Shipping Insurance Costs Surge Amid Israel-Iran Conflict

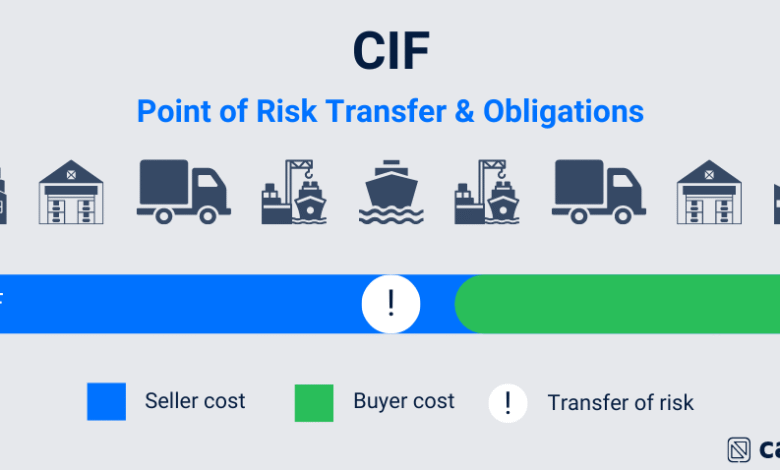

Shipping insurance costs have seen a dramatic increase in the wake of escalating tensions in the Middle East, particularly due to the ongoing Israel-Iran conflict. As marine insurers respond to the heightened risks, the cost for insuring vessels traveling through the Gulf has surged to 0.2% of the ship’s value, up from a mere 0.125%. Moreover, coverage related to ports in Israel has experienced even more substantial hikes, reaching rates as high as 0.7%. With the geopolitical landscape becoming increasingly precarious, the need for comprehensive shipping insurance is more urgent than ever, as uncertainties loom over routes that pass through pivotal areas like the Strait of Hormuz. These soaring marine insurance rates underscore how critical it is for shipping companies to adapt their strategies in this volatile environment, where the implications of local conflicts can ripple across global markets.

The escalation of military tensions in the region has prompted shipping companies to reevaluate their marine insurance strategies, leading to a significant uptick in coverage costs. As these companies navigate the complexities of risk management, terms such as maritime insurance and cargo protection rates have become more prominent in discussions about operational safety. The increase in war risk insurance across vital shipping corridors further emphasizes the urgency of reassessing financial protections for vessels transiting areas fraught with instability. This is particularly evident in routes through the Red Sea and near the critical Strait of Hormuz, where naval activities and geopolitical conflicts play a substantial role in defining insurance pricing. Thus, ensuring safe passage in today’s cost-enforced maritime landscape mirrors broader economic considerations in light of turbulent regional affairs.

Rising Shipping Insurance Costs in the Middle East

As geopolitical tensions escalate, especially in the context of the Israel-Iran conflict, shipping insurance costs have surged dramatically. Marine insurers now impose charges amounting to 0.2% of a vessel’s value for journeys into the Gulf, reflecting a substantial increase from 0.125%. This hike illustrates the immediate impact of heightened security risks on maritime operations, compelling vessel owners to reassess their insurance strategies. Furthermore, insurers are now also adjusting policies to accommodate the increasing war risk insurance rates that are particularly visible in the Red Sea, showing the ripple effects of regional instability on global shipping.

The rising shipping insurance costs underscore the urgent need for businesses involved in Middle East shipping to reevaluate their risk management frameworks. With rates for covering ports in Israel soaring to over 0.7%, stakeholders must navigate a complicated landscape where security concerns and cost management are intricately linked. The escalation in prices can be attributed to not only the direct consequences of military confrontations but also the broader implications of potential U.S. interventions and their effects on maritime safety in critical regions like the Strait of Hormuz.

Frequently Asked Questions

What are the current shipping insurance costs for the Middle East?

Shipping insurance costs in the Middle East have surged, particularly due to the Israel-Iran conflict. Marine insurers now charge around 0.2% of a ship’s value for journeys into the Gulf, up from 0.125%. For ports in Israel, insurance premiums have more than tripled to approximately 0.7%.

How does the Israel-Iran conflict affect marine insurance rates?

The escalating Israel-Iran conflict has significantly impacted marine insurance rates, especially for voyages in the Red Sea and Persian Gulf. Insurers have raised war risk insurance rates due to heightened security concerns, causing shipping insurance costs to increase.

What is war risk insurance and how does it relate to shipping costs?

War risk insurance is specialized coverage for vessels against perils associated with military action. In light of recent developments in the Israel-Iran conflict, war risk insurance rates have escalated, consequently raising overall shipping insurance costs for transit through affected regions.

Are shipping companies avoiding the Strait of Hormuz due to rising insurance costs?

Yes, many shipping companies are now opting to avoid the Strait of Hormuz due to escalating tensions from the Israel-Iran conflict and the rising shipping insurance costs associated with transiting this critical chokepoint.

Why has the validity period of shipping insurance quotes shortened?

The validity period for shipping insurance quotes has been reduced from 48 hours to 24 hours due to the rapidly changing security environment in the Middle East, particularly influenced by the ongoing Israel-Iran conflict.

How do increasing shipping insurance costs impact global trade?

Increasing shipping insurance costs, particularly in areas affected by the Israel-Iran conflict, can lead to higher shipping expenses, potential delays in supply chains, and a decrease in the number of vessels willing to undertake these routes, ultimately impacting global trade dynamics.

What factors influence marine insurance rates in conflict zones like the Middle East?

Marine insurance rates in conflict zones such as the Middle East are influenced by the level of military activity, the perceived risk of attacks on vessels, geopolitical tensions, and the overall security situation, all of which have been exacerbated by the Israel-Iran conflict.

Are there alternatives to traditional shipping routes affected by escalating insurance costs?

With rising shipping insurance costs in traditional routes impacted by the Israel-Iran conflict, some shipping companies are exploring alternative shipping routes to mitigate risks and avoid higher premiums.

| Key Points | Details |

|---|---|

| Marine insurance cost increase | Insurance charges have risen to 0.2% of ship value for Gulf journeys, up from 0.125%. |

| War risk insurance rates | Rates for the Red Sea have increased significantly. |

| Coverage for Israeli ports | Coverage has tripled, reaching over 0.7%. |

| Validity of quotes | Quote validity has decreased from 48 hours to 24 hours. |

| Impact of conflict on shipping | There is growing unease, leading to some shipowners avoiding the Strait of Hormuz. |

| Broader implications | Disruptions could lead to spikes in energy prices and shipping costs. |

Summary

Shipping insurance costs have surged due to the escalating Israel-Iran conflict, highlighting the urgent need for reassessment in the industry. As marine insurers increase their charges and risk rates, the security landscape in the Middle East becomes an increasingly critical factor for shipping routes. This rising trend not only affects insurance premiums but also contributes to broader economic concerns, potentially influencing global energy prices and logistics.