Kurdistan Crypto Crackdown: New Measures After $15M Fraud

In a significant move, the Kurdistan Crypto Crackdown has been initiated by the Kurdistan Regional Government (KRG) to combat cryptocurrency fraud in the region. Following a shocking $15 million scam that exploited unsuspecting investors, the KRG has mandated the Ministry of Interior to create a special committee focused on regulating electronic trading and digital currencies. This coordinated effort aligns with recent directives from the Central Bank of Iraq, emphasizing the urgent need for stringent digital currency regulations. As Iraq crypto news continues to reveal concerning trends in crypto trading, this crackdown is poised to reshape the cryptocurrency landscape in Kurdistan. By addressing these rampant issues, the KRG aims to foster a safer environment for potential investors while curbing illicit activities associated with a growing digital economy.

The recent cryptocurrency regulations imposed by the authorities in the Kurdistan Region highlight a broader trend of governmental intervention in the digital financial systems across various jurisdictions. Following alarming reports of sizable fraud cases, officials are taking decisive steps to implement a trading ban on multiple crypto enterprises. This crackdown, aimed primarily at safeguarding the interests of investors, mirrors global efforts to mitigate risks associated with digital currencies. With the aim of establishing secure frameworks for cryptocurrency, the newly formed task force signifies a proactive approach in response to the challenges posed by illicit crypto schemes. As developments in this arena unfold, it is crucial to remain informed about the policies and guidelines shaping the future of digital currencies.

Understanding the Kurdistan Government’s Stance on Cryptocurrency

The Kurdistan Regional Government (KRG) has taken a firm stance against cryptocurrency, particularly in light of rising incidents of cryptocurrency fraud. Following a significant $15 million fraud case, the KRG has mandated strict actions to regulate digital currencies and electronic trading. The directive emphasizes the need for the Ministry of Interior to dismantle operations related to these financial technologies, highlighting the government’s priority of safeguarding its citizens from the risks associated with unregulated trading. With this crackdown, the KRG aims to create a safer environment for future financial innovations while protecting the legitimacy of the market.

This move forms part of a broader narrative in Iraq regarding digital currency regulations, as various government agencies recognize the potential risks of cryptocurrency trading. The Central Bank of Iraq’s influence on this decision indicates a shift towards stricter financial oversight. The KRG’s actions could pave the way for more definitive guidelines in the region, ensuring that any future digital currency endeavors comply with local and international regulations, ultimately enhancing the trust placed in this rapidly evolving financial landscape.

Kurdistan Crypto Crackdown: A Response to Fraud

The recent decision by the Kurdistan Regional Government to enforce a crypto crackdown is a direct response to the fraudulent activities that have emerged within the cryptocurrency space. The case involving a $15 million scam underscores the potential dangers of unregulated digital currency transactions. By taking action against companies involved in cryptocurrency trading, the KRG aims to restore public confidence in the financial system and deter potential offenders. This crackdown is not just reactive; it reflects an ongoing concern about how cryptocurrency fraud could undermine the economy and harm investors, particularly in a region still recovering from economic instability.

The Kurdistan crypto crackdown serves as a cautionary tale for other regions considering similar pursuits in digital currencies. As cryptocurrencies gain popularity worldwide, the need for robust regulatory frameworks is becoming increasingly evident. The KRG’s involvement highlights its commitment to protecting the interests of its citizens while aligning with global standards of financial regulation. Moving forward, such measures will be essential in preventing cryptocurrency fraud and setting clearer paths for legitimate crypto businesses within Iraq.

The Impact of Digital Currency Regulations on Investors

As the Kurdistan Regional Government implements stringent regulations on cryptocurrency, the implications on current and prospective investors are significant. The introduction of a trading ban could deter some investors from entering the digital currency market, fearing that additional restrictions might arise. However, establishing clear guidelines can also help protect investors from fraudulent schemes like the recent $15 million case noted in Duhok. Investors are likely to seek assurance in a regulatory environment that actively combats fraud and promotes ethical trading practices.

Moreover, these regulations can ultimately contribute to a more stable financial environment, fostering trust in cryptocurrency as a legitimate investment vehicle. As the KRG continues to refine its approach to digital currencies, investors may find that a regulated marketplace offers both security and potential for future growth. In this sense, while immediate responses like a trading ban might seem limiting, the long-term effects could cultivate a safer investment landscape for all those interested in cryptocurrencies within the Kurdistan region.

Reactions to Kurdistan’s Crypto Trade Shutdown

The announcement of the Kurdistan crypto crackdown has elicited mixed reactions from the public and crypto advocates alike. Supporters of the decision often argue it represents a responsible approach to combating rampant cryptocurrency fraud, which has increasingly targeted inexperienced investors. By shutting down operations tied to unregulated trading, they believe the KRG is taking essential steps to protect its citizens from exploitation in an unpredictable market.

Conversely, critics of the crypto trade shutdown contend that such measures could stifle innovation and push potential growth in digital currencies underground. This concern for the stifling of a burgeoning sector highlights the delicate balance that governments must strike between enforcing regulations and fostering economic growth. As the KRG navigates these challenges, ongoing dialogue within the community is crucial to understanding the broader implications of these decisions on cryptocurrency in the region.

Future Implications for Cryptocurrency in Iraq

The Kurdistan crypto crackdown raises essential questions about the future landscape of cryptocurrency in Iraq. As the government takes measures to suppress unregulated trading, stakeholders must consider how this might affect legitimate enterprises aiming for growth in a structured regulatory framework. With a clear strategy from the KRG, there is potential for a flourishing market that attracts investment while minimizing risks associated with fraud and volatility in digital currencies.

Simultaneously, the emergence of more defined regulations could inspire a new wave of startups focused on legal and ethical cryptocurrency initiatives. By promoting an environment that adheres to the regulations set by the Central Bank of Iraq, innovators may feel empowered to explore the digital currency space creatively. This regulatory clarity could be the catalyst needed for a competitive digital economy in Kurdistan and the broader Iraqi landscape.

Lessons Learned from the Duhok Fraud Case

The $15 million fraud case in Duhok has provided crucial lessons for the Kurdistan Regional Government and stakeholders involved in cryptocurrency. It highlights the need for vigilant oversight, especially in a rapidly evolving financial landscape where fraudsters can easily exploit the lack of regulations. The incident serves as a wake-up call for authorities to strengthen their approach towards monitoring digital currency platforms and enhancing public awareness about the risks associated with unregulated trading.

Additionally, this case emphasizes the importance of investor education in the cryptocurrency space. As more individuals consider investing in digital currencies, it becomes imperative for the KRG to implement programs aimed at informing the public about potential scams and the importance of conducting thorough due diligence before investing. Through these proactive measures, the government can empower citizens while fostering a healthier investment environment.

Regulatory Collaboration: KRG and the Central Bank’s Role

The joint efforts of the Kurdistan Regional Government and the Central Bank of Iraq in addressing cryptocurrency regulations underscore an essential collaboration in maintaining financial stability. By working together to establish clear guidelines, these institutions can create a more structured approach to digital currencies that protects consumers while still allowing for innovation. Their coordinated response to the recent fraudulent activities showcases a commitment to not only addressing immediate issues but also planning for the future.

This collaboration could lead to comprehensive policy frameworks that encompass various aspects of cryptocurrency, including trading practices, investor protections, and compliance measures. As these entities come together to tackle challenges in the crypto space, the potential for a robust and secure environment for digital currencies in Kurdistan becomes increasingly attainable, benefiting both investors and businesses.

The Role of Community in Digital Currency Awareness

Community involvement plays a critical role in fostering awareness around digital currencies and preventing cryptocurrency fraud. During times of uncertainty, such as the recent crackdown in Kurdistan, community leaders and organizations can bridge the knowledge gap by educating the public about the risks and benefits of cryptocurrency. Informative workshops, seminars, and online resources can empower individuals and promote a culture of informed investing.

Moreover, active community engagement encourages open discussions about regulations and the future of digital currencies. It’s vital for members of the community to voice their concerns and participate in shaping policies designed to regulate cryptocurrency trading. This grassroots approach can ensure that the KRG’s regulations are reflective of the needs and experiences of citizens, establishing a more inclusive and effective regulatory environment.

Potential Economic Benefits of Regulated Cryptocurrency

As the Kurdistan Regional Government moves towards establishing regulations for cryptocurrency, there are potential economic benefits that could arise from a regulated environment. By creating a framework for legitimate digital trading, the region could attract both local and foreign investors interested in entering the cryptocurrency market. Such investments could stimulate economic growth, create new jobs, and bolster the vibrancy of the local economy.

In addition to attracting investment, regulated cryptocurrency practices can unlock new avenues for revenue generation, including taxes on digital transactions and service fees from compliant crypto ventures. These financial inflows could be pivotal for the Kurdistan region, especially as authorities seek sustainable solutions to bolster economic recovery. Consequently, a well-regulated cryptocurrency market could serve as a significant catalyst for comprehensive economic development in the region.

Frequently Asked Questions

What is the Kurdistan Crypto Crackdown and why was it initiated?

The Kurdistan Crypto Crackdown refers to the Kurdistan Regional Government’s recent directive to shut down companies involved in cryptocurrency trading and digital currencies. This initiative was prompted by a $15 million fraud case linked to a cryptocurrency scheme, aiming to enhance regulations and prevent further financial fraud in the region.

How has the Kurdistan government responded to recent cryptocurrency fraud?

In response to recent cryptocurrency fraud cases, including a significant $15 million scam, the Kurdistan government has ordered the establishment of a special committee to close down electronic trading companies. This action highlights the government’s commitment to enforcing stricter digital currency regulations.

What implications does the Kurdistan Crypto Crackdown have for cryptocurrency trading in the region?

The Kurdistan Crypto Crackdown imposes significant restrictions on cryptocurrency trading by shutting down companies involved in digital currency operations. This could temporarily deter crypto trading activities and requires potential investors to be cautious in their engagements with digital currency in Kurdistan.

What role does the Central Bank of Iraq play in the Kurdistan Crypto Crackdown?

The Central Bank of Iraq has been instrumental in the Kurdistan Crypto Crackdown by providing directives that led to the formation of a special committee. Its involvement emphasizes the importance of adhering to financial regulations and combating cryptocurrency fraud within Iraq’s semi-autonomous regions.

What recent events prompted the Kurdistan government to enhance its digital currency regulations?

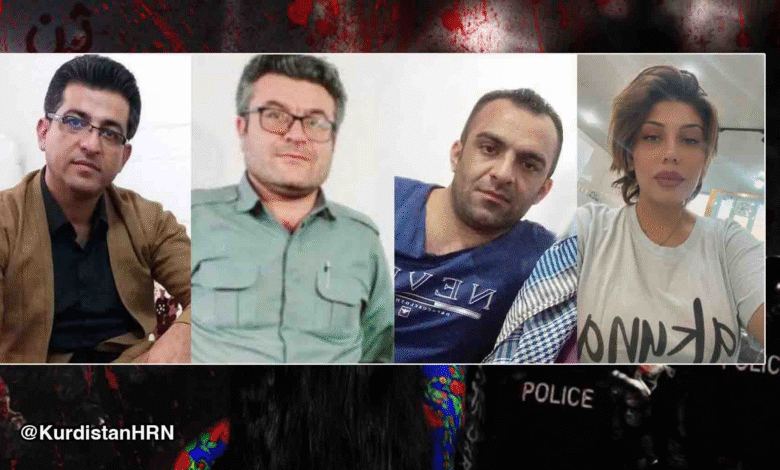

The Kurdistan government’s decision to enhance its digital currency regulations was prompted by the recent arrest of two suspects involved in a cryptocurrency fraud case that allegedly defrauded investors of $15 million. This incident catalyzed the crackdown and highlighted the need for stricter oversight of digital financial operations.

How can individuals protect themselves from cryptocurrency fraud in Kurdistan?

Individuals can protect themselves from cryptocurrency fraud in Kurdistan by staying informed about the ongoing regulations, avoiding unregulated trading platforms, and conducting thorough research before investing in any digital currency schemes. Following the Kurdistan Crypto Crackdown, being cautious is essential to mitigate risks.

What are the potential outcomes of the Kurdistan Crypto Crackdown for investors?

The Kurdistan Crypto Crackdown could lead to heightened regulatory scrutiny, reducing opportunities for unsafe investment options. While it aims to protect investors from fraud, it may also limit legitimate trading options available to them in the region.

What is the future of cryptocurrency in the Kurdistan region following this crackdown?

The future of cryptocurrency in the Kurdistan region is uncertain following the crackdown. Depending on how the regulations evolve and the government’s approach to digital currencies, there could be a temporary decline in crypto activities, but there is potential for renewed interest as regulations mature and safe trading practices are established.

| Key Point | Details |

|---|---|

| KRG Response | The Kurdistan Regional Government (KRG) ordered the Ministry of Interior to establish a special committee to shut down companies involved in crypto trading. |

| Fraud Case Background | This crackdown follows the arrest of two individuals in Duhok related to a $15 million cryptocurrency fraud case. |

| Instruction Origin | The directive is based on the Central Bank of Iraq’s guidelines to combat electronic trading fraud. |

| Focus on Digital Finance | The KRG’s decision emphasizes a commitment to regulating digital financial operations in the region. |

Summary

The Kurdistan Crypto Crackdown marks a significant step by the KRG to mitigate the risks associated with digital currency trading. Following a major fraud case, this initiative underscores the regional government’s commitment to safeguarding investors and fostering a secure financial environment.