Bitcoin Liquidations Surge to $1.16 Billion Amid Criticism

Bitcoin liquidations have surged dramatically to $1.16 billion as market volatility spikes, drawing significant attention from investors and analysts alike. Following a recent drop in the Bitcoin price, which fell by over 4.5% due to geopolitical tensions, traders are increasingly wary of the cryptocurrency’s resilience as a store of value. This price drop, coupled with criticisms from figures like economist Peter Schiff, has sparked a renewed debate over Bitcoin’s status as “digital gold”. Investors are closely monitoring cryptocurrency market trends and their implications for both Bitcoin and traditional assets such as gold. As the crisis unfolds, the digital gold comparison becomes more relevant, revealing how Bitcoin reacts to market forces differently than its precious metal counterpart.

In recent days, the volatility of Bitcoin has raised alarms as record levels of liquidations surface, prompting discussions among traders and economists. The unfolding situation showcases how both financial instruments and digital currencies interact in turbulent times, particularly amidst a Bitcoin price drop. Experts and proponents of cryptocurrency are weighing in on the assets’ safety and stability, with several suggesting that Bitcoin’s performance should be analyzed in parallel with gold. The Bitcoin and gold analysis highlights the contrasting behaviors of these two assets during crisis scenarios, as seen in the recent geopolitical events. Observers are pondering whether Bitcoin can truly stand as a viable alternative to gold, or if it remains at the mercy of market fluctuations.

Understanding Bitcoin Liquidations Amidst Market Volatility

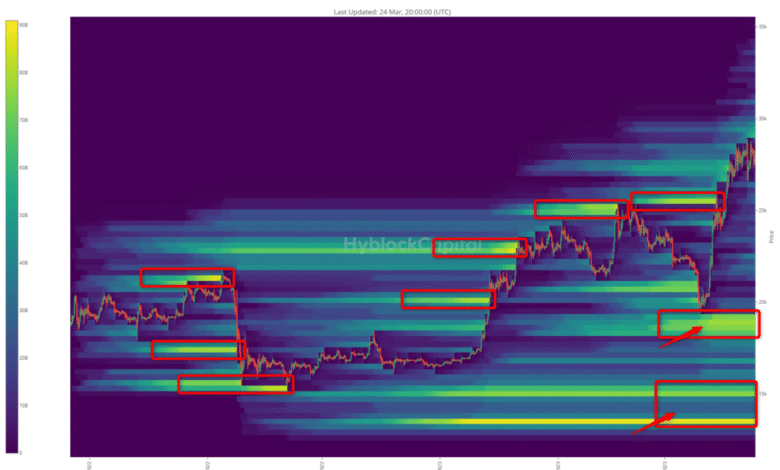

Recent trends in the cryptocurrency market have highlighted significant liquidations, with Bitcoin liquidations surging to a staggering $1.16 billion. This wave of liquidations is primarily driven by rapid price fluctuations during periods of market stress, such as geopolitical events and financial uncertainty. Investors often use leverage to trade cryptocurrencies, which can amplify gains but also heightens the risk of liquidation when prices drop unexpectedly. This has been starkly illustrated by Bitcoin’s recent price dynamics, where a minor dip was enough to trigger massive sell-offs and liquidations.

Moreover, Bitcoin’s connection to traditional financial markets complicates the landscape further. As seen after the Israeli strikes, Bitcoin’s price reacted in tandem with stock markets, diverging from its perceived status as ‘digital gold.’ Understanding these dynamics is essential for investors, as they illustrate the potential risks involved in trading Bitcoin, particularly in volatile conditions. The recent liquidations signal a need for caution within the cryptocurrency space.

Peter Schiff’s Analysis: Bitcoin vs. Gold

Economist Peter Schiff has been vocal in his critique of Bitcoin, especially in the wake of its recent performance compared to gold. His argument revolves around the notion that if Bitcoin is indeed the digital equivalent of gold, it should ideally rise alongside gold in times of crisis. Instead, Schiff points out that Bitcoin saw a 2% drop following geopolitical tensions, while gold prices surged. This reaction raises fundamental questions about Bitcoin’s stability and its place in the market as a safe haven asset, challenging its long-promoted status as ‘digital gold’.

Schiff’s claims emphasize Bitcoin’s struggle to compete with gold’s historical strength as an enduring store of value. He argues that despite Bitcoin’s fleeting highs, its failure to appreciate relative to gold reinforces his view that the cryptocurrency market operates under speculative pressures rather than intrinsic value. Furthermore, Schiff notes that Bitcoin is currently over 15% lower than its all-time high when measured against gold, indicating a concerning trend for investors who see Bitcoin as a potential safeguard during economic strife.

Market Reactions: Bitcoin’s Correlation with Traditional Assets

The correlation between Bitcoin and traditional markets has become increasingly evident, especially in moments of volatility. The cryptocurrency has often followed the trends of major stock indices and commodities, despite being perceived as an independent asset class. For instance, the recent price drop of Bitcoin in response to geopolitical events raises questions about its ability to function as a ‘hedge’ against market instability, a characteristic investors typically seek in gold.

This dependence on traditional market performance can undermine the narrative of Bitcoin as an alternative monetary system. As investors reassess the role of Bitcoin amidst shifting market dynamics, understanding this correlation is crucial. It highlights that in times of uncertainty, investor sentiment can shift quickly, leading to simultaneous sell-offs in both cryptocurrencies and traditional stocks.

The Impact of Geopolitical Events on Cryptocurrency Prices

Geopolitical events have always had a significant impact on financial markets, and the cryptocurrency sector is no exception. The recent Israeli military strike, which coincided with Bitcoin’s 2% drop, demonstrates how external political events can influence market behavior. Investors often react to such news by altering their portfolios, seeking safe-haven assets like gold, which historically retains value during turmoil, rather than Bitcoin, which has yet to hold a similar reputation.

As geopolitical tensions escalate, the reactions within the cryptocurrency market can be volatile and unpredictable. The effect of such events highlights the need for investors to stay informed and consider the broader economic implications when trading. Understanding these dynamics is key for navigating the cryptocurrency landscape, particularly for those looking to invest significantly in Bitcoin during unpredictable times.

Long-term Trends: Bitcoin and Gold Performance Analysis

When examining the long-term price trends of Bitcoin compared to gold, the evidence presents a complex narrative. While Bitcoin demonstrated remarkable growth to reach an all-time high, recent performance shows that its upward trend has not consistently mirrored that of gold. In stark contrast to gold’s gradual appreciation over the years, Bitcoin’s price fluctuations exhibit considerable volatility, raising doubts about its long-term stability and reliability as a store of value.

The disparity in performance becomes even more pronounced when considering key metrics such as the 15% price difference between Bitcoin and gold since November 2021. Investors who entered the market on the promise of Bitcoin’s status as ‘digital gold’ may now question whether that narrative holds water. Understanding these trends is crucial for preparing for future shifts in the market and for investors seeking to balance risk with potential returns.

Investor Sentiment: Cryptocurrencies vs. Safe Havens

Investor sentiment plays a vital role in shaping the fortunes of Bitcoin and similar cryptocurrencies. As geopolitical tensions and economic uncertainty rise, many investors gravitate towards traditional safe-haven assets like gold, often sidelining Bitcoin. This behavior reflects a fundamental aspect of forex markets where perceived security translates into market actions, particularly in crisis situations.

In the context of recent market movements, Bitcoin’s failure to rally when gold does underscores the need for investors to evaluate their asset allocation carefully. If cryptocurrencies are to take a rightful place alongside traditional safe havens, they must establish themselves as reliable alternatives, capable of withstanding market pressures during challenging times.

The Role of Cryptocurrency in Investment Portfolios

Cryptocurrency has increasingly become a fixture in modern investment portfolios, with Bitcoin often cited as the leading asset in this sector. However, the volatility and unpredictable nature of Bitcoin’s price fluctuations require investors to approach their investment strategies with caution. The recent liquidation events serve as a powerful reminder of the risks associated with over-leveraging and the impact of sudden market changes.

It is essential for investors to adopt a balanced strategy that incorporates both cryptocurrencies and traditional assets such as gold. By diversifying their portfolios, investors can mitigate risks while still participating in the potential upside of emerging technologies and digital currencies. As the cryptocurrency market continues to evolve, maintaining a well-rounded approach will be vital for long-term success.

Future Implications for Bitcoin and the Crypto Market

As the cryptocurrency market matures, the implications for Bitcoin’s future remain multifaceted. Analysts speculate that shifts in regulatory frameworks, investor behavior, and technological advancements could shape the trajectory of Bitcoin and its peers. The question lingers: can Bitcoin solidify itself as a true alternative to gold, or will it return to being perceived merely as a speculative asset?

Future market trends may hinge on Bitcoin’s ability to adapt to changing financial landscapes. Investors will be keenly observing how Bitcoin interacts with traditional assets like gold in response to unforeseen events and market pressures. The crypto industry must navigate these challenges effectively to secure its position within the global financial ecosystem.

Insight into Bitcoin’s Market Dynamics and Price Influences

Understanding Bitcoin’s market dynamics involves a deep dive into the factors that influence its price movements. Market sentiment, geopolitical events, and economic indicators play pivotal roles in shaping the behavior of Bitcoin. For instance, when unexpected global tensions arise, Bitcoin’s status as a digital asset is tested against traditional benchmarks like gold, often revealing weaknesses in its appeal as a safe haven.

Moreover, other cryptocurrencies exhibit similar susceptibility to market trends, demonstrating that the entire spectrum of digital currencies can respond adversely to broader economic fluctuations. Investors must be attuned to these influences to mitigate risks effectively and make informed decisions in a rapidly evolving marketplace.

Frequently Asked Questions

What are Bitcoin liquidations and how do they relate to Bitcoin’s price drop?

Bitcoin liquidations occur when traders’ positions are automatically closed due to margin requirements not being met, often triggered by significant price drops. Recently, Bitcoin experienced a decline, leading to over $1.16 billion in liquidations within 24 hours, which highlights the volatility of the cryptocurrency market and its sensitivity to price movements.

How did the recent events in the Middle East impact Bitcoin liquidations?

The recent military strike by Israel on Iranian nuclear facilities caused a ripple effect in the financial markets, leading to a Bitcoin price drop. This incident prompted a wave of Bitcoin liquidations as traders reacted to the volatility, resulting in the liquidation of over $1.16 billion worth of positions.

What is the significance of Peter Schiff’s comparison of Bitcoin and gold during Bitcoin’s price drop?

Economist Peter Schiff criticized Bitcoin’s status as ‘digital gold’ especially after its price dropped in response to global events. He pointed out that while gold rose in price, Bitcoin faced a sell-off, questioning its reliability as a safe-haven asset compared to traditional commodities like gold.

How do cryptocurrency market trends affect Bitcoin liquidations?

Cryptocurrency market trends significantly impact Bitcoin liquidations. When prices fall sharply, as seen recently, it can lead to widespread liquidations of both long and short positions. This creates a cascading effect, causing prices to drop further and triggering even more liquidations.

Can Bitcoin be considered a reliable alternative to gold based on recent price analysis?

Based on recent price analysis, notably Peter Schiff’s commentary, Bitcoin is underperforming compared to gold. Despite Bitcoin’s historical gains, its recent inability to appreciate against gold, especially after dips, raises questions about its reliability as a digital alternative to the traditional safe haven.

What implications do Bitcoin liquidations have for new investors in the cryptocurrency market?

Bitcoin liquidations can pose a risk to new investors, as they might find themselves ‘holding the bag’ if the market turns against them. The extreme volatility exhibited during significant market drops can lead to losses that impact small investors more harshly than experienced traders.

| Key Point | Details |

|---|---|

| Bitcoin Liquidations Surge | Over $1.16 billion in long and short positions were liquidated within 24 hours following a price drop. |

| Impact of Israeli Strikes | Bitcoin dropped by 2% while gold prices rose after Israeli military strikes on Iranian nuclear facilities. |

| Peter Schiff’s Criticism | Economist Peter Schiff questioned Bitcoin’s status as ‘digital gold’, noting its failure to rise alongside gold. |

| Bitcoin vs Gold Pricing | BTC is reportedly 15% lower compared to gold prices since its peak in November 2021. |

| Market Reactions | BTC shows correlation with traditional markets, while gold acts as a safe haven during geopolitical tensions. |

Summary

Bitcoin Liquidations have surged dramatically, with over $1.16 billion liquidated following a notable drop in Bitcoin prices. This volatility highlights ongoing debates about Bitcoin’s role as a digital version of gold, particularly in times of market distress. Peter Schiff’s analysis underscores concerns over Bitcoin’s stability compared to the traditional safe haven of gold, especially when the latter has demonstrated robust gains. With the cryptocurrency market responding sharply to geopolitical events, Bitcoin continues to be scrutinized amidst fears of being overpriced and underperforming compared to precious metals.