proof-of-Reserves: Why It’s a Bad Idea for Bitcoin

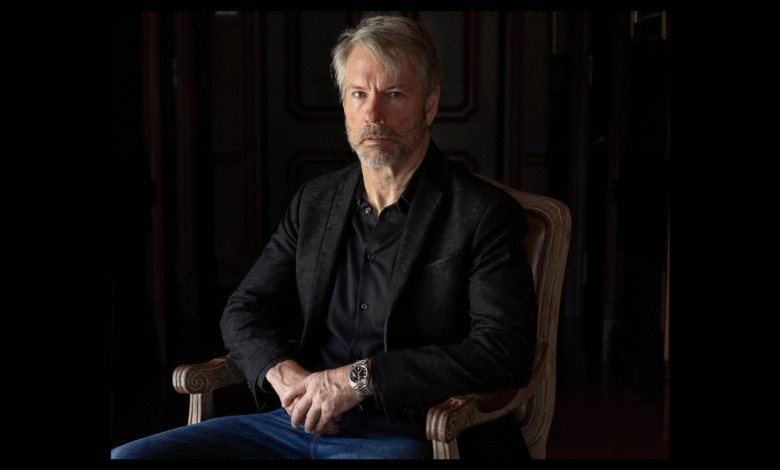

Michael Saylor, the founder of Strategy and a prominent advocate for Bitcoin, recently made headlines with his controversial stance on the concept of Saylor Proof-of-Reserves. Ahead of the highly anticipated Bitcoin Conference 2025 in Las Vegas, Saylor publicly dismissed proof of reserves as a fundamentally flawed idea. He argued that revealing such sensitive financial information only serves to exacerbate crypto security risks rather than mitigate them. Citing the potential dangers of exposing wallet addresses, Saylor stressed the need for a more secure and private verification process. His provocative remarks have sparked a heated discussion in the ongoing reserve transparency debate, challenging the assumptions that underpin conventional notions of accountability in the cryptocurrency space.

In light of recent discussions surrounding asset verification, the notion of Saylor Proof-of-Reserves brings to the forefront the importance of transparency versus security in the crypto landscape. As Michael Saylor prepares for the pivotal Bitcoin Conference 2025, his critique highlights the broader implications of proving ownership without compromising safety. The essence lies in balancing the need for public trust with the imperative to safeguard sensitive financial details, a dilemma that resonates with ongoing dialogues about cryptographic security practices. These issues are paramount in navigating the complexities of cryptocurrency audits, as stakeholders strive for clarity while remaining vigilant against potential vulnerabilities. Ultimately, Saylor’s perspective raises crucial questions about the future of cryptocurrency governance and the best methods for ensuring both transparency and security.

Understanding Michael Saylor’s Views on Crypto Security

Michael Saylor, a prominent figure in the world of cryptocurrencies, particularly Bitcoin, has expressed strong views regarding the idea of proof-of-reserves. His recent remarks, particularly in the lead-up to the Bitcoin 2025 conference, have provoked much discussion. Saylor argues that establishing a public proof-of-reserves system does not bolster security but rather diminishes it. He believes that broadcasting such sensitive financial information is akin to publishing personal banking details of family members, which opens them up to various security risks. This skepticism about public disclosures stems from concerns surrounding the potential for hacking and other vulnerabilities that could arise from making wallet addresses publicly accessible.

Moreover, Saylor highlights that while Bitcoin’s blockchain allows anyone to verify if funds exist at a given address, it does not prove ownership or control over those funds without further action, such as signing a message with private keys. This pivotal distinction underlines his point that mere visibility of an address does not equate to security; it can instead invite malicious attempts to exploit any weaknesses in the system. By advocating for traditional institutional checks, where audits are conducted by ‘Big Four’ firms, he pushes for a more secure and evaluated approach to verifying holdings rather than an open-book policy that could exacerbate existing crypto security risks.

The Reserve Transparency Debate in the Crypto Sphere

The issue of reserve transparency remains controversial within the cryptocurrency community. On one side, proponents of proof-of-reserves argue that it enhances trustworthiness and accountability among exchanges and custodians. They believe that demonstrating the custody of assets can alleviate fears of insolvency and reassure investors about the legitimacy of their platforms. However, as Saylor points out, this transparency comes with significant risks. His assertion that traditional financial institutions do not publish detailed accounts of their assets and liabilities suggests a belief that some level of confidentiality is essential for maintaining security and trust.

In the contemporary reserve transparency debate, it is crucial to consider the implications of various strategies and regulations. Many in the crypto world advocate for a robust auditing framework that guarantees the cryptographic proofs of assets while maintaining a level of privacy that does not expose them to attacks. Saylor’s cautions against simplistic solutions to complex security dilemmas underline the necessity of a more nuanced approach, one that balances the need for transparency with the imperative of safeguarding sensitive financial information. This debate will likely continue to evolve as the industry matures and as more stakeholders weigh the merits and risks associated with proof-of-reserves.

Michael Saylor’s Stance on Bitcoin and Institutional Trust

Michael Saylor’s position on Bitcoin and proof-of-reserves reflects a broader trend in the crypto market where institutional trust is paramount. As the co-founder of Strategy, he holds a substantial amount of Bitcoin, which compels him to advocate for a model that maintains safety for investors. By emphasizing the need for institutional-grade proof of assets accompanied by proof of liabilities, Saylor is recognizing the challenges that come with managing large cryptocurrency portfolios. He believes that these should be verified through reliable auditing by competent firms, rather than through potentially misleading public disclosures.

The relationship between transparency and trust in cryptocurrency is delicate. Many investors are drawn to Bitcoin for its perceived security over traditional assets, and Saylor’s arguments align with the need for fortified standards in crypto asset management. His critique of public proof-of-reserves calls into question not just the efficacy of such practices but also the broader implications for investor confidence. As we move towards events like the Bitcoin 2025 conference, the ongoing conversation about trust, security measures, and the practicality of proof-of-reserves will continue to shape the landscape of cryptocurrency investment.

The Impact of Public Perception on Proof-of-Reserves

Public perception plays a significant role in shaping the discourse around proof-of-reserves in the cryptocurrency industry. Saylor’s comments have sparked both support and backlash, highlighting the polarized views on how to approach reserve transparency. Critics argue that by rejecting the necessity of public proof-of-reserves, Saylor may appear to be defending his own interests, especially when contrasted with the broader push for greater transparency in financial practices. The backlash he faced underlines the tensions between innovation and traditional accountability standards, which are especially heightened in an environment characterized by skepticism.

Simultaneously, defenders of Saylor’s viewpoint emphasize the need for security over unwarranted transparency. They argue that exposing too much information could compromise the safety of digital assets, just as Saylor suggests. The debate reflects broader themes in the cryptocurrency arena, where how one manages trust, reputation, and financial security amidst emerging technologies is constantly evolving. Engaging with the public through discussions like these not only impacts individual businesses but also sets the tone for industry-wide standards moving forward.

Analyzing Criticisms of Saylor’s Stance on Reserve Transparency

The criticisms leveled against Michael Saylor regarding his remarks on proof-of-reserves illustrate the complexities involved in navigating the evolving cryptocurrency ecosystem. Detractors point to his significant investment in Bitcoin and question whether his opposition to public audits serves as a barrier to accountability. Some observers have gone as far as to label his stance as indicative of his own company’s prior controversies. This scrutiny reflects a broader scrutiny of high-profile figures in cryptocurrency, especially as trust remains a critical concern in an industry still perceived by many as unregulated and volatile.

However, it is essential to recognize that the pushback Saylor receives is not uniform among crypto enthusiasts. Supporters argue that his insights, born from extensive involvement in the Bitcoin ecosystem, merit consideration, especially amidst security vulnerabilities faced by many digital platforms. By debating the necessity and methods of proving reserves, Saylor reminds the community of the importance of security protocols and reliable institutional practices, which are pivotal in building investor confidence. Balancing privacy with accountability continues to be a major discourse in the crypto community, one that Saylor’s comments have undeniably intensified.

The Future of Bitcoin and Its Security Landscape

As the cryptocurrency space continues to evolve, security will undoubtedly remain a pivotal focal point, especially with Bitcoin’s increasing prominence. With events like the Bitcoin 2025 conference approaching, discussions around measures like proof-of-reserves will be crucial for shaping the future of digital finance. Saylor’s criticism of current proof-of-reserves practices invites industry leaders to rethink their strategies for assuring investors without compromising the security of their holdings. This sentiment aligns with broader concerns about the implications of crypto security risks, shedding light on the importance of robust security measures in a rapidly expanding marketplace.

Looking ahead, the challenge will be reconciling the need for transparency with the fundamental principles of security that underpin financial assets, particularly in cryptocurrencies like Bitcoin. As conversations around auditing protocols, regulatory frameworks, and best practices for asset management continue, stakeholders must contemplate innovative solutions that harmonize investor trust with the preservation of security. Saylor’s remarks serve as a catalyst for this ongoing dialogue and raise pertinent questions about the methodologies employed by custodians and exchanges, ensuring that the future of Bitcoin remains secure and primarily focused on its core tenets.

Institutional Confidence and Proof-of-Reserves Dilemma

Institutional confidence in the cryptocurrency market heavily relies on sound practices concerning proof-of-reserves. As digital assets become more integrated with mainstream finance, the demand for transparency in asset management practices will undoubtedly rise. However, such transparency must be balanced with the need for security, as highlighted by Saylor’s critiques of public disclosures. His stance raises a crucial point – that overly transparent practices could expose institutions to risks that may deter investor confidence, especially among institutions that are featured as benchmarks for security.

In light of these considerations, creating institutional frameworks that deliver verifiable proof of reserves without compromising security is paramount. Audits by reputable firms, alongside stringent internal controls, can provide similar levels of confidence without necessitating the public disclosure of sensitive wallet information. Therefore, the resolution to the proof-of-reserves dilemma lies not just in advocating for transparency but in implementing powerful assessments that reinforce safety and trust within the rapidly changing landscape of cryptocurrency investment.

Public Opinion and Its Role in Shaping Crypto Practices

Public opinion plays an instrumental role in determining best practices in the cryptocurrency space, particularly regarding issues like proof-of-reserves. The reactions to Michael Saylor’s views underscore how critical community perception is in shaping operational norms among crypto organizations. With a broad spectrum of opinions in play, the challenge for industry influencers is to navigate this landscape while promoting practices that align with both investor expectations and sound financial stewardship. The interaction between public sentiment and institutional behavior will heavily influence the policies adopted by exchanges and custodians as they strive to strike a balance between transparency and security.

Furthermore, as a significant portion of Bitcoin’s user base grows more vocal in demanding assurance regarding asset holdings, companies are increasingly finding themselves at a crossroads. This climate of scrutiny invites organizations to consider adopting more rigorous audits and asset confirmations to foster trust within the community. By addressing public concerns, leaders in the cryptocurrency sector can take proactive steps toward establishing robust frameworks that ensure security while evidencing compliance with the overarching demands of transparency, paving the way for a more dependable crypto ecosystem.

Frequently Asked Questions

What is Michael Saylor’s stance on proof-of-reserves in Bitcoin?

Michael Saylor, founder of Strategy, strongly opposes the idea of proof-of-reserves in Bitcoin. He believes it dilutes security and has publicly described it as a ‘bad idea,’ likening it to exposing sensitive personal financial information.

How does Saylor’s criticism of proof-of-reserves relate to crypto security risks?

Saylor argues that the current methodologies for proof-of-reserves present significant crypto security risks. By publishing wallet addresses, he maintains that individuals could easily trace transactions, potentially compromising the safety of both the assets and the users involved.

What alternative to proof-of-reserves does Michael Saylor propose?

Instead of public proof-of-reserves, Saylor suggests that an institutional-grade audit conducted by a reputable ‘Big Four’ firm would be a more secure approach. This would involve verifying both assets and liabilities without compromising the integrity of the private keys.

What did Saylor say about the transparency debate surrounding proof-of-reserves?

In the reserve transparency debate, Michael Saylor criticized the notion of sharing wallet addresses, cautioning that it does not truly verify control over bitcoins. He insists that effective transparency also requires understanding who holds the private keys.

Why might the Bitcoin community be divided on Saylor’s view of proof-of-reserves?

The Bitcoin community is divided due to differing opinions on security versus transparency. Critics believe that Saylor’s refusal to provide proof-of-reserves raises red flags about the legitimacy of holdings, while supporters view him as a key advocate for Bitcoin’s integrity.

How does Saylor’s approach impact discussions at the Bitcoin Conference 2025?

Saylor’s stance on proof-of-reserves likely sets the stage for discussions at the Bitcoin Conference 2025, where security experts may explore the implications of his views on crypto security and institutional practices in asset verification.

What risks does Saylor associate with exposing wallet addresses in proof-of-reserves?

Saylor highlights that exposing wallet addresses can lead to vulnerabilities, including targeted attacks on asset holders. He argues that this practice complicates security and management of bitcoin holdings.

In what way does Saylor emphasize the importance of audited reserves over public disclosures?

Saylor emphasizes that audited reserves provide a more secure and verifiable method of confirming asset ownership and integrity. He believes that relying on audits mitigates risks associated with publicly disclosed wallet information.

| Key Point | Details |

|---|---|

| Michael Saylor’s Stance | Michael Saylor strongly opposes proof-of-reserves, calling it a ‘bad idea’ that dilutes security. |

| Concerns Over Transparency | Saylor believes that publishing wallet addresses can create security vulnerabilities and risks. |

| Insecure Proof of Reserves | He describes current proof-of-reserves methods as inadequate and prone to misinterpretation. |

| Auditor’s Role | Saylor advocates for institutional-grade proof of assets and liabilities handled by a reputed auditor. |

| Public Reaction | Saylor’s remarks sparked significant discussion, with mixed reactions on social media. |

Summary

Saylor Proof-of-Reserves has ignited a robust debate within the cryptocurrency community about the efficacy and security of reserve transparency. Michael Saylor’s blunt dismissal of the concept highlights concerns over potential vulnerabilities linked to public address disclosures. While he advocates for verified audits by reputable firms, the mixed reactions from the public demonstrate the ongoing friction between calls for transparency and the need for security in digital asset management.