Robinhood Shares Drop Amid S&P 500 Rebalance Speculation

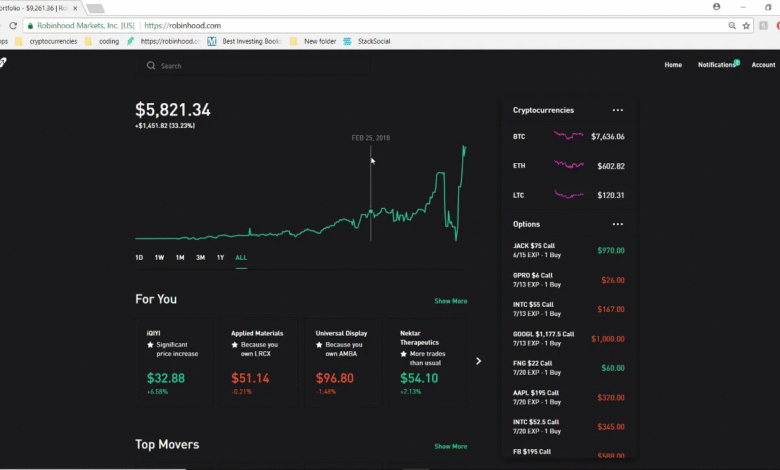

Robinhood shares dropped on Monday, disappointing investors as the online brokerage was surprisingly overlooked in the latest quarterly rebalance of the S&P 500 Index. Following a promising performance that saw Robinhood stock rally 3.3% on Friday and gain over 13% for the week, the news stung. In premarket trading, shares of Robinhood fell nearly 5% as traders reacted to the announcement that the S&P 500 would remain unchanged. This significant omission comes after months of speculation about their potential inclusion, with Bank of America previously identifying Robinhood as a leading candidate for the upgrade. As the dust settles on this Robinhood investment news, market analysts are now assessing the implications for Robinhood’s future market performance and upcoming quarterly results in light of this latest setback.

The recent decline in shares of Robinhood has stirred conversations about the brokerage’s status in the market. After being passed over in the much-anticipated S&P 500 rebalance, many are left questioning the firm’s prominence and resilience. With the backdrop of fluctuating stock trends and shifting investor sentiments, Robinhood’s market position may be precarious. Analysts will likely scrutinize the implications of this exclusion for the firm’s future, especially in regard to upcoming fiscal reports. As investors watch closely, the ramifications of this pivotal event could shape the narrative around Robinhood stock for the foreseeable future.

Robinhood Shares Drop Amid S&P 500 Rebalance Announcements

On Monday, Robinhood shares dropped nearly 5% in premarket trading, a significant decline that came as a shock to investors who had hoped for an inclusion in the S&P 500 Index during its latest quarterly rebalance. This news followed a period of speculation and optimism, particularly after Bank of America had previously highlighted Robinhood as a strong candidate for the prestigious index. Following months of talks about its potential ascension, the actual update left many in the trading community underwhelmed and concerned about the online brokerage’s future performance.

Historically, inclusion in the S&P 500 has led to bullish trading activity, with companies often experiencing a surge in their stock prices due to the influx of passive fund investments. For instance, Coinbase’s stock jumped a remarkable 24% the day after its S&P 500 announcement, showcasing the powerful impact of such recognition. Unfortunately for Robinhood, its missed inclusion raises questions about its market performance and potential for growth moving forward. Investors are now left to assess what this means for their ongoing engagement with Robinhood’s stock.

Analyzing Robinhood’s Market Performance and Future Outlook

Despite the recent drop and disappointment surrounding the S&P 500 rebalance, it’s crucial to note that Robinhood has shown remarkable resilience during the year. The company’s shares have already doubled in price, reflecting a volatile but ultimately positive trend amidst the broader market fluctuations, which have seen revivals in both stock and cryptocurrency investments. The recent gains considerably boost investor sentiment, demonstrating that there is still room for Robinhood to reclaim its position as a key player in online trading.

However, the online brokerage still faces significant hurdles. The aftermath of the GameStop trading frenzy, coupled with the collapse of major cryptocurrency exchange FTX, has caused a shake-up within the industry, prompting a reevaluation of business models for many firms. Moving forward, Robinhood’s ability to regain its foothold in the market hinges on its strategy to restore investor confidence and navigate the challenging trading landscape. The upcoming quarterly results will be critical for assessing whether the ongoing recovery trend can be sustained.

The Impact of Robinhood Investment News on Investor Sentiment

In the world of investing, news regarding major companies like Robinhood often sways investor sentiment dramatically. Recent reports indicating Robinhood’s failure to secure a position in the S&P 500 revealed deep feelings of uncertainty among its stakeholders. News that once hinted at promising potential has morphed into a source of anxiety, raising questions about the firm’s overall market strategy and its implications for Robinhood stock. Investors, keen on the performance of trending stocks, are now more circumspect, seeking reliable news that can hint at future growth.

The importance of timely and relevant investment news cannot be overstated. For Robinhood, communicating effectively about its operational milestones and market strategies could foster a more robust investor relationship. With accurate data and transparency, the company can not only recover from this slump but potentially drive up anticipation for upcoming quarterly results. As the online brokerage continues to navigate a competitive market landscape, how it manages investor communication will likely play a pivotal role in determining its future trajectory.

Prospects for Robinhood After Recent Trading Changes

After the sharp drop in Robinhood shares due to the missed S&P 500 inclusion, many investors are pondering the future prospects of this online brokerage. The current landscape is unfriendly, not only because of their recent setbacks but also due to shifts in trading behaviors and preferences among retail investors. Understanding these changes is crucial for Robinhood as it seeks to reposition itself as a go-to trading platform. The ability to attract new users, especially among young investors, will be essential for sustaining its market presence.

Robinhood has made significant strides this year, but sustaining growth will require continuous adaptations to its platform and enhancing user experience. With an increasing number of competitors entering the digital brokerage space, Robinhood must capitalize on its brand recognition while innovating its services. Future strategies may involve enhancing educational resources for users or developing advanced trading features, aligning with investor expectations and securing a foothold in an evolving marketplace.

Understanding the Repercussions of Market Movements on Robinhood

Market movements can have a profound effect on companies like Robinhood, particularly in times of significant economic shifts, such as the recent rise and fall of cryptocurrencies and equities. As online trading becomes more ingrained in everyday life, the performance of Robinhood’s stock signals broader market sentiments. A reactionary drop in shares prompts concern and speculation, but there are also opportunities for strategic positioning following these fluctuations. Investors often gauge Robinhood’s resiliency by its ability to withstand turbulent market conditions.

Furthermore, the correlation between market performance and Robinhood’s user engagement is critical to understand. As trading volumes fluctuate—heightened by significant events impacting the S&P 500 or cryptocurrency markets—Robinhood’s operational metrics will reflect these changes. The brokerage’s performance will be closely monitored in conjunction with market indices as trends evolve, making it imperative for Robinhood to maintain agility in its operational strategy and value proposition.

Future of Robinhood’s Trading Platforms Post-S&P 500 News

Following the recent news regarding its absence from the S&P 500 rebalance, Robinhood’s prospects for growth hinge significantly on its ability to adapt and innovate within its trading platforms. The company must look at its technology offerings and user interface, ensuring they remain appealing to both new and returning investors. Continuous improvements could bolster user engagement and create an easier trading experience, which is vital for attracting more users amidst increasing competition.

As Robinhood navigates the post-S&P 500 landscape, it will need to implement a strategy focusing on retention and user satisfaction. By enhancing educational resources that empower investors to make informed decisions, Robinhood could foster a more loyal customer base. Moreover, innovation in its marketing approach might draw in new investors eager to capitalize on favorable market conditions as they evolve, making it essential for Robinhood to reestablish its footing in a shifting financial environment.

Navigating Investor Confidence in Robinhood’s Market Strategies

Investor confidence plays a crucial role in the stock market, and for Robinhood, nurturing this confidence is vital in overcoming the current downturn. Recent declines in Robinhood’s share price after failing to secure a spot in the S&P 500 have led many investors to reevaluate their positions. It is imperative for the online brokerage to provide transparent communication about its strategies and reassure shareholders through detailed updates on its performance metrics and future outlook.

Building investor confidence is not merely about addressing current fears; it is also about laying the groundwork for future growth. Robinhood must continue to analyze market trends, including shifts in trading behaviors influenced by economic conditions. By doing so, it can establish itself as a trusted platform that values the needs of its users, ultimately enhancing investor loyalty and driving long-term success even amid turbulent market conditions.

Impact of S&P 500 Rebalance on Future Investments in Robinhood

The S&P 500 rebalance undeniably has far-reaching implications for stocks in the market, and Robinhood is no exception. The recent news emphasized how significantly the online brokerage was impacted by its omission, leading to a noticeable decline in investor interest. As the S&P 500 typically involves billions of dollars in trade movements, this event not only shaped perceptions related to the company’s value but also influenced the strategies employed by institutional investors in their assessments of Robinhood stock for future investments.

Going forward, Robinhood must navigate this landscape with caution, always considering the potential impact of such key market announcements on its stock. Investors will be observing the brokerage closely as they seek signs of resilience and adaptability in reaction to major index changes. To regain momentum, Robinhood may need to pivot and focus on emphasizing its strengths, such as user engagement and trading technologies, to capture the attention of institutional investors in future trading rounds.

Potential for Recovery: Robinhood’s Path Forward

The pathway to recovery for Robinhood is fraught with both challenges and opportunities. Following the recent drop in shares attributable to the S&P 500 rebalance announcement, the brokerage faces the immediate task of restoring confidence among its investor base. Such a recovery will depend heavily on delivering strong quarterly results and engaging communication regarding its strategic plans moving forward. This period of introspection and realignment could very well set the stage for a renewed focus on growth and innovation.

Looking ahead, Robinhood has the chance to capitalize on its existing user base while attracting new customers through enhancements in both technological offerings and user experiences. By leveraging feedback and adapting to the evolving needs of traders, whether they are interested in stocks or cryptocurrencies, Robinhood can position itself favorably within the competitive landscape of online trading. This adaptability may be the key to not only rebound but also to outperform in a post-rebalance world.

Frequently Asked Questions

Why did Robinhood shares drop recently in the market?

Robinhood shares dropped nearly 5% recently after being overlooked for inclusion in the S&P 500 Index during its quarterly rebalance. This announcement followed previous speculation about Robinhood potentially earning a spot in the index, which typically results in significant trading activity and demand for selected stocks.

What impact does the S&P 500 rebalance have on Robinhood’s stock?

The S&P 500 rebalance typically triggers billions in trading as passive funds reassess their portfolios. A company added to this index, like Robinhood speculated to be, often sees a considerable increase in its stock price, as evidenced by other stocks like Coinbase, which gained 24% after its inclusion.

How have Robinhood’s quarter results affected its market performance?

Despite the recent drop, Robinhood’s market performance has been strong this year, with its shares doubling in price. This recovery is attributed to rebounds in the broader stock market and cryptocurrencies, which bodes well for its future in light of its quarterly results.

What can investors expect from Robinhood following this drop in stock?

Following the drop in Robinhood shares, investors may want to monitor the company’s ability to restore confidence and adapt to market changes. If Robinhood successfully navigates these challenges, its stock could rebound, especially given its recent performance improvements in the current market.

Is Robinhood still a good investment after shares fell?

While Robinhood shares recently experienced a drop, they have shown significant recovery over the year. Investors should consider the recent S&P 500 rebalance and Robinhood’s overall market trends before making investment decisions. Its forward-looking potential remains strong, driven by market rebounds and investor interest.

What led to the speculation about Robinhood joining the S&P 500?

Speculation about Robinhood joining the S&P 500 was fueled by its strong market performance and positive reports from banks like Bank of America, which identified it as a leading candidate for inclusion during the quarterly rebalance, reflecting optimism among analysts about the company’s growth potential.

| Key Point | Details |

|---|---|

| Robinhood Shares Performance | Robinhood shares dropped nearly 5% in premarket trading after being excluded from the S&P 500 rebalancing. |

| S&P 500 Rebalance Timing | The quarterly S&P 500 rebalance took place on the third Friday of the last month in each quarter. |

| Analyst Expectations | Bank of America previously anticipated that Robinhood might be included in the S&P 500. |

| Market Reaction | Last week, Robinhood shares had increased by over 13%, reflecting positive market sentiment prior to the announcement. |

| Future Outlook | Robinhood has recovered significantly this year, with shares doubling in price, but investor confidence remains crucial. |

| Historical Context | The stock’s performance is influenced by past events, such as the GameStop trading frenzy and the FTX collapse. |

Summary

Robinhood shares dropped on Monday as it was overlooked for the latest S&P 500 rebalancing. This decision has raised uncertainty among investors, especially after prior expectations of its inclusion. While the shares experienced significant gains last week, this recent decline highlights the volatility and challenges Robinhood faces in maintaining investor confidence and navigating market conditions.