Russia Bitcoin Mining: Poised to Become a Global Leader

Russia Bitcoin mining is set to become a formidable force in the global cryptocurrency landscape, potentially securing the position of the second largest player in bitcoin hashrate. According to GIS Mining’s Vasily Girya, this surge is expected despite existing economic restrictions, driven by the influx of larger financial entities into the mining sector. The forecasted growth in Russia’s bitcoin mining industry presents an exciting opportunity for cryptocurrency investment, as new technological and regulatory developments stimulate a more robust mining ecosystem. Additionally, the anticipated legalization of bitcoin trading by Russian authorities is likely to bolster investor confidence and encourage participation in this burgeoning market. With a rich supply of cheap energy and conducive environmental conditions, Russia is well-positioned for significant advancements in the lucrative realm of bitcoin mining growth.

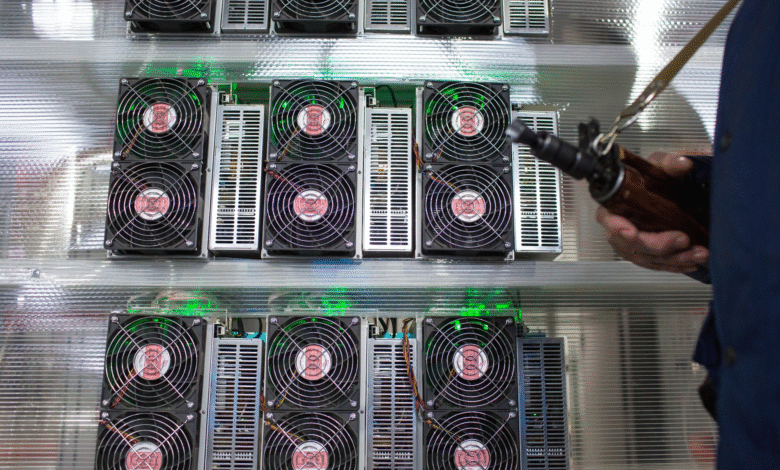

The rise of cryptocurrency mining in Russia represents an intriguing chapter in the world of digital currencies. This emerging trend, often referred to as the cryptocurrency extraction industry, showcases the country’s potential to leverage its vast resources for bitcoin production. Industry experts highlight the ability of Russian mining operations to capitalize on low energy costs and cold climates, which are ideal for sustaining the high demands of such technological enterprises. As global interest in cryptocurrency escalates, the Russian mining sector is preparing to become a pivotal player, harnessing both domestic capabilities and international investments. With strategic moves like the development of self-sufficient mining facilities and supportive regulatory frameworks, Russia’s position in the cryptocurrency ecosystem looks increasingly promising.

The Rise of Russia in Bitcoin Mining

The bitcoin mining landscape is shifting, and Russia is poised to become a significant player. With its vast energy resources and favorable climate, Russia presents an enticing opportunity for cryptocurrency enthusiasts. As Vasily Girya, CEO of GIS Mining, points out, the possibility for the Russian mining sector to grow its production capabilities to 7 GW in the next few years could solidify its position as the second-largest Bitcoin mining power globally, following the United States. This growth is driven by both domestic interest and global attention as more investors recognize the potential returns in cryptocurrency investments.

As new financial groups begin to enter the sector, the momentum for Russia’s bitcoin mining industry is expected to increase. These larger economic entities bring capital and innovation, which can significantly enhance mining operations. The upcoming legalization of cryptocurrency trading will further stimulate participation in the Russian mining ecosystem, making it an appealing venture. Furthermore, this influx of interest and investment is expected to lead to a more robust infrastructure that can support the needs of an expanding mining community.

Understanding Bitcoin Hashrate in Russia

Bitcoin hashrate is a critical indicator of the overall health and competitiveness of a mining ecosystem. As Russia’s position improves within the global bitcoin mining hash power rankings, it will likely attract more investors and miners, eager to take advantage of the opportunities available. The combination of cheap electricity and an abundance of cold climates creates optimal conditions for high-efficiency mining operations, incentivizing both local and international entities to consider Russia as a viable option for their bitcoin mining activities.

In the context of the evolving landscape of Bitcoin mining, GIS Mining’s insights reveal that Russia’s bitcoin hashrate has significant room for growth. With the market’s increasing acceptance of cryptocurrencies, the demand for mining capacity is anticipated to surge. Investments in new technologies and facilities will be essential to meet this surge, as well as to navigate the competitive landscape dominated by early adopters in the United States and other regions. The strategic development of mining operations will be crucial for Russia to not only secure its position as a mining power but also to become a leading innovation hub in cryptocurrency.

Legalization and the Future of Cryptocurrency Investment in Russia

The potential legalization of cryptocurrency trading in Russia is a watershed moment that could revolutionize the nation’s mining landscape. As stated by Girya, regulatory measures are already being put in place that empower banks to offer cryptocurrency investment instruments. This move is likely to attract a wider array of investors who may have been hesitant due to previous uncertainties in regulations surrounding digital currencies. The transition to a more established legal framework for cryptocurrencies will likely catalyze an influx of capital into the Russian bitcoin mining sector.

With clearer regulations, more players will feel secure entering the market, further elevating the mining industry’s standing. This burgeoning segment of the Russian economy could lead to not only increased revenue but also job creation and technological advancements in various related fields. As the government recognizes the potential of cryptocurrencies as an economic driver, strategic investments in infrastructure and education will be essential to sustain growth and ensure that the sector remains competitive on a global scale.

The Advantages of Mining in Cold Climate Regions

Russia’s unique geographical characteristics offer distinct advantages for bitcoin mining operations. The country’s cold climate plays a vital role in the efficiency of mining rigs, as lower temperatures help mitigate the overheating of equipment, thereby enhancing operational longevity and performance. This natural cooling factor allows miners to save significantly on cooling expenses, giving Russian bitcoin miners a competitive edge against those located in warmer climates where cooling costs can consume substantial portions of their profits.

Additionally, the availability of state-provided energy at lower costs allows miners to operate profitably even with fluctuating Bitcoin prices. These factors combine to create an ideal mining environment where efficiency can be maximized, and operational costs minimized. As mining technology continues to evolve, regions like Siberia, with abundant cold air and energy resources, are becoming increasingly attractive to cryptocurrency investors looking to tap into the lucrative world of bitcoin mining.

The Critical Role of Energy Policies in Mining Growth

Energy policies play a crucial role in shaping the future of the bitcoin mining sector in Russia. Government regulations currently prioritize social and enterprise uses for energy, impacting how mining operations can scale rapidly. However, the recognition of surplus electricity in various regions has allowed miners to propose innovative solutions for energy usage that could benefit both the state and the mining community. By developing self-sufficient energy facilities powered by alternative and renewable sources, miners can potentially bypass restrictions and manage energy needs more effectively.

As the Ministry of Energy focuses on balancing various energy demands, dialogue between the government and mining stakeholders will be essential to encourage cooperative strategies. By embracing technological advancements and sustainable practices in energy consumption, Russia can nurture a more resilient mining ecosystem. This will not only support the immediate needs of miners but will also align with worldwide trends towards greener energy, positioning Russia as an appealing location for international mining investments.

Competition with the United States in Bitcoin Mining

As Russia positions itself to challenge the United States in the global bitcoin mining arena, understanding the dynamics of competition is key. The U.S. has long been a leader, with significant advancements in mining technology and infrastructure investment. However, with Russia’s strategic advantages—such as lower operational costs and abundant energy resources—there lies a unique opportunity for a competitive rivalry.

Vasily Girya’s prediction about Russia’s likelihood to secure the second position in bitcoin hashrate indicates growing confidence and ambition within the sector. The competitive landscape in bitcoin mining will prompt both nations to innovate continually, pushing the boundaries of efficiency and technological advancements.

The competition will not only shape policy decisions but will also affect private-sector investments in the mining landscape. Russia’s commitment to enhancing its mining infrastructure and attracting international players could eventually level the playing field with the U.S. It remains to be seen how these ongoing developments will unfold, but the drive towards becoming a leading player in the global bitcoin mining industry is evident.

Technological Innovation in Russian Mining Operations

Technological innovation is at the heart of the ongoing evolution within the Russian bitcoin mining sector. Companies like GIS Mining are at the forefront, developing advanced mining facilities that incorporate cutting-edge technologies. The integration of AI and machine learning to optimize mining processes can lead to more efficient energy use and increased bitcoin yield. As competition intensifies, those who adopt innovative mining practices will likely secure a stronger market position.

Furthermore, Russia has the potential to foster a tech hub that promotes research and development within cryptocurrency mining. By collaborating with universities and tech startups, the industry can cultivate new ideas and advancements aimed at improving productivity and reducing costs. This technological shift will not only benefit local operations but can also attract foreign investment, amplifying Russia’s influence on the global bitcoin mining stage.

Investment Trends in Russia’s Cryptocurrency Sector

Investment trends in the Russian cryptocurrency sector suggest a burgeoning interest in both mining and trading. As regulations begin to clarify, there is an increasing influx of institutional investors who see significant potential in the economic benefits that cryptocurrencies can provide. Reports from industry leaders highlight a transformational period for the sector, where venture capital and private equity are increasingly directed towards mining operations—a clear signal of the industry’s promising future.

As more financial entities begin to look at cryptocurrencies as a legitimate investment vehicle, the capital flowing into Russian bitcoin mining is expected to grow. This trend reflects a global recognition of bitcoin as not just a form of currency but as an asset class, leading to a reshaping of investment strategies across borders. The implications of these developments will have lasting effects on the structure and competitiveness of the Russian mining ecosystem.

Challenges Facing the Russian Mining Sector

Despite its vast potential, the Russian bitcoin mining sector faces several challenges that could impede its growth trajectory. Regulatory hurdles, particularly concerning energy consumption and environmental considerations, present significant barriers for miners. As the government looks to maintain control over energy regulation, it will need to strike a balance between encouraging growth in the mining sector and meeting the demands of the energy market. This balance is crucial for fostering an environment conducive to mining expansion.

Additionally, the competition on the global stage introduces uncertainties for Russian miners as they vie against established players in countries like the United States and Canada. These established markets have already implemented refined operational practices and technological advancements that can be hard to compete with. Going forward, it is vital for the Russian mining sector to address these challenges actively—with strategic planning, cooperation with government bodies, and continuous investment in technology—to secure a strategic advantage.

Frequently Asked Questions

What is the current status of Russia Bitcoin mining industry growth?

The Russia Bitcoin mining industry is poised for significant growth, with predictions indicating it could become the second largest global player in terms of bitcoin hashrate. As stated by GIS Mining’s Vasily Girya, the sector is expected to increase its production capacity to 7 GW within three years, driven by the entry of larger economic players and the legalization of cryptocurrency investments.

How does Russia’s climate benefit Bitcoin mining operations?

Russia’s cold climate is advantageous for Bitcoin mining operations as it naturally helps with cooling mining equipment, reducing overall operational costs. This favorable environmental condition, combined with the availability of low-cost energy, enhances the profitability and efficiency of cryptocurrency investments in the Russian mining sector.

What role do large financial groups play in the future of Bitcoin mining in Russia?

The entry of large financial groups into the Russian Bitcoin mining sector is expected to accelerate growth and innovation. These groups can inject capital, expertise, and technology, fostering a more robust mining ecosystem. As noted by industry experts, their involvement is crucial for expanding production capabilities and solidifying Russia’s position in the global bitcoin hashrate ranking.

How are regulations affecting the Russian Bitcoin mining sector?

Recent regulations have sought to control the energy consumption of Bitcoin mining in Russia; however, the government is also making efforts to formalize cryptocurrency trading practices. By allowing banks to offer cryptocurrency-based investment products to qualified investors, the regulatory environment is gradually becoming more favorable for the expansion of the Bitcoin mining industry.

What infrastructure developments are planned for Bitcoin mining in Russia?

Key infrastructure developments for Bitcoin mining in Russia include the establishment of self-sufficient mining facilities powered by privately owned power plants. This shift is aimed at overcoming energy restrictions imposed by the Ministry of Energy and ensuring consistent power supply, allowing miners to boost their output and capitalize on the country’s abundant resources.

Why is Russia competitive in the global Bitcoin mining market?

Russia is competitive in the global Bitcoin mining market due to its surplus of electricity, access to lower energy costs, and a skilled workforce. These factors, combined with a supportive regulatory framework and the potential for significant growth in production capacity, position Russia as a formidable player in the Bitcoin mining landscape.

What potential challenges face Bitcoin mining growth in Russia?

Potential challenges for Bitcoin mining growth in Russia include stringent regulations, seasonal energy restrictions, and global market competition, particularly from the United States. Additionally, political and economic uncertainties could disrupt investment and development, posing risks to the sector’s expansion ambitions.

| Key Factors | Description |

|---|---|

| Potential Growth | Russia’s bitcoin mining industry is expected to grow significantly as new players enter the ecosystem. |

| Projected Capacity | Over the next three years, the capacity could reach 7 GW. |

| Market Competition | Competition with the United States will intensify as Russia aims for the second position in global bitcoin mining. |

| Legislation Support | Legalization efforts for bitcoin trading are underway, with banks allowed to offer crypto investment options. |

| Self-Sufficient Facilities | Development of private power plants will enable miners to operate independently of governmental restrictions. |

| Favorable Conditions | Cold climate and low energy costs provide an advantageous environment for mining operations. |

| Resource Availability | Abundant electricity and trained personnel support the mining sector’s expansion. |

Summary

Russia Bitcoin mining is on the verge of becoming a dominant force, with predictions indicating that it could secure the second position in global bitcoin hashrate. Despite current obstacles, strategic growth initiatives and favorable environmental conditions suggest a bright future for this industry. The upcoming legalization of bitcoin trading, coupled with the entry of large financial entities, will likely catalyze substantial advancements in mining capacity, allowing Russia to compete fiercely with leading markets such as the United States.