Pop Mart Shares Decline Amid Market Concerns

Pop Mart shares have recently experienced significant fluctuations in the market, reflecting both investor sentiment and trends within the toy industry. This Chinese toy company, known for its innovative Labubu toys, saw its stock tumble by over 5% after Morgan Stanley decided to remove Pop Mart stock from its focus list. The decline marks a troubling moment for a company that had previously enjoyed a remarkable rise, with gains of over 160% year-to-date. While Pop Mart has captivated audiences with its unique blind box concept, the latest market analysis suggests that investors are becoming wary of its long-term growth prospects. As the excitement around Pop Mart shares continues to evolve, it becomes essential to monitor the company’s performance and strategic direction closely.

Shares of Pop Mart, the renowned toy manufacturer from China, have come under scrutiny as investors assess the implications of recent market developments. Known for creating the popular Labubu line of collectibles, this company has gained significant attention from both local and international markets. Following a notable decline, experts are revisiting the potential of Pop Mart stock against the backdrop of Morgan Stanley’s decision to exclude it from their focus list. Understanding the nuances of Pop Mart’s market analysis can provide valuable insights into the broader trends shaping the toy industry, especially as consumer interest shifts. With the rising popularity of adult collectibles, the dynamics surrounding this China-based toy company warrant further exploration.

Decline of Pop Mart Shares: What Investors Need to Know

Shares in Pop Mart, known for its innovative toy lines including the popular Labubu collection, have been experiencing a troubling decline recently. After Morgan Stanley removed Pop Mart stock from its focus list, the stock plummeted by over 5%, extending a rough week where it saw losses exceeding 13%. This shift can be alarming for investors who have benefitted from its impressive gain of over 160% year-to-date. Understanding the market sentiment around Pop Mart shares is crucial for making informed investment decisions, especially given its significant volatility in recent sessions.

The drop is indicative of how sensitive the market can be to analyst ratings and adjustments in stock focus. Morgan Stanley’s recent analysis suggests a potential lack of long-term confidence in Pop Mart’s upward trajectory, despite its attractive price target adjustments. Investors should closely monitor market reactions and further analyses, as these can dictate Pop Mart’s stock performance in the near term. Keeping abreast of such changes will help in navigating the turbulent waters of the toy industry, especially as Pop Mart continues to contend with fluctuating market demands.

The Labubu Craze: Driving Sales or Driving Losses?

Labubu, the latest sensation from Pop Mart, has transformed the toy landscape, making the company a household name in recent months. This elf-like character has not only captivated children but also the adult collector community, signaling a new trend in consumer behavior where toys are sought after as collectible art pieces. Several high-profile sales, including a 4-foot-tall Labubu fetching an astonishing $170,000 at auction, embody the growing demand for unique toys. This enthusiasm indicates that while Pop Mart shares may be down, the enthusiasm for its products hasn’t waned.

However, this surge in interest raises questions about sustainability. The current demand and hype surrounding Labubu toys may not last indefinitely, leading investors and analysts to speculate on whether such trends can translate into long-term profitability for Pop Mart. Moreover, with Pop Mart expanding its product lines amid this phenomenon, understanding the potential impact on its overall sales and market analysis becomes critical. Will Labubu remain a cash cow for Pop Mart, or will the company need to innovate to keep up with consumer trends?

Morgan Stanley’s Analysis of Pop Mart: A Shift in Focus

Morgan Stanley’s decision to move Pop Mart off its focus list has sent ripples through the investment community, making it essential for stakeholders to grasp the implications of such a pronouncement. While the bank acknowledged the company’s remarkable growth potential, they also indicated concerns regarding its high valuations in the current market landscape. This duality in Morgan Stanley’s analysis highlights the challenges that Pop Mart may face going forward, balancing investor expectations with its performance in an often unpredictable market.

The removal of Pop Mart from a focus list suggests that analysts are recalibrating their expectations, especially in light of recent stock performance trends. For investors, this could signal an opportunity to reevaluate their portfolios and consider deeper market analysis before doubling down on Pop Mart shares. Understanding the financial nuances, including potential price targets and market sentiments expressed by firms like Morgan Stanley, is critical as they navigate the complexity of investments in the China toy company sector.

Pop Mart’s Global Expansion Strategy: Capturing New Markets

Pop Mart has made significant strides in its international expansion, establishing a presence in online platforms and physical locations across various countries, including the U.S. and the U.K. This strategic move aims to diversify its market base, especially following the remarkable success of its Labubu line. The global market presents vast opportunities, allowing Pop Mart to tap into new customer segments and build a loyal fanbase outside of its traditional markets. Understanding regional preferences for toys—especially in well-established markets—will be crucial to sustaining this growth.

However, the international expansion journey is filled with challenges, including cultural differences and varying consumer demands. As Pop Mart seeks to scale its operations globally, it’s essential that the company continues to innovate and adapt its products to meet these diverse preferences. The success of its Labubu toys in different markets can serve as a benchmark for future launches, and leveraging data from market analysis will be vital for Pop Mart to strategize its offerings effectively.

Consumer Trends in the Toy Industry: What Pop Mart Reveals

The rise of Pop Mart and its Labubu craze highlights significant trends within the toy industry, particularly the shift towards collectibles that appeal to both children and adults. As toy consumption evolves, companies are increasingly catering to adult collectors, a demographic that has emerged as a powerful force in the market. Pop Mart’s ability to tap into this interest signifies a deeper understanding of consumer behavior and trends, reflecting a broader shift towards nostalgia-driven purchasing patterns.

These shifts present both opportunities and threats for Pop Mart. While tapping into adult markets can yield tremendous growth potential, it also requires a careful balance to maintain its relationship with traditional child demographics. Analyzing pop culture trends and staying ahead of consumer desires will be critical as Pop Mart continues to expand its product offerings. Ultimately, embracing change will be essential for Pop Mart as it navigates the complex, dynamic landscape of today’s toy industry.

The Future of Pop Mart: Prospects and Predictions

Considering the current landscape, the future of Pop Mart remains a topic of keen interest among investors and market analysts. While recent stock performance reflects concerns about its long-term viability, the underlying strengths of the company and its products, especially the Labubu line, suggest potential for recovery. Watching how the company adapts to market feedback and consumer preferences will be pivotal in determining whether it can rebound from the recent declines witnessed in its shares.

Analysts predict that if Pop Mart successfully leverages its unique selling propositions and continues to innovate its product lines, there could be a resurgence in both market confidence and stock performance. Keeping an eye on economic factors that impact the toy industry as a whole, along with advancements in marketing strategies and product diversification, will be crucial for determining Pop Mart’s trajectory. The anticipation surrounding its future developments remains a key factor for investors keeping a close watch on Pop Mart shares.

Investment Insights: Navigating Pop Mart Shares

For investors looking at Pop Mart shares, understanding the financial and market dynamics surrounding the company is critical. With the stock experiencing volatility, marked by recent downgrades from major financial institutions like Morgan Stanley, investors must approach with caution. Evaluating market trends, especially within the toy industry and sentiment around collectible items, will play a significant role in how Pop Mart is perceived moving forward.

Investors should also consider diversification strategies and the overall stability of their portfolios when engaging with Pop Mart stock. Given the company’s unique positioning in the market as a leader in collectible toys, there lies potential for profitable returns, provided that investors are well-informed and strategic. Employing thorough market analysis and remaining aware of consumer behaviors will help in making calculated investment decisions concerning Pop Mart shares.

Collectibles and the Adult Market: Pop Mart’s Unique Position

Pop Mart has successfully carved a niche within the collectibles market, appealing not only to children but also to adults. This unique positioning allows the company to leverage trends within the industry effectively, as adult collectors seek limited-edition items and exclusive releases. By tapping into this demographic, Pop Mart has broadened its consumer base and enhanced its market strategy, thereby differentiating itself from traditional toy brands focused solely on younger audiences.

As the collectibles market expands, understanding the psychology of adult consumers becomes crucial for Pop Mart. Successful marketing campaigns and product designs that resonate with adult collectors can drive further growth and sustain interest in its toy lines. The company must continue to analyze trends and preferences within this demographic to ensure that it stays relevant in a rapidly evolving market.

Challenges Faced by Pop Mart: Market Analysis and Competition

Despite its success, Pop Mart faces numerous challenges that could impact its performance in the marketplace. Among these are intense competition within the toy industry and shifting consumer preferences that may affect long-term sales. As other companies also vie for a share of the collectibles market, Pop Mart must sustain innovation and find ways to capture consumer interest to maintain its leading position.

Conducting thorough market analysis, including the competitive landscape and emerging industry trends, will provide valuable insights that Pop Mart can utilize to navigate these challenges effectively. Understanding competitor strategies and anticipating shifts in customer preferences will be key to ensuring sustained growth for this Chinese toy company as it continues to build its brand globally.

Frequently Asked Questions

What caused the recent decline in Pop Mart shares?

The recent decline in Pop Mart shares is primarily attributed to Morgan Stanley’s decision to remove the stock from its focus list. Following this announcement, Pop Mart stock fell over 5%, further extending its losses from previous trading sessions. This marks a 13% decrease over the week, though the stock has still gained over 160% year-to-date.

How has Morgan Stanley influenced Pop Mart stock?

Morgan Stanley has significantly influenced Pop Mart stock by recently raising its price target from 224 HKD to 302 HKD, indicating potential long-term growth. However, their subsequent removal of Pop Mart from their focus list has led to a decline in the stock’s value, raising concerns about the company’s long-term outlook.

What is the Labubu phenomenon associated with Pop Mart?

The Labubu phenomenon refers to the immense popularity of Pop Mart’s Labubu toy series, which features a unique elf-like character. This series has not only captured attention in the toy market but has also gained significant media coverage, leading to skyrocketing sales and even auction prices reaching up to $170,000 for collectible items.

How does the market view the long-term growth potential of Pop Mart?

The market appears to have mixed sentiments about Pop Mart’s long-term growth potential. While the company has shown exponential growth, analysts express concerns that the stock’s high valuation may not be sustainable in the coming quarters, as outlined in Morgan Stanley’s reports.

What are the major drivers behind Pop Mart’s overseas expansion?

Pop Mart’s overseas expansion is driven by the popularity of its ‘blind box’ toy concept and successful product lines like Labubu, appealing not just to children but also to adult collectors and consumers. The company’s significant sales growth, particularly in international markets such as the U.S. and U.K., underscores this trend.

What are the current market trends impacting Pop Mart shares?

Current market trends impacting Pop Mart shares include heightened interest in collectible toys, particularly among adults, and the global phenomenon surrounding products like Labubu. As collectors drive demand, Pop Mart’s sales from overseas have surged, reflecting changing consumer behavior and market dynamics.

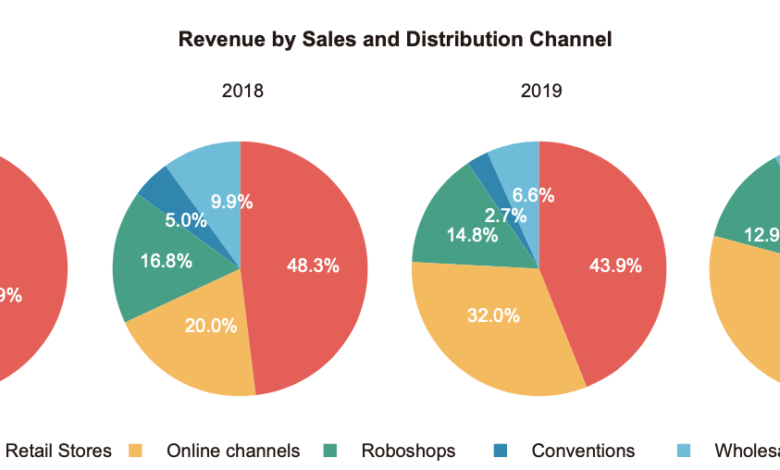

How does Pop Mart’s sales performance compare in domestic and overseas markets?

In 2024, Pop Mart’s overseas sales surpassed the total sales from 2021, reaching 5.1 billion yuan, which marks a 373% increase year-over-year. This indicates the company’s effective strategy in tapping into international markets while also seeing strong sales growth in mainland China.

| Key Point | Details |

|---|---|

| Stock Decline | Pop Mart shares fell over 5% after being removed from Morgan Stanley’s focus list, marking a 13% decline over the week. |

| Market Performance | Despite recent declines, Pop Mart shares have still increased by over 160% year-to-date. |

| Morgan Stanley Update | Morgan Stanley raised Pop Mart’s price target to 302 HKD but expressed concerns about long-term growth prospects. |

| Popularity of Labubu | The Labubu series has gained global popularity, prompting expansion into related merchandise. |

| Sales Growth | 2024 overseas sales surpassed total sales in 2021, indicating a growing interest in collectibles. |

Summary

Pop Mart shares have experienced a notable drop recently, highlighting the volatility of the toy market. Despite this setback, the company has demonstrated remarkable growth in sales, especially driven by the popularity of its Labubu series. As Pop Mart continues to innovate and expand, both domestically and internationally, investors remain cautiously optimistic about its long-term potential.