China Yuan Internationalization: Beijing’s Bold Moves

The internationalization of the China yuan is gaining momentum as the nation implements strategic measures to increase its global presence in financial markets. With the waning confidence in the U.S. dollar, Beijing is ambitiously promoting the yuan as a viable alternative for international transactions and trade. Enhanced investment channels and the introduction of yuan-denominated futures are paving the way for foreign investment in China, further embedding the yuan into global finance. Additionally, the advent of a digital yuan exemplifies China’s commitment to modernizing its currency infrastructure and enabling seamless transactions. This transformation not only challenges existing global currency competition but also aims to solidify the yuan’s role in international economic relations.

As the People’s Republic of China continues to expand its financial influence, the rise of the yuan as a prominent currency in global trade is becoming increasingly clear. Efforts to establish the Chinese currency as a competitor to the dollar are evident in the development of innovative trading mechanisms, including yuan-denominated futures and an emphasis on foreign investments. Furthermore, the push towards adopting a digital form of the yuan aligns with global trends in financial technology, ensuring China remains at the forefront of international economic discourse. Consequently, Beijing’s initiatives are instigating a shift in preferences among investors, reflecting a broader movement towards reducing reliance on traditional currencies in the evolving financial landscape.

China Yuan Internationalization: A Strategic Move

China’s strategy to internationalize the yuan is becoming increasingly prominent, especially as global confidence in the U.S. dollar fluctuates. The country’s financial authorities are actively exploring ways to enhance the yuan’s appeal, allowing foreign investors broader access to Chinese capital markets. With the rise of digital yuan and systematic regulatory adjustments, Beijing aims to position the yuan not only as a regional currency but also as a formidable global player. The initiative includes facilitating trade in yuan-denominated futures, which is expected to bolster the currency’s use in global commerce.

Recent statements from Chinese officials highlight their ambition to alleviate dependence on the U.S. dollar. A significant move was articulated by Pan Gongsheng, the Governor of the People’s Bank of China, during his address at the Lujiazui Forum, where he discussed the importance of flexibly transitioning towards a diversified currency system. This indicates a strategic pivot towards fostering a stronger yuan presence globally, particularly through innovative financial products like digital yuan and yuan-denominated futures that engage international investors.

Frequently Asked Questions

What are the implications of China yuan internationalization for global currency competition?

The internationalization of the China yuan signifies a strategic effort to enhance its status as a global currency amid declining confidence in the U.S. dollar. By opening its financial markets to foreign investment and allowing trading in yuan-denominated futures, China is positioning the yuan as a viable alternative, aiming to shift global trade dynamics and reduce reliance on the dollar.

How is the digital yuan contributing to the internationalization of the yuan?

The digital yuan is a crucial element in China’s strategy for yuan internationalization, as it modernizes financial transactions and enhances the accessibility of the yuan for international investors. By establishing a digital infrastructure and promoting the use of digital currency, China aims to streamline cross-border payments and solidify the yuan’s role in global markets.

What recent measures has China taken to enhance foreign investment in China related to yuan-denominated futures?

China has permitted qualified foreign institutional investors to engage in trading more yuan-denominated futures and options contracts. This expansion includes various commodities, thereby increasing foreign investment opportunities in mainland financial markets and strengthening the yuan’s influence in global commodity pricing.

Why is the internationalization of the yuan significant for China’s financial markets?

The internationalization of the yuan is significant as it facilitates greater foreign participation in China’s financial markets, which enhances market liquidity and stability. Furthermore, it provides Chinese businesses with more robust avenues for financing and trade, ultimately promoting economic growth and asserting China’s position in the global financial system.

How does the internationalization of the yuan impact cross-border trade settlements?

The internationalization of the yuan boosts the use of the currency in cross-border trade settlements, allowing businesses to conduct transactions without relying on the U.S. dollar. This shift can lower transaction costs and reduce exposure to currency fluctuations, increasing economic connectivity between China and trading partners.

What challenges does the China yuan face in its internationalization efforts?

Despite its advancements, the yuan faces challenges in its internationalization, including capital control laws, concerns about market transparency, and geopolitical risks. Analysts have noted that these factors may deter foreign investors despite China’s ongoing efforts to boost yuan usage globally.

How is China’s strategy for yuan internationalization affecting global financial systems?

China’s yuan internationalization strategy is influencing global financial systems by encouraging diversification of currency holdings among international investors. As the yuan gains traction, it can alter trade settlement practices and challenge the dominance of the U.S. dollar, which may lead to a reconfiguration of global financial power.

What role do yuan-denominated futures play in the global financial landscape?

Yuan-denominated futures are becoming increasingly important in the global financial landscape as they provide international investors with new hedging opportunities against commodity price fluctuations. This development not only enhances the yuan’s acceptance in global markets but also reinforces China’s influence over commodity pricing.

How is Beijing facilitating the use of the yuan for international investors?

Beijing is facilitating yuan use for international investors by expanding access to its financial markets and allowing foreign currencies as collateral for yuan-settled trades. Additionally, measures such as waiving fees for establishing local accounts are being implemented to further encourage foreign participation.

What effect does the decline of the U.S. dollar have on yuan internationalization?

The decline of the U.S. dollar is providing a favorable environment for yuan internationalization by prompting countries and investors to seek alternatives for trade and investment. This trend creates opportunities for the yuan to establish itself as a more attractive currency option for global transactions.

| Key Point | Details |

|---|---|

| China’s Measures | Enhancing yuan usage amid declining confidence in the U.S. dollar. |

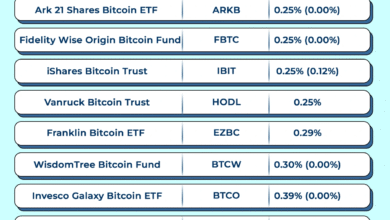

| Futures and Options Trading | Three Chinese exchanges permitted foreign institutional investors to trade additional contracts in commodities. |

| Digital Infrastructure | Plans to develop a digital yuan center in Shanghai and promote yuan-denominated trading. |

| Hedging Products | Expansion of futures contracts and proposals for foreign currencies as collateral. |

| Bilateral Trade Settlements | Encouraging trade in yuan, with initiatives like a $100 billion fund in Hong Kong. |

| International Usage | The yuan’s share in global payments decreased to 2.89% in May; still rising in various markets. |

| Geopolitical Dynamics | Asian markets are shifting away from the dollar due to tensions and seeking currency hedging. |

Summary

China yuan internationalization is gaining momentum as the nation implements strategic measures to expand the use of its currency globally. With decreasing confidence in the U.S. dollar, China is not only facilitating easier access for foreign investors to trade yuan-denominated assets but is also pushing for the digitalization of its currency. These initiatives, aimed at reducing reliance on the dollar, include the introduction of new futures contracts, the establishment of a digital yuan center, and promoted bilateral trade settlements. As geopolitical tensions rise and the financial landscape shifts, China’s commitment to enhancing the yuan’s role in global finance is evident, positioning it as a potential contender against existing currencies.