Tariffs Inflation Impact: Why Prices Remain Stable

The impact of tariffs on inflation is a crucial topic as it continues to unfold in today’s economy. Despite the fears that hefty duties imposed by the government could drive inflation rates higher, recent data indicates a more complex reality. Consumer prices, as reported by the Bureau of Labor Statistics, have noted only a moderate 0.1% rise in May, suggesting the impact of tariffs on prices is yet to be fully realized. While the intention behind tariffs is to level the playing field for U.S. businesses, their economic impact has varied, showing pressure only in select sectors like canned goods and appliances. As we navigate the coming months, the true effects of tariffs on inflation and consumer behavior will become increasingly clear.

Exploring the economic implications of trade barriers, particularly those associated with tariffs, reveals a nuanced landscape regarding their contribution to inflationary trends. The relationship between imposed duties and price fluctuations remains pivotal as we consider how these measures influence consumer spending patterns and overall market stability. Although initial reports suggested a limited effect on inflation rates, the potential for delayed impacts suggests that the ramifications of tariffs could become pronounced as businesses adjust and repricing strategies evolve. As we delve deeper into how these trade interventions shape consumer costs and economic dynamics, it is essential to monitor the unfolding scenarios that may either bolster or undermine confidence in the marketplace.

Understanding the Impact of Tariffs on Inflation Rates

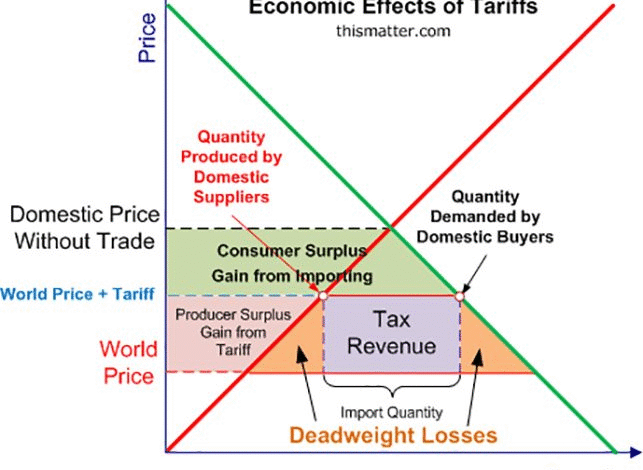

Tariffs are government-imposed taxes on imported goods, and they are implemented with the aim of protecting domestic industries from foreign competition. However, one of the significant concerns surrounding tariffs is how they affect inflation rates. When tariffs are imposed, the primary expectation is that they increase costs for manufacturers, leading to higher prices for consumers. Nevertheless, current data suggests that despite the tariffs, inflation rates have remained stable, prompting questions about their actual economic impact.

In recent reports, inflation rates measured by the Bureau of Labor Statistics showed only minimal increases, indicating that tariffs have not yet translated into widespread price rises across most sectors. This stability in inflation can be attributed to several factors, such as companies stockpiling goods before tariff implementation and a lack of consumer demand that has kept companies from raising prices. As a result, the anticipated inflationary impact of tariffs appears to be delayed or less pronounced than originally feared.

Evidence shows that consumer prices are only impacted in select areas, such as specific food items and durable goods, suggesting a nuanced approach to understanding how tariffs influence overall inflation. Economists warn that while some sectors are experiencing price increases due to tariffs, broader economic conditions, including consumer spending habits, play a critical role in determining inflation trends.

As is often the case in such complex economic matters, the relationship between tariffs and inflation is not entirely straightforward. If consumers continue to restrict spending, it could diminish any inflationary pressure that tariffs might exert on the economy. Therefore, while tariffs have the potential to drive inflation higher, their immediate effects may be muted by other economic forces that keep consumer demand in check.

The Complex Relationship Between Tariffs and Consumer Prices

Consumer prices reflect the overall cost of goods and services that households must pay, and understanding how tariffs affect these prices is essential. As tariffs increase the cost of imported products, one would expect to see a corresponding rise in consumer prices. However, recent trends indicate that consumers have not experienced significant price spikes, suggesting that businesses have so far absorbed many of these costs rather than passing them on.

The reluctance of companies to increase prices could be tied to changing consumer behaviors, particularly in light of an increasingly cautious economic environment. Many consumers are tightening their budgets, leading businesses to reconsider price hikes. This behavior not only reflects current inflationary pressures but also underscores the challenge companies face regarding pricing power in a struggling economy.

Moreover, while certain consumer goods like canned fruits and appliances have seen price increases, these instances remain isolated and do not signify a widespread inflationary trend. Economist Luke Tilley posits that the overall economic landscape may diminish the potential impact of tariffs on consumer prices, highlighting the interplay between tariff policy and consumer sentiment in shaping price trends.

Ultimately, the dynamics between tariffs and consumer prices highlight the need for ongoing analysis. While tariffs may lead to price increases in select goods, the broader implications for consumer prices depend significantly on market conditions and consumer behaviors. Continued monitoring will be essential to determine whether these tariff-induced price changes are temporary or indicative of more profound inflationary trends.

As this economic situation unfolds, the ability of consumers to adapt to price changes will play a defining role in the economic impact of tariffs. Businesses must balance maintaining profitability while ensuring that they do not alienate budget-conscious consumers, suggesting that the ongoing interaction between tariffs and consumer prices requires careful observation in the coming months.

Assessing the Economic Impact of Tariffs

The economic impact of tariffs extends beyond mere price changes; it also affects consumer behavior and overall economic growth. Tariffs, designed to protect domestic industries, can lead to retaliatory measures from trading partners. This retaliation can escalate trade tensions and create uncertainty in the market, which in turn can dampen consumer confidence and spending. If consumers anticipate higher prices due to tariffs, they may adjust their spending habits preemptively, leading to a decline in overall economic activity.

Moreover, the Federal Reserve’s role in monitoring these conditions is critical. While the Fed may adjust monetary policy in response to inflationary pressures, significant tariffs could lead to an economic stagnation rather than accelerating inflation. To navigate the complexities of tariffs and their effects, the Fed must remain vigilant in analyzing economic indicators that signal changes in consumer behavior or inflation trends, ultimately impacting their policy decisions.

The potential downside of tariffs includes creating an environment where prices rise but not enough to boost economic growth. For example, as consumers brace for price increases, they might curtail non-essential spending, negatively influencing businesses that rely heavily on consumer demand. It could lead to a cycle where tariffs intended to protect domestic production result in economic weakness, contradicting their original purpose.

As economists assess the long-term consequences of tariffs, they emphasize the need to evaluate how these policies impact the broader economic landscape, including employment rates and consumer confidence. While tariffs may have been introduced to safeguard domestic industries, their indirect effects on the economy could lead to unintended consequences that undermine their goals. The interplay between tariffs, inflation rates, and consumer spending will be a key area of focus as policymakers seek to balance trade policies with economic stability.

Future Expectations: Tariffs and Inflation Trends

Looking ahead, the expectation of higher prices resulting from tariffs remains a significant concern for consumers and policymakers alike. The general sentiment is that while tariffs have not yet caused widespread inflation, the potential for future price increases exists as these policies take full effect. Economic analysts suggest that the delayed response of tariffs in affecting consumer prices may soon materialize, especially as companies navigate rising costs and competitive pressures in the marketplace.

As tariff-related price increases begin to affect broader sectors, it will be crucial for consumers to remain vigilant about price changes in everyday goods. Whether the tariffs will ultimately drive inflation higher or lead to consumer rationing will significantly affect economic growth. The Federal Reserve’s decisions regarding interest rates will also hinge on these developments, as they weigh the implications of rising prices against the need to maintain economic stability.

Additionally, sustained inflation could alter consumer behavior in unpredictable ways. Should consumers perceive that prices are likely to rise permanently, they may shift their purchasing patterns, potentially leading to panic buying or increased stockpiling of goods. The interplay between expectations of future inflation and consumer behavior will be a critical aspect of understanding how tariffs continue to influence market dynamics.

In conclusion, while tariffs have not yet dramatically affected inflation rates, their potential economic impact remains a pressing issue. As current trends indicate, the relationship between tariffs, inflation, and consumer prices will continue to evolve, necessitating close observation. The economic responses to tariffs will likely shape the future fiscal landscape, influencing everything from consumer behavior to the decisions made by central banking authorities.

The Historical Context of Tariffs and Inflation

Historically, tariffs have played a significant role in shaping economic policies and influencing inflation trends. Notably, the Smoot-Hawley Tariff Act of 1930 is often cited as an example of how tariffs can inadvertently lead to economic downturns, subsequently contributing to the Great Depression. As economists reflect on past events, they underscore the importance of understanding the historical context of tariffs to comprehend their potential effects on inflation and economic stability.

Economic lessons derived from historical tariff implementations reveal a complex relationship between tariffs and inflation. In the case of the Smoot-Hawley Tariffs, rising costs led to decreased consumer spending and adverse impacts on economic growth. Current policymakers must take these historical perspectives into account, acknowledging the delicate balance required in tariff policy to avoid similar economic pitfalls.

Additionally, the lessons learned from past tariff legislation highlight the importance of timing and consumer reactions. The way in which tariffs are introduced and perceived by the public can significantly shape their impact on inflation. If consumers believe that tariffs will lead to sustained price increases, they may react more heavily, which could exacerbate inflationary pressures and lead to economic distress.

By analyzing historical contexts, economists can formulate better strategies for managing tariff policies in ways that minimize adverse effects on the economy. The ongoing discourse surrounding tariffs, inflation, and consumer prices is not merely an academic exercise; it directly informs current economic strategies and the evaluation of necessary reforms in trade practices.

Consumer Behavior and Inflationary Expectations

Consumer behavior is a critical element in understanding the role of tariffs in influencing inflationary expectations. When consumers believe that tariffs will result in higher prices, their spending habits may shift, leading to changes in demand patterns. This behavioral response highlights the psychological aspects of economics, where expectations can drive actual outcomes. If consumers anticipate inflation, they may accelerate their purchases to avoid future price increases, thereby inadvertently creating an inflationary cycle.

Economists assert that consumer expectations play a pivotal role in shaping the severity of inflation. If households begin to expect that their cost of living will continue to rise due to tariffs, they may change their spending and saving behaviors accordingly. This could push companies to adjust their pricing strategies in response to perceived inflationary pressures, leading to a self-fulfilling prophecy. Therefore, the interaction between consumer perceptions and actual pricing trends about tariffs is vital to monitoring inflation.

Understanding how consumer behavior adapts to tariff announcements can offer essential insights into the broader economic landscape. Retailers and businesses must navigate these shifting expectations while being sensitive to the potential ripple effects tariffs can cause. Ensuring that consumers remain confident in their purchasing power is critical to maintaining economic stability. Consequently, it is essential to continuously analyze how tariffs influences consumer behavior in real-time.

In summation, the relationship between consumer expectations and tariffs presents a multifaceted challenge for economists and policymakers. Observing how these expectations influence spending and inflation provides key insights into managing the economic impacts of tariffs while mitigating potential pitfalls. The link between consumer behavior and price pressures must remain at the forefront of economic analyses pertaining to tariffs.

The Role of the Federal Reserve in Tariff Economy

The Federal Reserve plays a crucial role in steering the economy, especially in the context of tariffs and their potential inflationary effects. As the central bank, the Fed monitors economic indicators and assesses how external factors, such as tariffs, could impact inflation rates and overall economic stability. The relationship between the Fed’s monetary policies and tariffs is particularly significant, as the central bank must decide when to intervene to ensure that inflation remains under control.

Recent trends indicate that the Fed might be holding off on altering interest rates despite the ongoing tariff situation. This cautious approach reflects the uncertainty surrounding how tariffs will influence economic activity and inflation rates. While the Fed may be prepared to react to changes in economic indicators, they need to retain a balanced perspective on the potential long-term repercussions of tariffs in the economy.

By maintaining a careful watch on how tariffs influence consumer prices and inflationary pressures, the Federal Reserve can make more informed decisions that directly impact the economic environment. As tariffs have the potential to slow down economic growth or contribute to inflation, the Fed needs to be ready to implement responsive monetary policies to safeguard economic stability.

In summary, the Federal Reserve’s role in navigating the complexities of tariffs and their economic implications is paramount. By understanding the potential impacts of tariffs on both inflation and consumer prices, the Fed can contribute to a more stable economic framework. As tariffs continue to affect the economy, the Fed’s decisions will become increasingly critical to moderating any adverse effects that arise.

Frequently Asked Questions

How do tariffs affect inflation rates in the economy?

Tariffs can influence inflation rates primarily by increasing the cost of imported goods, which may lead to higher consumer prices. However, the current impact of tariffs on inflation rates has been limited due to factors such as stockpiling of goods before tariffs were imposed, the time lag for these costs to affect the economy, and reduced pricing power among companies.

What is the impact of tariffs on consumer prices in the U.S.?

While tariffs can lead to higher consumer prices by raising import costs, recent data suggests that the overall impact on consumer prices has been minimal thus far. Specific categories, like canned fruits and appliances, have seen price increases, but many areas remain unaffected as companies adjust and partially absorb these costs.

How do tariffs and inflation interplay in the current economic climate?

In the current economic climate, tariffs and inflation are intertwined, yet the anticipated inflation spikes have not fully materialized. Factors like pre-tariff stockpiling and low consumer spending power have kept inflation in check, delaying the full impact of tariffs on inflation rates.

What are the economic impacts of tariffs on prices for everyday goods?

The economic impact of tariffs on prices for everyday goods can vary; some sectors experience notable price hikes while others remain stable. For example, items such as durable goods have seen price increases due to the imposition of tariffs. However, many consumers are tightening their budgets, which limits the ability of companies to raise prices across the board.

Are tariffs expected to drive up inflation in the future?

Future inflation driven by tariffs remains a concern among economists. While current data shows low inflation rates, there is an expectation that increased prices may arise as the economy adjusts to tariffs, particularly if consumers begin to shift their spending habits or if companies choose to pass on costs to customers.

What lessons can we learn from historical tariff impacts on inflation?

Historical examples, such as the Smoot-Hawley tariffs during the Great Depression, illustrate that high tariffs can lead to significant economic downturns and deflation rather than sustained inflation. This suggests that while tariffs can temporarily raise prices, their long-term effects may ultimately weaken the economy.

How do consumer behaviors affect the impact of tariffs on inflation?

Consumer behavior plays a crucial role in determining the impact of tariffs on inflation. If consumers cut back on spending in response to rising prices, companies may struggle to increase prices further, mitigating the inflationary pressure that tariffs theoretically create.

What indicators should be monitored to assess the impact of tariffs on inflation rates?

To assess the impact of tariffs on inflation rates, key indicators to monitor include consumer price index changes, producer price index trends, company pricing strategies, and consumer spending patterns. These metrics will provide insights into how tariffs are influencing overall inflation in the economy.

| Key Point | Explanation |

|---|---|

| Tariffs have yet to drive inflation higher | Despite concerns, recent consumer and producer price data showed only marginal increases, suggesting tariffs are not currently affecting inflation significantly. |

| Factors keeping inflation in check | Three main reasons include stockpiling of goods prior to tariffs, the delayed effect of tariffs on the economy, and reduced consumer spending power. |

| Isolated tariff pressures observed | Certain imported goods like canned fruits, coffee, and appliances have seen price increases; however, these are isolated instances rather than widespread inflation. |

| Consumer behavior’s role | Consumer spending patterns are crucial, as they account for a large portion of the economy; reduced spending can dampen pricing power among companies. |

| Historical comparison with Smoot-Hawley tariffs | Past tariff impacts, like those during the Great Depression, suggest potential economic weakness rather than inflation. |

Summary

The tariffs inflation impact has been minimal thus far, attributed to preemptive stockpiling by companies, delayed economic effects, and consumer spending constraints. As recent analyses indicate, the anticipated price increases from tariffs have not materialized across the board but remain a concern for the future, signaling the need for continued observation and evaluation.