Stablecoin Access: Fiserv Launches New Payment Platform

Stablecoin access is set to be revolutionized by Fiserv’s new platform, aiming to enhance financial inclusivity in the digital economy. By partnering with industry leaders like Solana, Circle, and Paxos, Fiserv is introducing a stablecoin payment system centered around its innovative digital currency, FIUSD. This initiative is designed to democratize stablecoin access, enabling regional banks and a myriad of other financial institutions to conveniently participate in the burgeoning stablecoin marketplace. With the capability for banks to issue their own tokens, the platform promises expansive opportunities for growth and scalability. As this technology powers the stablecoin ecosystem, it is positioned to support the increasing demand for efficient, low-cost transactions across various sectors.

The emergence of a new digital monetary framework is heralded with Fiserv’s efforts to enhance the accessibility of cryptocurrency-linked financial systems. By utilizing advanced stablecoin technology, the global fintech giant aims to foster an inclusive environment, allowing smaller banks to integrate with cutting-edge financial solutions. This initiative promises to introduce the FIUSD stablecoin while empowering institutions with the ability to launch their own custom tokens, enhancing transactional flexibility. By tapping into the growing trend that emphasizes secure, efficient, and low-fee payment systems, Fiserv is positioned to be a key player in redefining the financial landscape. As e-commerce giants and traditional banking entities explore the potential of stablecoin integration, the demand for such forward-thinking solutions is stronger than ever.

The Rise of Stablecoin Technology in Financial Services

Stablecoin technology has gained unprecedented traction in recent years, shaping a new landscape for financial transactions. As traditional banking practices evolve, fintech companies like Fiserv are at the forefront, paving the way for innovative payment solutions. This shift is largely driven by the need for faster, more efficient payment systems that can support the demands of a digital economy. Stablecoins, which are pegged to stable assets, provide a unique solution that combines the benefits of cryptocurrencies with the reliability of fiat currencies.

Moreover, as more consumers and businesses embrace the idea of digital currencies, the integration of stablecoins into everyday transactions is becoming increasingly plausible. The ability to transact quickly and cost-effectively with stablecoins not only enhances user experience but also significantly reduces transaction fees. As Fiserv launches its stablecoin payment platform, it is set to offer a robust infrastructure that supports seamless transactions while adhering to regulatory standards—a vital consideration as this market matures.

Frequently Asked Questions

What is the Fiserv stablecoin platform and how does it improve stablecoin access?

The Fiserv stablecoin platform aims to democratize stablecoin access by enabling regional banks and financial institutions to adopt and issue stablecoins, such as FIUSD. This platform, built on Solana’s blockchain in collaboration with Circle and Paxos, enhances access to stablecoin technology and facilitates low-fee, high-speed payment solutions for a wider audience.

How does the FIUSD stablecoin work within the stablecoin payment system?

FIUSD is a stablecoin launched by Fiserv that functions within its stablecoin payment system, allowing banks to utilize or issue their own digital tokens backed by reserve assets like U.S. Treasury yields. This integration helps streamline transactions and expand the financial ecosystem, making stablecoin access easier for smaller institutions.

In what way does Fiserv’s initiative aim to democratize stablecoin access for smaller banks?

Fiserv’s initiative to democratize stablecoin access focuses on providing smaller banks with the tools and infrastructure necessary to participate in the stablecoin ecosystem. By overseeing compliance and simplifying operational processes, Fiserv ensures that these institutions can leverage stablecoin technology without facing significant barriers.

How can regional banks benefit from Fiserv’s stablecoin technology?

Regional banks can benefit from Fiserv’s stablecoin technology by adopting the FIUSD stablecoin to enhance their payment systems, reduce transaction costs, and offer their clients access to innovative financial services. The platform creates opportunities for these banks to remain competitive in an evolving digital landscape.

What are the implications of Fiserv democratizing stablecoin access for the financial sector?

Democratizing stablecoin access through Fiserv’s platform may lead to significant changes in the financial sector, promoting broader adoption of stablecoins for transactions. This shift could enable improved efficiency, lower fees, and enhanced customer experiences, ultimately reshaping the payments landscape.

Will Fiserv’s stablecoin platform support interoperability with other stablecoins?

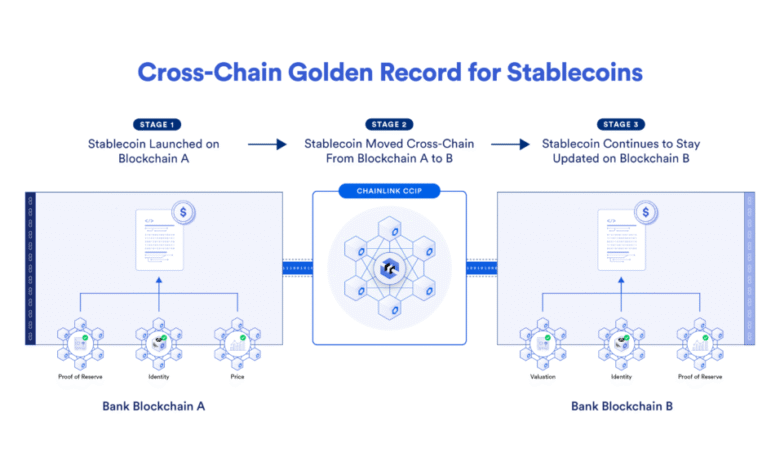

Yes, Fiserv’s stablecoin platform will support interoperability with other stablecoins by utilizing Circle’s infrastructure. This allows a seamless exchange and integration of different stablecoins, thereby further enhancing stablecoin access for users.

How does Fiserv plan to generate revenue from its stablecoin payment system?

Fiserv plans to generate revenue from its stablecoin payment system by retaining a portion of the transaction fees associated with stablecoin transactions on its platform and earning from the reserve assets backing these stablecoins, such as U.S. Treasury yields.

What role do partnerships play in Fiserv’s stablecoin initiative?

Partnerships with companies like Solana, Circle, and Paxos play a crucial role in Fiserv’s stablecoin initiative by providing the technological backbone and expertise needed to establish a robust stablecoin payment platform that broadens access and functionality for banks and customers alike.

What future developments can we expect from Fiserv regarding stablecoin access?

Future developments from Fiserv regarding stablecoin access may include enhancements to their platform’s features, extended support for additional stablecoins, and increased partnerships with more regional and international banks to reinforce their position in the growing stablecoin market.

How does Fiserv’s stablecoin access align with current trends in the payment landscape?

Fiserv’s stablecoin access aligns with current trends in the payment landscape by tapping into the increasing demand for digital currencies and low-fee transaction methods. As more businesses explore stablecoin integration, Fiserv’s platform positions itself at the forefront of this shift towards efficient and modern financial solutions.

| Key Point | Details |

|---|---|

| Launch of Stablecoin Platform | Fiserv announces a platform to democratize stablecoin access for millions via regional banks. |

| Partnerships | Collaboration with Solana, Circle, and Paxos to develop the platform. |

| Introduction of FIUSD | FiUSD will be Fiserv’s own stablecoin, facilitating transactions on the platform. |

| Token Issuance by Banks | Regional banks will have the option to issue their own stablecoins. |

| Operational Launch Date | Expected to be operational by the end of the year. |

| Fee Structure | Fiserv will manage transaction fees and earnings from stablecoin reserves. |

| Interoperability | The platform will be compatible with other stablecoins using Circle’s infrastructure. |

| Market Trends | Stablecoin market capitalization exceeds $250 billion, gaining traction in mainstream finance. |

| Industry Adoption | Large companies like Amazon and Walmart are exploring their own stablecoins. |

Summary

Stablecoin access is becoming increasingly vital as Fiserv steps into the arena with its new payment platform aimed at empowering regional banks and financial institutions. This initiative demonstrates a clear shift towards integrating stablecoins into mainstream finance, allowing institutions of various sizes to leverage the benefits of digital currency transactions. With the potential to issue their own stablecoins and the infrastructure support from partners like Solana and Circle, Fiserv is positioning itself as a leader in democratizing stablecoin access for all.