Cryptocurrency Remittances Rise 40% in Latin America

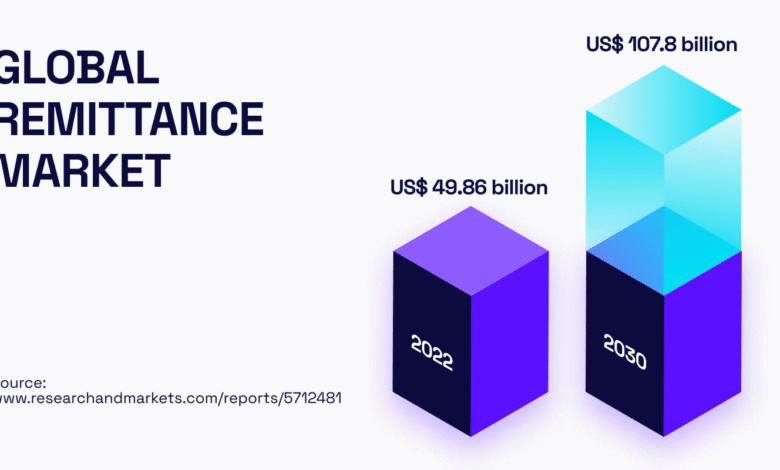

Cryptocurrency remittances are experiencing a remarkable surge in Latin America, marking a transformative shift in how the region conducts cross-border money transfers. According to a recent Chainalysis report, remittance transactions via cryptocurrency have skyrocketed by 40% in 2024, indicating a growing acceptance of digital currencies among residents. The rise of stablecoins in remittances has been pivotal, providing a stable and low-cost alternative for those sending funds back home. Moreover, the expansion of crypto ATM adoption in Latin America has facilitated easier access to digital assets, allowing users to navigate their crypto transactions with relative ease. As remittance trends in cryptocurrency continue to evolve, they highlight the changing landscape of financial solutions in a region increasingly embracing technological innovations for economic empowerment.

Digital currency remittances are revolutionizing the financial ecosystem in Latin America, where traditional sending methods are often fraught with high fees and delays. With the integration of stablecoins into everyday transactions, individuals are discovering more effective ways to transmit money to their families and friends abroad. The rise in the availability of crypto ATMs represents a significant breakthrough, making it easier for users unfamiliar with digital wallets to engage in cryptocurrency transactions. Recent insights from the Chainalysis report indicate a resurgent interest in this financial technology, suggesting that the region is poised for even greater developments in this space. As patterns of money transfer increasingly shift to incorporate digital solutions, cryptocurrency stands out as a promising avenue for efficient remittance.

The Surge of Cryptocurrency Remittances in Latin America

As highlighted in recent studies, particularly by the Chainalysis report for 2024, the adoption of cryptocurrency for remittances in Latin America has surged dramatically, showing a remarkable growth of 40%. This increase not only reflects the increasing willingness of individuals to utilize crypto for financial transactions but also emphasizes the critical role stablecoins play in this transformation. The utilization of cryptocurrencies offers a unique solution to the remittance challenges faced by many, including high fees and lengthy transfer times commonly associated with traditional banking systems.

This surge can be partially attributed to the growing number of crypto ATMs across the region, which facilitates easier transactions for users unfamiliar with digital wallets. As more individuals gain access to these ATMs in countries like Mexico, Argentina, and Colombia, the potential for cryptocurrency remittances to flourish continues to expand. These developments indicate not just a temporary spike but the beginnings of a significant shift in how remittances are conducted, offering a glimpse into a future where cryptocurrencies become the go-to choice for transferring funds.

Frequently Asked Questions

How are cryptocurrency remittances impacting financial transactions in Latin America?

Cryptocurrency remittances are revolutionizing financial transactions in Latin America, with a reported growth of nearly 40% in 2024, according to the Chainalysis report. These digital currencies provide a more efficient, lower-cost alternative to traditional remittance methods, allowing for faster cross-border transactions that benefit individuals and businesses alike. As adoption of stablecoins in remittances increases, this trend is expected to further empower users financially.

What role do stablecoins play in cryptocurrency remittances for Latin America?

Stablecoins play a crucial role in cryptocurrency remittances for Latin America, serving as a stable alternative to volatile cryptocurrencies. This stability is essential in regions where local currencies are prone to devaluation. The Chainalysis report highlights that stablecoins are now officially recognized in the White House’s crypto strategy, reinforcing their significance in providing citizens a means to safeguard their purchasing power amidst economic instability.

How is the adoption of crypto ATMs influencing remittance trends in cryptocurrency in Latin America?

The increase in crypto ATM adoption is significantly influencing remittance trends in cryptocurrency across Latin America. These ATMs simplify the process of sending money by allowing users to convert cash into cryptocurrency with ease. As noted in the Chainalysis report, the region has seen a surge in the number of crypto ATMs, which aids less tech-savvy individuals in utilizing crypto for remittances, thereby enhancing overall accessibility and adoption.

What does the Chainalysis report suggest about the future of cryptocurrency remittances in Latin America?

The Chainalysis report suggests a promising future for cryptocurrency remittances in Latin America, with potential for continued growth beyond the current 40% increase in 2024. The integration of stablecoins and the rise of crypto ATMs are expected to further drive adoption, especially in regions where traditional financial systems are inadequate. Despite regulatory challenges in some countries, the advantages of using cryptocurrency for remittances will likely prevail.

Why are remittance volumes declining in El Salvador despite the rise of cryptocurrency remittances?

Despite the rise of cryptocurrency remittances overall, remittance volumes in El Salvador are declining. This drop may be attributed to reduced usage of the Chivo Wallet, the state-sponsored wallet, and restrictions on Bitcoin activities in the public sector. The changing regulatory landscape and diminishing government support can influence user behavior, leading to a potential decrease in reliance on cryptocurrency remittances.

| Key Points | ||

|---|---|---|

| Cryptocurrency remittances in Latin America have grown by 40% in 2024. | This growth is driven by increased adoption of stablecoins and the rise of crypto ATMs, which facilitate easier transactions. | Despite regulatory challenges in certain countries, the trend of cryptocurrency remittances is expected to continue. |

Summary

Cryptocurrency remittances are experiencing a significant rise in Latin America, with a reported increase of 40% in 2024. This surge highlights the growing acceptance of digital currencies as viable alternatives for traditional remittance methods, especially in regions where access to fiat currency is limited. The increasing presence of crypto ATMs and the incorporation of stablecoins into financial strategies demonstrate the potential for further growth in this sector. As these innovations continue to flourish, cryptocurrency remittances are poised to play an essential role in the financial landscapes of Latin American economies.